Australia Acoustic Insulation Market Size, Share, Trends and Forecast by Material Type, Sales Channel, End User, and Region, 2025-2033

Australia Acoustic Insulation Market Overview:

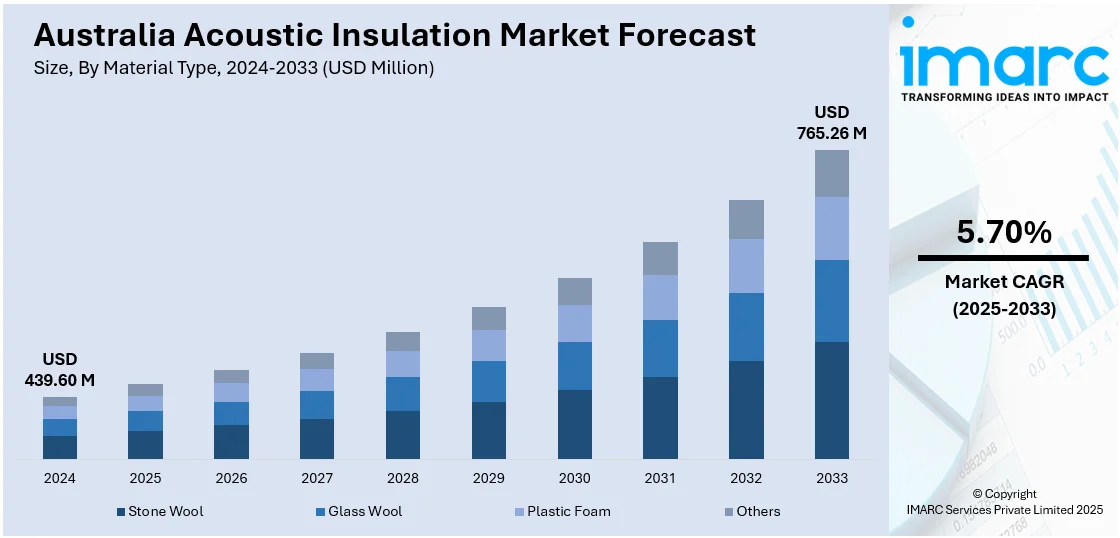

The Australia acoustic insulation market size reached USD 439.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 765.26 Million by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. The market is driven by stringent building regulations, rising noise pollution concerns, and growing demand for energy-efficient construction. Rapid urbanization, along with the need for soundproofing in residential and commercial spaces, further fuels growth. Sustainability trends and government incentives for green buildings also enhance the adoption of eco-friendly acoustic materials, expanding the Australia acoustic insulation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 439.60 Million |

| Market Forecast in 2033 | USD 765.26 Million |

| Market Growth Rate 2025-2033 | 5.70% |

Australia Acoustic Insulation Market Trends:

Increasing Demand for Sustainable and Eco-Friendly Acoustic Insulation Materials

The market is experiencing a growing demand for sustainable and eco-friendly materials, driven by stricter environmental regulations and rising consumer awareness. Builders and homeowners are increasingly opting for insulation made from recycled fibers, natural wool, and plant-based materials due to their low carbon footprint and non-toxic properties. Government initiatives promoting green building standards, such as the National Construction Code (NCC) and Green Star ratings, further encourage the adoption of these materials. During the fiscal year 2023-2024, Australia's green building sector reached a milestone. Over 1,000 projects have been Green Star certified by strong government policies such as the Net Zero in Government Operations Strategy, which mandates electrification and compliance with Green Star standards. Based on the GBCA's Year in Focus, 64 million square meters have been certified, with 46% of central business district offices assessed and Green Star shopping centers drawing more than 3.4 million shoppers a day. This growth indicates increased demand for sustainable options, such as acoustic insulation, for the creation of healthier, low-carbon buildings. Additionally, manufacturers are innovating with biodegradable and recyclable solutions to meet sustainability goals while maintaining high acoustic performance. This trend aligns with Australia’s broader shift toward energy-efficient and environmentally responsible construction practices, making eco-friendly acoustic insulation a key growth segment in the market.

Rising Adoption of Acoustic Insulation in Commercial and Residential Construction

The increased usage in both commercial and residential construction projects is also favoring the Australia acoustic insulation market growth. Rapid urbanization, coupled with noise pollution concerns, has accelerated the need for soundproofing solutions in offices, apartments, and educational institutions. Developers are incorporating high-performance acoustic insulation to comply with building codes and enhance occupant comfort. Additionally, the rise of remote work has positively influenced demand for home offices with superior noise control. Currently, 36% of Australians work remotely on a regular basis, which is a huge uprise from only 5% in 2016, primarily due to the popularity of hybrid work arrangements that have enhanced the availability of jobs for women with little children and workers with impairments by up to 9 percentage points. Even though productivity levels are on par with those found in conventional office environments and staff turnover is 33% less, 82% of Australian CEOs expect to have a full return to working from the office within three years. This change reflects the increased demand for acoustic insulation in home offices as Australia's work environment continues to shift. In the commercial sector, hospitality and healthcare facilities are prioritizing acoustic insulation to improve customer and patient experiences. With construction activity rebounding post-pandemic, this trend is expected to drive steady market growth, supported by advancements in lightweight and easy-to-install insulation materials.

Australia Acoustic Insulation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material type, sales channel, and end user.

Material Type Insights:

- Stone Wool

- Glass Wool

- Plastic Foam

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes stone wool, glass wool, plastic foam, and others.

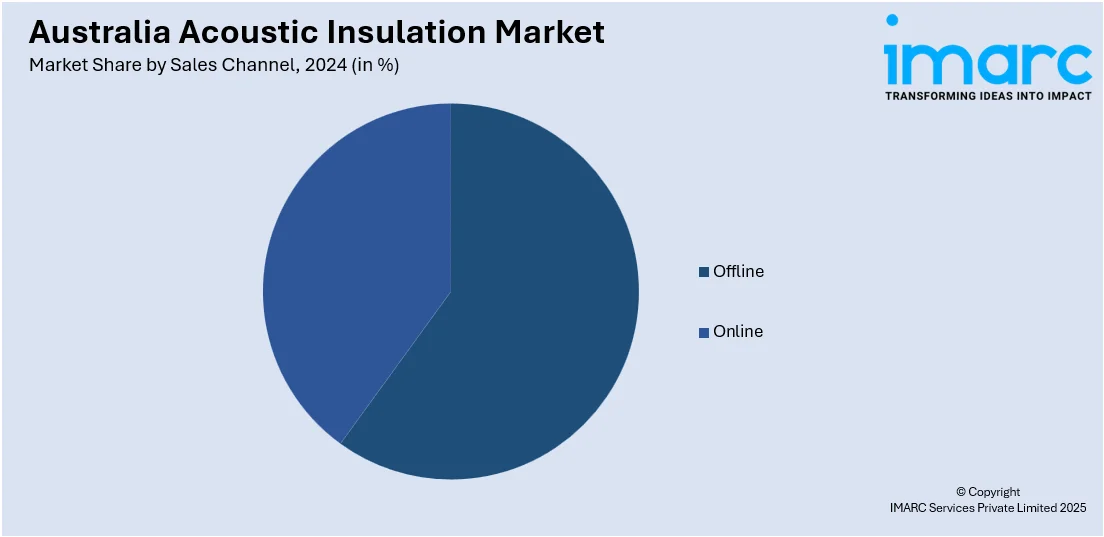

Sales Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes offline and online.

End User Insights:

- Building and Construction

- Industrial

- Transportation

The report has provided a detailed breakup and analysis of the market based on the end user. This includes building and construction, industrial, and transportation.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Acoustic Insulation Market News:

- August 15, 2024: Kingspan launched its new K-Roc™ wall and ceiling panels, made in Australia, that enhance local supply efficiency and offer superior fire-rated, non-combustible insulation products that comply with NCC requirements. The K-Roc product line consists of six launch products based on mineral wool cores that provide superior thermal and acoustic insulation performance, thus being ideal for Australian buildings that face extreme climate and soundproofing demands.

Australia Acoustic Insulation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Stone Wool, Glass Wool, Plastic Foam, Others |

| Sales Channels Covered | Offline, Online |

| End Users Covered | Building and Construction, Industrial, Transportation |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia acoustic insulation market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia acoustic insulation market on the basis of material type?

- What is the breakup of the Australia acoustic insulation market on the basis of sales channel?

- What is the breakup of the Australia acoustic insulation market on the basis of end user?

- What is the breakup of the Australia acoustic insulation market on the basis of region?

- What are the various stages in the value chain of the Australia acoustic insulation market?

- What are the key driving factors and challenges in the Australia acoustic insulation?

- What is the structure of the Australia acoustic insulation market and who are the key players?

- What is the degree of competition in the Australia acoustic insulation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia acoustic insulation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia acoustic insulation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia acoustic insulation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)