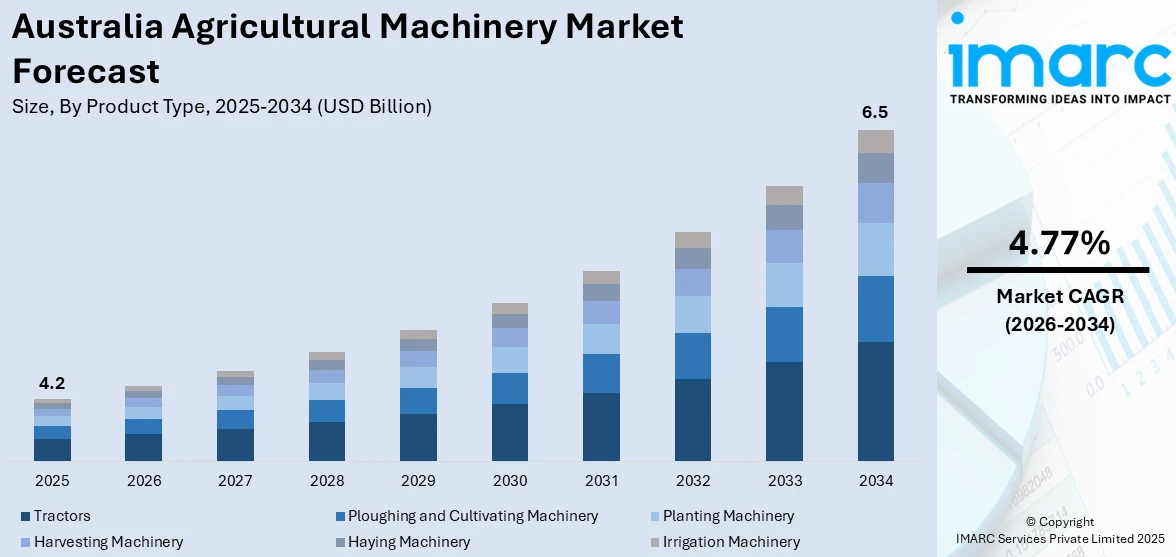

Australia Agricultural Machinery Market Report by Product Type (Tractors, Ploughing and Cultivating Machinery, Planting Machinery, Harvesting Machinery, Haying Machinery, Irrigation Machinery), and Region 2026-2034

Australia Agricultural Machinery Market Overview:

The Australia agricultural machinery market size reached USD 4.2 Billion in 2025. Looking forward, the market is expected to reach USD 6.5 Billion by 2034, exhibiting a growth rate (CAGR) of 4.77% during 2026-2034. The market is propelled by increasing demand for food and agricultural products, growing emphasis on sustainable farming practices, government policies and financial incentives, and rising adoption of smart technologies such as GPS guidance systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.2 Billion |

| Market Forecast in 2034 | USD 6.5 Billion |

| Market Growth Rate 2026-2034 | 4.77% |

Key Trends of Australia Agricultural Machinery Market:

Government Policies and Monetary Benefits

Governmental policies and monetary benefits serve as major drivers for the agricultural machinery market in Australia. The Australian government has given various policies and subsidies to uplift its agricultural sector, thus encouraging farmers to use modern agriculture machinery. Supportive grants and other soft loans are frequently given toward new investment in machinery for the growers, especially equipment applied to increase productivity and environmental sustainability. These are efforts that make the accessibility of advanced machinery easier and encourage the modernization of the farming sector. Besides those, tax benefits and agricultural investment write-offs bring extra financial easing to the farmers. Thus, government support is opening up a stronger market for Australia agricultural machinery market analysis as it lessens the financial burden of farming and opens more avenues toward the acceptance of newer, efficient technologies.

To get more information on this market Request Sample

Rising Demand for Food

The increasing demand for food and agricultural products is another key factor driving the growth of the agricultural machinery market in Australia. According to the Australian Department of Agriculture, Fishery, and Forestry, a 2.1% annual increase in indicative food production occurred from $65 billion to $117 billion, a 2.3% annual increase in household food consumption expenditures occurred from $49 billion to $92 billion, and a 1.5% annual increase in net food exports occurred from $16 billion to $25 billion between 1988-89 and 2016-17 in Australia. As the population continues to grow, there is a heightened need for food security, which puts pressure on the agricultural sector to enhance productivity. Australian farmers are thus compelled to adopt more efficient farming practices and invest in machinery that can help maximize output. This includes machinery for tillage, planting, irrigation, and harvesting that is capable of handling larger-scale operations and improving crop yields. Furthermore, the export of agricultural products from Australia is a significant contributor to the economy, requiring farmers to maintain high standards and meet international demand. The need to boost both quantity and quality of produce is encouraging farmers to invest in advanced machinery that can streamline operations and reduce labor costs.

Shift Toward Sustainable Farming

A growing emphasis on sustainable farming practices is also driving the Australia agricultural machinery market share. As environmental concerns become more pronounced, there is a strong push toward reducing the ecological footprint of farming operations. According to the Australian Department of Agriculture, Fishery, and Forestry, many farms that practice broadacre cropping keep their stubble (85% of farms), minimize tillage (68% of farms), and maximize the use of fertilizer and herbicides while reducing their reliance on them (65% of farms). Besides, numerous livestock farms use a range of grazing management techniques, including rotational, trip, or cell grazing (61% of farms) and establishing a requirement for long-term groundcover (61% of farms). Modern agricultural machinery plays a crucial role in this transition by enabling more efficient use of resources such as water, fertilizers, and pesticides. Equipment that supports conservation tillage, precise irrigation, and targeted application of inputs helps minimize environmental impact while maintaining or enhancing productivity. Additionally, the demand for machinery that supports organic farming and other eco-friendly practices is on the rise.

Growth Drivers of Australia Agricultural Machinery Market:

Increasing Farm Mechanization and Technological Advancement

The escalating adoption of farm mechanization across Australia's agricultural sector serves as a primary catalyst for machinery demand. With an average farm size of approximately 500 hectares, Australian farmers are increasingly investing in sophisticated equipment to optimize operational efficiency and reduce labor dependency. The integration of precision agriculture technologies, including GPS guidance systems, autonomous steering, and variable rate application systems, is transforming traditional farming practices. Modern tractors equipped with advanced features such as telematics, image sensors, and automated adjustments are becoming essential tools for contemporary agricultural operations. This technological revolution enables farmers to maximize productivity while minimizing resource waste, driving sustained investment in cutting-edge agricultural machinery throughout the country.

Rising Agricultural Production and Export Requirements

Australia's significant agricultural production growth, particularly in wheat, canola, and beef cattle sectors, is fueling substantial machinery investments. The country's role as a major agricultural exporter necessitates consistent production quality and efficiency to maintain competitive advantages in global markets. Favorable weather conditions coupled with improved farming practices have resulted in higher gross values of agricultural production, creating stronger financial capacity for machinery procurement, which is further driving the Australia agricultural machinery market demand. The export-oriented nature of Australian agriculture requires farmers to adopt advanced harvesting, processing, and handling equipment that meets stringent international standards. These commercial imperative drives continuous modernization of agricultural machinery fleets to ensure optimal product quality and operational reliability.

Government Support and Financial Incentives

Comprehensive government support through various schemes and financial incentives significantly accelerates agricultural machinery adoption across Australia. The Australian government actively promotes agricultural mechanization through subsidies, concessional loans, and tax benefits that reduce the financial barriers for farmers investing in modern equipment. Accelerated depreciation measures allow farmers to claim larger tax deductions for eligible machinery assets, making advanced technology adoption financially viable. Programs such as the On-Farm Connectivity Program provide additional funding for ag-tech solutions that enhance farming productivity. These supportive policies create an enabling environment for sustained machinery market growth by improving farmer access to capital and reducing investment risks associated with technological upgrades.

Government Initiatives of Australia Agricultural Machinery Market:

Federal Agricultural Research and Development Investment

The Australian government maintains substantial investment in agricultural research and development to support innovation and technology adoption. This is a comprehensive funding structure that allows the creation and implementation of advanced agricultural machinery solutions through cooperation between a government structure, research organizations, and individual manufacturers. The federal efforts are directed towards the adoption of accuracy in agriculture technologies, autonomous farming, and other sustainable mechanization approaches that meet national productivity objectives. These investments ensure that the machinery manufacturers have a conducive environment to develop machinery specific to Australia and help farmers to have access to the state-of-the-art equipment through a number of grant programs and research collaborations.

State-Based Mechanization Support Programs

Various state governments implement targeted programs to accelerate agricultural mechanization within their jurisdictions. Queensland's Rural Economic Development (RED) grants provide co-contribution funding to support primary producers in adopting modern farming equipment and technologies. The Regional Investment Corporation (RIC) offers concessional loans specifically designed to help farmers invest in productivity-enhancing machinery and infrastructure. State-specific initiatives address regional agricultural needs, with programs tailored to support different farming systems and crop types prevalent in various geographic areas. These localized approaches ensure that government support effectively addresses the diverse mechanization requirements across Australia's varied agricultural landscapes.

Technology Integration and Connectivity Programs

The Albanese Government's expansion of the On Farm Connectivity Program represents a significant initiative supporting agricultural technology integration, with an additional $20 million allocated for Round 3 in 2025. This program specifically targets ag-tech connectivity solutions that enable farmers to optimize soil quality monitoring, automate livestock management systems, and safeguard farming equipment through advanced monitoring technologies. The initiative demonstrates government commitment to bridging digital divides in rural areas while promoting smart farming practices that require sophisticated agricultural machinery. These connectivity-focused programs create essential infrastructure foundations that support the deployment and operation of modern, connected agricultural equipment throughout Australia.

Australia Agricultural Machinery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type.

Product Type Insights:

- Tractors

- Ploughing and Cultivating Machinery

- Ploughs

- Harrows

- Cultivators and Tillers

- Others

- Planting Machinery

- Seed Drills

- Planters

- Spreaders

- Others

- Harvesting Machinery

- Mowers

- Balers

- Others

- Haying Machinery

- Irrigation Machinery

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tractors, ploughing and cultivating machinery (ploughs, harrows, cultivators and tillers, and others), planting machinery (seed drills, planters, spreaders, and others), harvesting machinery (mowers, balers, and others), haying machinery, and irrigation machinery.

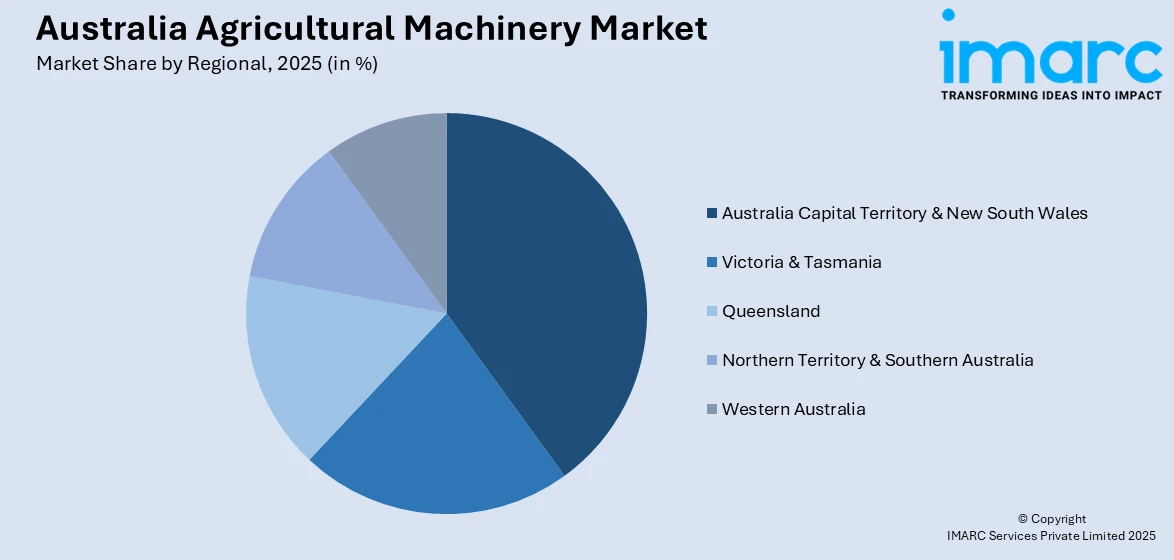

Regional Insights:

Access the comprehensive market breakdown Request Sample

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Agricultural Machinery Market News:

- In August 2024, John Deere announced significant improvements to its popular 6M tractor series for Model Year 2025, expanding the range to include thirteen models with increased speed and power capabilities. The enhanced lineup now features four models exceeding 200 horsepower with 50 kph transmission systems, addressing the growing demand for high-performance agricultural machinery in Australia's diverse farming operations.

Australia Agricultural Machinery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia agricultural machinery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia agricultural machinery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia agricultural machinery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia agricultural machinery market was valued at USD 4.2 Billion in 2025.

The Australia agricultural machinery market is projected to exhibit a CAGR of 4.77% during 2026-2034.

The Australia agricultural machinery market is projected to reach a value of USD 6.5 Billion by 2034.

Key trends in the Australia agricultural machinery market include precision farming adoption, automation and robotics, sustainable and energy-efficient equipment demand, government support, increasing use of telematics, and rising preference for advanced tractors, harvesters, and smart irrigation systems.

Australia agricultural machinery market growth is driven by expanding export opportunities, rising farm mechanization, supportive government subsidies, increased farmer incomes, strong research and development (R&D) investments, evolving agribusiness models, demand for productivity enhancement, and modernization of post-harvest management practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)