Asia Pacific Refrigerated Transport Market Size, Share, Trends and Forecast by Mode of Transportation, Technology, Temperature, Application, and Country, 2025-2033

Market Overview:

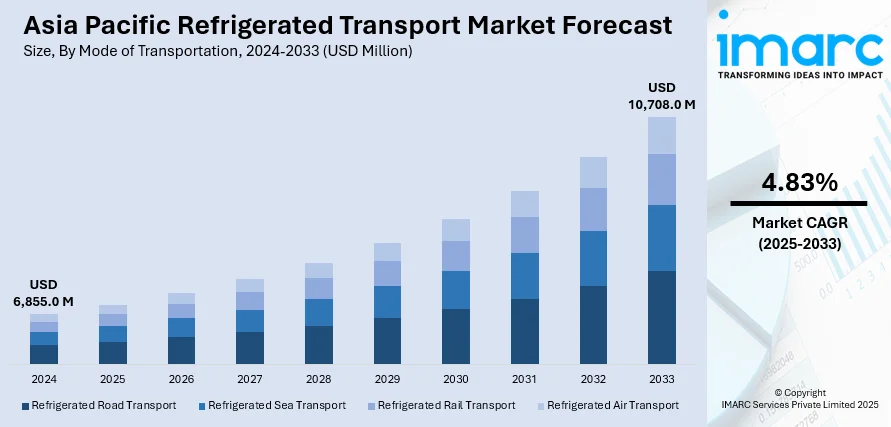

The Asia Pacific refrigerated transport market size reached USD 6,855.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 10,708.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.83% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6,855.0 Million |

|

Market Forecast in 2033

|

USD 10,708.0 Million |

| Market Growth Rate 2025-2033 | 4.83% |

Refrigerated transport refers to the process of shipping freight that requires special temperature-controlled vehicles. These vehicles have a built-in refrigeration system to keep the products at a desirable temperature throughout transportation. Some products that need continuous refrigeration include fruits, vegetables, meat, dairy, and seafood, as well as medical products, pharmaceuticals, and flowers. In the Asia Pacific region, refrigerated transport has gained traction as it maintains an ideal temperature and keeps the products from deteriorating during the transportation process.

To get more information on this market, Request Sample

The Asia Pacific refrigerated transport market is primarily driven by the rising demand for refrigerated fruits and vegetables, on account of the improving standards of living and sustained economic growth. Refrigerated transport helps maintain the freshness of perishable products by extending the shelf-life of the product while ensuring year-round availability of seasonal goods. Besides this, the increasing preference for outsourcing logistics services and the improvements in cross-border and international trade are also propelling the growth of the market. Moreover, governments of several countries in the region have implemented rules and regulations regarding the production, processing, transportation and quality of products to support refrigerated transport.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Asia Pacific refrigerated transport market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on mode of transportation, technology, temperature and application.

Breakup by Mode of Transportation:

- Refrigerated Road Transport

- Refrigerated Sea Transport

- Refrigerated Rail Transport

- Refrigerated Air Transport

Breakup by Technology:

- Vapor Compression Systems

- Air-Blown Evaporators

- Eutectic Devices

- Cryogenic Systems

Breakup by Temperature:

- Single-Temperature

- Multi-Temperature

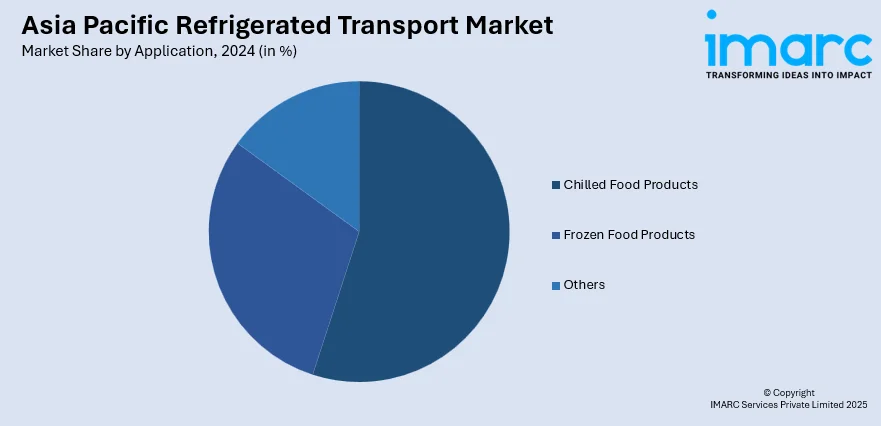

Breakup by Application:

- Chilled Food Products

- Dairy Products

- Bakery and Confectionery Products

- Fresh Fruits and Vegetables

- Others

- Frozen Food Products

- Frozen Dairy Products

- Processed Meat Products

- Fish and Seafood Products

- Others

- Others

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Mode of Transportation, Technology, Temperature, Application, Country |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Asia Pacific refrigerated transport market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Asia Pacific refrigerated transport market?

- What are the key regional markets?

- What is the breakup of the market based on the mode of transportation?

- What is the breakup of the market based on the technology?

- What is the breakup of the market based on the temperature?

- What is the breakup of the market based on the application?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the Asia Pacific refrigerated transport market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)