Australia Animal Health Market Size, Share, Trends and Forecast by Animal Type, Product Type, and Region, 2026-2034

Australia Animal Health Market Size and Share:

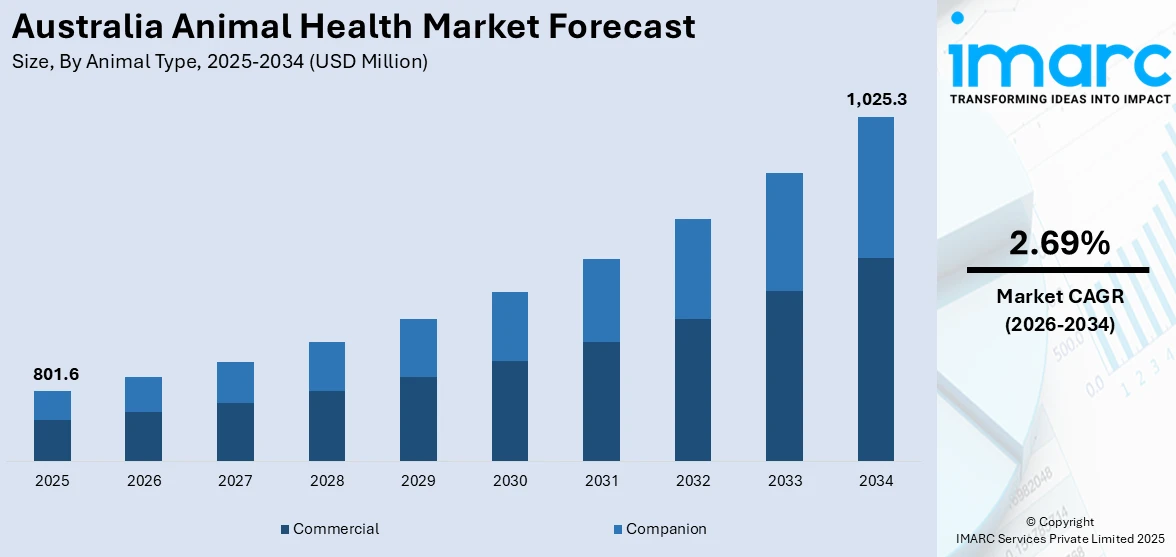

The Australia animal health market size reached USD 801.6 Million in 2025. Looking forward, the market is projected to reach USD 1,025.3 Million by 2034, exhibiting a growth rate (CAGR) of 2.69% during 2026-2034. The market is driven by increased pet ownership, growing demand for livestock disease management, biosecurity regulations, veterinary technological advancements, and rising awareness of zoonotic diseases. Government initiatives, export-focused livestock industries, and evolving consumer preferences for high-quality animal-derived products further contribute to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 801.6 Million |

| Market Forecast in 2034 | USD 1,025.3 Million |

| Market Growth Rate 2026-2034 | 2.69% |

Key Trends of Australia Animal Health Market:

Rise in Companion Animal Therapeutics and Preventive Care

Australia has experienced a significant increase in pet ownership, with pet parents investing more in veterinary services, diagnostics, and wellness products. This shift has accelerated the development and availability of companion animal therapeutics, including targeted medications for chronic conditions, parasite control, and advanced diagnostic tools. For instance, in August 2024, Animal Medicines Australia highlighted a concerning rise in parasite cases, including fleas, ticks, and mod worms, posing year-round health threats to pets across the country. To support pet owners, AMA released educational materials, including a set of frequently asked questions, aimed at raising awareness about parasite control and promoting proactive protection strategies for companion animals. Preventive care, including annual health screenings and vaccinations, is becoming a routine expectation among Australian pet owners. Clinics are increasingly offering wellness plans and bundled services, responding to consumer demand for comprehensive and accessible animal healthcare. Additionally, the growth of pet insurance adoption is making high-cost treatments more financially viable, encouraging investment in long-term animal health. The trend highlights a shift from reactive to preventive care, expanding revenue opportunities across veterinary service providers and pharmaceutical companies.

To get more information on this market Request Sample

Digitalization and Telehealth Integration in Veterinary Services

The digital transformation of the animal health sector in Australia is reshaping service delivery models. Veterinary telehealth has gained traction, offering remote consultations, prescription renewals, and post-operative follow-ups through secure platforms. This is particularly beneficial in rural and underserved areas where veterinary access has traditionally been limited. Digital platforms also facilitate pet health monitoring through wearables and app-based record systems, enabling real-time tracking of vitals and behavioral changes. Clinics are increasingly investing in digital practice management software to streamline operations, manage patient data, and enhance client engagement. These innovations improve efficiency and align with changing consumer expectations around convenience and technology-enabled services. The integration of digital tools into animal healthcare is likely to continue expanding as part of broader health system modernization. For instance, in March 2025, One Health Epi Consulting launched "Animal Disease Insights," a free online dashboard for global animal disease data. It consolidates trends, country-specific outbreaks, and news, aiding professionals in disease surveillance and management. Developed without external funding, it aims for evidence-based decisions. Future plans include integrating social media data for real-time insights, enhancing public health responses.

Biosecurity and Livestock Disease Control Initiatives

Australia’s economic reliance on livestock exports places a strong emphasis on biosecurity and proactive disease management. The government, in collaboration with industry stakeholders, has strengthened surveillance systems and response protocols to protect against outbreaks such as foot-and-mouth disease or avian influenza. For instance, in October 2024, Animal Medicines Australia welcomed the Australian Government’s allocation of an additional AUD 95 Million to strengthen preparedness for high pathogenicity avian influenza (HPAI) H5N1. The investment is directed toward enhancing national biosecurity response systems, surveillance, scientific infrastructure, and vaccine acquisition for vulnerable captive bird species. The initiative is intended to safeguard agriculture and native wildlife from potential outbreaks. The animal health sector was recognized for its contribution to bird welfare and its alignment with government priorities through focused investments in disease response planning. Additionally, the livestock industry is increasing investment in vaccines, antimicrobial alternatives, and herd health analytics to minimize productivity losses and meet global trade standards. Heightened public and political focus on biosecurity is also encouraging innovation in diagnostic tools and early detection platforms. These efforts are reinforcing Australia’s reputation for maintaining high animal health standards, crucial for sustaining export competitiveness and market access.

Growth Drivers of Australia Animal Health Market:

Rising Pet Ownership

The increasing trend of pet ownership in Australia is the key factor driving the Australia animal health market growth, due to the rising demand for veterinary services, vaccines, preventive medications, and wellness products. With more households viewing pets as family members, spending on pet care has surged to include routine check-ups, advanced treatments, and premium nutrition. This change is also fostering growth in companion animal insurance, enhancing access to veterinary care. Growing awareness about preventive healthcare is minimizing the risks of chronic illnesses in pets, which contributes to the overall stability of the market. As the cultural shift toward pet humanization becomes stronger, it directly influences the industry, expanding the Australia animal health market share by widening the consumer base and creating new opportunities for specialized veterinary and healthcare service providers.

Technological Advancements

Innovations in diagnostics, telemedicine, and digital monitoring tools are transforming the animal health sector in Australia, enhancing both accessibility and efficiency. Veterinary professionals are increasingly utilizing advanced imaging, rapid diagnostic kits, and AI-based solutions to improve the precision and outcomes of treatments. Telemedicine platforms enable pet owners in rural or less served areas to obtain timely veterinary advice, thus bridging geographic care gaps. Wearable technology for pets and livestock allows for real-time health monitoring, providing owners with crucial insights for preventive care. These advancements improve service quality and reduce treatment delays. As technology adoption continues to grow, the rising use of these tools is stimulating strong Australia animal health market demand, positioning digital solutions as a significant catalyst for growth.

Government Support

Government efforts in Australia aimed at enhancing biosecurity, improving animal welfare, and ensuring food safety are crucial in advancing the animal health sector. Policies focused on controlling livestock diseases, monitoring zoonotic risks, and bolstering veterinary infrastructure are promoting greater integration of healthcare solutions. Subsidies and awareness initiatives encourage farmers and pet owners to focus on preventive measures, vaccinations, and responsible care practices. By enforcing strict animal welfare regulations, the government stimulates higher demand for veterinary compliance and monitoring systems. This regulatory backing secures the livestock industry and boosts consumer confidence in pet care services. These developments, highlighted through Australia animal health market analysis, illustrate the significance of policy-driven growth in shaping the long-term progress of the industry.

Australia Animal Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on animal type and product type.

Animal Type Insights:

- Commercial

- Companion

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes commercial and companion.

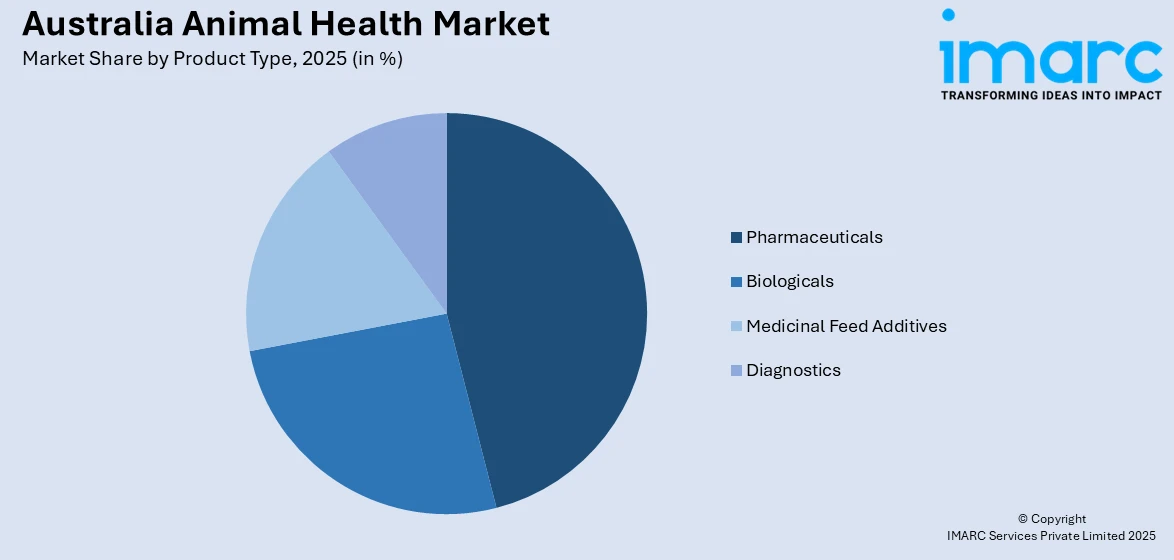

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Pharmaceuticals

- Biologicals

- Medicinal Feed Additives

- Diagnostics

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes pharmaceuticals, biologicals, medicinal feed additives, and diagnostics.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Animal Health Market News:

- In January 2024, Ceva Santé Animale acquired Scout Bio, aiming to drive innovation in pet therapeutics. This acquisition strengthens Ceva’s position in the animal health sector by expanding its capabilities in advanced treatments for companion animals. The move highlights Ceva’s continued investment in research and development for cutting-edge veterinary solutions.

- In March 2024, Zoetis Australia, a global animal health company, announced an investment of up to AUD 350 Million to establish operations in Parkville, Victoria. The move includes developing manufacturing capabilities at the former CSL site. This investment supports Australia's health technology sector and strengthens local vaccine and diagnostic production.

Australia Animal Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Commercial, Companion |

| Product Types Covered | Pharmaceuticals, Biologicals, Medicinal Feed Additives, Diagnostics |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia animal health market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia animal health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia animal health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The animal health market in Australia was valued at USD 801.6 Million in 2025.

The Australia animal health market is projected to exhibit a CAGR of 2.69% during 2026-2034, reaching a value of USD 1,025.3 Million by 2034.

The market is driven by the increasing livestock production, growing pet ownership, and increasing awareness regarding animal wellness and preventive healthcare. Additionally, demand for veterinary pharmaceuticals, vaccines, and nutritional supplements, along with technological advancements in diagnostics and treatment, supports market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)