ATM Market Size, Share, Trends, and Forecast by Solution, Screen Size, Application, ATM Type, and Region 2026-2034

ATM Market Statistics & Research Report:

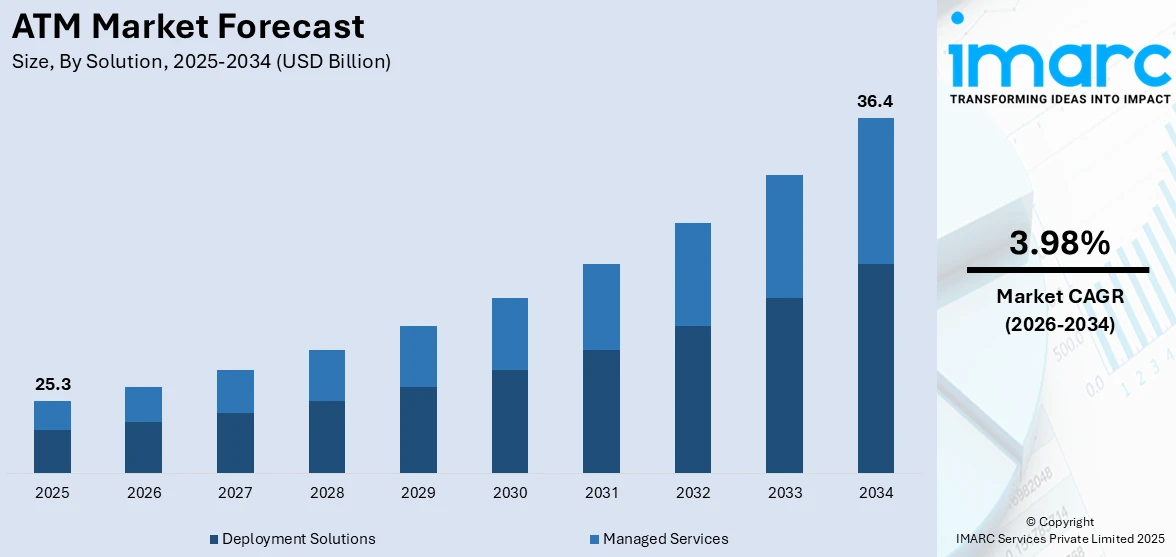

The global ATM market size was valued at USD 25.3 Billion in 2025, and is projected to reach USD 36.4 Billion by 2034, at a CAGR of 3.98% during 2026-2034. North America currently dominates the market, holding a significant market share of over 35.3% in 2025. The rise of digital transformation, increasing convenience and accessibility provided by ATMs, rapid growth in globalization and international tourism, and integration of innovative technologies, such as biometric authentication, are some of the major factors propelling the market.

|

Report Attribut9e

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 25.3 Billion |

| Market Forecast in 2034 | USD 36.4 Billion |

| Market Growth Rate (2026-2034) | 3.98% |

The growth of demand for convenient, secure, and cash-based banking facilities drives the ATM market. Urbanization and financial inclusion initiatives have expanded the reach of ATMs, primarily in developing regions. The growth in cash-based economies and easy access to cash further add to the fuel. Technological advancements, such as touch screen interfaces, biometric authentication, and real-time cash depositing systems, are improving the function and experience of ATMs. Secondly, the integration of ATMs into online payment systems and mobile banks also sustains their appeal. Security upgrades to resist fraud and meet regulatory needs also fuel market growth. At the same time, the needs for offsite and freestanding ATMs to malls and airports are aiding in expanding the market.

To get more information on this market Request Sample

The ATM market in the United States is fueled by the need for access to cash, which should be convenient and secure. In urban and high-traffic areas, the need for cash is more prevalent. This increased adoption of advanced ATMs with features such as touchscreens, biometric authentication, and cash recycling increases user experience and operational efficiency. For example, in October 2024, Hyosung Americas, a well-known disruptor in the ATM and self-service kiosk space, announced its partnership with eGlobal, based in Grant Victor, to reimagine the use of the ATM in a retail environment. Hyosung started a Hyosung Pay trial program using the revolutionary Pivot ATM, which reimagines the function and value of the ATM for both the retail operator and the ATM user. Increased security issues led to the development of advanced anti-fraud technologies, thereby raising the confidence level of the use of ATMs. Increasing adoption of surcharge-free ATM networks and mobile banking capabilities is also supporting market growth. Moreover, financial service needs in under-banked locations and offsite ATMs' popularity in retail locations also positively impact the U.S. market.

ATM Market Trends:

Rapid Digital Transformation

With the widespread adoption of technologies like biometric authentication, contactless payments, and mobile banking apps, ATMs have adapted to provide a seamless and secure user experience. It has been reported that in 2020, over 671 Million individuals made payments via facial biometrics, which is expected to reach 1.4 Billion individuals by 2025. Fingerprint or facial recognition represent some of the key biometric authentication measures that improve security by verifying users' identities before processing transactions. Contactless payment options, enabled through Near Field Communication (NFC) technology, allow users to make quick and secure transactions by simply tapping their cards or mobile devices.

Convenience and Accessibility Associated with ATMs

Unlike conventional banking hours, ATMs enables the easy round-the-clock access to cash and banking services. This ease caters to the busy schedules of customers who need flexibility in conducting transactions. Additionally, ATMs are strategically placed in various locations, including urban centers, rural areas, and commercial hubs, ensuring accessibility to a wide range of users. According to the CIA, 36.4% of the total population of India is urbanized in the year 2023. This accessibility plays a vital role in serving customers who might not have immediate access to physical bank branches during their preferred times.

Promoting Financial Inclusion

ATMs are pivotal for consumers who do not have convenient access to conventional banking services. They offer a crucial means for underserved populations, enabling them to perform basic banking transactions, such as cash withdrawals and balance inquiries. This empowerment enables individuals in remote or underserved areas to participate in the formal financial system, fostering economic growth and improving their overall quality of life. The expansion of ATMs into such regions contributes to bridging the gap between those with and without access to traditional banking services, thereby promoting financial inclusivity. According to the government of UK, as of early June 2023, the UK had a total of 49,421 cash machines, with 78%, or 38,612 units, offering free access to users.

ATM Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ATM market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on solution, screen size, application, ATM type, and region.

Analysis by Solution:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

Deployment solutions stand as the largest component in 2025, holding around 53.5% of the market. As the global ATM industry expands, financial institutions and ATM operators require efficient and effective ways to deploy and manage these machines across diverse locations. Various services are included in deployment solutions, such as site selection, installation, setting up network connectivity, and continuing maintenance. Comprehensive deployment methods are also required due to the widespread use of ATMs in several locations, including retail establishments, urban centers, and remote places. The need for specialist deployment services is fueled by financial institutions' efforts to strategically position ATMs to increase consumer accessibility and convenience. To guarantee smooth operations and reduce risks, proficiency in the installation and maintenance of automated teller machines is required due to the ongoing advancements in technology and security regulations. In addition to physical installation, deployment solutions integrate cutting-edge features like contactless payment methods and biometric authentication.

Analysis by Screen Size:

- 15" and Below

- Above 15"

15” and below leads the market with around 65%% of market share in 2025. ATMs with 15” and smaller screens hold the largest market share due to their compact size, cost efficiency, and suitability for diverse locations. These ATMs are ideal for deployment in high-traffic areas like retail stores, gas stations, and smaller banking kiosks, where space is limited. Their lower production and maintenance costs make them attractive to banks and independent ATM deployers (IADs). Additionally, these machines efficiently handle essential transactions such as cash withdrawals, balance inquiries, and deposits, meeting user needs without requiring larger displays. The widespread adoption of these versatile and space-saving ATMs drives their dominance in the market.

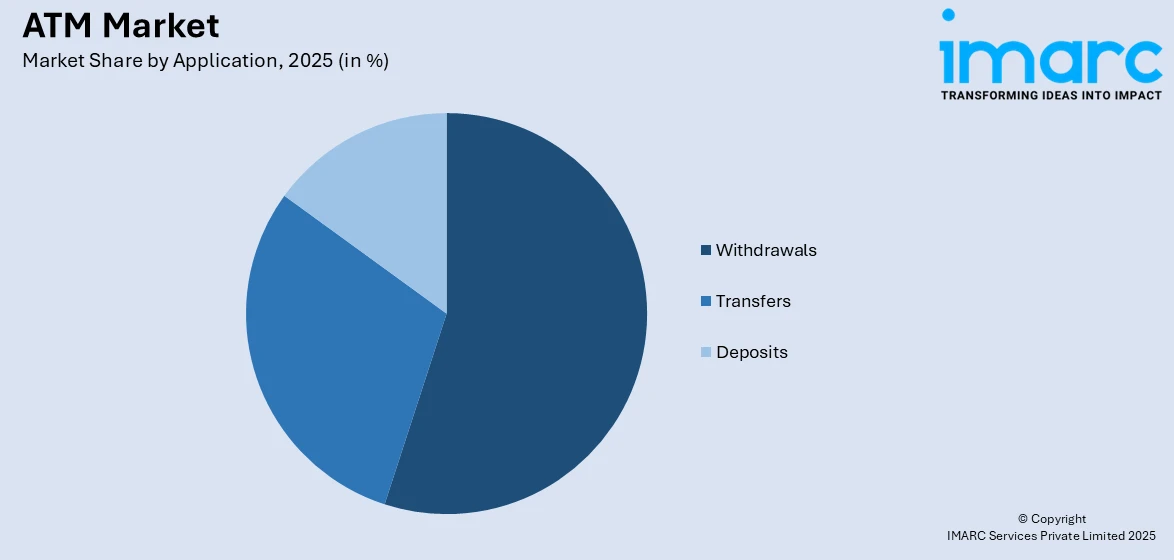

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Withdrawals

- Transfers

- Deposits

Withdrawal leads the market with around 69% of market share in 2025. Withdrawal transactions hold the largest share in the ATM market because cash remains a critical component of day-to-day financial activities, even in increasingly digital economies. Particularly in regions with heavy cash usage or restricted access to digital payment methods, consumers depend on ATMs for rapid and easy access to cash. The main purpose of ATMs is withdrawal, which appeals to banked and underbanked people. The withdrawal experience has also been improved by developments in ATM technology, such as quicker processing and more security. Withdrawals continue to be the most common form of ATM transaction due to the ubiquitous need for cash in a variety of situations, including emergencies.

Analysis by ATM Type:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

Conventional/bank ATMs leads the market with around 33.2% of market share in 2025. Conventional or bank ATMs hold the largest share in the ATM market due to their widespread presence and trust among users. Usually found at bank locations, these automated teller machines (ATMs) provide dependable access to necessary financial services like deposits, cash withdrawals, and account inquiries. Customers who value security will find their integration with core banking systems intriguing because it guarantees high security and real-time transactions. Banks also spend a lot of money maintaining and modernizing these ATMs with cutting-edge features like improved fraud protection techniques and biometric verification. Conventional ATM supremacy is further supported by client loyalty and the consistent need for traditional banking services.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 35.3%. The demand for convenient and secure access to financial services drives the ATM market in North America. Widespread ATM deployment is supported by a strong financial infrastructure and high rates of urbanization. The functionality and user experience of ATMs are improved by the growing usage of cutting-edge technologies like touchscreens, biometric authentication, and cash recycling. Consumer trust has increased as a result of investments in anti-skimming and encryption technologies brought about by growing concerns about fraud and insecurity. The region's strong emphasis on financial inclusion drives ATM installations in underserved and rural areas. Additionally, the popularity of surcharge-free ATM networks and integration with mobile banking platforms further supports market growth. The convenience of offsite ATMs in retail locations, airports, and other high-traffic areas contributes to their demand. Furthermore, the ongoing transition toward smart ATMs offering contactless and cardless transactions aligns with consumer preferences, solidifying North America's position as a key ATM Industry.

Key Regional Takeaways:

ATM Industry Analysis in the United States

In 2025, the United States accounted for the market share of over 83.50%. The ATM market in the United States is experiencing growth due to several specific drivers. Financial institutions are increasingly investing in advanced ATMs that offer features like contactless payments, enhanced security measures, and biometrics for identity verification, improving customer convenience and security. Banks are expanding their ATM networks to serve underserved regions, aiming to boost customer access to cash and banking services. The rising demand for self-service banking solutions is encouraging businesses to deploy ATMs in retail and high-traffic locations, enhancing accessibility for consumers. Additionally, the ongoing trend of increasing cash usage, particularly for small transactions, is fueling ATM installations in various commercial settings. As the demand for 24/7 banking continues to rise, businesses are adopting ATMs equipped with multiple functionalities, such as bill payments and mobile top-ups, to cater to evolving customer needs. While cash usage is declining, the demand for ATMs offering multi-functional services like mobile banking, bill payments, and cardless withdrawals remains strong. Security concerns, including fraud and data breaches, also drive ATM manufacturers to develop advanced anti-skimming and encryption technologies. For instance, the IT Governance USA's study of the data breach notifications of the Office of the Maine Attorney General stated that there were around 83 new data breaches reported, which collectively impacted over 5,266,320 individuals.

ATM Industry Analysis in Asia Pacific

The ATM market in the Asia-Pacific region is driven by increasing demand for banking services, high cash usage, and government initiatives aimed at enhancing financial inclusion. In many developing countries in APAC, there is a strong push for expanding access to banking services, particularly in rural and remote areas, where ATMs are vital for offering essential financial services. The region still sees a high reliance on cash transactions, particularly in countries like India and China, which sustains the demand for ATMs. Hong Kong stated the maximum 8,600 withdrawals per ATM machine per month average number of cash withdrawals, according to research. Banks are increasingly deploying multi-function ATMs to provide diverse services, such as cash deposit and bill payment, addressing customer convenience. The rise in digital banking is driving the demand for ATMs equipped with biometric authentication, ensuring secure transactions. Government initiatives supporting financial inclusion are pushing the installation of ATMs in underserved areas, and expanding accessibility. Additionally, the growing adoption of contactless payment methods is shaping ATM designs, with more machines incorporating NFC technology. According to the National Population and Talent Division, as of June 2023, Singapore's total population reached 5.92 Million, reflecting a 5.0% year-on-year growth compared to June 2022.

ATM Industry Analysis in Europe

The ATM market in Europe is experiencing growth due to several specific drivers. To improve customer experience and security, banks and other financial institutions are constantly adding cutting-edge technologies, such contactless and biometric authentication, to their ATM networks. As customer tastes change, ATMs with integrated features like bill payment and cash deposit are becoming more and more popular due to the growing need for self-service banking. Traditional ATM services are changing to satisfy new demands as the European populace depends more and more on digital and mobile banking. According to the European Commission, between 1 January 2003 and 1 January 2023, the European Union's population grew by 4%, rising from 431.2 Million to 448.8 Million. Additionally, the rapid expansion of the retail and hospitality sectors is encouraging the installation of ATMs in high-traffic areas for greater accessibility. Furthermore, governments and financial regulators are pushing for improved security measures in ATMs, leading to the development of more secure machines.

ATM Industry Analysis in Latin America

In Latin America, the ATM market is primarily driven by the need for financial inclusion, security concerns, and cash dependency. In nations like Brazil, Mexico, and Argentina, where there are significant numbers of unbanked people, automated teller machines (ATMs) are a vital source of financial services, giving people access to banking in places where traditional bank branches are few. In many Latin American nations, cash is still the most common method of payment, which guarantees a consistent demand for ATMs. Furthermore, a major element in resolving issues with financial access is the development of ATM networks in rural and isolated regions, which permits participation in the formal economy by larger parts of the people. For instance, at least 77 Million rural inhabitants are reported in Latin America and the Caribbean who are unable to access internet services that meet minimal quality standards. Such incidences significantly drive the market growth for cash withdrawals through ATM.

ATM Industry Analysis in the Middle East and Africa

The ATM market in the Middle East and Africa is experiencing growth due to several factors. Financial institutions are widely adopting advanced ATMs with biometric authentication for improved security security. The rise in contactless payment systems is driving demand for modern ATMs. Governments are investing in cashless infrastructure, encouraging digital payments. Additionally, the ongoing urbanization and growing banked population are boosting ATM installations in urban centers. These developments are collectively expanding the market across the region.

Competitive Landscape:

The ATM market is intensely competitive, with major players aiming at strategic partnerships, geographic expansion, innovation. Major companies like NCR Corporation, Diebold Nixdorf, and Hyosung dominate the market, offering advanced ATM solutions with features like biometric authentication, cash recycling, and mobile integration. Independent ATM deployers (IADs) play a crucial role, especially in offsite locations. Competition is driven by advancements in security technologies to combat fraud and enhance user trust. Additionally, the growing demand for smart ATMs and the rise of fintech collaborations intensify market rivalry. Regional players and emerging startups also contribute by targeting niche markets and specific customer needs.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Diebold Nixdorf, Inc.

- NCR Corporation

- Triton Systems of Delaware

- Hitachi-Omron Terminal Solutions

- GRG Banking Equipment Co. Ltd.

- OKI Electric Industry co. Ltd.

- Nautilus Hyosung Corporation

- HESS Cash Systems GmbH & Co KG

- Fujitsu Ltd.

- Euronet Worldwide

- Brink's Company

Latest News and Developments:

- April 2024: Hitachi Payment Services, a prominent provider of payment and commerce solutions in India, has officially introduced the nation’s first Upgradable ATM. Moreover, the Upgradable ATM’s can be seamlessly upgraded to a high-performance Cash Recycling Machine (CRM) at any given time.

- June 2024: A new network of advanced ATMs have been deployed across 17 UK locations where recent branch closures have impacted residents' access to essential banking services. These ATMs will offer a range of functionalities, including cash withdrawals, balance inquiries, PIN changes, and cash deposits, enhancing customer convenience and ensuring continued access to vital banking services.

- November 2024: The well-known foreign exchange company Travelex joined forces with NCR Atleos to modernize its global ATM network in its entirety. Travelex updated the software and hardware of all 600 of its ATMs in eight different countries as part of this partnership. The inclusion of contactless cash withdrawal capabilities is one of the many improved, secure features that this upgrade is expected to provide to clients.

- December 2024: East of England Co-op announced its plans to commence ATM cash services in the East Anglia region across all its stores. The retailer further announced the partnership for the rollout with the UK Cashzone Network, which is a notable network of independent ATMs.

ATM Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Solutions Covered | Deployment Solutions (Onsite ATMs, Offsite ATMs, Work Site ATMs, Mobile ATMs), Managed Services |

| Screen Sizes Covered | 15” and Below and Above 15” |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Diebold Nixdorf, Inc., NCR Corporation, Triton Systems of Delaware, Hitachi-Omron Terminal Solutions, GRG Banking Equipment Co. Ltd., OKI Electric Industry co. Ltd., Nautilus Hyosung Corporation, HESS Cash Systems GmbH & Co KG, Fujitsu Ltd., Euronet Worldwide, Brink's Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ATM market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global ATM market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ATM market was valued at USD 25.3 Billion in 2025.

IMARC estimates the ATM market to exhibit a CAGR of 3.98% during 2026-2034, reaching a market value of USD 36.4 Billion by 2034.

The ATM market is driven by increasing convenience, accessibility, and demand for secure banking solutions. Rapid urbanization, financial inclusion initiatives, globalization, international tourism, and technological advancements such as biometric authentication and real-time cash deposits also contribute significantly to market growth.

North America currently dominates the ATM market, accounting for a share exceeding 35.3%. This dominance is fueled by strong financial infrastructure and high rates of urbanization in the region.

Some of the major players in the ATM market include Diebold Nixdorf, Inc., NCR Corporation, Triton Systems of Delaware, Hitachi-Omron Terminal Solutions, GRG Banking Equipment Co. Ltd., OKI Electric Industry co. Ltd., Nautilus Hyosung Corporation, HESS Cash Systems GmbH & Co KG, Fujitsu Ltd., Euronet Worldwide, and Brink's Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)