Australia Active Pharmaceutical Ingredients Market Size, Share, Trends and Forecast by Drug Type, Manufacturer Type, Synthesis Type, Therapeutic Application, and Region, 2025-2033

Australia Active Pharmaceutical Ingredients Market Overview:

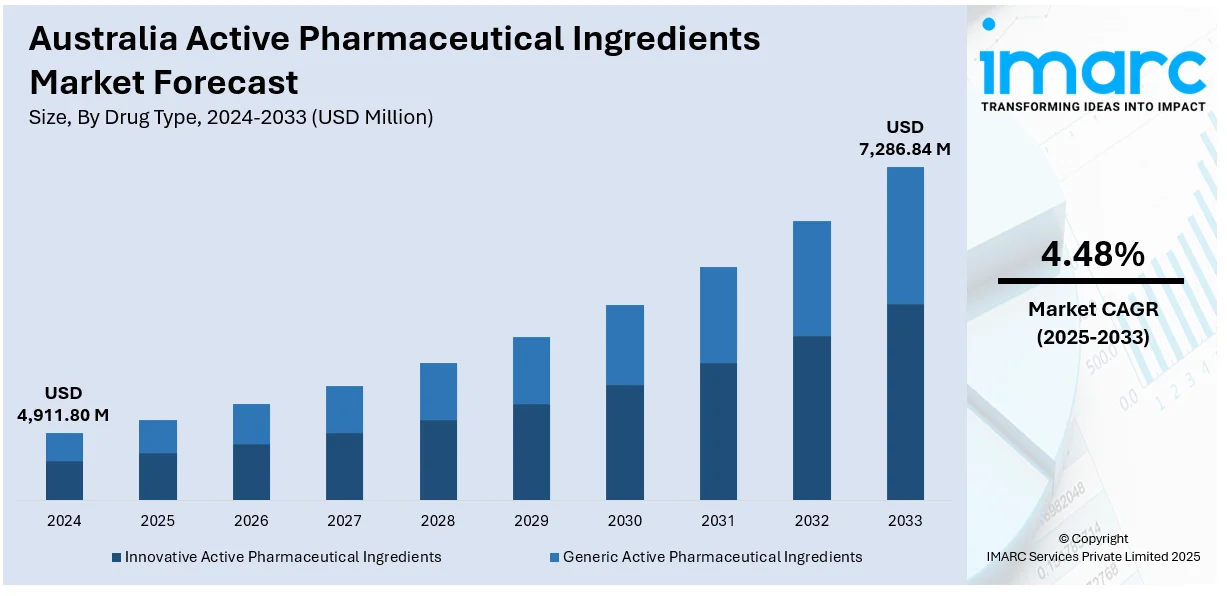

The Australia active pharmaceutical ingredients market size reached USD 4,911.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,286.84 Million by 2033, exhibiting a growth rate (CAGR) of 4.48% during 2025-2033. The market is driven by local manufacturing incentives and the push for self-reliance in API supply. Also, global regulatory alignment and emphasis on high compliance standards are fueling the product adoption. Domestic API production incentives, international GMP harmonization, early-phase drug discovery collaborations, and advanced infrastructure support for high-potency manufacturing are further expanding the Australia active pharmaceutical ingredients market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,911.80 Million |

| Market Forecast in 2033 | USD 7,286.84 Million |

| Market Growth Rate 2025-2033 | 4.48% |

Australia Active Pharmaceutical Ingredients Market Trends:

Domestic Manufacturing Incentives and API Self-Reliance

In recent years, the Australian government has increasingly emphasized self-sufficiency in pharmaceutical production, particularly for essential medicines and their raw components. This strategic pivot comes amid global supply chain disruptions and a growing recognition of the vulnerabilities associated with heavy dependence on imported APIs. Local manufacturing grants, streamlined regulatory approvals, and support for advanced manufacturing technologies have incentivized pharmaceutical firms to either establish or expand in-country API facilities. Industry players are also encouraged by the alignment of these policies with broader national interests in health security and economic resilience. Approximately midway through the supply chain recalibration efforts, the emphasis on localization has become a defining trend influencing Australia active pharmaceutical ingredients market growth. Major industry stakeholders are adopting continuous manufacturing models and investing in green chemistry platforms to enhance productivity and reduce environmental impact. Furthermore, Australia’s strong IP protection framework and world-class research institutions provide a fertile ground for domestic API innovation. On April 4, 2025, Griffith Hack provided an in-depth legal update on pharmaceutical patent term extensions (PTEs) in Australia, emphasizing how claim language affects eligibility for extended exclusivity of Active Pharmaceutical Ingredients. The analysis highlighted a key case: Sun Pharma ANZ Pty Ltd v Otsuka Pharmaceutical Co Ltd [2025] FCA 44, which clarified that claims involving sustained release profiles and particle size definitions can still qualify for up to a 5-year PTE if they fall within statutory criteria. These developments collectively contribute to a structural transformation of the country’s pharmaceutical landscape. By prioritizing in-house API development and production, Australia is not only mitigating import risks but also enhancing its global competitiveness in high-value, specialty APIs used in oncology, cardiology, and CNS disorders.

To get more information on this market, Request Sample

Regulatory Alignment with International Quality Standards

Australia’s Therapeutic Goods Administration (TGA) plays a pivotal role in harmonizing domestic pharmaceutical practices with global quality standards. Through mutual recognition agreements and adherence to ICH guidelines, Australian manufacturers are positioned to produce APIs that meet the stringent criteria required for international distribution. This alignment enhances the appeal of locally manufactured APIs not just within national borders, but also across regulated markets such as the EU and North America. As a result, Australian API exporters find themselves increasingly integrated into high-value global supply chains. The consistent implementation of Good Manufacturing Practices (GMP) has reinforced Australia’s reputation for pharmaceutical reliability and safety. Additionally, the TGA’s collaborative partnerships with the USFDA, EMA, and PMDA have ensured rapid access to new guidelines and compliance benchmarks. These factors enable Australian manufacturers to remain competitive on quality and regulatory foresight, attracting international pharmaceutical companies seeking stable, reliable API suppliers. Importantly, this regulatory strength reduces market entry risks and supports long-term commercial viability for companies expanding their API operations in Australia. By maintaining a high standard of compliance, Australia ensures that its API sector is both future-ready and strategically aligned with the evolving dynamics of global pharmaceutical trade.

R&D Capabilities and Growth in Specialty APIs

Australia’s strong academic-research ecosystem, coupled with a robust biotech industry, has positioned it as a hub for API innovation, particularly in the niche domain of specialty and high-potency APIs. Collaborations between universities, public research agencies, and private pharmaceutical companies are yielding proprietary compounds and production technologies that differentiate Australia in a competitive global landscape. These partnerships often focus on oncology, immunotherapy, and rare disease therapies, where APIs require complex synthesis and precise pharmacological targeting. With increasing demand for personalized medicine and biologics, specialty APIs are gaining prominence, and Australia is capitalizing on this shift. Numerous biotech clusters in Melbourne, Sydney, and Brisbane are actively engaged in early-phase drug development that necessitates small-batch, high-purity APIs. Unlike mass-produced generics, these APIs require tailored production environments and agile supply chain management—areas where Australia demonstrates proven capabilities. The availability of advanced analytical labs, skilled scientific talent, and funding through grants and venture capital also enhances the innovation cycle. As global pharmaceutical companies seek partners for next-generation drug development, Australia’s specialty API offerings are becoming a competitive advantage that supports both domestic health objectives and international commercialization opportunities.

Australia Active Pharmaceutical Ingredients Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on drug type, manufacturer type, synthesis type, and therapeutic application.

Drug Type Insights:

- Innovative Active Pharmaceutical Ingredients

- Generic Active Pharmaceutical Ingredients

The report has provided a detailed breakup and analysis of the market based on the drug type. This includes innovative active pharmaceutical ingredients and generic active pharmaceutical ingredients.

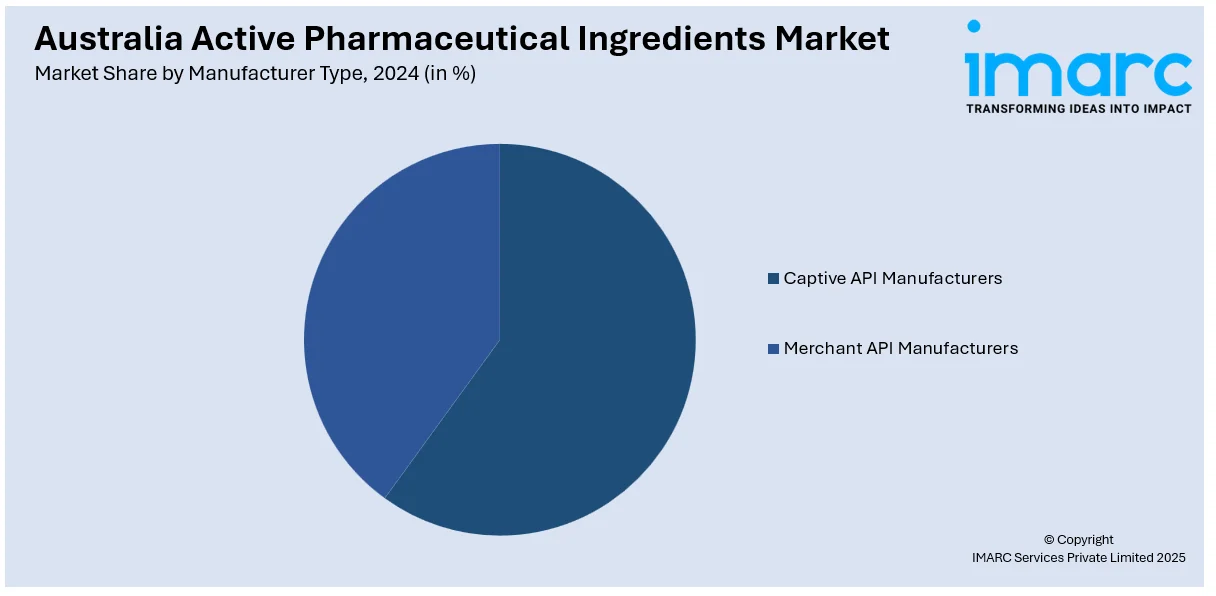

Manufacturer Type Insights:

- Captive API Manufacturers

- Merchant API Manufacturers

- Innovative Merchant API Manufacturers

- Generic Merchant API Manufacturers

The report has provided a detailed breakup and analysis of the market based on the manufacturer type. This includes captive API manufacturers and merchant API manufacturers (innovative merchant API manufacturers and generic merchant API manufacturers).

Synthesis Type Insights:

- Synthetic Active Pharmaceutical Ingredients

- Innovative Synthetic APIs

- Generic Synthetic APIs

- Biotech Active Pharmaceutical Ingredients

- Drug Type

- Innovative Biotech APIs

- Biosimilars

- Product Type

- Monoclonal Antibodies

- Vaccines

- Cytokines

- Others

- Expression System Type

- Mammalian Expression System

- Microbial Expression System

- Yeast Expression System

- Others

- Drug Type

The report has provided a detailed breakup and analysis of the market based on the synthesis type. This includes synthetic active pharmaceutical ingredients (innovative synthetic APIs and generic synthetic APIs) and biotech active pharmaceutical ingredients [drug type (innovative biotech APIs and biosimilars), product type (monoclonal antibodies, vaccines, cytokines, and others), and expression system type (mammalian expression system, microbial expression system, yeast expression system, and others)].

Therapeutic Application Insights:

- Oncology

- Cardiovascular and Respiratory

- Diabetes

- Central Nervous System Disorders

- Neurological Disorders

- Others

The report has provided a detailed breakup and analysis of the market based on the therapeutic application. This includes oncology, cardiovascular and respiratory, diabetes, central nervous system disorders, neurological disorders, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Active Pharmaceutical Ingredients Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Innovative Active Pharmaceutical Ingredients, Generic Active Pharmaceutical Ingredients |

| Manufacturer Types Covered |

|

| Synthesis Types Covered |

|

| Therapeutic Applications Covered | Oncology, Cardiovascular and Respiratory, Diabetes, Central Nervous System Disorders, Neurological Disorders, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia active pharmaceutical ingredients market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia active pharmaceutical ingredients market on the basis of drug type?

- What is the breakup of the Australia active pharmaceutical ingredients market on the basis of manufacturer type?

- What is the breakup of the Australia active pharmaceutical ingredients market on the basis of synthesis type?

- What is the breakup of the Australia active pharmaceutical ingredients market on the basis of therapeutic application?

- What is the breakup of the Australia active pharmaceutical ingredients market on the basis of region?

- What are the various stages in the value chain of the Australia active pharmaceutical ingredients market?

- What are the key driving factors and challenges in the Australia active pharmaceutical ingredients?

- What is the structure of the Australia active pharmaceutical ingredients market and who are the key players?

- What is the degree of competition in the Australia active pharmaceutical ingredients market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia active pharmaceutical ingredients market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia active pharmaceutical ingredients market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia active pharmaceutical ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)