Australia Auto Parts Aftermarket Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Australia Auto Parts Aftermarket Market Size & Share:

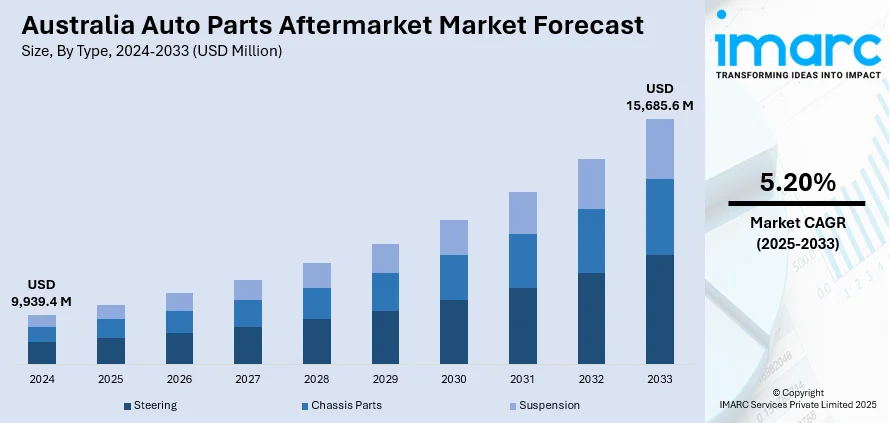

The Australia auto parts aftermarket market size reached USD 9,939.4 Million in 2024. Looking forward, the market is expected to reach USD 15,685.6 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The aging vehicle fleet, increasing vehicle lifespan, a growing vehicle parc, and rising demand for performance and customization parts are propelling the market growth. Furthermore, a shift toward online retail and e-commerce platforms, the rise of electric and hybrid vehicles, the growth of ride-sharing and fleet services, and expansion in the road freight sector are fueling the market growth. Apart from this, a surge in used car sales, greater demand for collision repairs, and supportive insurance-linked repair models are providing a thrust to the Australia auto parts aftermarket share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9,939.4 Million |

|

Market Forecast in 2033

|

USD 15,685.6 Million |

| Market Growth Rate 2025-2033 | 5.20% |

Key Trends of Australia Auto Parts Aftermarket Market:

Surging Aging Vehicle Fleet

The aging vehicle fleet in Australia is one of the major drivers of the auto parts aftermarket. As vehicles get older, they naturally require more servicing, replacement parts, and ongoing maintenance to stay roadworthy. This marks a steady upward trend and reflects how Australian consumers are holding on to vehicles longer rather than replacing them quickly. Older cars generally require more frequent part replacements, including wear-and-tear items such as brake pads, filters, belts, and spark plugs. This trend supports a steady, recurring demand in the aftermarket segment. In regions with older fleets, parts distributors and workshops can expect a higher flow of business as drivers aim to extend the usability of their cars. With cars aging across the board, the aftermarket sector remains essential to Australia’s vehicle ownership landscape.

To get more information on this market, Request Sample

Increasing Average Vehicle Lifespan

Another factor pushing the Australia auto parts aftermarket market growth is the increasing average lifespan of vehicles. Rather than replacing vehicles every few years, many Australians are opting to maintain and repair existing ones. This reflects the durability of modern cars along with the changing consumer behavior, where cost-of-living pressures and high new vehicle prices are encouraging people to delay purchasing new cars. As a result, older vehicles on the road need more frequent servicing and part replacement to remain functional. Common components like batteries, tires, suspension parts, and hoses tend to degrade over time, creating constant aftermarket demand. In fact, according to a 2024 report by the Australian Automotive Aftermarket Association (AAAA), the average age of vehicles in Australia reached 11.2 years, the highest on record, underscoring the growing reliance on maintenance and parts replacement. Workshops and service centers also benefit from this, as customers are more willing to invest in keeping vehicles running than buying new ones. The longer a car stays in use, the more likely it is to need non-warranty repairs, which typically fall outside dealership servicing and enter the aftermarket space.

Expansion of Vehicle Parc

According to the Australia auto parts aftermarket market analysis, the expansion of the region’s overall vehicle parc directly influences the size of the auto parts aftermarket. As of January 2023, Australia had 21.2 million registered motor vehicles, showing a 2.3% increase compared to the previous year. This growing fleet means more cars, trucks, and vans on the road needing routine servicing and occasional part replacement. A larger vehicle base naturally leads to higher consumption of essential components like oil filters, brakes, and air conditioning parts. It also increases demand for collision repairs, cosmetic upgrades, and tech retrofits. The rise in vehicle registrations includes both new and used vehicles, and many of the latter are already out of warranty and depend on aftermarket services. Additionally, Australia’s vast geography leads to greater vehicle dependence, especially in regional and remote areas where car ownership is often essential for mobility. As the number of vehicles grows, so does the pressure on workshops, parts suppliers, and distributors to meet ongoing repair and service needs. This growth in parc size ensures a stable demand pipeline for the aftermarket segment, making it a vital component of the country’s automotive industry.

Growth Factors of Australia Auto Parts Aftermarket Market:

Harsh Driving Conditions and Geographic Variety

Australia's distinctive and frequently harsh driving conditions are a primary force behind the auto parts aftermarket business. From the searing heat and sand of the Outback to the wet, coastal climates of Queensland and Tasmania, vehicles in Australia are exposed to increased wear and tear. These conditions result in a greater need for replacement items like air filters, brake parts, suspension units, and cooling systems. Extensive driving distances, particularly in rural and remote locations, also result in more rapid degradation of vehicle parts, especially those used for commercial or agricultural purposes. Off-road vehicles, UTEs, and 4WDs employed in work and recreational activities undergo even greater stress, necessitating more frequent servicing and part replacement. This broad range of terrain and vehicle usage patterns generates steady Australia auto parts aftermarket demand in both urban and rural markets. Providers satisfying these regional and condition-based demands have favorable growth prospects, especially if they can supply rugged, climate-suited components.

Growth of E-Commerce and Online Automotive Parts Retailing

The swift rise of online shopping in Australia has had a strong impact on the auto parts aftermarket, providing businesses and consumers alike with more convenient access to a wider variety of products. Internet sites now enable car owners to shop around, research reviews, and purchase particular components for delivery, usually cheaper than at high-street stores. This trend is especially pronounced in regional and remote areas of the country, where specialty auto parts stores might not be accessible. Growth of e-commerce also serves to support small repair shops and home mechanics who are able to obtain parts without having to depend on large suppliers or local stock. Online marketplaces provide everything from brake pads and filters to performance upgrades and accessories, creating a dynamic and competitive environment. Moreover, the proliferation of digital tools used by consumers to find compatible parts for their vehicle models has made it easier to buy, prompting more individuals to undertake self-servicing and repair, which further boosts aftermarket demand throughout Australia.

Emergence of Independent Workshops and DIY Car Maintenance Culture

Another significant driver in Australia's auto parts aftermarket is the robust existence of independent repair workshops and rising culture of DIY car maintenance. Whereas dealership servicing is still crucial, particularly for new cars, most Australians opt for the cost-effectiveness and convenience of independent garages. This trend is most marked in suburban and country areas where neighbourhood workshops are relied upon for their convenience and personalized attention. Such enterprises tend to depend on a consistent supply of good quality aftermarket components to contain costs while satisfying customer demands. In addition to this, Australia boasts a strong community of car fans and hobbyists who participate in car restoration, modification, and routine do-it-yourself maintenance. With the existence of tutorials, forums, and how-to guides on the internet, more car owners have become empowered to maintain their own vehicles themselves, boosting demand for cheap and readily available parts. Such suppliers who target this expanding category with easy-to-use platforms and broad product offerings are finding significant room for growth in the Australian market.

Australia Auto Parts Aftermarket Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-20333. Our report has categorized the market based on type and application.

Type Insights:

- Steering

- Chassis Parts

- Suspension

The report has provided a detailed breakup and analysis of the market based on the type. This includes steering, chassis parts, and suspension.

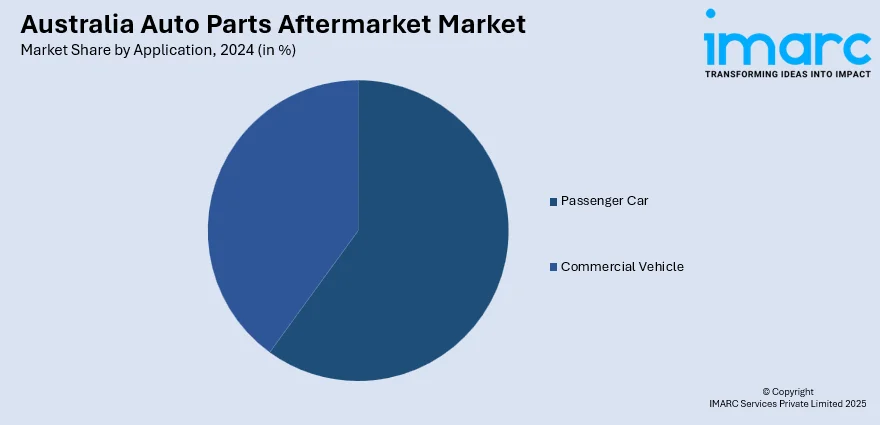

Application Insights:

- Passenger Car

- Commercial Vehicle

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes passenger car and commercial vehicle.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- ARB Corporation Ltd

- Auto Parts Group Pty Ltd

- Bapcor Limited

- Carparts2u

- DENSO Auto Parts Australia

- Pedders Suspension & Brakes

- Repco Australia

- Run Auto Parts

- RYCO Group Pty Ltd

Australia Auto Parts Aftermarket Market News:

- In 2024, ARB announced a strategic collaboration with Toyota for the new 4Runner Trailhunter, an off-road-focused vehicle. ARB will provide a range of specialized off-road accessories, including custom suspension systems, recovery gear, and vehicle protection products tailored to the Trailhunter's rugged performance. This collaboration highlights ARB's continued push to innovate within the off-road segment and expand its footprint in the automotive aftermarket sector.

- In 2023, Castrol launched the HYSPEC range, designed for hybrid vehicles, featuring eight variants that deliver at least 25% improvement in key performance areas. These products now cater to nearly all hybrid models in Australia.

Australia Auto Parts Aftermarket Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Steering, Chassis Parts, Suspension |

| Applications Covered | Passenger Car, Commercial Vehicle |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | ARB Corporation Ltd, Auto Parts Group Pty Ltd, Bapcor Limited, Carparts2u, DENSO Auto Parts Australia, Pedders Suspension & Brakes, Repco Australia, Run Auto Parts, RYCO Group Pty Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia auto parts aftermarket market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia auto parts aftermarket market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia auto parts aftermarket industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia auto parts aftermarket market was valued at USD 9,939.4 Million in 2024.

The Australia auto parts aftermarket market is projected to exhibit a CAGR of 5.20% during 2025-2033.

The Australia auto parts aftermarket market is expected to reach a value of USD 15,685.6 Million by 2033.

The Australia auto parts aftermarket trends include growing demand for durable, terrain-specific components, increased online parts retailing, and rising consumer preference for aftermarket over OEM products. There is also a notable shift toward DIY repairs and vehicle upgrades, with digital platforms and independent workshops playing a key role in supporting this evolving landscape.

The Australia auto parts aftermarket is driven by harsh driving conditions, a strong DIY vehicle maintenance culture, and rising e-commerce accessibility. The widespread use of vehicles across diverse terrains and growing demand for cost-effective repair solutions continue to fuel market expansion, especially through independent workshops and online auto parts platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)