Australia Artisanal Chocolate Market Size, Share, Trends and Forecast by Product Type, Ingredients, Distribution Channel, Consumer Demographics, Application, and Region, 2025-2033

Australia Artisanal Chocolate Market Overview:

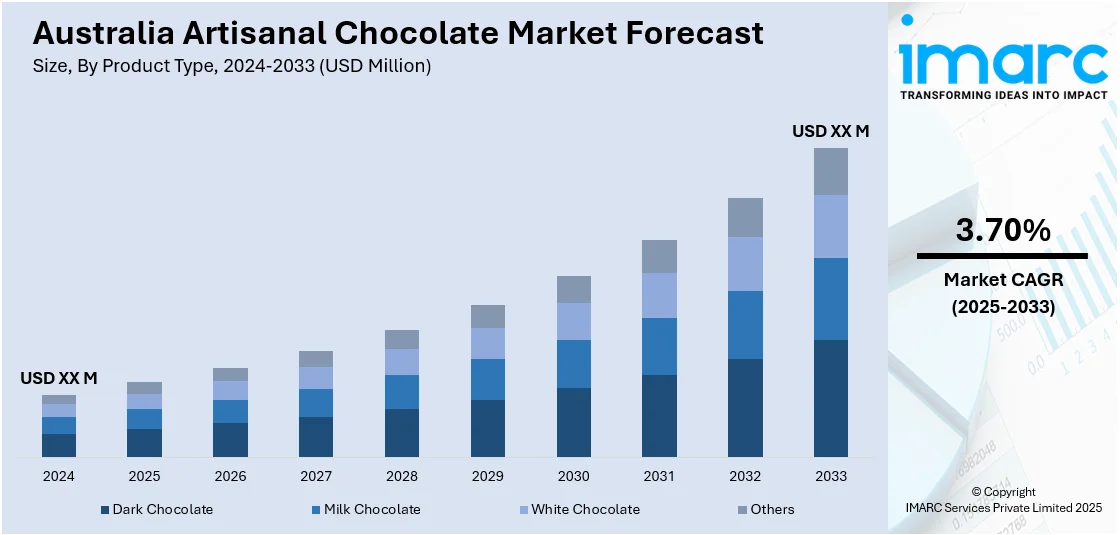

The Australia artisanal chocolate market size is exhibiting a growth rate (CAGR) of 3.70% during 2025-2033. The market is fueled by rising consumer demand for premium, handcrafted products made with ethically sourced, high-quality ingredients. Growing awareness about sustainability, unique flavor exploration, and support for local chocolatiers are also driving market expansion. The influence of global food trends and rising interest in luxury gifting are some of the other growth-inducing factors that are further contributing to the increasing Australia artisanal chocolate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 3.70% |

Australia Artisanal Chocolate Market Trends:

Rising Demand for Premium, Ethical, and Sustainable Chocolate Products

Australian consumers are increasingly prioritizing ethically sourced, sustainable, and premium chocolate products, aligning with broader global trends toward conscious consumption. The artisanal chocolate makers who are frequently dedicated to the process of bean-to-bar and small-batch create an emphasis on transparency in sourcing, fair trade cacao, organic components, and environmentally friendly packaging materials. This appeals to the Australian consumers conscious of the environmental and social effects of their buying. The need for ethical luxury goes beyond the quality of the products to the values of the brands, which can be realized by working with the artisanal chocolatiers who practice responsible production. This change is generating room for the local chocolatiers to diversify their products, win customers’ loyalty, and drive a market share through offering the increasing demand for top-quality, sustainable chocolate experiences.

To get more information on this market, Request Sample

Influence of Global Culinary Trends and Local Innovation

Australia’s artisanal chocolate market is characterized by the intertwining of international trends in cuisine and local gastronomy inventions. Australian consumers, being exposed to mixed cultural influences and global food movements, are keen on trying novel, brash, and cosmopolitan tastes in chocolate. The artisanal chocolatiers are reacting by playing with exotic spices, local Australian fare such as wattleseed and lemon myrtle, and daring flavor pairings for daring taste buds. This innovation is also enhanced by the legendary café culture and specialty food culture in Australia, where demand for unique and artisanal products is high. The blending of global inspirations with local creativity allows chocolatiers to offer distinctive products that cater to evolving consumer preferences, driving the Australia artisanal chocolate market growth.

Growth of Niche Retail, Specialty Stores, and E-commerce Platforms

The expansion of niche retail channels, specialty gourmet shops, premium food markets, and dedicated chocolate boutiques in Australia has significantly supported the accessibility and visibility of artisanal chocolates. These platforms offer curated selections that allow chocolatiers to tell their brand stories, highlight craftsmanship, and engage directly with consumers. Additionally, the rapid growth of e-commerce and social media has opened new avenues for artisanal brands to reach broader audiences, both locally and internationally. Online channels provide opportunities for personalized offerings, virtual tastings, and direct-to-consumer sales, enhancing customer engagement and loyalty. This multi-channel approach helps artisanal chocolate brands to grow their presence, expand market reach, and compete effectively in Australia’s dynamic premium chocolate landscape.

Australia Artisanal Chocolate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, ingredients, distribution channel, consumer demographics, and application.

Product Type Insights:

- Dark Chocolate

- Milk Chocolate

- White Chocolate

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dark chocolate, milk chocolate, white chocolate, and others.

Ingredients Insights:

- Organic and Natural Ingredients

- Conventional Ingredients

A detailed breakup and analysis of the market based on the ingredients have also been provided in the report. This includes organic and natural ingredients and conventional ingredients.

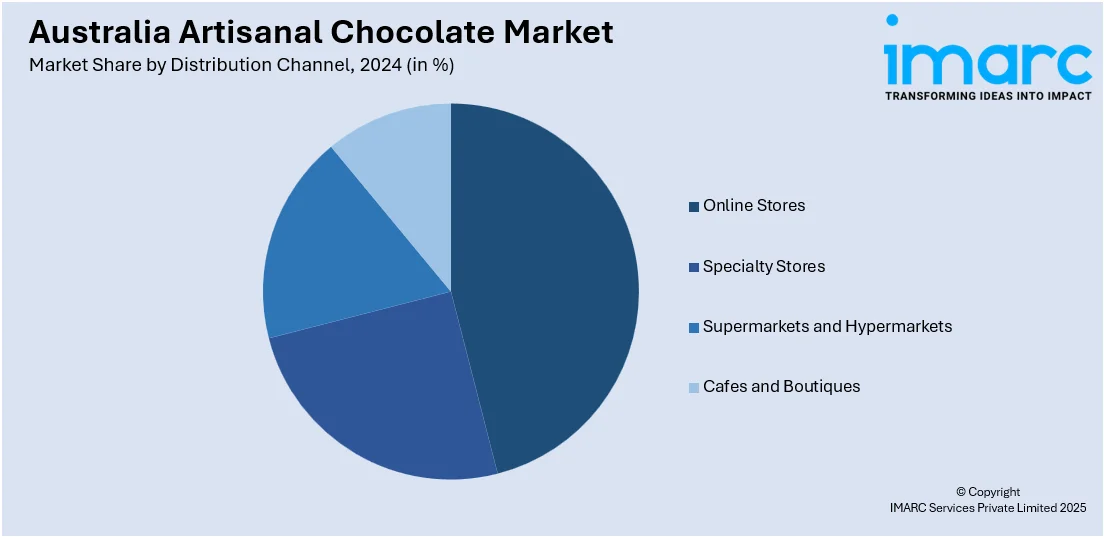

Distribution Channel Insights:

- Online Stores

- Specialty Stores

- Supermarkets and Hypermarkets

- Cafes and Boutiques

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online stores, specialty stores, supermarkets and hypermarkets, and cafes and boutiques.

Consumer Demographics Insights:

- Premium

- Mass

A detailed breakup and analysis of the market based on the consumer demographics have also been provided in the report. This includes premium and mass.

Application Insights:

- Direct Consumption

- Bakery and Confectionery

- Beverages

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes direct consumption, bakery and confectionery, and beverages.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Artisanal Chocolate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dark Chocolate, Milk Chocolate, White Chocolate, Others |

| Ingredients Covered | Organic and Natural Ingredients, Conventional Ingredients |

| Distribution Channels Covered | Online Stores, Specialty Stores, Supermarkets and Hypermarkets, Cafes and Boutiques |

| Consumer Demographics Covered | Premium, Mass |

| Applications Covered | Direct Consumption, Bakery and Confectionery, Beverages |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia artisanal chocolate market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia artisanal chocolate market on the basis of product type?

- What is the breakup of the Australia artisanal chocolate market on the basis of ingredients?

- What is the breakup of the Australia artisanal chocolate market on the basis of distribution channel?

- What is the breakup of the Australia artisanal chocolate market on the basis of consumer demographics?

- What is the breakup of the Australia artisanal chocolate market on the basis of application?

- What is the breakup of the Australia artisanal chocolate market on the basis of region?

- What are the various stages in the value chain of the Australia artisanal chocolate market?

- What are the key driving factors and challenges in the Australia artisanal chocolate market?

- What is the structure of the Australia artisanal chocolate market and who are the key players?

- What is the degree of competition in the Australia artisanal chocolate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia artisanal chocolate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia artisanal chocolate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia artisanal chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)