Australia 5G Network Deployment Market Size, Share, Trends, and Forecast by Service Type, Network Type, End User, and Region, 2025-2033

Australia 5G Network Deployment Market Size and Share:

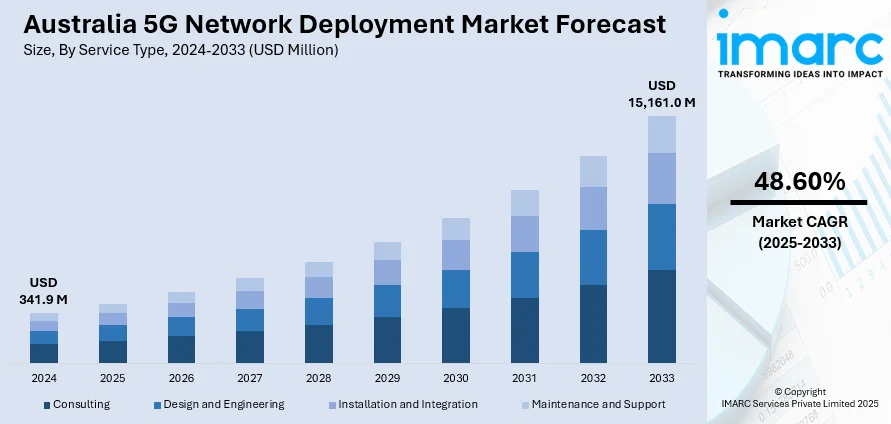

The Australia 5G network deployment market size reached USD 341.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 15,161.0 Million by 2033, exhibiting a growth rate (CAGR) of 48.60% during 2025-2033. The market is principally influenced by the rising number of strategic alliances and partnerships among key players, rapid expansion of 5G service to rural areas leading to higher connectivity, the growing use of advanced technology, and ongoing enhancement in network quality. Extensive research and development (R&D) activities are also contributing to the market growth positively.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 341.9 Million |

| Market Forecast in 2033 | USD 15,161.0 Million |

| Market Growth Rate (2025-2033) | 48.60% |

Australia 5G Network Deployment Market Trends:

Strategic Collaborations and Partnerships

A key trend in the Australian 5G network deployment market is the rapid emergence of collaborations and partnerships. Telecommunications firms are increasingly developing partnerships with technology providers, infrastructure companies, and local governments to speed up 5G network deployment. In line with this, collaborations between network operators and infrastructure companies facilitate the sharing of resources such as towers and fiber networks, reducing costs and deployment times. For instance, in November 2023, Airspan Networks Holdings Inc. announced partnership with Prospecta Utilities to deploy a 5G mmWave Fixed Wireless Access network across Australia. The collaboration aims to revolutionize telco infrastructure, offering high-speed services and lowering fixed fees for residents and businessess. Furthermore, collaborations with technology companies facilitate the incorporation of sophisticated solutions and services into the 5G network ecosystem. These joint initiatives simplify the process of deployment as well as encourage innovation and ensure a stronger and more extensive 5G infrastructure in Australia.

To get more information of this market, Request Sample

Integration of Advanced Technologies

Another significant trend is the continued incorporation of leading-edge technologies to support 5G network performance. The deployment of 5G networks in Australia increasingly incorporates innovative technologies like network slicing, edge computing, and artificial intelligence (AI). Network slicing enables multiple virtual networks within one physical 5G network to be created, each customized for a variety of use cases. Edge computing cuts latency by computing nearer the edge-user, whereas artificial intelligence (AI) is used to manage networks more effectively and provide predictive maintenance. For instance, in October 2024, Optus, a leading telecom operator in Australia announced its partnership with Ericsson and Qualcomm to install 5G RedCap technology in industrial factory settings to augment safety through powering AI-driven pedestrian detection systems. These technologies collectively contribute to improving the efficiency, flexibility, and responsiveness of 5G networks, ultimately providing an enhanced user experience, and enabling innovative applications across different industries.

Australia 5G Network Deployment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on service type, network type, and end user.

Service Type Insights:

- Consulting

- Design and Engineering

- Installation and Integration

- Maintenance and Support

The report has provided a detailed breakup and analysis of the market based on the service type. This includes consulting, design and engineering, installation and integration, and maintenance and support.

Network Type Insights:

- Standalone

- Non-Standalone

A detailed breakup and analysis of the market based on the network type have also been provided in the report. This includes standalone and non-standalone.

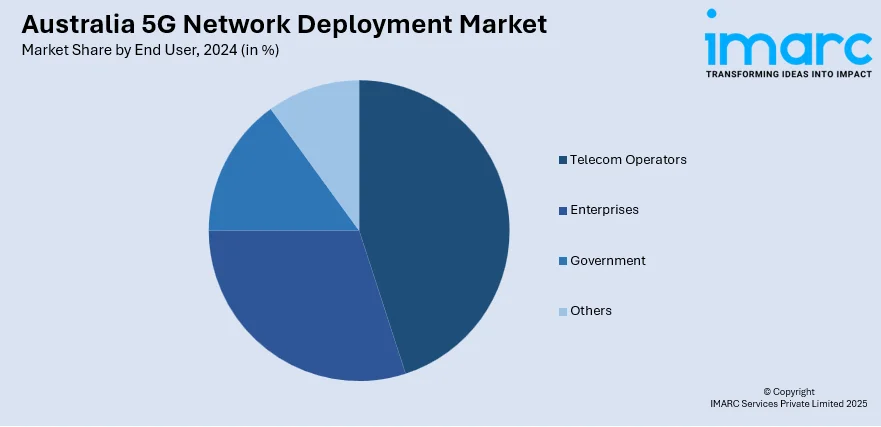

End User Insights:

- Telecom Operators

- Enterprises

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes telecom operators, enterprises, government, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia 5G Network Deployment Market News:

- In April 2024, TPG Telecom and Optus Mobile signed an 11-year agreement to enhance regional mobile coverage in Australia by sharing Optus' regional radio access network and spectrum, expanding TPG's 4G coverage and accelerating Optus' 5G rollout. The agreement aims to reduce costs, improve service quality, and increase network capacity for customers. The shared network MOCN is expected to be available to customers in early 2025, pending regulatory approvals.

- In September 2024, Ericsson and Telstra deployed Ericsson’s 4th generation Radio Access Network (RAN) compute platform in Australia, paving the way for 5G Advanced (5G-A) technology. This deployment increases network capacity and energy efficiency, laying the groundwork for future 5G-A and associated technologies. The new platform supports advanced automation, AI/ML capabilities, and up to 20 times more pre-loaded AI models. Additionally, Telstra and Ericsson plan to deliver 5G network slicing services for Australian enterprises.

Australia 5G Network Deployment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Consulting, Design and Engineering, Installation and Integration, Maintenance and Support |

| Network Types Covered | Standalone, Non-Standalone |

| End Users Covered | Telecom Operators, Enterprises, Government, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia 5G network deployment market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia 5G network deployment market on the basis of service type?

- What is the breakup of the Australia 5G network deployment market on the basis of network type?

- What is the breakup of the Australia 5G network deployment market on the basis of end user?

- What is the breakup of the Australia 5G network deployment market on the basis of region?

- What are the various stages in the value chain of the Australia 5G network deployment market?

- What are the key driving factors and challenges in the Australia 5G network deployment market?

- What is the structure of the Australia 5G network deployment market and who are the key players?

- What is the degree of competition in the Australia 5G network deployment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia 5G network deployment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia 5G network deployment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia 5G network deployment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)