Australia Anti Caking Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Australia Anti Caking Market Overview:

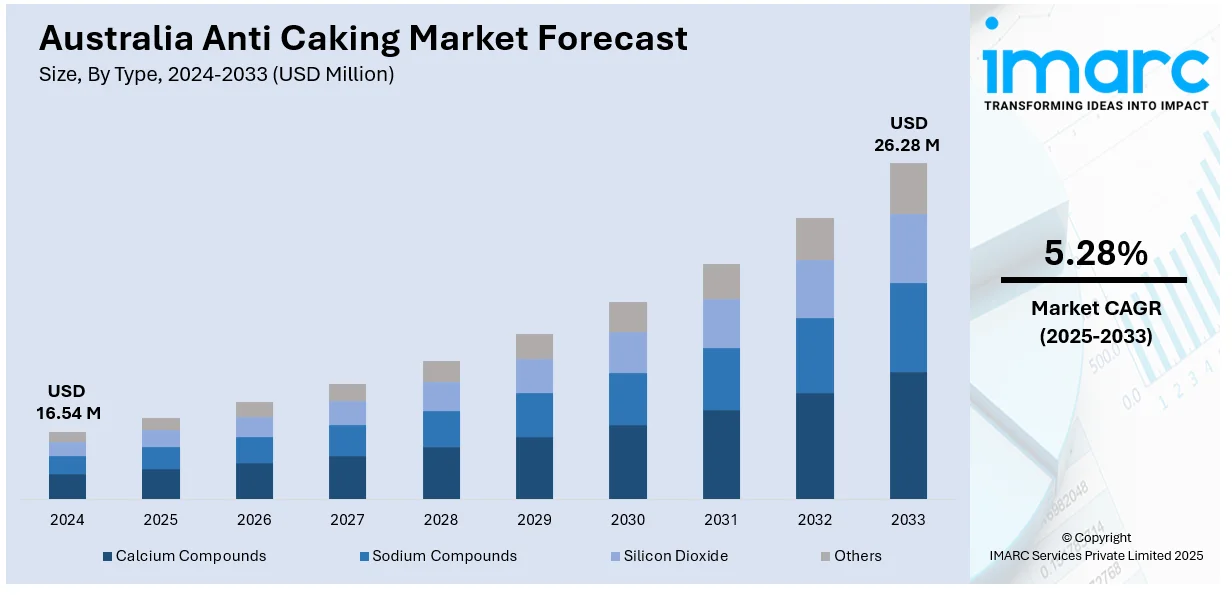

The Australia anti caking market size reached USD 16.54 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 26.28 Million by 2033, exhibiting a growth rate (CAGR) of 5.28% during 2025-2033. The rising demand for processed and convenience food products is impelling the market growth in Australia. The growing emphasis on food safety and quality is also offering a favorable market outlook. Apart from this, constant research and development (R&D) in production technologies are expanding the Australia anti caking market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.54 Million |

| Market Forecast in 2033 | USD 26.28 Million |

| Market Growth Rate 2025-2033 | 5.28% |

Australia Anti Caking Market Trends:

Growing Focus on Food Safety and Quality

Increasing concerns for food safety and quality is strengthening the market growth in Australia. Food companies are focusing more on utilizing additives, including anti caking agents, to provide the desired form and appearance to products while still meeting safety levels. Anti caking agents contribute to preventing agglomeration and ensure homogeneous distribution of ingredients in food items like powdered foods, spice blends, and powdered drink mixes. In Australia, consumers are becoming increasingly aware about food quality, prompting increased regulatory attention to consumable products. Consequently, manufacturers of food are constantly in search of new methods to enhance product performance and shelf life. This focus on quality and food safety is driving the adoption of anti-caking agents, which are becoming integral to meeting both regulatory requirements and consumer expectations for high-quality products. The Implementation Subcommittee for Food Regulation (ISFR) meeting was held in Australia on 29 to 30 May 2024 where food ministers agreed to strengthen food safety procedures with four new Strategic Outcomes for the Joint Food Regulatory System (safe and suitable food; nutritious food supply; informed and empowered consumers; and a thriving food economies).

To get more information on this market, Request Sample

Increasing Demand for Processed Food Products

The Australia anti caking sector is experiencing significant growth due to the rising demand for processed and convenience food products. People are increasingly seeking quick and easy meal solutions, which is driving the demand for ready-to-eat (RTE) and packaged foods. Manufacturers are actively incorporating anti caking agents into these products to ensure that ingredients, such as salt, spices, and powdered products, remain free-flowing and easy to use. This trend is particularly prominent in the seasoning, dairy, and baking industries, wherein anti caking agents help in maintaining the quality and usability of products over extended periods. With more people opting for processed food in response to busy lifestyles, the consumption of anti caking agents is steadily increasing as a result. The market is also witnessing an expansion in the variety of anti caking agents used to meet user preferences for natural or clean-label food options, further contributing to the Australia anti caking market growth. The Australian food processing market size is anticipated to attain USD 187.60 Billion by 2033. This is expected to further increase the use of anti caking agents.

Advancements in Anti Caking Technologies

Constant research and development (R&D) of anti caking technologies are bolstering the market growth. R&D personnel and manufacturers are working hard on creating more cost-effective, efficient, and sustainable anti caking solutions. Novel technologies are working towards the development of anti caking agents not only more capable of achieving desired flowability in ingredients but also compatible with natural and clean-label product development. Moreover, innovations are catering to requirements of different industries, including dairy, beverages, and seasoning blends, where the risk of clumping is high. Since manufacturers are constantly refining anti caking technologies, the performance and functionality of these agents are becoming better, enabling them to serve a wider variety of food applications. These developments are making anti caking agents more readily available, cost-effective, and useful to producers and consumers alike.

Australia Anti Caking Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Calcium Compounds

- Sodium Compounds

- Silicon Dioxide

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes calcium compounds, sodium compounds, silicon dioxide, and others.

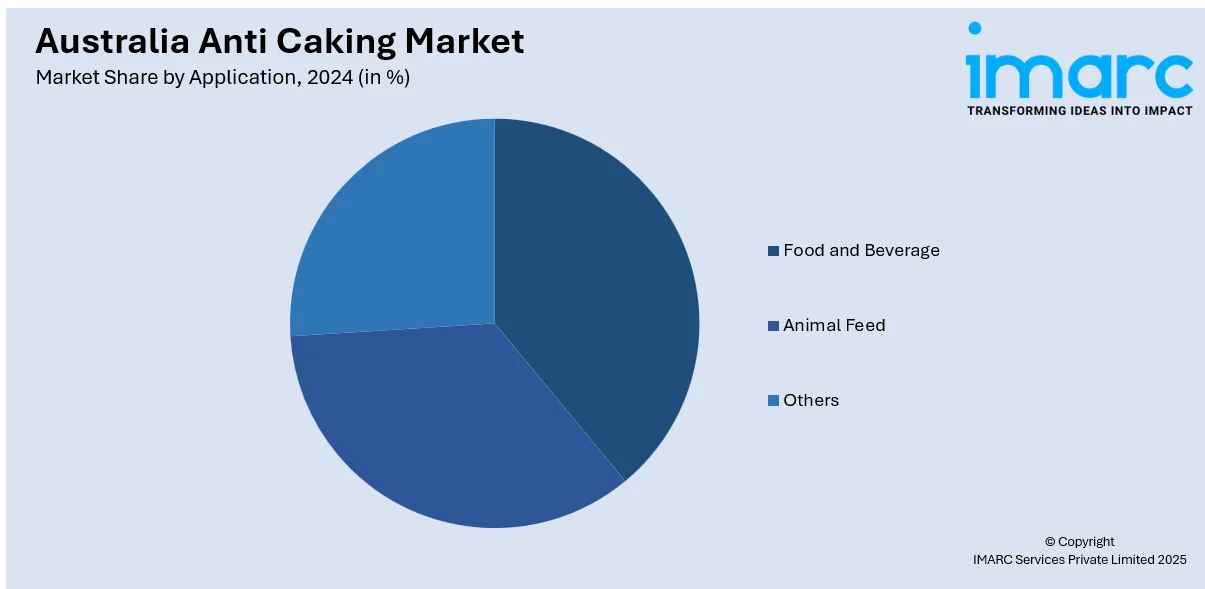

Application Insights:

- Food and Beverage

- Animal Feed

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverage, animal feed, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Anti Caking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Calcium Compounds, Sodium Compounds, Silicon Dioxide, Others |

| Applications Covered | Food and Beverage, Animal Feed, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia anti caking market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia anti caking market on the basis of type?

- What is the breakup of the Australia anti caking market on the basis of application?

- What is the breakup of the Australia anti caking market on the basis of region?

- What are the various stages in the value chain of the Australia anti caking market?

- What are the key driving factors and challenges in the Australia anti caking market?

- What is the structure of the Australia anti caking market and who are the key players?

- What is the degree of competition in the Australia anti caking market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia anti caking market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia anti caking market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia anti caking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)