Australia Asphalt Pavers Market Size, Share, Trends and Forecast by Type, Paving Range, and Region, 2025-2033

Australia Asphalt Pavers Market Overview:

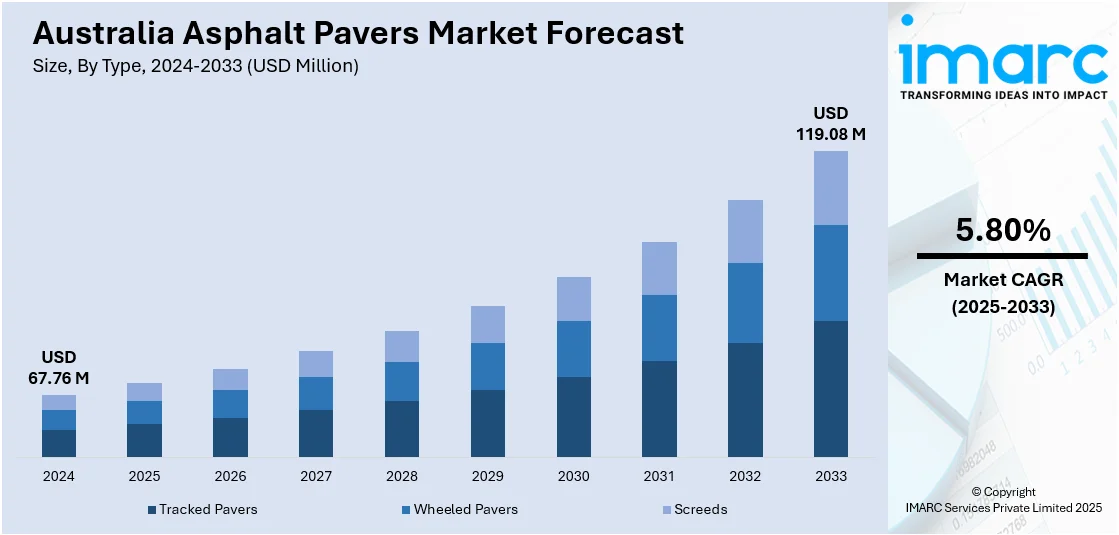

The Australia asphalt pavers market size reached USD 67.76 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 119.08 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is being shaped by rising demand for mobile mixing plants and compact, multi-functional paving equipment. Trends like regional infrastructure expansion and labor-saving innovations are driving equipment upgrades and adoption, contributing positively to Australia asphalt pavers market share across urban and remote project segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 67.76 Million |

| Market Forecast in 2033 | USD 119.08 Million |

| Market Growth Rate 2025-2033 | 5.80% |

Australia Asphalt Pavers Market Trends:

Growing Focus on Mobility and On-Site Efficiency

The market is showing strong momentum toward mobile, fast-deploying technologies designed for use across dispersed, regional job sites. Contractors increasingly favor equipment that offers high productivity while minimizing setup time and logistical barriers. This demand is particularly prominent in infrastructure projects outside urban centers, where mobility, speed, and adaptability play critical roles in meeting project deadlines and budget constraints. Continuous asphalt mixing plants with integrated chassis and modular components are now viewed as key assets, replacing more static systems that limit agility and responsiveness. In March 2024, KEE Surfacing deployed Australia’s first Lintec CDP5001M Continuous Asphalt Mixing Plant for infrastructure upgrades at CBH Group’s Latham grain receival site in Western Australia. The plant’s compact structure, rapid setup, and 30–50 tph output allowed seamless project execution, followed by quick relocation to the next site. Its application in expanding bulkhead capacity while maintaining asphalt consistency reinforced how mobile equipment can reduce labor costs and improve timelines in remote projects. The success of this deployment reflects a wider shift toward machinery that balances performance and mobility. As demand rises for efficient, travel-ready equipment, Australia’s asphalt pavers market is poised to adopt more advanced mobile mixing and paving technologies in both public and private sector work.

To get more information on this market, Request Sample

Demand for Compact, Multi-Function Paving Solutions

The increasing preference for compact, multi-use pavers that minimize manual labor and suit a range of job types, is driving the Australia asphalt paver market growth. Contractors are seeking versatile machines that can operate in narrow spaces, manage detailed tasks like trench or shoulder paving, and reduce dependence on larger, less adaptable equipment. This shift is being driven by rising labor costs, tight construction windows, and the need to perform with precision in urban or confined project zones. Pavers that integrate smart control features and offer flexible width and depth settings are increasingly valuable to contractors focused on productivity and accuracy. In March 2025, ShoulderMaster launched the CP-1000 skid steer centre paver at World of Asphalt. Built for precision, it featured wireless controls, integrated cameras, and adjustable screed width ranging from 30 cm to 100 cm, with depth settings of up to 10 cm. Its universal skid steer connection and hydraulic coupler enabled quick attachment and full mobility across sites. The paver significantly reduced material waste and eliminated hand spreading for smaller projects. Its application marked a major step in addressing gaps in mid-size paving solutions. This innovation confirmed the growing importance of compact, operator-friendly machines that enhance project efficiency across Australia’s infrastructure and utility sectors.

Australia Asphalt Pavers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type and paving range.

Type Insights:

- Tracked Pavers

- Wheeled Pavers

- Screeds

The report has provided a detailed breakup and analysis of the market based on the type. This includes tracked pavers, wheeled pavers, and screeds.

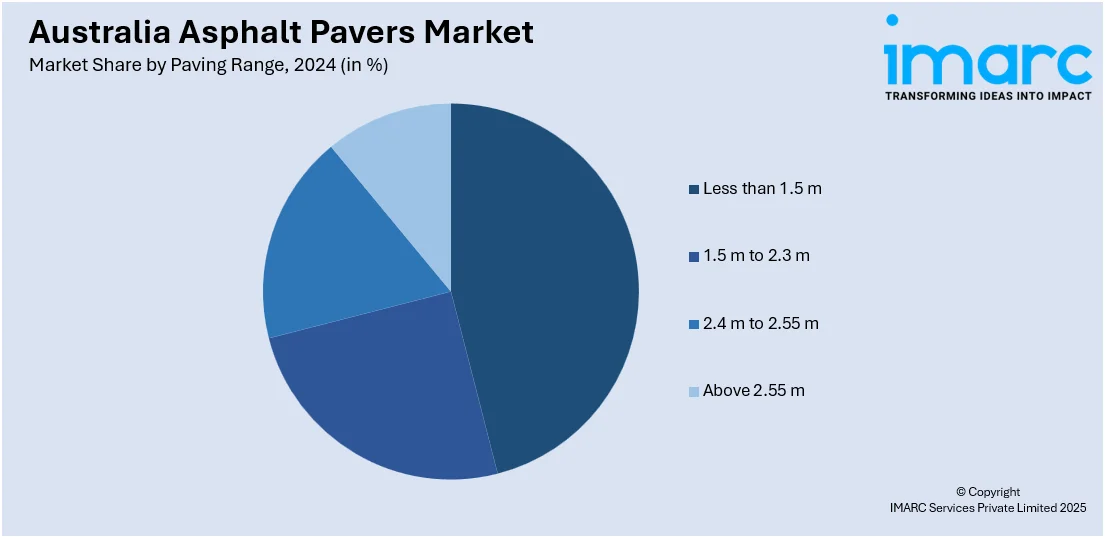

Paving Range Insights:

- Less than 1.5 m

- 1.5 m to 2.3 m

- 2.4 m to 2.55 m

- Above 2.55 m

A detailed breakup and analysis of the market based on the paving range have also been provided in the report. This includes less than 1.5 m, 1.5 m to 2.3 m, 2.4 m to 2.55 m, and above 2.55 m.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Asphalt Pavers Market News:

- March 2025: Boral introduced Australia’s first asphalt using crumbed rubber from Off-the-Road (OTR) tyres. Developed with AfPA and Tyre Stewardship Australia, the mix improved UV resistance and extended pavement life, advancing sustainability and performance standards in the Australia asphalt pavers market.

- March 2025: Australia’s ShoulderMaster unveiled the CP-1000 skid steer paver at World of Asphalt. Featuring wireless controls, built-in cameras, and variable screed width, it reduced material waste and manual labor, advancing Australia’s asphalt pavers market with cost-efficient, multi-layer paving capabilities.

Australia Asphalt Pavers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tracked Pavers, Wheeled Pavers, Screeds |

| Paving Ranges Covered | Less than 1.5 m, 1.5 m to 2.3 m, 2.4 m to 2.55 m, Above 2.55 m |

| Regions Covered | Australia Capital Territory and New South Wales, Victoria & Tasmania, Queensland, Northern Territory and Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia asphalt pavers market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia asphalt pavers market on the basis of type?

- What is the breakup of the Australia asphalt pavers market on the basis of paving range?

- What is the breakup of the Australia asphalt pavers market on the basis of region?

- What are the various stages in the value chain of the Australia asphalt pavers market?

- What are the key driving factors and challenges in the Australia asphalt pavers market?

- What is the structure of the Australia asphalt pavers market and who are the key players?

- What is the degree of competition in the Australia asphalt pavers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia asphalt pavers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia asphalt pavers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia asphalt pavers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)