Australia Aged Care Market Size, Share, Trends, and Forecast by Services, Application, and Region, 2026-2034

Australia Aged Care Market Size and Share:

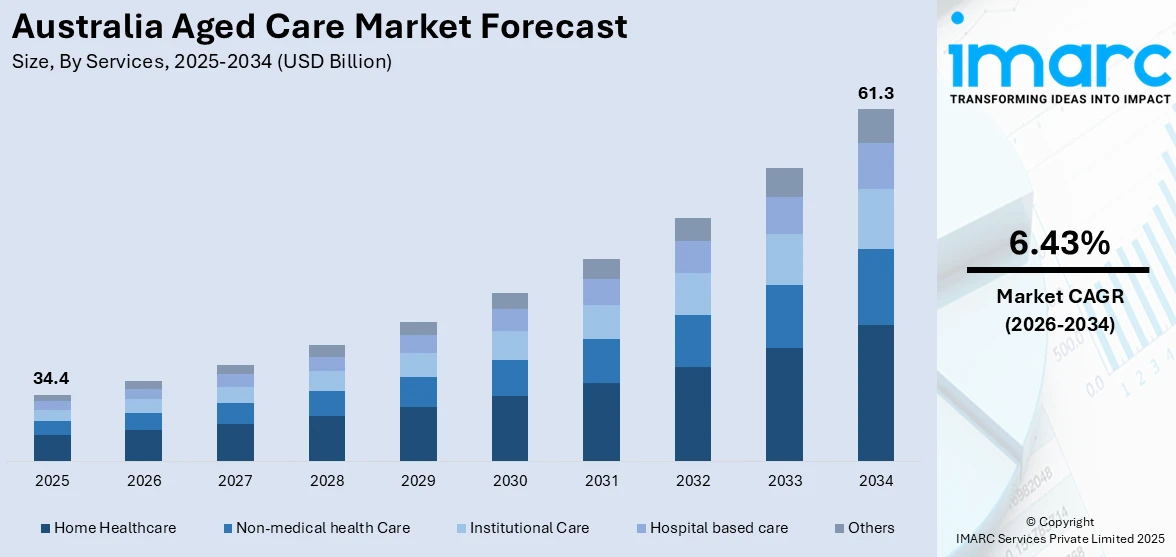

The Australia aged care market size reached USD 34.4 Billion in 2025. Looking forward, the market is expected to reach USD 61.3 Billion by 2034, exhibiting a growth rate (CAGR) of 6.43% during 2026-2034. The rising aging population, the increasing demand for personalized and high-quality care services, government funding and reforms aimed at improving care standards, advancements in healthcare technology, and a growing emphasis on in-home and community-based care are some of the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 34.4 Billion |

| Market Forecast in 2034 | USD 61.3 Billion |

| Market Growth Rate (2026-2034) | 6.43% |

Key Trends of Australia Aged Care Market:

Rising Aging Population

The growing number of elderly Australians facilitates the requirement for aged care services and facilities, as more individuals require assistance and support as they age. According to industry reports, by 2026, more than 22% of people in Australia will be aged over 65 years and above from 16% in 2020, which was already double of the 8.3% during 1970s beginning. The ratio of old-age dependency is the number of people aged 65 years or more than for every 100 individual of conventional working age 15-64. It is anticipated to increase significantly by the year 2063, with every five working-age individual there will be around two older person.

To get more information of this market Request Sample

Growing Favorable Government Initiatives and Funding

Government policies and increased funding to improve care standards and expand aged care services contribute significantly to market growth, supporting residential and in-home care options. For instance, in September 2024, The Australian Government deployed the Aged Care Bill 2024 to Parliament. The Bill is for a new Aged Care Act, with the main law defining how the aged care system operates. It will offer key aged care reforms. The Bill targets to enhance the lives of older people availing aged care solutions in residential aged care homes, community settings, or their homes. It also encourages aged care providers to deliver high-quality care. The proposed rights-based law addresses around 60 Royal Commission into Aged Care Quality and Safety recommendations. It incorporates feedback from several public consultations we’ve led about the aged care reforms and the new law. It responds to the Aged Care Taskforce about sustainably funding aged care into the future. The Bill will be provided to the Senate Community Affairs Legislation Committee for report and inquiry. During this period, the department will accept feedback for certain policies that will be enveloped under the new law. The new Aged Care Act is anticipated to be implemented from 1 July 2025.

Growth Drivers of Australia Aged Care Market:

Movement Toward Home-Based and Community-Centered Care

One of the main drivers transforming Australia's aged care market is the increasing movement toward home-based and community-centered care. Older Australians are choosing to age in place rather than relocate to conventional residential care facilities. This change is encouraging service providers to develop services that enable older people to stay at home and receive assistance with it. Such services are personal care, meal provision, mobility aid, and nursing home visits, all specific to individual health status and preferred lifestyle. Day programs and community centers are increasingly offering allied health services and social interaction for older people remaining at home. This trend is underpinned by funding for infrastructure and support programs, especially in suburban and provincial environments where it may be difficult to access full-size aged care facilities. With a desire from families for more flexible and respectful care options for relatives, the demand for local, community-based solutions remains strong, underpinned by diversification of services and investment throughout the Australia aged care market share.

Workforce Development and Training Investment

One of the key drivers of growth in Australia's aged care industry is the targeted investment in training and development of the workforce and professionalization. The sector has historically experienced staffing issues, while new policy changes, education alliances, and funding initiatives are supporting the attraction, education, and retention of qualified professionals. Training in vocational education and specialized certification programs is broadening to equip caregivers, nurses, and allied health professionals to meet the specific challenges of aged care. In addition, the focus on culturally sensitive care is also leading to specialized training for staff serving Australia's multicultural population, such as Indigenous Australians and non-English-speaking older people. Government incentives to upskill aged care staff, as well as routes for career advancement, are helping to improve the sector's capacity to provide high-quality, person-centered care. Technological competence is also being given greater focus, as technology increasingly plays a role in service delivery. This workforce readiness emphasis enhances care outcomes and stimulates employment generation and lasting industry stability and is thus a fundamental driver of Australia aged care market demand.

Technological Development and Invention in Care

Technology is increasingly becoming a critical driver of growth in Australia's aged care sector. Providers are also consolidating digital health tools like remote monitoring systems, electronic medication management, and telehealth services to enhance care delivery and efficiency. The technologies facilitate improved communication among patients, caregivers, and medical providers, particularly within home care environments. Furthermore, smart home technology such as fall detection sensors, voice assistants, and automated lighting is improving safety and autonomy for older adults who want to live at home for longer. In aged care homes, electronic records and data analysis tools enable more efficient operations and compliance with stringent health standards. Australia's robust telecommunications network underpins these developments, complemented by government programs offering funding and training for digitalization throughout the industry. These innovations enhance the quality of care while also lowering costs and the burden on resources. Hence, technology has become a key element in the continued advancement and growth of the aged care sector in Australia.

Government Support of Australia Aged Care Market:

Comprehensive Reform and Policy Overhaul

Government assistance for Australia's aged care sector is based on comprehensive policy reform designed to enhance the quality, safety, and accessibility of services for older Australians. Following revelations by high-level inquiries into conditions in aged care, the authorities have made significant legislative overhauls to enhance governance, transparency, and accountability across the sector. Among these reforms is the creation of a new Aged Care Act, with person-centered care as its focus and a clear definition of rights for older people. Additionally, the government has redesigning funding arrangements to more closely match care needs on an individual basis, moving toward home-based care but still with strong support for residential care. New rules to accompany this change guarantee that providers are delivering high-quality care and reporting. These changes increase the standard for quality care and stimulate innovation, as providers are incentivized to create adaptable, responsive services that respond to Australia's changing aged population in both urban and regional areas.

Mental Health and Wellbeing in Aged Care

Another important area of government support in Australia's aged care sector is the increasing focus on mental health and emotional wellbeing among older people. Through acknowledgement of issues of loneliness, depression, and mind decline in seniors, the government has introduced programs and provided funding designed to enhance psychological care in both in-home and residential care facilities. The measures taken include the hiring of mental health experts in aged care homes, creating individually focused therapy protocols, and incorporating wellness and social activity programs in care plans. In addition, support is also being made available for dementia care training to assist staff in meeting complex behavior and cognitive needs. These actions reflect a changing model of aged care, that respects holistic health, social interaction, and emotional quality of life as much as physical care. By putting mental wellbeing at the forefront of care plans, government policy is improving the overall level of care on offer to older Australians and creating new avenues for care providers to innovate.

Regional Access and Infrastructure Support

Making sure that aged care services are equitably accessed across Australia's broad geography is a top concern of the government, and a significant amount of support is given to enhancing regional and remote areas' infrastructure. A number of older Australians who live in non-metropolitan locations are subjected to limited access to healthcare, aged care settings, and support services. To counteract this, government schemes offer funding for the building and refurbishment of aged care infrastructure in deprived areas. This includes assistance for transport services, mobile outreach programs, and the integration of telehealth solutions to enable care providers to reach further. Collaborations between councils and community groups assist in personalizing services to suit the demands of regional communities. These actions improve quality of life among older Australians in rural areas, while also boosting local jobs and economic activity. By closing the urban-rural divide in care, government infrastructure funding is critical to delivering fairness and inclusivity throughout the whole aged care system, which further contributes to the Australia aged care market growth.

Opportunities of Australia Aged Care Market:

Culturally Inclusive Aged Care Service Expansion

According to the Australia aged care market analysis, the region’s multicultural society is a major opportunity for culturally inclusive aged care service development. As the population of older people from linguistically, ethno-cultural, and religious backgrounds continue to expand, providers are seeking means to adapt care that is responsive to cultural practices, dietary requirements, and language preferences. This involves the employment of bilingual personnel, provision of culturally suitable cuisine, and the inclusion of traditional practices within health and lifestyle programs. Areas with high immigrant concentrations such as Victoria and New South Wales are witnessing growing demand for these services, compelling service providers to partner with community groups and cultural councils. Multicultural development grants made available by the Australian government also reinforce this market segment by facilitating the establishment of specialized training and facilities improvement. By providing services that resonate with the cultural identities of ageing Australians, providers of aged care can strengthen relationships with communities and create a critical niche in the market by becoming inclusive and responsive care leaders.

Expansion in Regional and Remote Care Infrastructure

Australia's vast geography offers the benefit of extending aged care infrastructure to regional and remote communities, which previously have had limited access to healthcare services. With population aging taking place in major cities and throughout rural areas, the demand for aged care facilities, home care services, and outreach programs in areas of low population density is urgently needed. Private operators and local authorities are working together to develop or upgrade existing facilities in towns in Western Australia, Queensland, and the Northern Territory. Transportation solutions, roving care units, and telemedicine are being incorporated into aged care services to cater to residents dispersed over long distances. This move is overcoming healthcare disparity, while providing employment opportunities in regional communities, and adding to regional development in general. For providers, investing in these segments is accessing a less served and expanding market that is reinforced by federal incentives and regional development grants specific to infrastructure and workforce assistance in non-metropolitan regions.

Increasing Demand for Private and Premium Aged Care Services

The Australian aged care sector is also experiencing increasing demand for private and premium aged care services, offering large opportunities for providers addressing higher-income markets. A significant number of older Australians and their families are in search of services that exceed the traditional care model, focused on luxury, independence, and lifestyle amenities. This can include private suites, gourmet dining facilities, wellness centers, social clubs, and recreational programs that reflect high-end retirement living. In cities such as Sydney, Brisbane, and Melbourne, there is a definite shift toward aged care facilities that offer upmarket, boutique-like hotels instead of conventional care homes. Shoppers are inclined to pay for added comfort, privacy, and independence in older age. This drives the need for innovation in facility design, packages of services, and integration of technology. Providers who invest in high-end experience and hospitality-based models can capture an increasing portion of the elderly population that prioritizes quality of life and has the resources to fund more individualized care choices.

Australia Aged Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on services and application.

Services Insights:

- Home Healthcare

- Non-medical health Care

- Institutional Care

- Hospital based care

- Others

The report has provided a detailed breakup and analysis of the market based on the services. This includes home healthcare, non-medical health care, institutional care, hospital based care, and others.

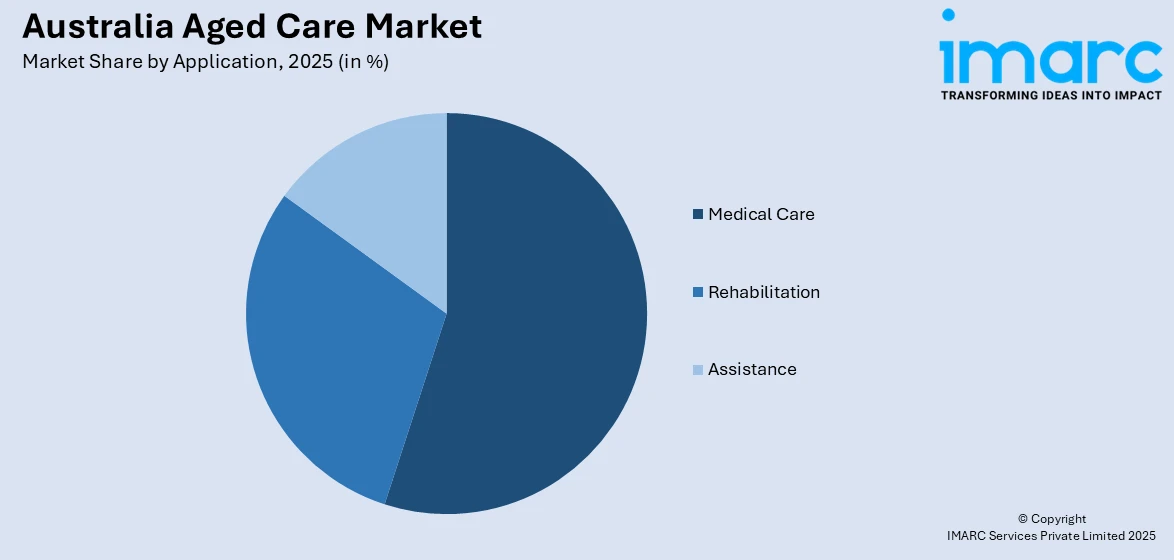

Application Insights:

Access the comprehensive market breakdown Request Sample

- Medical Care

- Rehabilitation

- Assistance

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes medical care, rehabilitation, and assistance.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Aged Care Market News:

- In August 2024, The Australian Department of Health and Aged Care expanded two more contracts to Accenture to aid with delivering IT abilities in the aged care sector for upcoming two years. Particularly, Accenture is tasked with the development and deployment of workforce application services on the Salesforce MuleSoft platform.

- In July 2023, Touchbio announced its partnership with the Aged & Community Care Providers Association (ACCPA). ACCPA, a leader in the aged care sector, shares its aim of improving the quality of life for Australia's elderly demographic. With a focus on sustainable, innovative, and person-centered care services, ACCPA resonates with our commitment to our "Protection, Detection, and Treatment" health journey.

Australia Aged Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Home Healthcare, Non-Medical Health Care, Institutional Care, Hospital Based Care, Others |

| Applications Covered | Medical Care, Rehabilitation, Assistance |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia aged care market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia aged care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia aged care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia aged care market was valued at USD 34.4 Billion in 2025.

The Australia aged care market is projected to exhibit a CAGR of 6.43% during 2026-2034.

The Australia aged care market is expected to reach a value of USD 61.3 Billion by 2034.

Key drivers of Australia aged care market include an aging population, increased government funding, and a shift toward home-based and person-centered care. Rising demand for culturally inclusive services, mental health support, and digital health solutions also fuels growth, prompting innovation and investment across both urban and regional care sectors.

The key trend of the Australia aged care market is the growing emphasizes on personalized, home-based services supported by digital health technologies. Providers are expanding culturally inclusive and dementia-specific programs. There is also increased adoption of tech-enabled facilities with smart monitoring and telehealth integration. These developments reflect evolving consumer expectations and progressive policy reforms shaping the sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)