Australia Agricultural Equipment Market Size, Share, Trends and Forecast by Equipment, Application, and Region, 2025-2033

Australia Agricultural Equipment Market Overview:

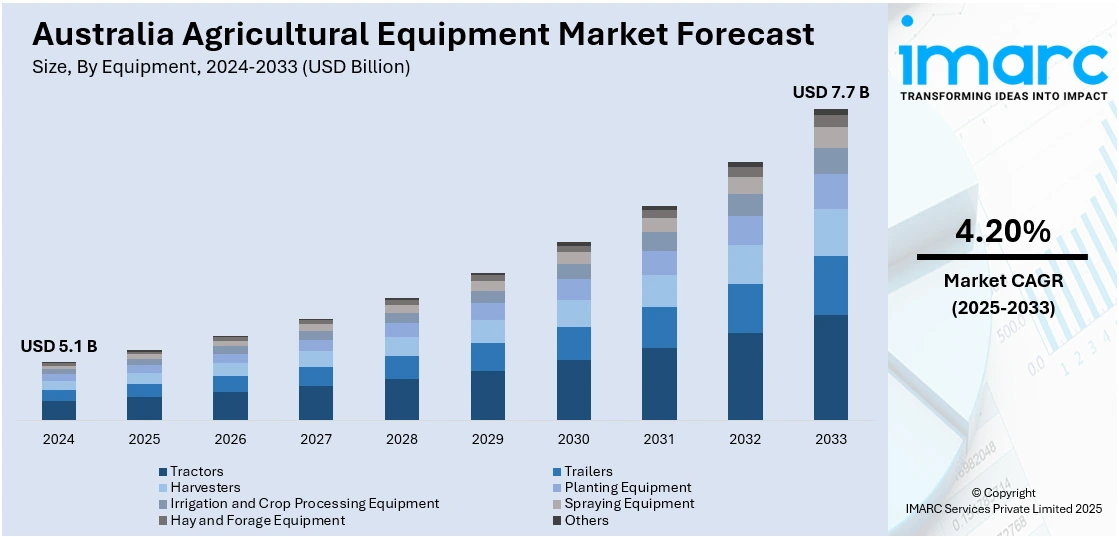

The Australia agricultural equipment market size reached USD 5.1 Billion in 2024. Looking forward, the market is projected to reach USD 7.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The market is driven by rising fuel costs encouraging electric machinery, adoption of AI and robotics for efficiency, increased demand for repair rights to reduce maintenance costs, and government support for ag-tech innovation. These factors collectively promote modern, sustainable farming practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.1 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Market Growth Rate 2025-2033 | 4.20% |

Key Trends of Australia Agricultural Equipment Market:

Technological Advancements and Precision Agriculture

The widespread adoption of advanced technologies, like autonomous vehicles, artificial intelligence, drones, and GPS-based systems, is reshaping farming operations in Australia, further fueling the Australia agricultural equipment market share. Precision agriculture enables farmers to monitor crops, soil, and weather conditions in real-time, allowing for optimized resource allocation and increased efficiency. These technologies help reduce costs, minimize environmental impact, and increase crop yields, particularly important in a country prone to drought and variable climates. Robotics is also increasingly used for tasks like planting and harvesting, reducing reliance on seasonal labor. With Australia’s strong ag-tech ecosystem and investment in research, farmers are better equipped to adapt and thrive in changing environmental and economic conditions. For instance, in March 2025, KUHN Australia’s latest configurator represents a notable advancement in the field of customization for agricultural machinery. It places the design directly in our customers' hands, offering solutions that are ideally suited to their specific farming requirements and surroundings. This degree of customization guarantees maximum productivity and efficiency, establishing a new benchmark for the sector.

To get more information on this market, Request Sample

Government Support and Ag-Tech Investment

Government initiatives play a key role in the Australia agricultural equipment market growth. Programs such as AgriFutures and funding through the National Farmers’ Federation support innovation, sustainability, and the commercialization of agricultural technologies. For instance, in April 2025, via the NHT, the Australian Government launched the $302.1 million Climate-Smart Agriculture Program over five years starting from 2023-24. This initiative will promote sustainability, productivity, and competitiveness in agriculture. These initiatives help small and medium farms access advanced machinery and training, reducing barriers to entry. Additionally, public-private partnerships and university-led research centers foster the development of smart farming tools tailored to Australian conditions. Investments in automation, drought-resilient equipment, and digital infrastructure are helping farms modernize, particularly in remote and regional areas. Government backing creates a stable policy environment that encourages long-term investment in agricultural equipment and practices, which further creates a positive impact on the Australia agricultural equipment market outlook.

Sustainability Focus

Sustainability is increasingly becoming a key trend in the agricultural industry, leading to transformations in equipment design and usage throughout Australia. Farmers are now more focused on machinery that reduces carbon emissions, saves fuel, and enhances practices such as precision irrigation and soil management. Equipment manufacturers are rolling out eco-friendly tractors, harvesters, and irrigation systems that support green farming efforts and comply with government climate resilience policies. This emphasis on sustainability goes beyond fulfilling regulatory obligations; it also aims at achieving long-term cost savings and protecting natural resources. As more agricultural enterprises incorporate sustainability into their main strategies, the demand for environmentally responsible equipment has surged, significantly enhancing Australia agricultural equipment market demand in recent years.

Growth Drivers of Australia Agricultural Equipment Market:

Mechanization of Farming

The advancement of machinery in agriculture is a key factor driving growth in the Australian agricultural equipment sector. Farmers are increasingly utilizing sophisticated machinery to boost efficiency, reduce reliance on manual labor, and enhance crop production. As farms grow larger and the need to maximize time during critical harvest periods increases, tools such as tractors, harvesters, and irrigation systems have become vital. Mechanized approaches alleviate physical stress and enhance consistency in tasks like planting, spraying, and harvesting. Furthermore, the integration of smart farming technologies into machinery facilitates precision farming. This ongoing transition toward mechanization is empowering farmers to achieve greater productivity and profitability, making it a crucial element in shaping the future of agricultural practices in Australia.

Rising Food Demand

The growing need for food, both within Australia and for export, plays a significant role in driving the demand for modern agricultural machinery in the country. Population growth and an increasing consumer inclination toward high-quality produce are placing pressure on farmers to scale up production while maintaining efficiency. The focus on export-oriented agriculture, especially in grains, livestock feed, and horticultural products, amplifies this demand. To meet these escalating needs, farmers are investing in advanced machinery that enhances precision farming, resource management, and sustainable practices. According to Australia agricultural equipment market analysis, modern equipment is essential in addressing food security challenges by enabling efficient and large-scale sustainable production that meets the rising demands of both local and international markets.

Large-Scale Farming Expansion

The growth of large-scale farming and agribusinesses is significantly influencing investments in advanced agricultural machinery throughout Australia. As commercial farms expand, there is a greater emphasis on maximizing operational efficiency, lowering costs, and ensuring consistent production. Large farming operations typically require robust equipment such as powerful tractors, combine harvesters, and precision seeding machines to effectively manage extensive areas. Moreover, commercial farms are increasingly adopting technology-driven solutions like GPS mapping, automated irrigation, and IoT-enabled monitoring systems to enhance productivity. The transition from small-scale to large-scale farming is also in line with the global demand for bulk agricultural exports. This trend is projected to continue driving substantial investment in equipment, further solidifying Australia’s role in the global agricultural market.

Opportunities of Australia Agricultural Equipment Market:

Adoption of Precision Farming Technologies

The integration of precision farming technologies is revolutionizing Australia’s agricultural industry by boosting efficiency and productivity. An increasing number of farmers are investing in GPS-equipped tractors, drones, and intelligent sensors to enhance land use, raise crop yields, and decrease resource waste. These innovations facilitate real-time monitoring of soil conditions, water usage, and crop development, promoting decisions based on data. As the agricultural sector becomes more reliant on technology, the demand for advanced and interconnected machinery is on the rise. This transition also aligns with the nation’s commitment to sustainable farming, cutting input costs while maximizing outputs. Precision farming enhances operational efficacy and fortifies long-term competitiveness within global food supply networks.

Expanding Demand for Equipment Leasing and Rental Services

The escalating costs associated with modern agricultural machinery are prompting numerous small and medium-sized farmers in Australia to choose leasing and rental options instead of outright purchases. This trend provides farmers with access to the latest tractors, harvesters, and other sophisticated equipment without substantial capital outlays. Leasing offers adaptability, allowing farmers to utilize equipment during busy seasons and return it afterward, which significantly alleviates ownership and maintenance expenses. Furthermore, rental service providers are enlarging their fleets to include technologically advanced machinery, catering to the increasing desire for mechanization. This trend is fostering a robust secondary market that enables broader access to innovation and modern farming tools across various farm sizes.

Integration of Digital Platforms

Digital transformation is becoming a significant opportunity in the Australian agricultural equipment landscape, with platforms that support predictive maintenance, remote monitoring, and equipment optimization gaining popularity. Farmers are increasingly leveraging digital tools to monitor machinery performance, minimize downtime, and cut operational expenses. These platforms also offer valuable insights through data analytics, assisting farmers in enhancing productivity and sustainability. Remote operation systems allow farmers to effectively manage equipment across extensive farms, even in isolated regions. Additionally, integration with mobile applications boosts accessibility and supports real-time decision-making. As agriculture grows more digitally connected, the implementation of smart platforms is anticipated to reshape equipment utilization and farm management approaches.

Government Support in Australia Agricultural Equipment Market:

Subsidies and Grants for Modern Farming Machinery

The Australian government is crucial in promoting mechanization in agriculture through the provision of subsidies and grants that aid in the adoption of modern farming machinery. These programs significantly reduce the financial strain on farmers, particularly those operating on a small to medium scale, allowing them to invest in advanced equipment such as precision tractors, harvesters, and irrigation systems. By making high-cost machinery more economical, these subsidies stimulate increased mechanization within the sector. This shift enhances productivity and optimizes resource management efficiency. Additionally, government-supported funding initiatives encourage innovation, enabling farmers to access cutting-edge technologies that improve sustainability and competitiveness. Such efforts are vital in closing the divide between traditional farming methods and modern, technology-driven agricultural practices.

Incentives for Sustainable and Low-Emission Equipment

To support environmental initiatives, the government is implementing incentives that encourage the use of sustainable and low-emission agricultural machinery. Farmers are motivated to transition to equipment that minimizes carbon emissions, conserves fuel, and increases resource efficiency. Incentive programs, which include tax reductions and financial assistance, facilitate the shift to eco-friendly machinery such as electric tractors, energy-efficient irrigation systems, and renewable-powered equipment. These initiatives align with Australia’s broader climate action objectives, ensuring that agriculture contributes to national sustainability goals. By promoting the use of green technologies, such incentives lessen environmental harm and prepare farms for more stringent global environmental compliance standards.

Investment in Rural Infrastructure

Government investment in rural infrastructure serves as a vital support system for the agricultural equipment sector. Enhancements such as improved road networks, better rural connectivity, and electrification directly benefit farmers by providing easier access to advanced machinery and after-sales services. A robust infrastructure framework also supports the effective deployment of mechanized equipment in remote and large farming operations, which may otherwise face logistical obstacles. Additionally, the development of digital infrastructure, including internet access, promotes the integration of precision farming tools, GPS-enabled machinery, and digital solutions for monitoring and automation. These investments create a strong ecosystem that supports mechanization, making modern agricultural technologies more accessible and effective across various farming regions.

Challenges of Australia Agricultural Equipment Market:

High Upfront Costs of Advanced Machinery

One significant hurdle in the Australian agricultural equipment sector is the substantial initial investment needed for modern farming machinery. Advanced tools like automated harvesters, GPS-equipped tractors, and precision irrigation systems demand considerable capital, making them often out of reach for small-scale farmers. Although these machines enhance efficiency and productivity over time, the initial costs create a financial barrier for those with limited resources or unstable income. Alternative options such as leasing and rentals are becoming more common, yet many still face challenges in ownership. This situation hampers the mechanization of smaller farms, widening the divide between larger agribusinesses that can afford advanced technologies and smallholders who depend on traditional methods.

Shortage of Skilled Operators and Technicians

A crucial issue confronting the market is the lack of skilled operators and technicians who can proficiently manage advanced agricultural machinery. Modern equipment demands specific training for its operation, calibration, and maintenance, which many farmers and rural workers might not possess. Without proper expertise, the full potential of these machines cannot be realized, leading to decreased efficiency and effectiveness. Furthermore, the lack of skilled technicians for timely repairs and servicing can result in downtime, hindering productivity during critical farming periods. This skills gap underscores the necessity for training programs, vocational courses, and manufacturer-led workshops to ensure that modern machinery is utilized effectively. Tackling this shortage is vital for optimizing the advantages of mechanization and promoting long-term adoption on farms.

Volatility in Commodity Prices

Fluctuations in both global and domestic commodity prices represent a major challenge for the adoption of agricultural equipment in Australia. Farmers’ purchasing power is closely linked to the income generated from crop and livestock sales, which can vary due to market prices, weather conditions, and export demand. When prices drop, farmers may be hesitant to invest in expensive machinery, postponing their modernization efforts and affecting equipment sales. This uncertainty results in cyclical market demand, with machinery adoption increasing during times of high profitability and declining during downturns. To address this issue, flexible financing alternatives and risk-mitigation strategies are essential for empowering farmers to sustain their investment capacity, regardless of price fluctuations. Ensuring stability in the agricultural economy is crucial for fostering long-term growth in equipment adoption.

Australia Agricultural Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on equipment and application.

Equipment Insights:

- Tractors

- Trailers

- Harvesters

- Planting Equipment

- Irrigation and Crop Processing Equipment

- Spraying Equipment

- Hay and Forage Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes tractors, trailers, harvesters, planting equipment, irrigation and crop processing equipment, spraying equipment, hay and forage equipment, and others.

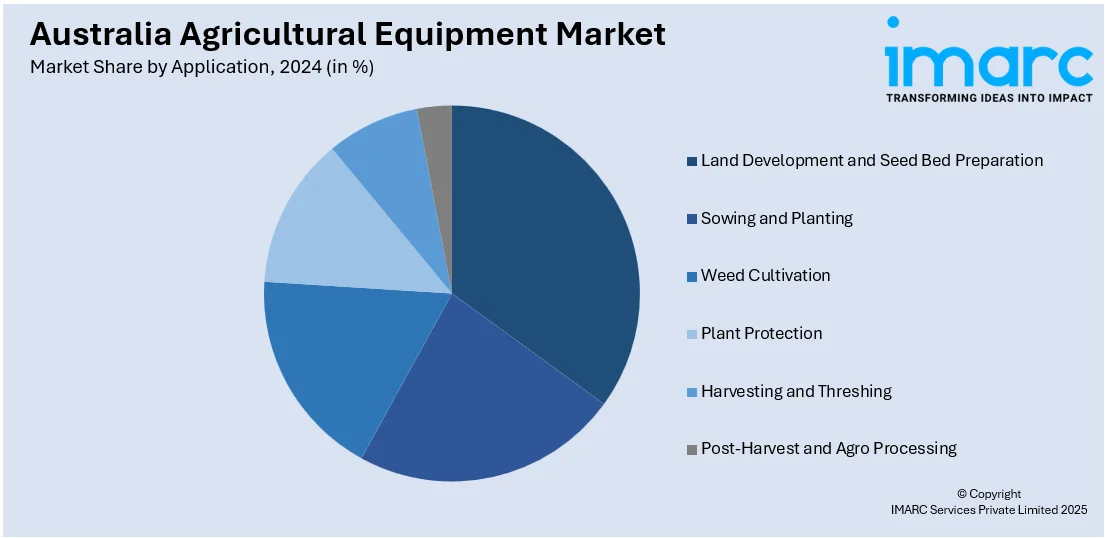

Application Insights:

- Land Development and Seed Bed Preparation

- Sowing and Planting

- Weed Cultivation

- Plant Protection

- Harvesting and Threshing

- Post-Harvest and Agro Processing

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes land development and seed bed preparation, sowing and planting, weed cultivation, plant protection, harvesting and threshing, and post-harvest and agro processing.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Agricultural Equipment Market News:

- In September 2023, SwarmFarm Robotics, a pioneer in Integrated Autonomy based in Australia, unveiled its innovative "dock and refill" feature. This development aims to free equipment dimensions from productivity constraints by allowing robots to independently replenish and refuel themselves.

Australia Agricultural Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipments Covered | Tractors, Trailers, Harvesters, Planting Equipment, Irrigation and Crop Processing Equipment, Spraying Equipment, Hay and Forage Equipment, Others |

| Applications Covered | Land Development and Seed Bed Preparation, Sowing and Planting, Weed Cultivation, Plant Protection, Harvesting and Threshing, Post-Harvest and Agro Processing |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia agricultural equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia agricultural equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia agricultural equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agricultural equipment market in Australia was valued at USD 5.1 Billion in 2024.

The Australia agricultural equipment market is projected to exhibit a compound annual growth rate (CAGR) of 4.20% during 2025-2033.

The Australia agricultural equipment market is expected to reach a value of USD 7.7 Billion by 2033.

The market is shaped by the adoption of precision farming tools, smart sensors, and GPS-enabled machinery for better efficiency. Growing interest in automation, robotics, and AI-driven solutions supports modern farming practices. Equipment rental services and sustainable, low-emission machinery are also emerging as significant market trends.

Growing demand for higher agricultural productivity, expansion of large-scale commercial farms, and rising export requirements are key growth drivers. Supportive government policies, coupled with rising investments in rural infrastructure, encourage mechanization. Increasing food security concerns and the need to reduce labor dependency further accelerate the adoption of advanced agricultural machinery across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)