Australia Aluminum Alloys Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

Australia Aluminum Alloys Market Overview:

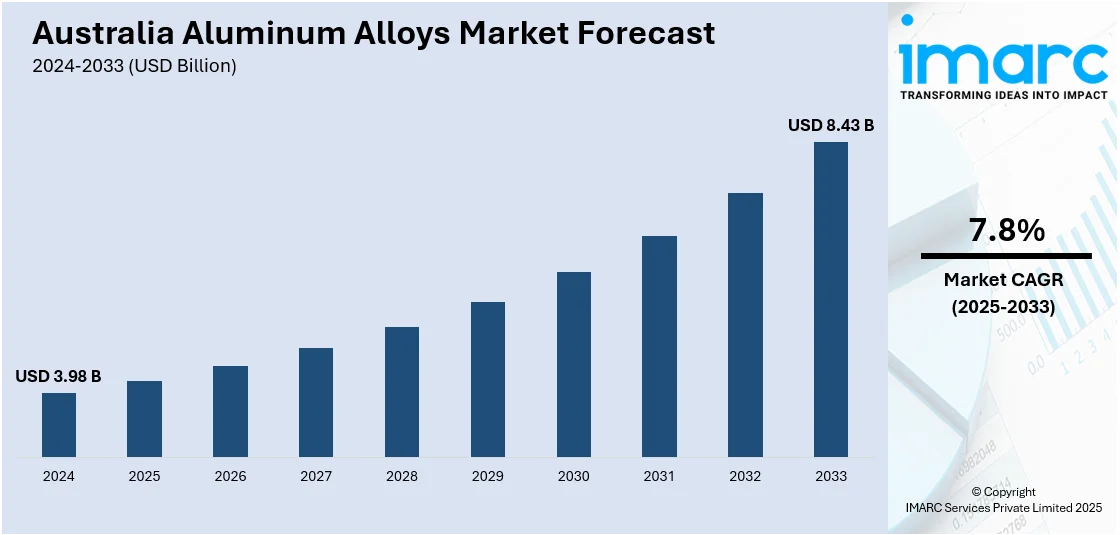

The Australia aluminum alloys market size reached USD 3.98 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.43 Billion by 2033, exhibiting a growth rate (CAGR) of 7.8% during 2025-2033. Rising demand in the automotive, aerospace, and construction sectors, growing preference for lightweight materials, increased infrastructure development, technological advancements in alloy production, and government initiatives promoting sustainable materials for energy efficiency and emissions reduction are some of the factors contributing to Australia aluminum alloys market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.98 Billion |

| Market Forecast in 2033 | USD 8.43 Billion |

| Market Growth Rate 2025-2033 | 7.8% |

Australia Aluminum Alloys Market Trends:

Aluminum Export Growth and Renewable Energy Shift

Australia has experienced a considerable growth in aluminum exports, particularly to overseas markets, indicating a rising influence in the global aluminum sector. To encourage this development, the Australian government has undertaken a significant project to assist aluminum smelters in transitioning to renewable energy, with an emphasis on sustainability and employment protection. This deliberate strategy intends to strengthen Australia's position as a major aluminum producer while maintaining the sector's long-term survival. The emphasis on renewable energy integration not only promotes environmental aims but also increases the industry's resilience and competitiveness in a continuously changing market. These factors are intensifying the Australia aluminum alloys market growth. For example, as per industry reports, in 2024, Australia’s aluminum exports to the US surged 103%, with US imports reaching USD 692 Million and 207,711 Tons in 2022. The Australian government unveiled an AUD 2 Billion plan to help aluminum smelters transition to renewable energy, aiming to secure up to 75,000 jobs. As the world’s sixth-largest aluminum producer, Australia continues to strengthen its position in the global market.

To get more information on this market, Request Sample

Sustainability Focus Driving Growth in the Aluminum Sector

The aluminum sector in Australia is expanding rapidly, owing to increased export demand and a strong commitment to environmental sustainability. The Australian government's recent strategic plan to assist aluminum smelters in switching to renewable energy signals a watershed moment in the industry's future. This initiative attempts to lower carbon footprints while creating long-term work prospects in remote communities. By focusing on renewable power sources, the government is preparing the industry for future development while also meeting global market expectations for cleaner, more sustainable manufacturing techniques. The approach is consistent with the growing worldwide demand for low-emission materials, offering Australian aluminum a competitive edge as markets prioritize environmentally friendly goods. This shift to green energy strengthens the sector's resilience, ensuring that Australia's aluminum production stays both internationally competitive and ecologically responsible. As the globe seeks sustainable manufacturing solutions, Australia's forward-thinking strategy puts the country in a strong position to fulfill rising global demand while also supporting local economies and environmental goals.

Australia Aluminum Alloys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application.

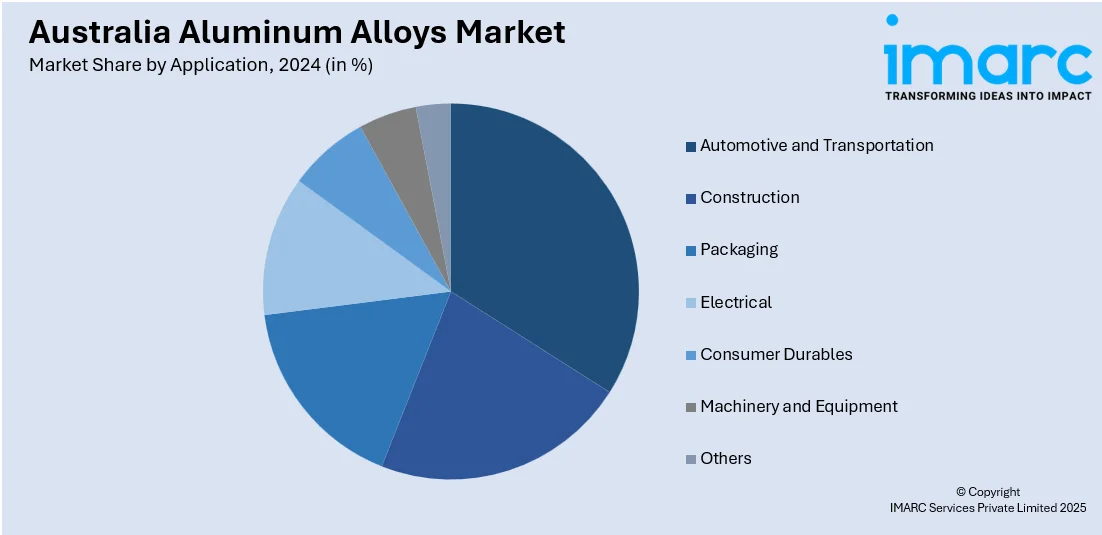

Application Insights:

- Automotive and Transportation

- Construction

- Packaging

- Electrical

- Consumer Durables

- Machinery and Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive and transportation, construction, packaging, electrical, consumer durables, machinery and equipment, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Aluminum Alloys Market News:

- In January 2025, the Australian government invested USD 2 Billion to strengthen the local aluminum industry, securing well-paid jobs and reducing emissions. A new Green Aluminium Production Credit will support smelters transitioning to renewable electricity by 2036. This initiative aims to boost Australian aluminum production, leveraging the country’s abundant resources and skilled workforce. Australia's aluminum industry, already the sixth-largest globally, is poised for significant growth in the decarbonizing economy.

Australia Aluminum Alloys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Automotive and Transportation, Construction, Packaging, Electrical, Consumer Durables, Machinery and Equipment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia aluminum alloys market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia aluminum alloys market on the basis of application?

- What is the breakup of the Australia aluminum alloys market on the basis of region?

- What are the various stages in the value chain of the Australia aluminum alloys market?

- What are the key driving factors and challenges in the Australia aluminum alloys market?

- What is the structure of the Australia aluminum alloys market and who are the key players?

- What is the degree of competition in the Australia aluminum alloys market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia aluminum alloys market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia aluminum alloys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia aluminum alloys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)