Australia Anti Corrosion Coatings Market Size, Share, Trends and Forecast by Technology, Material, Application, and Region, 2025-2033

Australia Anti Corrosion Coatings Market Overview:

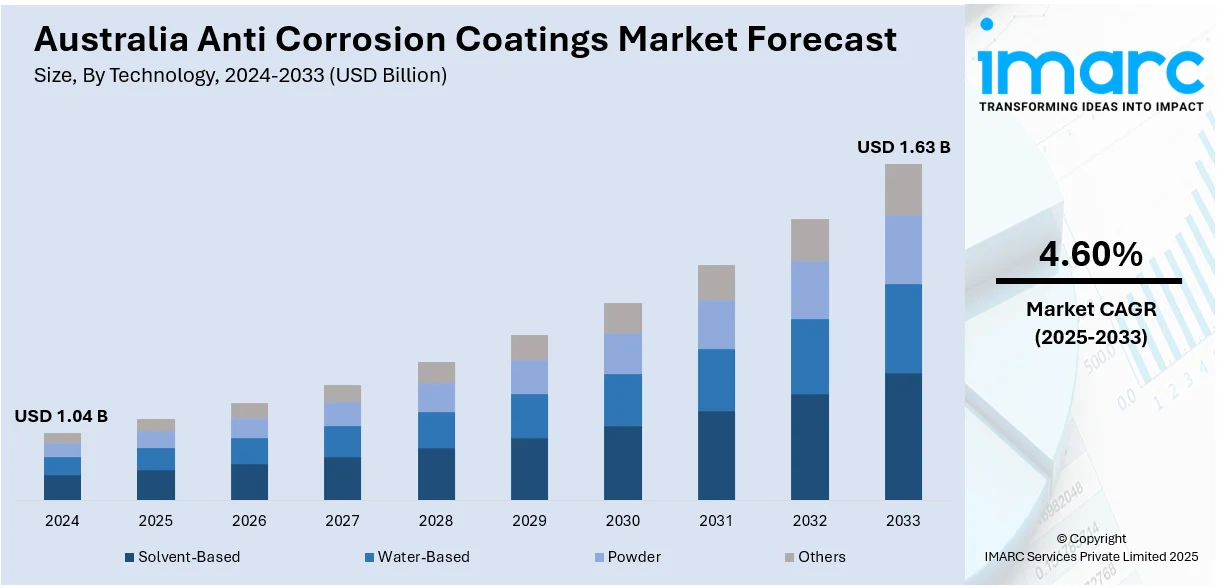

The Australia anti corrosion coatings market size reached USD 1.04 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.63 Billion by 2033, exhibiting a growth rate (CAGR) of 4.60% during 2025-2033. Australia's infrastructure expansion and the growing renewable energy sector are significantly driving the demand for anti-corrosion coatings. Increased construction, energy, transportation, and mining activities, along with the need for asset protection in harsh environments, are further contributing to the Australia anti corrosion coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.04 Billion |

| Market Forecast in 2033 | USD 1.63 Billion |

| Market Growth Rate 2025-2033 | 4.60% |

Australia Anti Corrosion Coatings Market Trends:

Infrastructure Expansion

The ongoing growth of infrastructure and industrial sites throughout Australia is driving the need for anti-corrosion coatings. Both the public and private sectors are significantly investing in extensive construction, energy, transportation, and mining initiatives that necessitate protective coatings to improve the lifespan of metal structures and reduce maintenance expenses. For example, in 2025, Sharjah developer Arada took over the New South Wales division of Roberts Co., a top-tier construction company, to aid their growth strategy in Sydney, where more than 2,000 residences are planned for construction. This growth is part of a wider trend, as Australia’s infrastructure upgrades, comprising roadways, bridges, and city developments, which is catalyzing the demand for corrosion protection. The severe environmental factors in the country, such as coastal salt exposure, intense ultraviolet (UV) radiation, and extreme temperatures, increase the need for corrosion-resistant coatings. Sectors like oil and gas, marine, and manufacturing are experiencing expansion in new developments as well as enhancements to current infrastructure. As these sectors expand, the demand for coatings to protect assets from rapid degradation increases. Strict safety regulations, alongside the need to reduce repair costs, downtime, and asset failures, further accelerate the need for reliable anti-corrosion solutions.

To get more information on this market, Request Sample

Growing Demand in Renewable Energy Sector

Rising investments in the renewable energy industry is a notable factor bolstering the Australia anti corrosion coatings market growth. As solar farms, wind energy projects, and battery storage systems expand, the need for durable defense against environmental degradation is growing. Renewable energy installations are frequently placed in challenging, exposed locations, such as offshore, in arid areas, or in humid climates, where the threat of corrosion is notably greater. For instance, in 2024, Engie started building the 250 MW Goorambat East Solar Farm in Victoria, which is the largest solar farm being built in Australia. These renewable energy systems need dependable coatings to ensure consistent performance, reduce downtime, and improve asset durability. Moreover, renewable energy initiatives generally entail significant capital investments over the long term, which makes safeguarding these assets a vital concern. The drive for sustainable energy generation coincides with the application of environment-friendly, long-lasting coatings that enhance durability and reduce ecological effects. As Australia moves forward with its shift to decarbonization and clean energy, there is a higher need to safeguard the physical integrity of new infrastructure. This trend is catalyzing the demand for sophisticated anti-corrosion solutions, as the renewable energy sector keeps expanding swiftly. The integration of substantial investments in renewable energy and the demand for efficient protective coatings guarantee the ongoing growth of the market in Australia.

Australia Anti Corrosion Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, material, and application.

Technology Insights:

- Solvent-Based

- Water-Based

- Powder

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes solvent-based, water-based, powder, and others.

Material Insights:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Zinc

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes acrylic, alkyd, polyurethane, epoxy, zinc, and others.

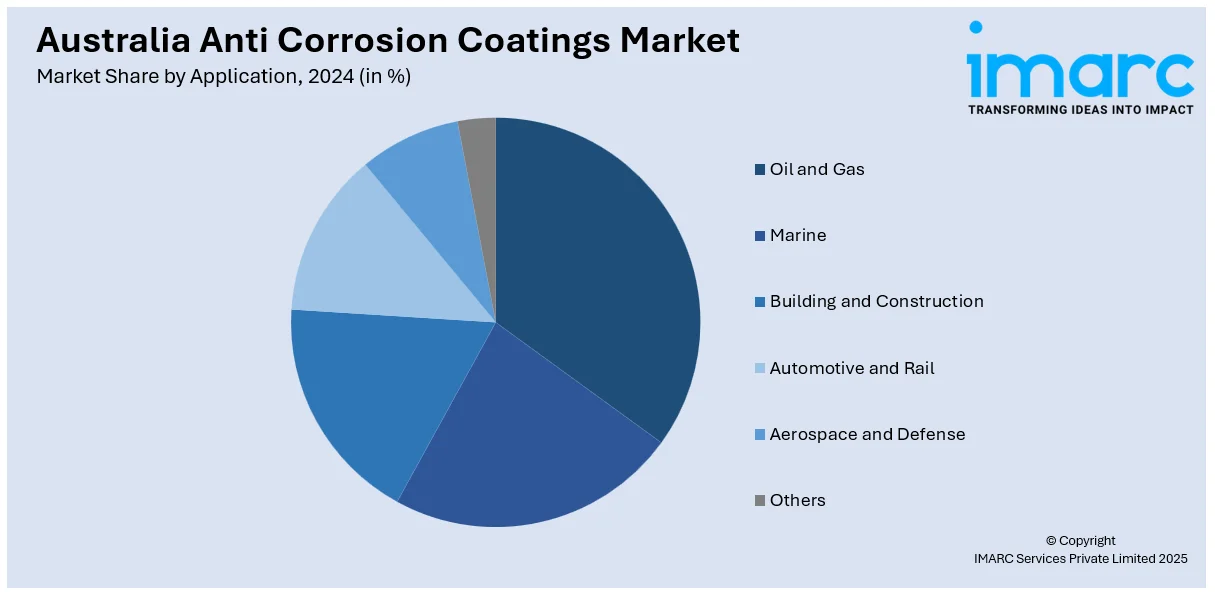

Application Insights:

- Oil and Gas

- Marine

- Building and Construction

- Automotive and Rail

- Aerospace and Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes oil and gas, marine, building and construction, automotive and rail, aerospace and defense, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Anti Corrosion Coatings Market News:

- In December 2024, ACM CRC, LaserBond, and the University of Sydney announced a project to develop an automated laser cladding system for creating metal matrix composite (MMC) coatings. This innovation aimed to enhance wear and corrosion resistance in industries, such as marine, mining, and defense. The system would help to reduce downtime, support local manufacturing, and address corrosion challenges, improving the durability of parts.

- In November 2024, Australian engineers from RMIT developed an anti-fatberg coating made from zinc and polyurethane to prevent blockages in wastewater pipes caused by fatbergs. The coating not only reduces fat, oil, and grease buildup but also prevents corrosion and has self-healing properties.

Australia Anti Corrosion Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Solvent-Based, Water-Based, Powder, Others |

| Materials Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Zinc, Others |

| Applications Covered | Oil and Gas, Marine, Building and Construction, Automotive and Rail, Aerospace and Defense, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia anti corrosion coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia anti corrosion coatings market on the basis of technology?

- What is the breakup of the Australia anti corrosion coatings market on the basis of material?

- What is the breakup of the Australia anti corrosion coatings market on the basis of application?

- What is the breakup of the Australia anti corrosion coatings market on the basis of region?

- What are the various stages in the value chain of the Australia anti corrosion coatings market?

- What are the key driving factors and challenges in the Australia anti corrosion coatings?

- What is the structure of the Australia anti corrosion coatings market and who are the key players?

- What is the degree of competition in the Australia anti corrosion coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia anti corrosion coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia anti corrosion coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia anti corrosion coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)