Australia Alcohol Free Perfumes Market Size, Share, Trends and Forecast by Product Type, Gender, Price Range, Distribution Channel, End User, and Region, 2025-2033

Australia Alcohol Free Perfumes Market Overview:

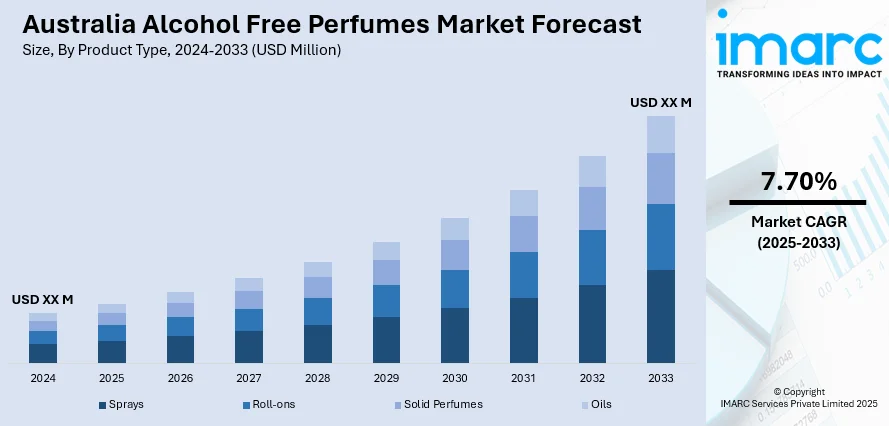

The Australia alcohol free perfumes market size reached USD 237.6 Million in 2024. Looking forward, the market is projected to reach USD 463.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.70% during 2025-2033. The market is experiencing steady growth driven by increasing consumer demand for gentle, skin-sensitive, and environment-friendly fragrance alternatives. Growing awareness about allergies, religious and ethical preferences such as halal and vegan standards, and a broader shift toward clean beauty are influencing purchasing decisions. Both domestic and global brands are expanding their non-alcoholic product lines to meet evolving expectations. These dynamics are reshaping the competitive landscape of the Australia alcohol free perfumes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 237.6 Million |

|

Market Forecast in 2033

|

USD 463.2 Million |

| Market Growth Rate 2025-2033 | 7.70% |

Key Trends of Australia Alcohol Free Perfumes Market:

Growing Demand for Skin-Friendly and Hypoallergenic Products

A significant driver of Australia’s alcohol free perfumes market is increasing consumer awareness of skin sensitivity and allergic reactions. Traditional perfumes with high alcohol content can cause irritation, dryness, or flare-ups in individuals with sensitive skin. As awareness around dermatological health grows, more consumers are opting for gentle, alcohol-free alternatives that offer a soothing fragrance experience without compromising skin safety. These perfumes are particularly appealing to individuals with conditions like eczema or rosacea. The shift toward skin-conscious choices is also supported by endorsements from dermatologists and health-conscious influencers, leading to a rising demand for hypoallergenic formulations. This trend is influencing both established fragrance brands and niche players to develop or expand their alcohol free product lines, strengthening the market’s overall momentum.

To get more information on this market, Request Sample

Increasing Popularity of Clean Beauty and Natural Formulations

The clean beauty movement, emphasizing transparency, non-toxic ingredients, and sustainability, is a major force behind the growing alcohol-free perfumes market in Australia. Consumers are scrutinizing product labels more than ever, favoring natural essential oils and plant-based ingredients over synthetic chemicals and alcohols. Alcohol free perfumes align well with this trend, offering eco-conscious alternatives without compromising fragrance quality. The demand for “green” personal care is also supported by growing environmental concerns and wellness-oriented lifestyles. Many consumers view alcohol free perfumes as a safer, more holistic choice that complements their broader health and wellness routines. This shift toward clean, sustainable beauty practices has encouraged both niche brands and mainstream companies to reformulate or launch alcohol-free lines, fueling continued market expansion.

Expansion of Niche and Artisan Fragrance Brands

The rise of niche and artisan fragrance brands in Australia is another important factor driving the Australia alcohol free perfumes market growth. These smaller, often independent brands focus on customization, unique scent profiles, and ethical ingredient sourcing, many of which avoid alcohol to enhance skin compatibility and environmental friendliness. Unlike mass-market fragrances, artisan perfumes often emphasize quality over quantity and cater to consumers looking for personalized or signature scents. These brands are especially popular among millennials and Gen Z, who value authenticity, individuality, and sustainability. By tapping into underserved segments—such as sensitive skin users, cultural minorities, or wellness enthusiasts—niche brands are helping expand market awareness and accessibility of alcohol free perfumes. Their innovation and customer engagement are instrumental in driving market differentiation and long-term growth.

Growth Drivers of Australia Alcohol Free Perfumes Market:

Innovation in Formulation Driving Performance and Appeal

According to Australia alcohol‑free perfumes market analysis, brands are placing significant emphasis on enhancing formulations to boost performance. Historically, alcohol-free fragrances faced criticism for their poor longevity and lack of projection, but advancements in fragrance formulation have changed that narrative. New bases utilizing plant-derived solvents and encapsulation methods help retain the scent for extended wear without causing dryness to the skin. The application experience is also more pleasant and hydrating, appealing to individuals with dry or sensitive skin. These developments have enabled alcohol-free perfumes to compete more effectively with mainstream options, eliminating the performance compromises that previously hampered their popularity. As a result, an increasing number of consumers are open to considering these alternatives, especially as issues related to safety, comfort, and environmental impact become more significant.

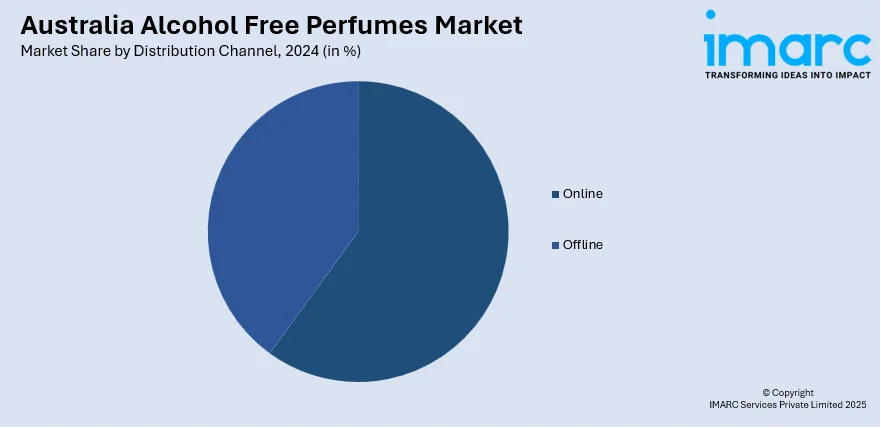

Online Retail Expansion Supporting Niche Brand Growth

E-commerce has emerged as a significant facilitator for niche fragrance brands in Australia, particularly those focusing on alcohol-free and wellness-centric offerings. Online channels eliminate the necessity for substantial retail investments, enabling smaller brands to penetrate the market and connect with a larger audience. These digital platforms also provide consumers with in-depth product details, reviews, and transparency regarding ingredients—essential factors when seeking skin-safe or ethical fragrances. Subscription services, discovery kits, and virtual scent-matching tools help address the issue of not being able to test products in-store. This transformation has paved the way for innovation and exploration, allowing brands to engage directly with communities that prioritize natural, non-toxic, and alcohol-free fragrances in their everyday lives.

Social Media Influence Boosting Awareness About Clean Fragrances

Australia alcohol‑free perfumes market demand has been significantly shaped by the emergence of social media and influencer marketing. Wellness and beauty influencers on platforms such as Instagram, TikTok, and YouTube are playing a crucial role in introducing clean, alcohol-free fragrances to wider audiences. These influencers frequently share their personal routines, product reviews, and recommendations for skin-safe options, which resonate strongly with their followers. Content that includes unboxing, “clean swaps,” and ingredient analyses generates curiosity and builds trust. Consumers, particularly younger demographics, are more inclined to try new products discovered through creators who embody their lifestyle or values. This increased visibility drives demand for transparent, ethical, and skin-friendly fragrance brands that were once confined to niche markets.

Australia Alcohol Free Perfumes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, gender, price range, distribution channel, and end user.

Product Type Insights:

- Sprays

- Roll-ons

- Solid Perfumes

- Oils

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sprays, roll-ons, solid perfumes, and oils.

Gender Insights:

- Men

- Women

- Unisex

A detailed breakup and analysis of the market based on gender have also been provided in the report. This includes men, women, and unisex.

Price Range Insights:

- Premium

- Mid-Range

- Economy

A detailed breakup and analysis of the market based on price range have also been provided in the report. This includes premium, mid-range, and economy.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End User Insights:

- Personal Use

- Gifting

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes personal use and gifting.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Alcohol Free Perfumes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sprays, Roll-ons, Solid Perfumes, Oils |

| Genders Covered | Men, Women, Unisex |

| Price Ranges Covered | Premium, Mid-Range, Economy |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Personal Use, Gifting |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia alcohol free perfumes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia alcohol free perfumes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia alcohol free perfumes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The alcohol free perfumes market in Australia was valued at USD 237.6 Million in 2024.

The Australia alcohol free perfumes market is projected to exhibit a compound annual growth rate (CAGR) of 7.70% during 2025-2033.

The Australia alcohol free perfumes market is expected to reach a value of USD 463.2 Million by 2033.

The Australia alcohol free perfumes market is driven by increased demand for clean, vegan, and cruelty-free products. Consumers are prioritizing sustainability with eco-friendly packaging, while the growth of online retail allows niche brands to reach broader audiences. Long-lasting, premium alcohol-free fragrances are also gaining popularity.

The market growth is driven by rising health consciousness, with consumers seeking non-toxic and skin-friendly options. Ethical concerns, including demands for vegan and cruelty-free products, are also significant factors. Additionally, the expansion of e-commerce platforms and innovative formulations offering better performance are fueling the market's growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)