Australia Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2026-2034

Australia Animal Feed Market Size and Share:

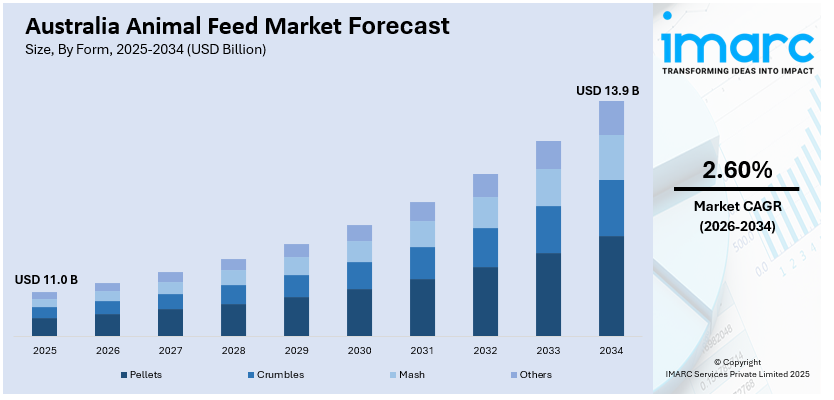

The Australia animal feed market size reached USD 11.0 Billion in 2025. Looking forward, the market is projected to reach USD 13.9 Billion by 2034, exhibiting a growth rate (CAGR) of 2.60% during 2026-2034. The rising livestock production, increasing demand for high-quality meat, expanding dairy industry, growing awareness of animal nutrition, and advancements in feed technology are augmenting the Australia animal feed market share, supported by government initiatives, export opportunities, and the need for sustainable, efficient feed solutions to meet domestic and international consumption trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 11.0 Billion |

| Market Forecast in 2034 | USD 13.9 Billion |

| Market Growth Rate 2026-2034 | 2.60% |

Key Trends of Australia Animal Feed Market:

Shift Toward Functional and Specialty Feed Additives

Australian livestock producers are increasingly integrating functional and specialty feed additives into animal diets to enhance health, productivity, and feed efficiency, which is positively impacting Australia animal feed market outlook. These additives include enzymes, probiotics, prebiotics, amino acids, organic acids, and phytogenics. A research article published in February 2025 examines prebiotics in animal nutrition, emphasizing their role as viable alternatives to antimicrobial growth promoters. It highlights agro-industrial residues as promising, sustainable sources of prebiotics with documented benefits for gut health, immune modulation, and overall animal performance. The article also outlines future directions, including biofortification and the use of genetically modified organisms to enhance prebiotic production efficiency and application. Additionally, the adoption is driven by a move away from antibiotic growth promoters, following both consumer pressure and regulatory tightening around antibiotic use. Moreover, specialty additives help improve gut health, immune response, and nutrient absorption in animals, directly supporting performance outcomes. The trend also reflects the growing emphasis on precision nutrition, where feed is tailored to the specific physiological needs of animals at different growth stages. In sectors like poultry and swine, where feed cost constitutes a large share of total production expense, such targeted supplementation provides both economic and performance benefits. In addition to this, research and development (R&D) investment from major feed producers and ingredient companies in Australia is also advancing product availability. Also, academic-industry collaborations are focusing on localizing additive solutions to suit Australia’s unique climate conditions, feed base, and livestock genetics.

To get more information on this market Request Sample

Rising Demand for Sustainable and Locally Sourced Feed Ingredients

Sustainability concerns and supply chain resilience are prompting a shift toward locally sourced and environmentally friendly feed ingredients in the market. An industry report highlights that approximately 40% of global crop harvests are used for animal feed, contributing significantly to deforestation. In response, Australian feed companies are reformulating their products and shifting toward more sustainable sourcing practices, including the use of alternative protein sources and locally available ingredients. This transition addresses environmental concerns and aligns with the increasing demand for traceable and eco-friendly livestock production. Moreover, climate volatility, transportation disruptions, and global trade tensions are highlighting the risks of relying on imported feed commodities like soybean meal or synthetic additives. Feed manufacturers are incorporating materials such as lupins, faba beans, canola meal, seaweed, insect protein, and food processing by-products. These ingredients offer the dual benefits of reducing carbon intensity and supporting circular economy models. The movement is further encouraged by national sustainability frameworks and carbon accounting standards, which are gradually influencing procurement and formulation strategies. Besides this, end consumers, particularly in premium export markets, are also placing greater value on sustainably raised meat and dairy, which is supporting Australia animal feed market growth. This is nudging livestock producers and feed companies to invest in transparent sourcing, life cycle assessments, and feed certification programs.

Technological Advancements in Feed Production

The Australian animal feed sector is increasingly leveraging technological innovations toward improving operational efficiency and increasing livestock productivity. Precision nutrition strategies allow for tailored feed formulations to be created for specific animal species as formulators pursue optimal growth, health, also feed conversion rates relative to age brackets also production objectives. Digestion, immunity, and livestock performance overall improve when farmers incorporate feed additives like amino acids, enzymes, and probiotics. Automated feed processing systems such as pelletizers mixers and extrusion equipment work to produce feed and also improve feed quality consistency. Those systems cut labor costs too. Livestock results are improved through these advancements along with operational waste, inefficiencies' reduction. The growing adoption of these technologies across poultry, cattle, and aquaculture sectors is considerably shaping Australia animal feed market demand, propelling growth as producers pursue more intelligent, efficient, and cost-effective feed solutions to align with changing industry standards.

Growth Drivers of Australia Animal Feed Market:

Expansion of Livestock Farming

The development of livestock production in Australia is one of the major drivers of the growth of the animal feed market. Increased demand for meat, dairy, and poultry by consumers has prompted farmers to increase production and adopt more effective feeding systems. With increasing herd and flock sizes, the demand for quality feeds that ensure optimal growth, reproduction, and well-being also increases. Feed formulations are being tailored to address the particular nutritional needs of different species, with a view to enhancing feed conversion ratios and productivity. Additionally, industrial livestock farming enterprises are investing more in advanced feed management systems and storage facilities. This is significantly increasing the overall usage of animal feed and promoting market expansion in both commercial and smallholder farming enterprises.

Increasing Focus on Animal Health and Nutrition

Growing awareness among Australian farmers about the significance of balanced diets and proper nutrition is driving the demand for fortified and functional feed solutions. High-quality feed enriched with vitamins, minerals, amino acids, and probiotics enhances livestock growth while also boosting immunity and improving product quality. According to Australia animal feed market analysis, this focus on animal health is pushing farmers to choose premium feed formulations that maximize efficiency and ensure consistent performance in livestock. Feed manufacturers are responding by creating specialized products tailored for different animal species, age groups, and production goals. The increasing emphasis on nutritional adequacy and animal welfare is thus leading to widespread adoption of advanced feed solutions across the poultry, cattle, and aquaculture sectors.

Growth of Aquaculture Industry

The rapid development of the aquaculture industry in Australia is generating significant opportunities for the animal feed market. The growing domestic and international demand for fish and seafood products has intensified the need for specialized aquafeed formulations that enhance growth, health, and feed conversion rates in farmed species. These feeds are crafted to fulfill the specific nutritional needs of fish and shrimp, including essential protein content, fatty acids, and micronutrients, ensuring sustainable and efficient production. Furthermore, advancements in feed processing technologies, such as extrusion and pelletization, are enhancing feed stability and digestibility. The expansion of aquaculture farms, alongside increased investments in high-quality and sustainable feed solutions, is making a significant contribution to market growth and shaping the future of animal nutrition in Australia.

Opportunities of Australia Animal Feed Market:

Adoption of Precision Feeding Technologies

The implementation of precision feeding technologies is reshaping the Australian animal feed industry by facilitating more effective and data-informed nutrition management. Automated feeding systems, paired with sensors and software, enable farmers to assess livestock health, growth rates, and feed intake in real time. This optimization guarantees that each animal receives the correct nutrient levels, enhancing feed conversion ratios and overall productivity. Furthermore, precision feeding reduces feed waste, lowers operational expenses, and improves sustainability by diminishing environmental impacts. As farmers place a greater emphasis on efficiency, profitability, and animal welfare, investments in intelligent feeding solutions are on the rise. The incorporation of technology into feed management presents a substantial growth opportunity for manufacturers of specialized equipment and advanced feed formulations in Australia.

Export-Oriented Livestock and Aquaculture Markets

Australia’s strong presence in the global trade of meat, dairy, and aquaculture is fueling the demand for high-quality animal feed. Export-focused livestock and aquaculture enterprises necessitate consistent, nutrient-dense feed that complies with international quality and safety standards. Producers are investing in premium formulations to ensure that livestock and seafood products achieve optimal growth, health, and quality for the global market. This trend motivates feed manufacturers to create specialized products with enhanced nutritional content, traceability, and compliance certifications. The expansion into international markets also encourages technological advancements in feed processing, storage, and distribution. Overall, the emphasis on global competitiveness is generating significant opportunities for innovation and growth in the Australian animal feed sector.

Expansion into Organic and Natural Feed Products

The increasing consumer demand for organic, chemical-free, and sustainably produced animal products is driving the growth of natural feed formulations in Australia. Farmers and producers are progressively utilizing feed composed of organic grains, natural additives, and probiotics to meet market expectations for healthier, residue-free meat, dairy, and poultry products. This change aligns with sustainability and environmental objectives while providing producers with access to premium markets and enabling them to charge higher prices. Feed manufacturers can seize the opportunity to innovate by developing certified organic products, enhancing ingredient traceability, and improving nutritional profiles. The rising interest in organic and natural feed opens an exciting path for market expansion, differentiation, and long-term acceptance within the Australian livestock and aquaculture sectors.

Challenges of Australia Animal Feed Market:

Fluctuating Raw Material Prices

One of the significant challenges confronting the Australian animal feed market is the volatility of raw material prices. Essential ingredients like grains, protein meals, and various feed components experience price fluctuations driven by factors such as climate conditions, global commodity prices, and variations in domestic production. Sudden spikes in prices can substantially increase production costs for feed manufacturers, affecting profit margins and the overall stability of the market. Smaller farms and producers are especially at risk, as they may lack the capacity to absorb rising costs. Moreover, this price volatility can influence the choices made in feed formulations, potentially compromising nutritional quality. Addressing these fluctuations necessitates strategic sourcing, careful inventory planning, and long-term supplier agreements; however, the inherent unpredictability remains a continual challenge for both manufacturers and livestock producers.

Stringent Regulatory Requirements

Compliance with stringent food safety, quality, and environmental regulations presents a major challenge in the Australian animal feed market. Feed manufacturers are required to follow regulations related to ingredient sourcing, processing standards, labeling, and storage practices to fulfill both domestic and international safety guidelines. Environmental directives also regulate emissions, waste management, and sustainable production methods. Meeting these regulatory standards heightens operational complexity and costs, requiring investments in quality control systems, certifications, and monitoring processes. Smaller firms may find it difficult to allocate sufficient resources for compliance, which can hinder their competitiveness in the market. Although these regulations are essential for ensuring safety and boosting consumer confidence, the compliance burden remains a barrier to operational efficiency and profitability, influencing market dynamics throughout the animal feed sector.

Disease Outbreaks in Livestock

Disease outbreaks within livestock represent a significant challenge to the Australian animal feed market. Epidemics such as avian influenza, foot-and-mouth disease, or bacterial infections can severely decrease livestock populations, affecting feed demand. These health crises also disrupt supply chains, as farms might restrict movements, and regulatory bodies enforce quarantines, curtailing feed distribution. The uncertainty produced by disease outbreaks can lead to mismatches in inventory and financial setbacks for both feed manufacturers and farmers. Furthermore, such outbreaks may change consumer demand or export requirements, adding further pressure to the market. Ensuring biosecurity, monitoring animal health, and maintaining preparedness for emergencies are crucial, but despite these initiatives, disease-related disruptions continue to be a persistent challenge for achieving consistent growth in the animal feed industry.

Australia Animal Feed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on form, animal type, and ingredient.

Form Insights:

- Pellets

- Crumbles

- Mash

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes pellets, crumbles, mash, and others.

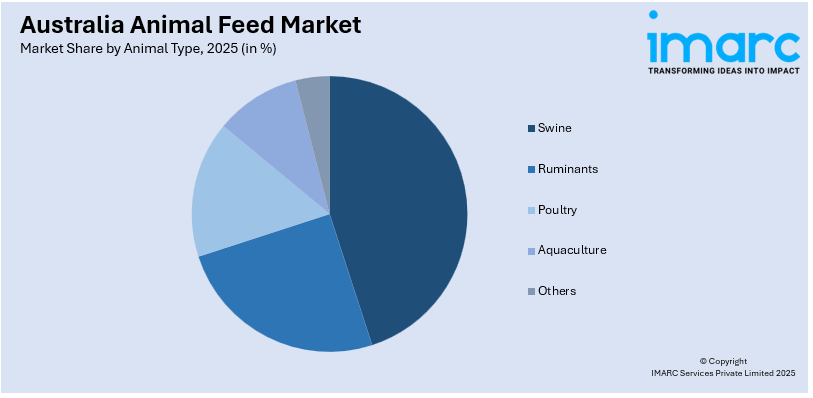

Animal Type Insights:

Access the comprehensive market breakdown Request Sample

- Swine

- Starter

- Finisher

- Grower

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Boilers

- Layers

- Turkeys

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackeral

- Milkfish

- Mollusks

- Salmon

- Others

- Others

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes swine (starter, finisher, and grower), ruminants (calves, dairy cattle, beef cattle, and others), poultry (boilers, layers, turkey, and others), aquaculture (carps, crustaceans, mackeral, milkfish, mollusks, salmon, and others), and others.

Ingredient Insights:

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes cereals, oilseed meal, molasses, fish oil and fish meal, additives (antibiotics, vitamins, antioxidants, amino acids, feed enzymes, feed acidifiers, and others), and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Animal Feed Market News:

- In August 2025, Australian agri-tech company núaFEEDs announced its plans to launch a facility in UAE to convert surplus bread waste into sustainable livestock feed. This initiative addresses food waste, lowers feed costs, and supports local agriculture, aligning with the UAE’s sustainability goals and reducing reliance on imports.

- In January 2025, CH4 Global commenced production at its EcoPark facility in Louth Bay, Australia, the first commercial-scale site for cultivating Asparagopsis. This cost-effective pond-based system enables profitable production of methane-reducing feed supplements, helping to significantly lower methane emissions from cattle without the need for government subsidies.

- In November 2024, NOVUS expanded its feed solutions for dairy farmers in Australia and New Zealand, offering products like MFP® Feed Supplement, MINTREX® Bis-Chelated Trace Minerals, and ZORIEN® SeY 3000 Prilled Yeast. These innovations aim to enhance milk yields, improve animal health, and optimize profitability despite challenging conditions.

- In July 2024, Real Pet Food Co. announced the launch of Billy + Margot Insect Single Protein + Superfoods, Australia's first pet food featuring black soldier fly (BSF) protein. The company secured the nation's inaugural permit to import BSF meal, culminating over two years of research into alternative protein sources. This product underscores Real Pet Food Co.'s commitment to sustainable practices and innovation in pet nutrition.

- In August 2024, Australian company Food Recycle secured USD 3 Million to advance its technology that transforms commercial food waste into animal feed, aiming to reduce landfill waste and greenhouse gas emissions. Following successful trials with various species, the company plans to commercialize and expand this technology across Australia and New Zealand. The funds will support engineering and design efforts for the inaugural commercial-scale production facility under Food Recycle's patented technology agreement.

Australia Animal Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Animal Types Covered |

|

| Ingredients Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia animal feed market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia animal feed market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia animal feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The animal feed market in Australia was valued at USD 11.0 Billion in 2025.

The Australia animal feed market is projected to exhibit a compound annual growth rate (CAGR) of 2.60% during 2026-2034.

The Australia animal feed market is expected to reach a value of USD 13.9 Billion by 2034.

The market is witnessing growing adoption of precision feeding technologies, expansion of organic and natural feed, and integration of sustainable practices. Rising demand for functional additives, coupled with aquaculture sector growth and use of alternative ingredients, is reshaping feed formulations and driving innovation across the industry.

Expansion of livestock and poultry farming, coupled with rising consumer preference for high-quality animal-based products, is fueling market growth. Increasing focus on animal health and nutrition, aquaculture development, and technological advancements in feed manufacturing are also driving adoption, creating strong opportunities for consistent growth in the Australian feed sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)