Australia Adhesive Tape Market Size, Share, Trends and Forecast by Material, Resin, Technology, Application, and Region, 2026-2034

Australia Adhesive Tape Market Summary:

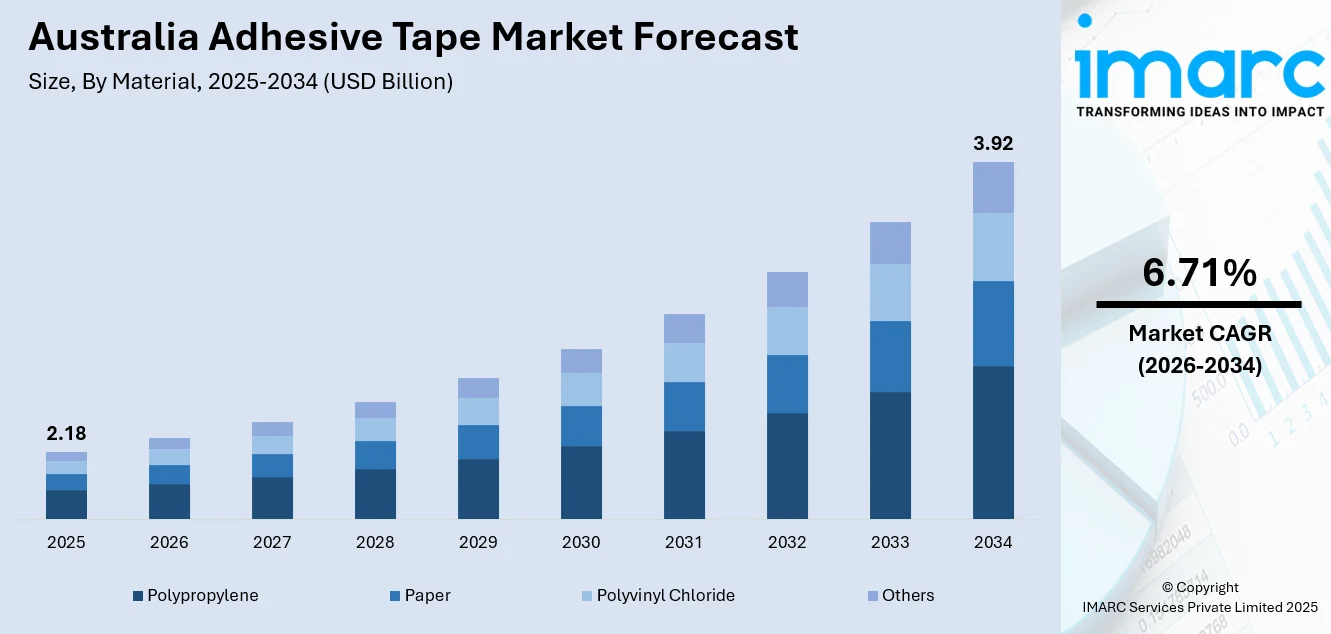

The Australia adhesive tape market size was valued at USD 2.18 Billion in 2025 and is projected to reach USD 3.92 Billion by 2034, growing at a compound annual growth rate of 6.71% from 2026-2034.

The Australia adhesive tape market is growing at a fast pace owing to the burgeoning e-commerce industry, where secure and robust packaging solutions have become the need of the hour. The burgeoning construction industry, in addition to the rise in infrastructure development activities in the country, is fueling the demand for specialized adhesives in sealing, insulation, and water-resistance applications. The automotive and electrical industries have also seen the increasing use of high-performance adhesive tapes as new-generation innovative substitutes for presently used fastening techniques.

Key Takeaways and Insights:

- By Material: Polypropylene dominates the market with a share of 42% in 2025, driven by its exceptional durability, moisture resistance, and cost-effectiveness making it the preferred choice for packaging applications across diverse industries.

- By Resin: Acrylic leads the market with a share of 45% in 2025, owing to its superior bonding strength, excellent aging properties, and resistance to environmental factors including UV exposure and temperature variations.

- By Technology: Water-based adhesive tapes represent the largest segment with a market share of 51% in 2025, attributed to growing environmental consciousness and regulatory pressures driving adoption of low-VOC, eco-friendly adhesive solutions.

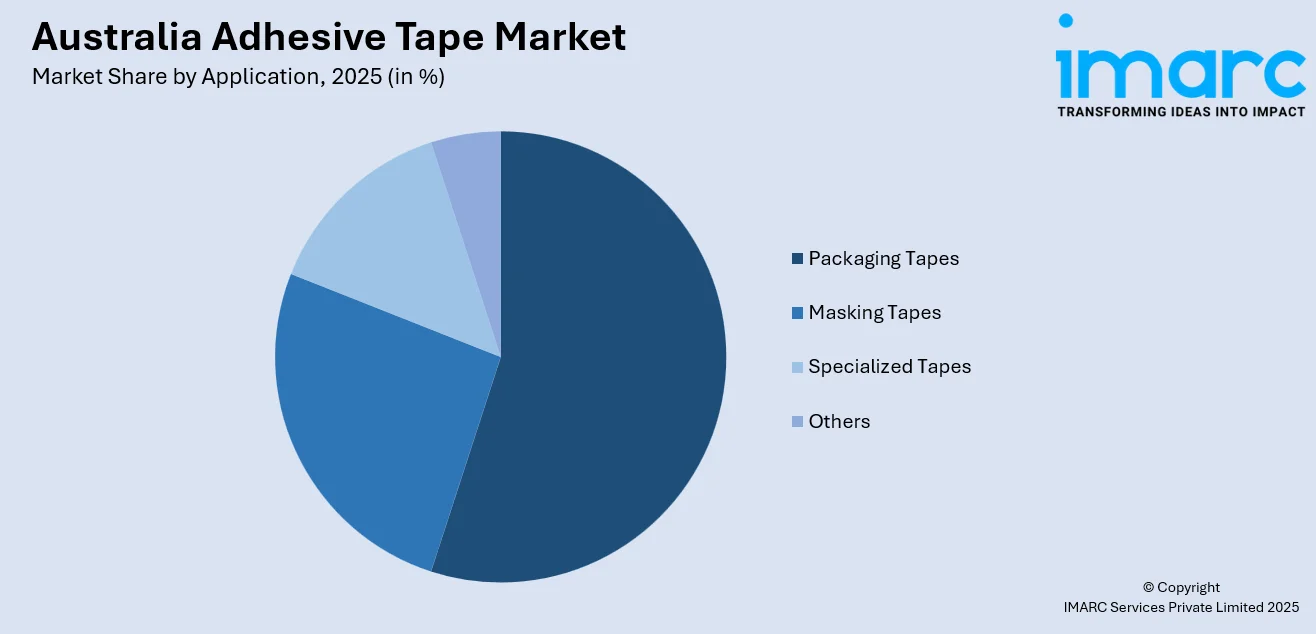

- By Application: Packaging tapes dominates with a market share of 55% in 2025, propelled by the exponential growth of e-commerce retail operations and increasing demand for secure, efficient shipping solutions across Australia.

- By Region: Australia Capital Territory & New South Wales leads with a 30% share in 2025, reflecting the concentration of manufacturing facilities, logistics hubs, and commercial activities in these economically vital regions.

- Key Players: The Australia adhesive tape market exhibits a moderately fragmented competitive landscape, with both multinational corporations and regional manufacturers competing across various price segments. Market players are focusing on product innovation, sustainable solutions, and strategic partnerships to strengthen their market positioning and expand their customer base.

To get more information on this market Request Sample

The Australia adhesive tape market is witnessing transformative growth as industries increasingly recognize the versatility and efficiency of adhesive tape solutions. In October 2025, CustomPrintedTape recognized Sands Industries as Australia’s Industrial Innovation Leader 2025 for its commitment to sustainable and high‑quality industrial solutions, underscoring innovation in the local adhesive and packaging tape sector. The packaging sector remains the dominant end-user, driven by the robust expansion of e-commerce operations that require reliable sealing solutions for millions of parcels shipped daily. The construction industry is emerging as a significant growth contributor, with infrastructure development projects across Victoria, Queensland, and New South Wales driving demand for specialized masking, insulation, and waterproofing tapes. Furthermore, the automotive sector is transitioning toward lightweight adhesive solutions that replace traditional mechanical fasteners, contributing to enhanced fuel efficiency and manufacturing flexibility. The market is also benefiting from heightened environmental awareness, with manufacturers developing biodegradable and recyclable tape options to meet evolving sustainability requirements and regulatory standards.

Australia Adhesive Tape Market Trends:

Rising Adoption of Sustainable and Eco-Friendly Adhesive Solutions

The Australia adhesive tape market is experiencing a significant shift toward environmentally sustainable products as businesses and consumers become increasingly conscious of their ecological footprint. In January 2025, tesa launched tesafilm® Paper, its first paper‑based version of the classic adhesive tape, expanding its sustainable product portfolio and reinforcing industry focus on eco‑friendly materials. Manufacturers are responding to this trend by developing biodegradable tapes made from renewable materials, recyclable packaging options, and adhesives with low volatile organic compound content. This sustainability-driven transformation is particularly pronounced in the packaging and retail sectors, where companies seek to align their operations with circular economy principles and meet growing consumer expectations for environmentally responsible products.

Growing Integration of Advanced Technologies in Tape Manufacturing

The adhesive tape industry in Australia is witnessing substantial technological advancements that are enhancing product performance and expanding application possibilities. In September 2024, Australian packaging specialist Stylus Tapes significantly expanded its range of eco‑friendly tapes, including compostable, recyclable paper, and post‑consumer recycled (rPET) content tapes, to help local businesses meet sustainability goals and evolving environmental standards in packaging applications. This reflects a broader industry push toward innovation that combines performance with sustainability. Manufacturers are investing in research and development to create tapes with improved temperature resistance, superior bonding strength, and enhanced durability for specialized applications. These innovations are enabling the use of adhesive tapes in increasingly demanding environments, including high-temperature industrial processes, outdoor applications requiring weather resistance, and precision electronics assembly where contamination-free bonding is essential.

Expansion of E-Commerce Driving Packaging Tape Demand

The exponential growth of online retail in Australia is fundamentally reshaping the adhesive tape market landscape. As consumers increasingly prefer the convenience of digital shopping, retailers and logistics companies require vast quantities of reliable packaging tape to secure shipments effectively. The Australia e-commerce market size was valued at USD 604.1 Billion in 2025, and looking forward, it is expected to reach USD 1,683.9 Billion by 2034, exhibiting a CAGR of 12.07% from 2026‑2034, highlighting the massive scale and growth potential of online retail that directly fuels demand for adhesive solutions. This trend is accelerating demand for high-performance sealing solutions that can withstand the rigors of transportation while ensuring package integrity. The e-commerce boom is also driving innovation in branded and customized tapes, enabling businesses to enhance their brand visibility and create memorable unboxing experiences for customers.

Market Outlook 2026-2034:

The Australia adhesive tape market shows promising future growth prospects over the forecast period, which will attract the market due to its growing demand in prominent industries and changing consumer behavior. The market will benefit from continuously developing infrastructure, the integration of e-commerce in the country’s economy, and the implementation of modern manufacturing techniques in industries, which prefer adhesive bonding over other joining techniques. In addition, the regulatory drive for green packaging will witness the adoption of environmentally friendly adhesive products. The market generated a revenue of USD 2.18 Billion in 2025 and is projected to reach a revenue of USD 3.92 Billion by 2034, growing at a compound annual growth rate of 6.71% from 2026-2034.

Australia Adhesive Tape Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Material |

Polypropylene |

42% |

|

Resin |

Acrylic |

45% |

|

Technology |

Water-Based Adhesive Tapes |

51% |

|

Application |

Packaging Tapes |

55% |

|

Region |

Australia Capital Territory & New South Wales |

30% |

Material Insights:

- Polypropylene

- Paper

- Polyvinyl Chloride

- Others

The polypropylene dominates with a market share of 42% of the total Australia adhesive tape market in 2025.

Polypropylene-based adhesive tapes have established themselves as the preferred choice across diverse industrial and commercial applications in Australia. The material offers an exceptional combination of tensile strength, flexibility, and resistance to moisture penetration, making it ideal for packaging and shipping applications where durability is paramount. At CHINAPLAS 2025, Starlinger & Co. GmbH showcased its sustainable and efficient polypropylene tape production technologies, including high‑speed extrusion lines capable of producing top‑quality PP tapes for demanding packaging uses, underscoring industry innovation that supports stronger, more sustainable polypropylene tape supply chains relevant to markets like Australia. The cost-effectiveness of polypropylene tapes, combined with their compatibility with various printing and customization processes, has solidified their dominance in the packaging sector.

The widespread adoption of polypropylene tapes is further supported by their excellent performance characteristics across varying temperature ranges and environmental conditions. These tapes demonstrate reliable adhesion properties on cardboard, corrugated boxes, and various plastic surfaces commonly encountered in logistics operations. The material's inherent resistance to chemicals and oils makes it suitable for industrial applications, while its availability in various widths, thicknesses, and adhesive formulations enables precise matching to specific application requirements.

Resin Insights:

- Acrylic

- Rubber

- Silicone

- Others

The acrylic leads with a share of 45% of the total Australia adhesive tape market in 2025.

Acrylic-based adhesive tapes have gained substantial market prominence due to their superior long-term bonding performance and environmental resistance characteristics. These adhesives demonstrate excellent aging properties, maintaining their bonding strength over extended periods without significant degradation or yellowing. The ability of acrylic adhesives to perform consistently across wide temperature ranges makes them particularly suitable for applications where exposure to varying climatic conditions is anticipated.

The growing preference for acrylic adhesives is also driven by their compatibility with sustainability objectives, as many formulations are water-based and contain minimal volatile organic compounds. Industries requiring clean, residue-free removal properties often favor acrylic tapes for their ability to bond strongly during use while allowing for easier removal when necessary. The versatility of acrylic adhesives in bonding to diverse substrates, including low-energy surfaces, has expanded their application scope across packaging, automotive, and electronics sectors.

Technology Insights:

- Water-Based Adhesive Tapes

- Solvent-Based Adhesive Tapes

- Hot-Melt-Based Adhesive Tapes

The water-based adhesive tapes dominate with a market share of 51% of the total Australia adhesive tape market in 2025.

Water-based adhesive tapes have emerged as the leading technology segment in the Australian market, driven primarily by environmental regulations and growing sustainability consciousness across industries. These tapes utilize water as the primary carrier for adhesive components, resulting in significantly lower emissions of volatile organic compounds during manufacturing and application processes. Waterborne adhesive technologies, which use water instead of solvent carriers, are increasingly being adopted because they produce very low VOC emissions and meet high environmental standards for safer, cleaner production and use. The technology aligns with Australia's increasingly stringent environmental standards and corporate sustainability initiatives.

Beyond environmental benefits, water-based adhesive tapes offer excellent performance characteristics including good initial tack, reliable bonding strength, and compatibility with recycling processes. The technology is particularly favored in food packaging applications where concerns about chemical migration and odor transfer are paramount. Manufacturers continue to advance water-based formulations to achieve performance parity with solvent-based alternatives, expanding their applicability to demanding industrial applications while maintaining their environmental advantages.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Packaging Tapes

- Masking Tapes

- Specialized Tapes

- Others

The packaging tapes leads with a share of 55% of the total Australia adhesive tape market in 2025.

Packaging tapes represent the largest application segment in the Australian adhesive tape market, driven by the extensive use of these products in securing cartons, boxes, and packages across retail, logistics, and manufacturing sectors. The remarkable growth of e-commerce has amplified demand for reliable sealing solutions that can withstand the challenges of modern supply chains. Packaging tapes are essential for ensuring product integrity during storage and transportation, protecting contents from damage, tampering, and environmental exposure.

The segment continues to evolve with innovations in tape performance, including enhanced adhesion to recycled cardboard materials, improved resistance to temperature fluctuations during transit, and development of security features for tamper-evident packaging. The trend toward branded packaging has driven demand for custom-printed tapes that serve both functional and marketing purposes, enabling businesses to reinforce brand identity throughout the delivery experience. Furthermore, the shift toward sustainable packaging practices is influencing tape selection, with buyers increasingly favoring recyclable and biodegradable options.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales exhibits a clear dominance with a 30% share of the total Australia adhesive tape market in 2025.

Australia Capital Territory and New South Wales accounts for the dominant market share in the country's adhesive tape industry due to its proximity to the economic hub of Australia. Sydney, as the country's largest city, has many manufacturing facilities and distribution channels for the products that create a demand in the market. The region has a sophisticated online shopping platform with advanced logistics systems that creates an ever-continuing demand for packaging tape solutions.

The construction industry, particularly the residential, commercial, and infrastructure sectors, continues to be an important regional market for tape, with specialized applications for tape products required for various projects. The diversity of industries, including food, pharmaceutical, electronics, and autos, provides other regional markets with opportunities for various types of tape. The headquarters of many corporations located in Sydney and Canberra provide additional regional markets for office tape products.

Market Dynamics:

Growth Drivers:

Why is the Australia Adhesive Tape Market Growing?

Expanding E-Commerce Sector and Online Retail Operations

The phenomenal growth of e-commerce in Australia represents a primary catalyst for adhesive tape market expansion, as online retailers require massive quantities of reliable packaging solutions to secure their shipments. The shift in consumer purchasing behavior toward digital channels has created unprecedented demand for sealing tapes that can protect packages throughout complex logistics networks spanning urban delivery routes and remote regional destinations. In 2025, Australia’s Carewell Group Pty Ltd highlighted a surge in demand for sustainable and customizable shipping tapes among local e‑commerce businesses, reflecting how online retail growth is driving uptake of both functional and branded adhesive solutions for secure, professional package sealing. Online shopping has transformed from a convenience option to an essential retail channel, driving sustained investment in packaging infrastructure and consumables. Retailers are increasingly focused on the unboxing experience as a brand differentiation tool, leading to demand for premium and customized tape products that enhance customer perceptions. The growth of same-day and next-day delivery services has intensified the need for quick-seal solutions that support efficient fulfillment operations while maintaining package security during rapid transit cycles.

Robust Construction Industry Growth and Infrastructure Development

Australia's construction sector is experiencing sustained growth driven by government-backed infrastructure initiatives, housing development programs, and commercial real estate expansion, all of which generate substantial demand for specialized adhesive tapes. The Australia construction market size was valued at USD 420.5 Billion in 2025 and is projected to reach USD 603.0 Billion by 2034, exhibiting a CAGR of 4.09% from 2026‑2034, highlighting the scale and steady growth of construction activity that directly supports adhesive tape demand across multiple applications. Major infrastructure projects including road networks, rail systems, and public facilities require various tape applications for sealing, insulation, surface protection, and temporary bonding during construction phases. The residential construction boom, particularly in growing metropolitan areas, drives demand for masking tapes used in painting operations and specialized tapes for weatherproofing and vapor barrier applications. Commercial construction projects increasingly utilize advanced adhesive tape solutions for curtain wall installations, glazing applications, and interior finishing work where traditional mechanical fasteners are impractical. The trend toward prefabricated and modular construction methods creates additional opportunities for tape products that facilitate rapid assembly while providing reliable performance throughout building lifecycles.

Automotive Industry Transition Toward Lightweight Bonding Solutions

The Australian automotive industry is increasingly adopting adhesive tape solutions as alternatives to traditional mechanical fastening methods, driven by the imperative to reduce vehicle weight and improve manufacturing efficiency. Advanced adhesive tapes offer significant advantages including vibration damping, noise reduction, and the ability to join dissimilar materials without compromising structural integrity. According to reports, Bostik Australia expanded its automotive adhesive tape offerings with advanced hot‑melt pressure‑sensitive adhesives tailored for wire harnessing and lightweight component bonding, underlining the growing role of specialized tape solutions in local automotive manufacturing and assembly. The transition toward electric vehicles is accelerating this trend, as battery assembly and thermal management systems require specialized bonding solutions that adhesive tapes can provide effectively. Automotive manufacturers value the design flexibility that tape bonding offers, enabling sleeker aesthetics and improved aerodynamic profiles that contribute to fuel efficiency and range optimization. The aftermarket segment also contributes to demand growth, with repair facilities and customization specialists utilizing various tape products for trim attachment, surface protection, and component assembly applications.

Market Restraints:

What Challenges the Australia Adhesive Tape Market is Facing?

Fluctuating Raw Material Prices and Supply Chain Volatility

The adhesive tape manufacturing industry faces ongoing challenges related to the volatility of raw material costs, particularly for petroleum-derived polymers and specialty chemicals used in adhesive formulations. Price fluctuations for polypropylene, polyester films, and various resin components can significantly impact production costs and profit margins. Supply chain disruptions affecting the availability of critical inputs create additional uncertainties for manufacturers seeking to maintain consistent production schedules and inventory levels.

Intense Competition from Alternative Fastening Technologies

The adhesive tape market faces competitive pressure from alternative fastening and bonding solutions including mechanical fasteners, liquid adhesives, and heat-sealing technologies. In certain applications, these alternatives may offer advantages in terms of bond strength, cost efficiency, or processing speed that limit tape adoption. The continuous development of competing technologies requires tape manufacturers to innovate constantly and demonstrate clear performance advantages to maintain market position.

Stringent Environmental Regulations and Sustainability Requirements

While environmental consciousness drives demand for sustainable tape products, the regulatory requirements for achieving compliance can present significant challenges for manufacturers. Developing eco-friendly formulations that match the performance characteristics of conventional products often requires substantial research investment and process modifications. The complexity of meeting various certification standards while maintaining cost competitiveness creates barriers, particularly for smaller manufacturers with limited resources for sustainable product development.

Competitive Landscape:

The Australia adhesive tape industry exhibits a fairly competitive marketplace with the coexistence of MNCs and local players catering to the respective segments of the market. The dominant players make use of their strong R&D efforts and capabilities to provide innovative solutions for their customers in response to changing market and government requirements. The competitive frameworks in this market get defined by the efforts of the dominant players in terms of capacity enhancement, distribution channels, and the focus of the products on sustainability. The industry players are now focusing on value addition in terms of support and handling and provide solutions through strong support and handling in addition to the products they provide. The industry faces collaboration between the tape suppliers and the respective industries to provide customized solutions for bonding requirements.

Recent Developments:

- In January 2026, 3M unveils its new high‑strength 3M™ VHB™ Tape Max Series, a next‑generation industrial adhesive tape delivering up to twice the strength of standard VHB tapes for demanding applications across transportation, construction and appliance assembly. The launch aims to reduce reliance on mechanical fasteners and liquid adhesives.

Australia Adhesive Tape Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Polypropylene, Paper, Polyvinyl Chloride, Others |

| Resins Covered | Acrylic, Rubber, Silicone, Others |

| Technologies Covered | Water-Based Adhesive Tapes, Solvent-Based Adhesive Tapes, Hot-Melt-Based Adhesive Tapes |

| Applications Covered | Packaging Tapes, Masking Tapes, Specialized Tapes, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia adhesive tape market size was valued at USD 2.18 Billion in 2025.

The Australia adhesive tape market is expected to grow at a compound annual growth rate of 6.71% from 2026-2034 to reach USD 3.92 Billion by 2034.

Polypropylene dominated the Australia adhesive tape market with a share of 42%, driven by its excellent durability, moisture resistance, cost-effectiveness, and widespread application in packaging operations across diverse industries including e-commerce, retail, and manufacturing sectors.

Key factors driving the Australia adhesive tape market include the expanding e-commerce sector requiring secure packaging solutions, robust construction industry growth fueled by infrastructure development projects, increasing adoption of lightweight adhesive bonding in the automotive industry, and growing demand for sustainable and eco-friendly tape products.

Major challenges include fluctuating raw material prices and supply chain volatility affecting production costs, intense competition from alternative fastening technologies, stringent environmental regulations requiring investment in sustainable product development, and the need to balance performance requirements with eco-friendly formulations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)