Australia Aircraft Line Maintenance Market Size, Share, Trends and Forecast by Service, Type, Aircraft Type, Technology, and Region, 2025-2033

Australia Aircraft Line Maintenance Market Overview:

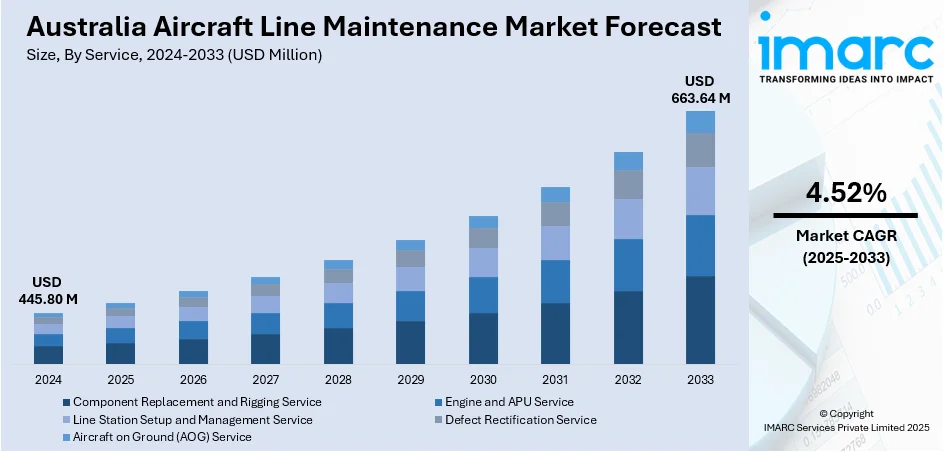

The Australia aircraft line maintenance market size reached USD 445.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 663.64 Million by 2033, exhibiting a growth rate (CAGR) of 4.52% during 2025-2033 The market share is expanding, driven by the growing domestic and international air travel activities, which are creating the need for regular inspections. This, along with the increasing investments in logistics infrastructure, is stimulating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 445.80 Million |

| Market Forecast in 2033 | USD 663.64 Million |

| Market Growth Rate 2025-2033 | 4.52% |

Australia Aircraft Line Maintenance Market Trends:

Rising domestic and international air travel activities

The growing domestic and international air travel activities are offering a favorable Australia aircraft line maintenance market outlook. As per the information given on the official website of the Australian Government, in January 2025, Australian domestic commercial aviation (including charter operations) transported 5.46 Million passengers, with an increase from 5.16 Million in January 2024. As more people are choosing air travel for business and leisure, airlines are experiencing higher traffic and increased flight frequencies, which is creating the need for regular maintenance to keep aircraft operational and safe. With Australia being a key travel hub in the Asia-Pacific region, both domestic and long-haul flights require frequent inspections, quick repairs, and technical checks between flights. The rise in budget carriers and new routes also contributes to a busier schedule for maintenance teams at airports across the country. This growing demand is encouraging airlines to invest in reliable line maintenance services to minimize downtime and ensure on-time performance. Additionally, Australia's well-developed aviation infrastructure and strict safety regulations highlight the importance of efficient line maintenance operations. Advanced aircraft models also require regular maintenance, catalyzing the demand for skilled technicians and modern tools. The overall growth in passenger numbers and airline operations is creating a solid foundation for the continued expansion of the aircraft line maintenance market, making it a critical part of Australia’s aviation industry.

To get more information on this market, Request Sample

Expansion of cargo logistics

The expansion of cargo logistics is fueling the Australia aircraft line maintenance market growth. As per the information provided by the Melbourne Airport authorities, during the initial three months of 2024, the airport enabled the shipment of 44,700 Tons of domestic cargo, accounting for 40.2% of the country’s overall air-freight export volume. As e-commerce portals continue to grow and supply chains are becoming more widespread, there is a higher demand for air freight services to ensure fast delivery of goods. This leads to an increase in the number of cargo flights operating across domestic and international routes. More cargo aircraft flying regularly means more frequent maintenance checks are needed to keep them running smoothly and avoid delays or disruptions. Australia’s strategic location and active trade links with Asia and other international markets make it a hub for air cargo movement, further creating the need for regular services. Line maintenance is especially important for cargo operations where time-sensitive deliveries are common and any technical fault can cause major setbacks. Airlines and logistics companies aim to keep their cargo aircraft in good shape to meet performance expectations. This requires reliable ground support and maintenance routines. The ongoing investments in logistics infrastructure, such as warehouse expansions and upgraded airport freight terminals, are also supporting increased aircraft operations.

Australia Aircraft Line Maintenance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on service, type, aircraft type, and technology.

Service Insights:

- Component Replacement and Rigging Service

- Engine and APU Service

- Line Station Setup and Management Service

- Defect Rectification Service

- Aircraft on Ground (AOG) Service

The report has provided a detailed breakup and analysis of the market based on the service. This includes component replacement and rigging service, engine and APU service, line station setup and management service, defect rectification service, and aircraft on ground (AOG) service.

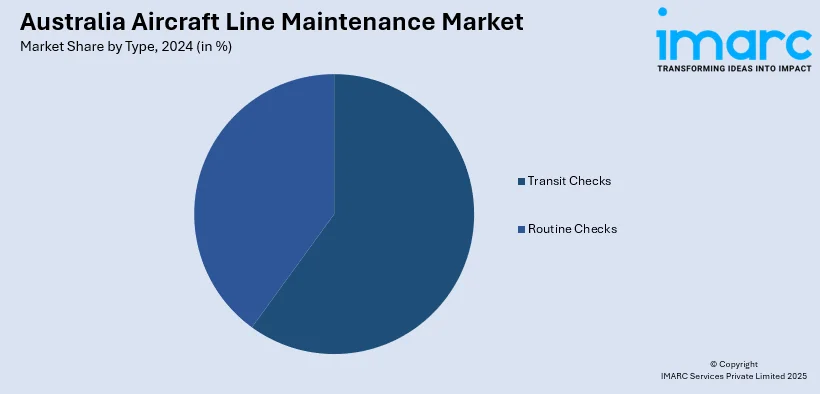

Type Insights:

- Transit Checks

- Routine Checks

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes transit checks and routine checks.

Aircraft Type Insights:

- Narrow Body Aircraft

- Wide-Body Aircraft

- Very Large Body Aircraft

- Others

The report has provided a detailed breakup and analysis of the market based on the aircraft type. This includes narrow body aircraft, wide-body aircraft, very large body aircraft, and others.

Technology Insights:

- Traditional Line Maintenance

- Digital Line Maintenance

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes traditional line maintenance and digital line maintenance.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Aircraft Line Maintenance Market News:

- In March 2024, Bombardier Defense revealed that Australia-based Principle Finance placed an order for two Bombardier Challenger 650 aircraft, shortly after the company inaugurated a new Line Maintenance Station (LMS) in Perth, Australia to improve original equipment manufacturer (OEM) support for clients in Australia. Bombardier announced its intention to establish a second aircraft line maintenance station in Sydney later in 2024.

- In January 2024, Engineers at ExecuJet MRO Services Australia (ExecuJet) announced the completion of Falcon 6X maintenance training that received approval from the European Aviation Safety Agency (EASA). The hands-on and engaging six-week training course enabled engineers to conduct line maintenance for 6X aircraft arriving in Australia and the Pacific area.

Australia Aircraft Line Maintenance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Component Replacement and Rigging Service, Engine and APU Service, Line Station Setup and Management Service, Defect Rectification Service, Aircraft on Ground (AOG) Service |

| Types Covered | Transit Checks, Routine Checks |

| Aircraft Types Covered | Narrow Body Aircraft, Wide-Body Aircraft, Very Large Body Aircraft, Others |

| Technologies Covered | Traditional Line Maintenance, Digital Line Maintenance |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia aircraft line maintenance market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia aircraft line maintenance market on the basis of service?

- What is the breakup of the Australia aircraft line maintenance market on the basis of type?

- What is the breakup of the Australia aircraft line maintenance market on the basis of aircraft type?

- What is the breakup of the Australia aircraft line maintenance market on the basis of technology?

- What is the breakup of the Australia aircraft line maintenance market on the basis of region?

- What are the various stages in the value chain of the Australia aircraft line maintenance market?

- What are the key driving factors and challenges in the Australia aircraft line maintenance market?

- What is the structure of the Australia aircraft line maintenance market and who are the key players?

- What is the degree of competition in the Australia aircraft line maintenance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia aircraft line maintenance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia aircraft line maintenance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia aircraft line maintenance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)