Australia Artisanal Bread Market Size, Share, Trends and Forecast by Type, Ingredients, Distribution Channel, and Region, 2025-2033

Australia Artisanal Bread Market Size and Share:

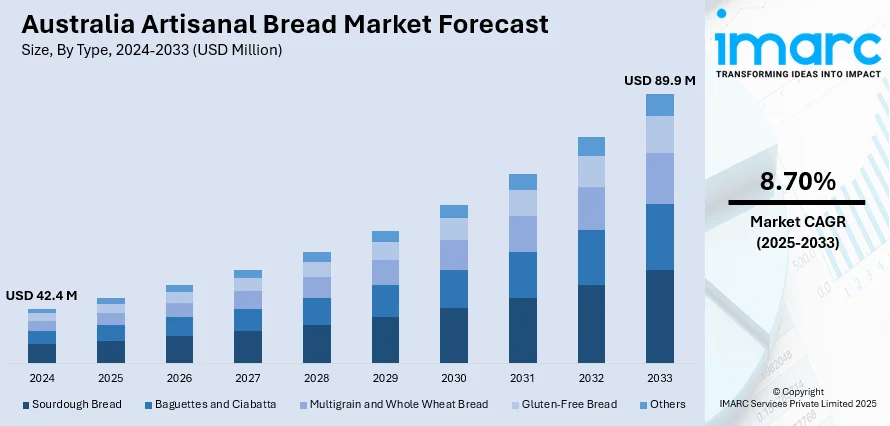

The Australia artisanal bread market size reached USD 42.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 89.9 Million by 2033, exhibiting a growth rate (CAGR) of 8.70% during 2025-2033. The market is driven by rising demand for organic and locally-sourced ingredients, as health-conscious consumers prioritize clean-label, sustainable options, fostering partnerships between bakeries and regional growers. Specialty and functional breads, such as gluten-free sourdough and nutrient-enriched loaves, are gaining traction, catering to diverse dietary preferences and personalized nutrition trends. Additionally, innovative ingredient experimentation is further augmenting the Australia artisanal bread market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 42.4 Million |

|

Market Forecast in 2033

|

USD 89.9 Million |

| Market Growth Rate 2025-2033 | 8.70% |

Australia Artisanal Bread Market Trends:

Rising Demand for Organic and Locally-Sourced Ingredients

The market is experiencing a rise in demand for organic and locally-sourced ingredients, driven by growing consumer awareness of health and sustainability. The Australian organic market is worth USD 2.6 Billion and has a growth rate of 15% per annum, led by augmenting demand for certified organic products, including bread, dairy, and meat. This shift towards organic and locally-sourced products is offering opportunities for Australia's artisan bread industry, which offers more value and confidence in certified products. Additionally, consumers are seeking bread that uses certified organic flour, free from synthetic pesticides and additives, due to their health and environmental concern. Also, consumers are increasingly looking for locally milled grains to sustain the local farmer and reduce the carbon cost of transporting over long distances to bring ingredients into town. Artisan bakeries are responding to this demand by establishing relationships with local farmers or millers, emphasizing the working relationship with growers locally, and labeling their products with clear, transparent, and direct labeling in order to attract environmentally conscious consumers. This trend is taking place within the context of the larger picture of "clean label" trends, whereby consumers are increasingly seeking less processed, non-ingredient label forms of food. Thus, organic and local ingredient bakeries are bolstering their competitive advantage, and many are beginning to offer selections that incorporate heritage and ancient grains like spelt, rye, and einkorn to cater to this niche market that is quickly scaling up.

To get more information on this market, Request Sample

Growth of Specialty and Functional Artisanal Breads

The rising popularity of specialty and functional breads designed to meet specific dietary needs and preferences is propelling the Australia artisanal bread market growth. In the period 2023-24, per capita food consumption in Australia grew by 0.7% to 1,550 grams per day. This growth was followed by a drop in the intake of functional foods, including wholegrain cereals, which accounted for 30.6% of grain servings. Simultaneously, dietary energy availability was flat at 8,667 kJ, 38.5% of which comes from discretionary food, reflecting increasingly strong demand for high-quality, functional artisanal breads as health-aware alternatives. Consumers are increasingly seeking gluten-free, sourdough, and low-carb options due to health concerns, intolerances, or lifestyle choices such as keto and paleo diets. Sourdough, in particular, remains a favorite due to its natural fermentation process, which enhances digestibility and nutrient absorption. Additionally, functional breads enriched with probiotics, seeds, and superfoods such as chia and quinoa are gaining traction as consumers look for added health benefits. Artisan bakeries are innovating with alternative flours, such as almond, coconut, and chickpea, to cater to diverse dietary requirements while maintaining premium quality and taste. This trend reflects a shift toward personalized nutrition, where consumers expect artisanal bread to not only be delicious but also align with their health goals, driving bakeries to continuously experiment with new ingredients and baking techniques.

Australia Artisanal Bread Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, ingredients, and distribution channel.

Type Insights:

- Sourdough Bread

- Baguettes and Ciabatta

- Multigrain and Whole Wheat Bread

- Gluten-Free Bread

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes sourdough bread, baguettes and ciabatta, multigrain and whole wheat bread, gluten-free bread, and others.

Ingredients Insights:

- Organic Flour-Based Breads

- Grain and Seed Mix Breads

- Dairy-Free and Vegan Options

A detailed breakup and analysis of the market based on the ingredients have also been provided in the report. This includes organic flour-based breads, grain and seed mix breads, and dairy-free, and vegan options.

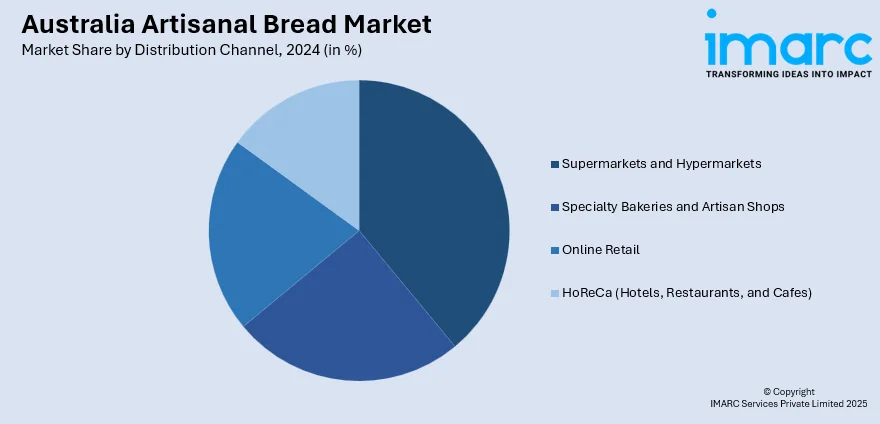

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Bakeries and Artisan Shops

- Online Retail

- HoReCa (Hotels, Restaurants, and Cafes)

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty bakeries and artisan shops, online retail, and HoReCa (hotels, restaurants, and cafes).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Artisanal Bread Market News:

- September 11, 2024: Associated British Foods (ABF) acquired The Artisanal Group, the leading producer and wholesaler of premium baked products in Australia, such as Brasserie Bread and Noisette, thus expanding its presence in the Australian artisanal bread market. This strategic buy, completed in the second half of ABF's financial year, consolidates their strong portfolio in Australia/New Zealand, while the grocery business forecasts 3% growth in sales.

Australia Artisanal Bread Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sourdough Bread, Baguettes and Ciabatta, Multigrain and Whole Wheat Bread, Gluten-Free Bread, Others |

| Ingredients Covered | Organic Flour-Based Breads, Grain and Seed Mix Breads, Dairy-Free and Vegan Options |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Bakeries and Artisan Shops, Online Retail, HoReCa (Hotels, Restaurants, and Cafes) |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia artisanal bread market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia artisanal bread market on the basis of type?

- What is the breakup of the Australia artisanal bread market on the basis of ingredients?

- What is the breakup of the Australia artisanal bread market on the basis of distribution channel?

- What is the breakup of the Australia artisanal bread market on the basis of region?

- What are the various stages in the value chain of the Australia artisanal bread market?

- What are the key driving factors and challenges in the Australia artisanal bread market?

- What is the structure of the Australia artisanal bread market and who are the key players?

- What is the degree of competition in the Australia artisanal bread market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia artisanal bread market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia artisanal bread market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia artisanal bread industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)