Australia Ammunition Market Size, Share, Trends and Forecast by Product, Caliber, Guidance, Lethality, Application, and Region, 2025-2033

Australia Ammunition Market Overview:

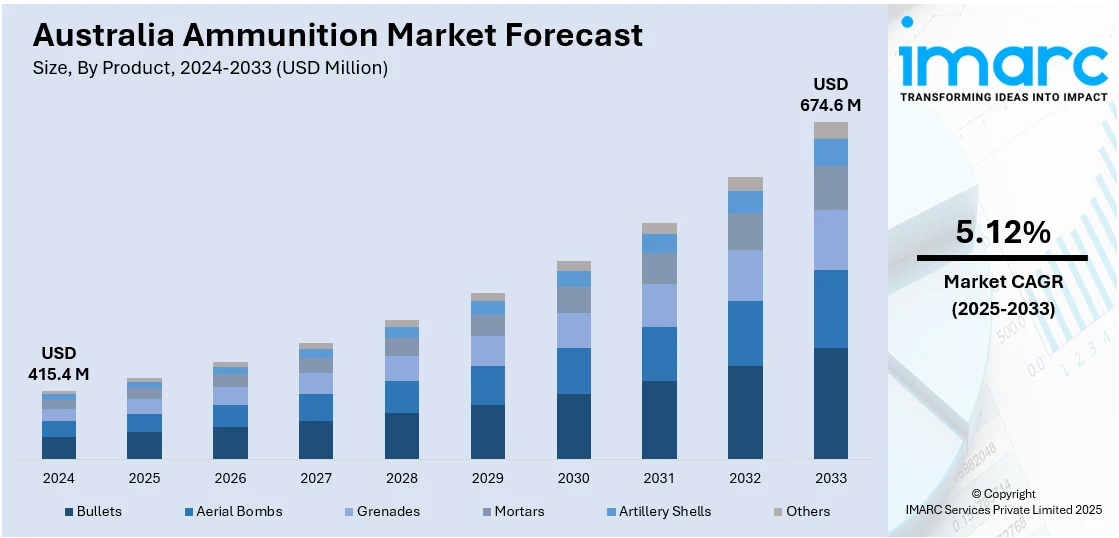

The Australia ammunition market size reached USD 415.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 674.6 Million by 2033, exhibiting a growth rate (CAGR) of 5.12% during 2025-2033. The market is driven by increased defense spending, especially in missile and artillery systems, due to geopolitical tensions with China. Additionally, strategic alliances, such as the Aukus agreement with the US and UK, that promote defense collaborations, and the modernization of armed forces care some of the other factors fueling the Australia ammunition market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 415.4 Million |

| Market Forecast in 2033 | USD 674.6 Million |

| Market Growth Rate 2025-2033 | 5.12% |

Australia Ammunition Market Trends:

Increased Defense Spending

Australia is significantly increasing its defense budget, with a focus on strengthening its missile and artillery systems. The government dedicates billions of dollars to advance guided missile systems along with military technologies because of elevated security threats, mainly in the Indo-Pacific region. Higher defense spending amounts directly drive the market need for specialized high-quality ammunition products. With an emphasis on modernizing defense infrastructure, Australia is investing in both conventional and cutting-edge ammunition solutions, from small arms to large-caliber artillery. These investments are central to ensuring military preparedness and enhancing national security, driving continued growth in the ammunition market. For instance, in October 2024, the federal government announced plans for two new Australian defense factories: one to manufacture Guided Multiple Launch Rocket Systems (GMLRS), as shown, and another to forge 155mm artillery ammunition. The government did not divulge the cost of the new plants, other than to say they were part of the Guided Weapons and Explosive Ordnance (GWEO) Enterprise, which is funded by an investment of up to $21 billion over the next decade.

To get more information on this market, Request Sample

Geopolitical Tensions

The rising geopolitical tensions in the Indo-Pacific, especially about China's increasing military assertiveness, are a crucial driver of the Australia ammunition market growth. The security landscape is shifting, leading Australia to bolster its defense capabilities. As part of this strategy, there is a growing demand for both defensive and offensive ammunition to support military readiness. The evolving geopolitical environment necessitates a more robust defense posture, which includes the procurement of large quantities of ammunition, as well as the development of advanced munitions. Australia’s proactive stance on national security, including a focus on missile defense and advanced weaponry, is contributing to heightened demand for specialized ammunition.

Strategic Alliances and Military Collaborations

Australia’s participation in international defense alliances, such as the Aukus pact with the United States and the United Kingdom, is influencing its ammunition needs. These strategic partnerships emphasize military cooperation and interoperability, which requires ammunition and munitions that align with international standards. Collaborations in defense technology, including missile systems and naval operations, are fostering the need for advanced, specialized ammunition. As Australia increases its defense engagements with global partners, the demand for highly sophisticated ammunition systems that meet the requirements of joint operations also rises. This international collaboration is essential for ensuring that Australian forces are adequately equipped for modern warfare scenarios.

Australia Ammunition Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, caliber, guidance, lethality, and application.

Product Insights:

- Bullets

- Aerial Bombs

- Grenades

- Mortars

- Artillery Shells

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes bullets, aerial bombs, grenades, mortars, artillery shells, and others.

Caliber Insights:

- Small

- Medium

- Large

A detailed breakup and analysis of the market based on caliber have also been provided in the report. This includes small, medium, and large.

Guidance Insights:

- Guided

- Non-Guided

A detailed breakup and analysis of the market based on the guidance have also been provided in the report. This includes guided and non-guided.

Lethality Insights:

- Less-Lethal

- Lethal

A detailed breakup and analysis of the market based on lethality have also been provided in the report. This includes less-lethal and lethal.

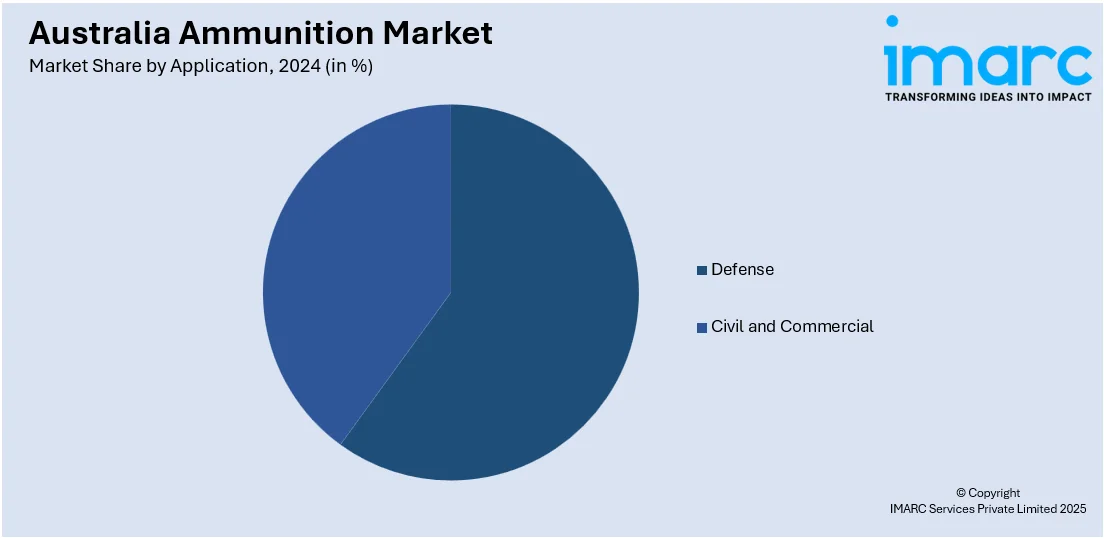

Application Insights:

- Defense

- Military

- Homeland Security

- Civil and Commercial

- Sporting

- Hunting

- Self-Defense

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes defense (military and homeland security) and civil and commercial (sporting, hunting, self-defense, and others).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Ammunition Market News:

- In November 2024, the Australian government chose Thales Australia as a key partner in the recently released Australian Guided Weapons and Explosive Ordnance Plan. As a vital partner, the company will assist in strengthening the nation’s defense capabilities, especially in improving Defence Australia’s GWEO stockpile, fortifying local munition production and supply chain, and accelerating the procurement of long-range missiles over the next ten years.

- In March 2025, the Albanese government took another step forward by signing two agreements of understanding, which will allow Australia to start producing missiles domestically. As a major step toward the co-production of feasible volumes of Guided Multiple Launch Rocket Systems (GMLRS) in Australia for worldwide consumption, the Guided Multiple Launch Rocket System Co-Assembly agreement permits the assembly of a first batch of this vital weapon in Australia in 2025.

Australia Ammunition Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bullets, Aerial Bombs, Grenades, Mortars, Artillery Shells, Others |

| Calibers Covered | Small, Medium, Large |

| Guidance Covered | Guided, Non-Guided |

| Lethalities Covered | Less-Lethal, Lethal |

| Applications Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia ammunition market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia ammunition market on the basis of product?

- What is the breakup of the Australia ammunition market on the basis of caliber?

- What is the breakup of the Australia ammunition market on the basis of guidance?

- What is the breakup of the Australia ammunition market on the basis of lethality?

- What is the breakup of the Australia ammunition market on the basis of application?

- What is the breakup of the Australia ammunition market on the basis of region?

- What are the various stages in the value chain of the Australia ammunition market?

- What are the key driving factors and challenges in the Australia ammunition market?

- What is the structure of the Australia ammunition market and who are the key players?

- What is the degree of competition in the Australia ammunition market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia ammunition market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia ammunition market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia ammunition industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)