Australia Agriculture Drones Market Size, Share, Trends and Forecast by Offering, Component, Farming Environment, Application, and Region, 2026-2034

Australia Agriculture Drones Market Size and Share:

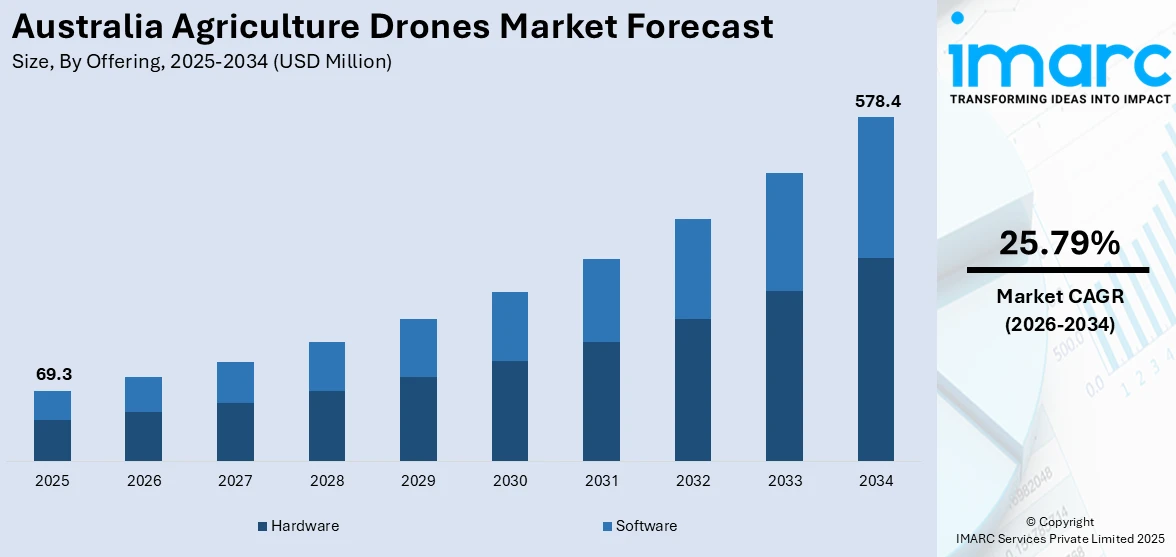

The Australia agriculture drones market size reached USD 69.3 Million in 2025. Looking forward, the market is expected to reach USD 578.4 Million by 2034, exhibiting a growth rate (CAGR) of 25.79% during 2026-2034. The growth of the market is driven by the rising demand for precision farming, labor shortages, and the need for cost-efficient crop management. Government support, climate change challenges, and advancements in drone technology, such as AI analytics and autonomous spraying, are further expanding the Australia agriculture drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 69.3 Million |

| Market Forecast in 2034 | USD 578.4 Million |

| Market Growth Rate 2026-2034 | 25.79% |

Key Trends of Australia Agriculture Drones Market:

Increasing Adoption of Precision Agriculture Technologies

The rising adoption of precision farming techniques is significantly supporting the Australia agriculture drones market growth. Farmers are increasingly using drones equipped with advanced sensors, GPS, and AI-powered analytics to monitor crop health, optimize irrigation, and manage pests. These drones provide real-time data, enabling farmers to make informed decisions, reduce resource wastage, and improve yields. The demand for cost-effective and efficient farming solutions has accelerated, particularly in large-scale farming operations across regions including Queensland and New South Wales. Additionally, government initiatives promoting smart farming and subsidies for agricultural drones are accelerating the market growth. On April 1st’ 2025, the Australian Government launched the Climate-Smart Agriculture Program, through the Natural Heritage Trust, a five-year investment of USD 302.1 Million from 2023 to 2028 that will support transformative practices for innovative and resilient farming. This new initiative includes USD 45 Million for Partnerships and Innovation, USD 25.5 Million for Capacity Building, and USD 2.5 Million for Small Grants, as well as substantial investments into soil health, regional implementation, and First Nations community engagement. This could be eventually implemented across Australia in an effort to allow agricultural organizations to adopt climate-smart agricultural practices, potentially integrating agricultural drones in order to increase productivity and promote environmental sustainability. As climate change and labor shortages challenge traditional farming, drones offer a sustainable alternative by enhancing productivity while minimizing environmental impact. With continuous advancements in drone technology, such as automated flight paths and multispectral imaging, their integration into Australian agriculture is expected to expand further in the coming years.

To get more information on this market Request Sample

Growth in Crop Spraying and Seeding Applications

The increasing use of drones for crop spraying and seeding is creating a positive Australia agriculture drones market outlook. Traditional methods of pesticide application and planting are labor-intensive and often inefficient. Drones equipped with spraying systems can cover large fields quickly, ensuring precise chemical distribution while reducing human exposure to harmful substances. This technology is particularly beneficial in hard-to-reach areas and steep terrains, common in Australian farmlands. Moreover, drone-based seeding allows for uniform distribution of seeds, improving germination rates and reducing costs. Companies are developing specialized agricultural drones with higher payload capacities and longer battery life to meet these demands. As farmers seek sustainable and cost-efficient solutions, the adoption of drone-based spraying and seeding is expected to rise. A recent study advocates that the height of spraying from a drone should be 2 meters with a spray duration of 8 seconds in coconut plantations. The appropriate propagation of droplets is obtained with a droplet volume median of 50 ranging from 200 to 400 micrometers with 13 to 21% spray coverage and a penetration efficiency of 34.41%. Researchers employed the E610P hexacopter UAV to verify that this method improves canopy accessibility, decreases labor risks, and increases pest control efficiency on larger trees. These findings have particular implications for the emerging agricultural drone market in Australia and for improving the management of tall crops such as coconuts. This trend is further supported by advancements in autonomous drone operations, making them more accessible to small and medium-sized farms across Australia.

Growth Drivers of Australia Agriculture Drones Market:

Widely Spread and Diverse Agricultural Terrain Fueling Drone Uptake

Australia's widespread agricultural terrain, from the wide cereal belts of Western Australia and New South Wales to hilly grazing country in northern Queensland, presents a perfect backdrop for drone utilization. Remote paddocks and large farms make spraying and monitoring using conventional methods time‑expensive and expensive. Drones provide a cost‑effective alternative to tractors, helicopters, or boom sprayers by providing aerial access in ground that is otherwise difficult. Drones can apply treatments on soft soils, uneven topography, or slopes without soil compaction or damaging machinery. Australian farmers take advantage of precision drones that are capable of mapping, spot-spraying, and crop health examination over varied farms, allowing for more effective and targeted operations. Regional differences, from vineyards in southwestern areas, horticulture along the coastal regions, and sheep grazing in the interior, result in drones fulfilling diverse purposes from weed discovery to sheep mustering. Such flexibility addresses distinct local challenges and underpins broader adoption among farmers seeking efficiency, cost savings, and better land stewardship across Australia’s varied agrarian zones.

Regulatory Support and Government Initiatives Catalyzing Growth

Supportive regulatory frameworks and government‑backed programs have significantly accelerated the uptake of agricultural drones in Australia. The Civil Aviation Safety Authority (CASA) has been continually enhancing drone rules, such as licensing and beyond-visual-line-of-sight approval, so that commercial drone pilots find it increasingly convenient to fly safely and within the law. State and federal programs also provide incentives in the form of grants or subsidies, which reduce the obstacle for farmers to test or switch to drone technology. Organizations such as Meat & Livestock Australia and agricultural development authorities’ partner with drone developers to test applications such as unmanned mustering or disease spot‑spraying services to generate confidence in new technologies. Public-private partnerships deliver training and operating models for take-up. Combined regulatory clarity and hands-on assistance decrease resistance among farmers, encouraging wider expansion from initial pilots to widespread utilization, putting Australia on the map as a model market for agricultural drone use under guided regulation.

Labor Shortages, Climate Variability and Resource Efficiency Needs

A number of structural pressures exclusive to Australian agriculture are propelling drone take-up as a response to current challenges. It is challenging to provide scalable, on-demand assistance with chronic labor shortages in rural areas and the seasonal composition of crop and animal labor. Drones are hence force multipliers that can map enormous acreage, conduct targeted spraying, and track livestock without additional hands. With water shortages and climate variability growing more acute, farmers appreciate drone technology that maximizes input use (such as fertilizers or pesticides) by applying treatments exactly where required, conserving waste and minimizing environmental effects. Multispectral sensors and aerial photography enable early detection of plant stress or nutrient deficiencies, and drones thus provide agronomic knowledge that can inform adaptive decision-making. With increasing input costs, these efficiencies return value to growers. Within Australia's large, high-risk farm environments, drones offer operational flexibility, reducing reliance on limited labour, reducing volatility, and allowing sustainable resource management in accordance with shifting industry needs.

Opportunities of Australia Agriculture Drones Market:

Growth in Specialty Crops and High-Value Farming

Australian increasing emphasis on specialty crops and high-value farming is a significant opportunity for the agricultural drone market. Tasmania, South Australia, and Victoria are among the regions that have vineyards, orchards, and vegetable farms that need intensive management practices. These crops tend to require precision in monitoring, irrigation, and pest management—domains where drones can offer real-time feedback and pinpoint accuracy of action. For example, drones can scan grape health over hilly vineyards or identify pest infestations in out-of-the-way orchard blocks, allowing for early and localized control. These high-value crops bring high returns, so investment in drone technology becomes more financially feasible for growers. Secondly, precision tools are also essential for export or organic farms, where traceability and quality assurance are paramount. Drones enable farmers to decrease chemical use, improve yields, and ensure stable quality, which are essential goals for those selling to both domestic and international high-end markets. With the increasing demand for quality, sustainable produce, drone technologies can be adapted to these segments and become pivotal in increasing production while not sacrificing quality.

Improved Drone Analytics and Data Integration

Increased sophistication in drone-based data analytics is a tremendous growth opportunity for agriculture in Australia. Farmers are interested in aerial images, and in actionable information obtained through advanced processing capabilities. Multispectral imaging, thermal imaging, and real-time mapping are increasingly being combined with farm management software to enable predictive modelling and real-time decision-making. This data-driven strategy fits into Australia's increasing take-up of precision agriculture techniques, particularly in New South Wales and Western Australian broadacre cropping. Tech-orientated farmers are keen to embrace solutions that enable them to measure soil water levels, crop and plant health, and growth rates. Additionally, drone data can be utilized to create digital records that enable compliance with environmental and biosecurity regulations. The capability to overlay drone-collected data with satellite imagery, IoT sensors, and equipment systems provides an environment where drones become a fundamental input for integrated farm planning. Such innovations unlock opportunities for drone service providers, software firms, and agritech advisory firms to engage with nascent farm tech solutions in the region.

Expanding Role in Livestock Monitoring and Rangeland Management

Australia's large pastoral industry, especially in Queensland and the Northern Territory, presents special opportunities for drone application in remote and hilly grazing country. Conventional livestock inspection and mustering involve heavy labor, vehicle activity, and even helicopters, which are costly and often wasteful methods. Drones with thermal imagery or zoom optics can follow herds, inspect injured animals, and monitor water points aerially. They can travel long distances rapidly and provide immediate data that enables station managers to make decisions without actually patrolling every inch of a property. Furthermore, drones can assist with rangeland condition monitoring, providing information about pasture health and rotational grazing plans in an improved manner. For farmers working far from populated areas where connectivity is limited, drones offer an adaptive and self-operating monitoring solution that minimizes operational costs. As climate and labor issues are still ongoing, drones are becoming means of convenience which are essential infrastructure in the handling and maintenance of Australia's big-scale livestock industries.

Government Support of Australia Agriculture Drones Market:

Funding and Grant Programs for Encouraging AgTech Adoption

The Australian federal and state governments have actively engaged in promoting the adoption of agriculture drones through a variety of funding and grant programs. Projects aimed at agricultural innovation, rural development, and drought resistance frequently incorporate drone technologies as qualifying elements for government funding. For instance, farmers in areas like New South Wales and South Australia have gained access to grants to pilot or buy precision farming equipment, such as drones for mapping, spraying, and monitoring. These initiatives aim to facilitate efficiency and sustainability in agriculture through the accessibility of technology. Specifically, funding is typically targeted toward small and medium-sized agricultural businesses that would otherwise be precluded from adopting newer equipment by limited finances. This funding lowers the entry cost of drone adoption and incentivizes new practice experimentation that has long-term productivity and environmental payoffs in Australia's varied zones of farming.

Government Collaboration with Research and Innovation Centers

Australia's government also supports the agricultural drones market through collaborations with universities, agritech centers, and innovation incubators. Between government agencies and universities like the University of Queensland or Charles Sturt University, these have resulted in field trials and demonstrations highlighting drone performance under actual farming conditions. These research efforts sponsored by the government play a vital role in establishing confidence among farmers, who are not sure if new technologies will work. With agricultural innovation hubs in Toowoomba and Wagga Wagga, among other areas, farmers are introduced to live use cases of drones for crop monitoring, yield prediction, and water management. These collaborations sometimes culminate in publications, training packages, and pilot projects that seek to bridge the research-to-farm gap. Through the coordination of public resources with academic and private-sector knowledge, the government is at the forefront of encouraging evidence-based drone use, bringing the technology within easier reach and more practical application to daily agricultural work throughout Australia.

Regulatory Frameworks Facilitating Safe Commercial Use of Drones

For the use of drones in agriculture, the Australian government has created structured yet adaptable regulatory frameworks through organizations like the Civil Aviation Safety Authority (CASA). Though the regulations are intended to create a safe environment, they also encourage commercial application by establishing well-defined categories of drone use and offering pathways to certification. Drone users who weigh under a specific limit can use their drones without a license, opening up access to small-scale users. For users needing more sophisticated capabilities such as flights beyond the pilot's line of sight, CASA provides extensive guidelines and licensing processes, enabling businesses to grow operations responsibly. The government also provides funding for public campaigns and training collaborations to inform farmers of drone safety, operational procedures, and compliance guidelines. This forward-thinking regulatory regime reflects the government's twin focus on safety and innovation, building a basis for lasting expansion of the agriculture drones market while being receptive to the varied operational requirements of farmers in Australia's vast rural terrain.

Challenges of Australia Agriculture Drones Market:

High Costs and Limited Access in Remote Areas

One of the most significant challenges facing the agriculture drone market in Australia is the high upfront cost of drone hardware and the recurring expense of maintenance, software subscriptions, and training. These expenses can be prohibitive for many small and medium-sized farmers, especially those in regional and remote locations, even though there can be long-term efficiencies won by using drones. Access to drone technology is also uneven within the nation. While farmers in proximity to urban centers or large agricultural regions such as the Riverina area or the Darling Downs might have access to drone service providers and training facilities, those in rural Western Australia, the Northern Territory, or the interior of Queensland tend to lack local support. Availability of technical skill, post-sale service, and stable infrastructure such as internet connections are also issues that prevent adoption. These differences cause a discrepancy between the potential of drone utilization in farming and actual on-ground capacity of most farmers to effectively deploy the technology in every area.

Regulatory Complexity and Airspace Limitations

In spite of the attempts of Australian regulating bodies to promote drone uptake, it is still a big hindrance for most agricultural users to navigate the legal and safety compliance. Civil Aviation Safety Authority (CASA) regulations have been put in place to provide for the safe use of drones, but adhering to them can be complex for farmers without knowledge of aviation procedures. They must comply with licensing regulations, maximum heights, and no-fly zones, especially around airports, defense areas, and residential zones, including where and how they may use drones. Where high densities of agriculture and air activity exist, such as Victoria and New South Wales, clashes between drone operation and common airspace can occur. Additionally, for the farmer who wants to utilize more sophisticated uses like autonomous flight or beyond-visual-line-of-sight (BVLOS) operations, approvals are even more stringent and laborious. This will deter mass adoption, particularly among farmers who desire to rapidly adopt drone solutions without having to spend a lot in going through regulatory schemes or leasing licensed operators.

Skills Gap and Resistance to Technological Change

One of the biggest hurdles within the Australian agriculture drones market is the skills gap and different degrees of digital literacy among farmers. As younger, tech-advanced farmers are more likely to embrace drone technology, older or conventionally oriented farmers are not so sure. They might view drones as too complicated or not needed for what they have always done. Further, using agricultural drones efficiently involves more than piloting skills but also interpreting multispectral imagery, learning agronomic data, and bringing in results with other farm management systems. Where availability of education and technical training facilities is low, especially in rural Australia, this gap in knowledge can act as a barrier to uptake. Some farmers also voice fears over data protection, continuous learning gradients, and dependence on unknown technology. Without proper support, training initiatives, and demonstrations that explicitly convey return on investment, many producers will choose to remain with traditional practices. Crossing this technical and cultural gap is critical for achieving the scaling of drone use across all sectors of the agricultural sector in Australia.

Australia Agriculture Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on offering, component, farming environment, and application.

Offering Insights:

- Hardware

- Fixed Wing

- Rotary Wing

- Hybrid Wing

- Software

- Data Management Software

- Imaging Software

- Data Analytics Software

- Others

The report has provided a detailed breakup and analysis of the market based on the offering. This includes hardware (fixed wing, rotary wing, and hybrid wing), and software (data management software, imaging software, data analytics software, and others).

Component Insights:

- Controller Systems

- Propulsion Systems

- Cameras

- Batteries

- Navigation Systems

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes controller systems, propulsion systems, cameras, batteries, navigation systems, and others.

Farming Environment Insights:

- Indoor

- Outdoor

The report has provided a detailed breakup and analysis of the market based on the farming environment. This includes indoor and outdoor.

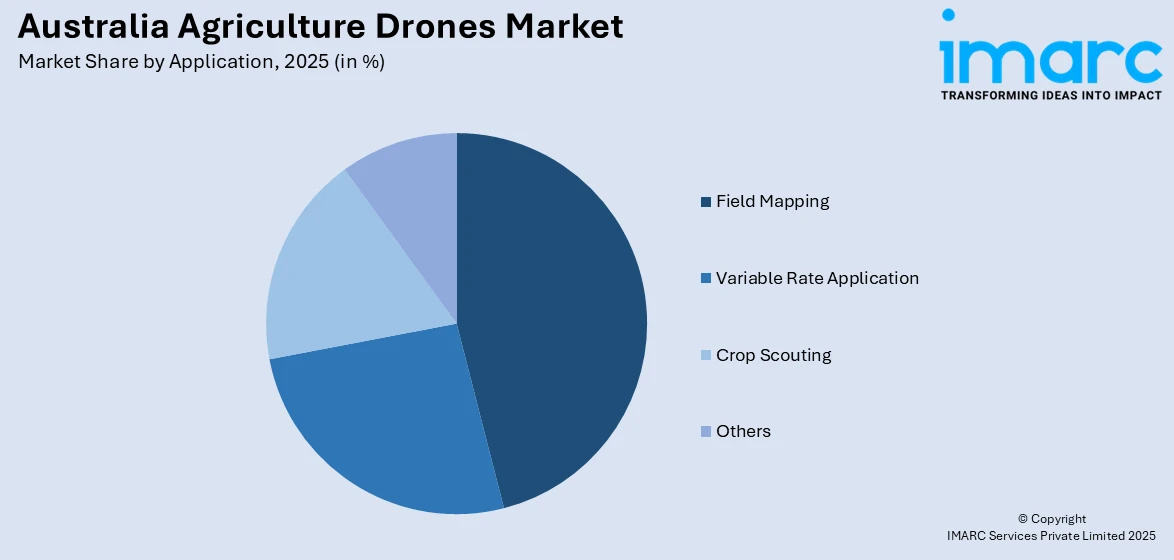

Application Insights:

Access the comprehensive market breakdown Request Sample

- Field Mapping

- Variable Rate Application

- Crop Scouting

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes field mapping, variable rate application, crop scouting, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- AgEagle Aerial Systems Inc

- Carbonix

- DJI

- Droidex

- XAG Australia

- Yamaha Motor Australia

Australia Agriculture Drones Market News:

- March 27, 2025: UNSW Sydney announced working with Seaflight Technologies and Macquarie University on an all-electric drone system for the AURA-E project, which aims to carry cargo of up to 50 kg over long distances and later be upgraded to carry 200–300 kg. This initiative comes with USD 3 Million in funding, including support from Australia’s EATP program. The project is expected to offer low-emission alternatives to diesel transport in rural industries such as agriculture. The first test flight is anticipated for late 2025, marking a significant breakthrough in the agricultural drone industry in Australia.

- May 22, 2024: SkyKelpie, an agri-drone start-up from Australia, successfully conducted its first live drone mustering demonstration at Beef2024 in Queensland to showcase its aerial cattle herding technology in collaboration with Hover UAV. SkyKelpie has now drone-mustered over 100,000 livestock and offers tailor-made autonomous docking stations and training modules per terrain. The company is focused on revolutionizing livestock management within Australia's expanding agricultural drone sector.

Australia Agriculture Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Components Covered | Controller Systems, Propulsion Systems, Cameras, Batteries, Navigation Systems, Others |

| Farming Environment Covered | Indoor, Outdoor |

| Applications Covered | Field Mapping, Variable Rate Application, Crop Scouting, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | AgEagle Aerial Systems Inc, Carbonix, DJI, Droidex, XAG Australia, Yamaha Motor Australia, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia agriculture drones market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia agriculture drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia agriculture drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia agriculture drones market was valued at USD 69.3 Million in 2025.

The Australia agriculture drones market is projected to exhibit a CAGR of 25.79% during 2026-2034.

The Australia agriculture drones market is expected to reach a value of USD 578.4 Million by 2034.

The Australia agriculture drones market is evolving with increased adoption of precision farming, real-time crop monitoring, and autonomous spraying. Farmers are leveraging drones for data-driven decisions, improved efficiency, and sustainable practices. Integration with analytics and growing use in livestock monitoring highlight the shift toward smarter, tech-enabled agricultural operations nationwide.

Key drivers of the Australia agriculture drones market include the need for increased farm efficiency, rising labor shortages, and growing demand for precision farming. Government support, vast agricultural landscapes, and the push for sustainable practices further encourage drone adoption, transforming how farmers manage crops, livestock, and land across diverse regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)