Australia Automated Assembly Line Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Australia Automated Assembly Line Market Overview:

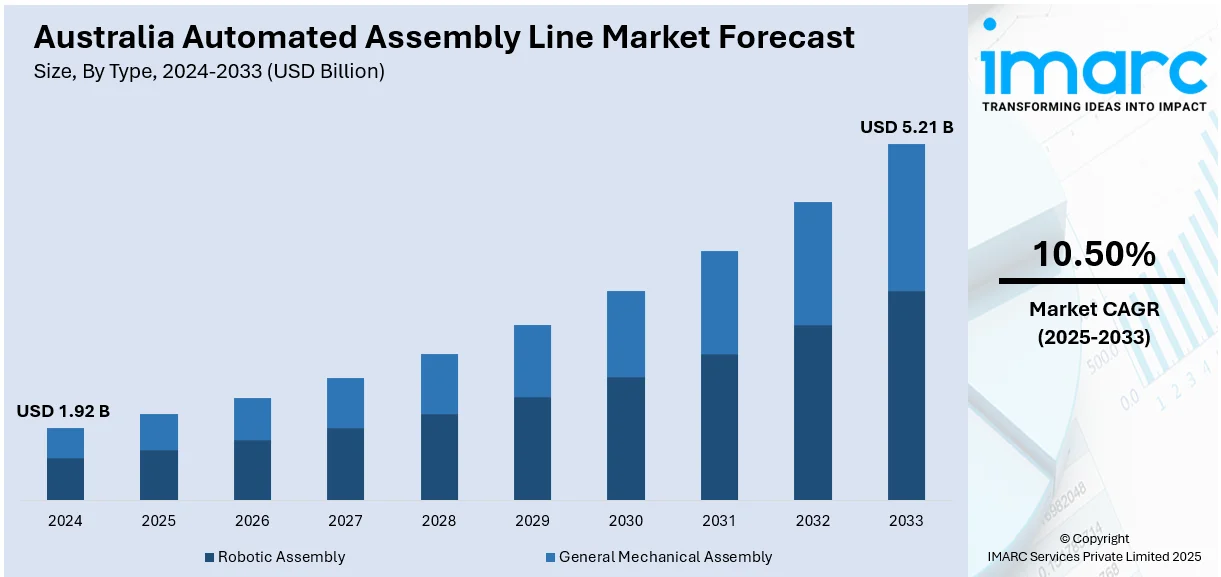

The Australia automated assembly line market size reached USD 1.92 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.21 Billion by 2033, exhibiting a growth rate (CAGR) of 10.50% during 2025-2033. The market is boosted by lack of labor and the necessity of productivity maximization. Moreover, advances in automation technology that help manufacturers improve productivity and lower costs are also encouraging automated assembly line adoption to ensure efficiency and production. Besides this, supportive government incentives and industry policies for the use of advanced manufacturing technologies are also boosting automation uptake. The convergence of technological innovation, labor optimization, and government programs is augmenting the Australia automated assembly line market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.92 Billion |

| Market Forecast in 2033 | USD 5.21 Billion |

| Market Growth Rate 2025-2033 | 10.50% |

Australia Automated Assembly Line Market Trends:

Advancements in Manufacturing Technologies

Australia's manufacturing industry is witnessing a massive makeover with the adoption of advanced technologies. Automation is now a major focus area for industries seeking to increase productivity and stay competitive in domestic as well as global markets. The adoption of automated assembly lines plays a critical role in this transformation by increasing throughput and reducing production costs. Modern robotics, artificial intelligence (AI), and machine learning are being implemented into assembly lines in order to maximize procedures, enhance product quality, and optimize the flexibility of manufacturing systems. The constant technological improvements makes it possible for manufacturers to rationalize their production process, thus enabling them to respond more quickly to market requirements and minimize human error in repetitive procedures. This has been particularly useful in industries like automotive, electronics, and food processing, where speed and precision are critical. Automation also assists Australian manufacturers in achieving sustainability targets by reducing waste, conserving energy, and producing more uniform product quality. With the growing emphasis on smart manufacturing, the automation of assembly lines is driving Australia automated assembly line market growth by enabling companies to remain competitive and future-proof their operations.

To get more information on this market, Request Sample

Labor Shortages and Productivity Optimization

Australia has experienced labor shortages in some manufacturing industries, spurred by an aging population, scarce skilled labor supply, and geographical constraints. Manufacturers have responded by increasingly adopting automated assembly lines to bridge the gap and ensure production efficiency. Automation not only mitigates the challenges posed by labor shortages but also ensures that manufacturers can maintain consistent production levels without relying on human labor for repetitive or physically demanding tasks. Automatic systems, like robots and conveyors, carry out operations with great accuracy and efficiency, minimizing the effect of labor shortages on production. In addition, computerized assembly lines assist in maximizing productivity by allowing manufacturers to produce 24/7 without the necessity of shift changes or worker downtime. This adaptability enables firms to maintain production smoothly, particularly in industries with high demand and close production schedules. By focusing on automation, manufacturers can reduce the reliance on temporary or contract workers, ensuring a stable and reliable workforce while maximizing production capacity. The increased adoption of automated assembly lines in response to labor shortages is an essential factor driving the growth of the market.

Government Support and Industry Policies

The Australian government has also actively encouraged the uptake of advanced manufacturing technologies, such as automated assembly lines, through initiatives and funding schemes. These programs are designed to boost the nation's manufacturing competitiveness, enhance productivity, and promote innovation. Initiatives like the Advanced Manufacturing Growth Centre (AMGC) offer funding and support to enable manufacturers to embrace automation technologies, particularly in the areas of robotics, artificial intelligence, and digitalization. Government support also extends to fostering collaboration between industry players, research organizations, and educational institutions to promote the development and integration of new manufacturing technologies. This policy framework helps ensure that Australian manufacturers can access the expertise and resources necessary to implement automated systems successfully. Furthermore, the emphasis on sustainability and environmental responsibility within government policies encourages manufacturers to adopt energy-efficient and environmentally friendly automated systems. These supportive policies are instrumental in driving the automation of assembly lines, contributing significantly to the market.

Australia Automated Assembly Line Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Robotic Assembly

- General Mechanical Assembly

The report has provided a detailed breakup and analysis of the market based on the type. This includes robotic assembly and general mechanical assembly.

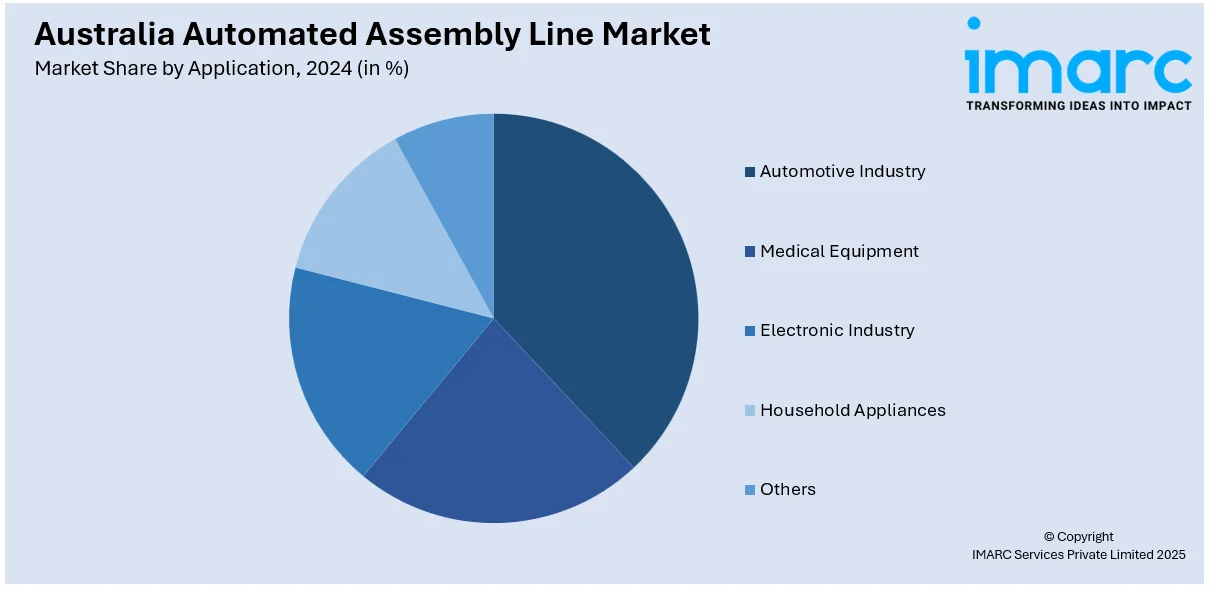

Application Insights:

- Automotive Industry

- Medical Equipment

- Electronic Industry

- Household Appliances

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive industry, medical equipment, electronic industry, household appliances, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has provided a comprehensive analysis of all major regional markets, including Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automated Assembly Line Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Robotic Assembly, General Mechanical Assembly |

| Applications Covered | Automotive Industry, Medical Equipment, Electronic Industry, Household Appliances, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automated assembly line market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automated assembly line market on the basis of type?

- What is the breakup of the Australia automated assembly line market on the basis of application?

- What is the breakup of the Australia automated assembly line market on the basis of region?

- What are the various stages in the value chain of the Australia automated assembly line market?

- What are the key driving factors and challenges in the Australia automated assembly line market?

- What is the structure of the Australia automated assembly line market and who are the key players?

- What is the degree of competition in the Australia automated assembly line market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automated assembly line market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automated assembly line market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automated assembly line industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)