Australia Automotive Connectors Market Size, Share, Trends and Forecast by Connection Type, Connector Type, System Type, Vehicle Type, Application, and Region, 2025-2033

Australia Automotive Connectors Market Overview:

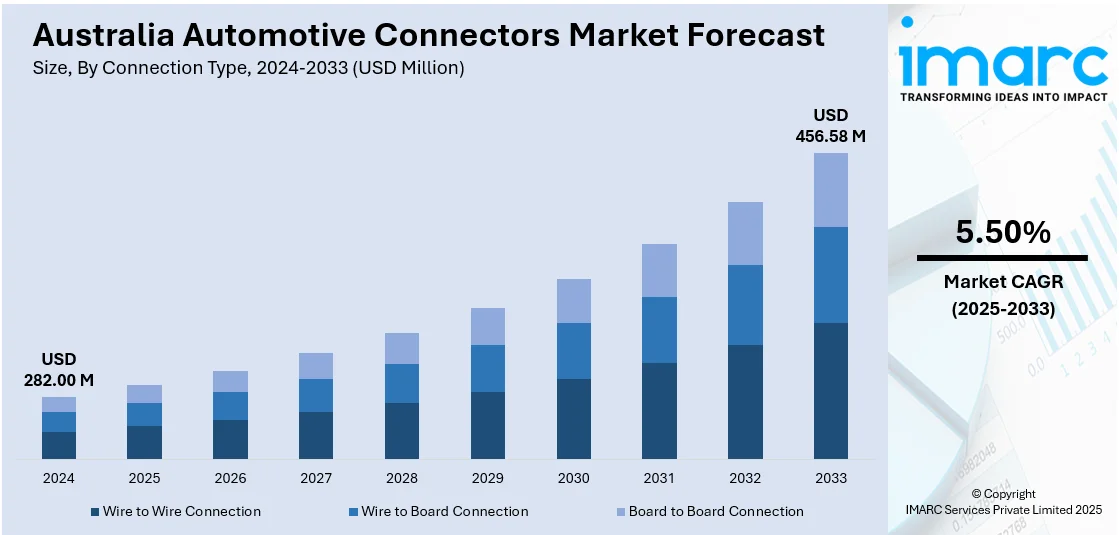

The Australia automotive connectors market size reached USD 282.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 456.58 Million by 2033, exhibiting a growth rate (CAGR) of 5.50% during 2025-2033. The market share in Australia is expanding, driven by rising demand for advanced electrical systems that support efficient vehicle operations, along with the expansion of retail outlets, which aid in boosting the availability and accessibility of automotive components.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 282.00 Million |

| Market Forecast in 2033 | USD 456.58 Million |

| Market Growth Rate 2025-2033 | 5.50% |

Australia Automotive Connectors Market Trends:

Increasing production and sales of hybrid and electric vehicles (HEVs)

Rising production and sales of HEVs are impelling the market growth. The data released by the Federal Chamber of Automotive Industries (FCAI) indicated that a record 129,895 new hybrid vehicles (HVs) were sold during January to September in 2024, reflecting an 87% increase compared to the same timeframe in 2023. HEVs rely heavily on intricate electronic architectures to manage power distribution, charging systems, and sensors, which require reliable and high-performance connectors. As automakers are ramping up EV production to meet environmental regulations and user preferences for eco-friendly transportation, the need for specialized connectors that can handle high voltage and ensure safety is becoming prominent. This is driving consistent demand for innovative connector solutions that offer durability, precision, and resistance to harsh conditions. Additionally, government incentives and infrastructure development for EV adoption is further stimulating vehicle sales. The rising focus on lightweight components and compact designs in EVs is also motivating manufacturers to develop miniaturized and reliable connectors. As Australia is shifting towards cleaner mobility and expanding its EV ecosystem, the demand for automotive connectors is increasing.

To get more information on this market, Request Sample

Expansion of retail outlets

The expansion of retail channels is fueling the Australia automotive connectors market growth. As per industry reports, in February 2025, retail sales in Australia increased by 0.2% compared to January 2025, which saw a 0.3% growth. As more retail outlets, both physical and online, are offering a wide assortment of automotive parts, it is becoming easier for users and service providers to source quality connectors for vehicle maintenance, upgrades, and repairs. The broadening of automotive retail chains and e-commerce platforms is also boosting aftermarket sales, driving the demand for compatible and durable connectors. With the rising number of vehicles on the road and increasing user interest in automotive enhancements, the retail sector plays a key role in supporting consistent supply. Furthermore, promotional activities, discounts, and bundled offerings by retailers are attracting more buyers.

Growing integration of infotainment in vehicles

Increasing integration of infotainment and connectivity features in vehicles is offering a favorable Australia automotive connectors market outlook. Modern vehicles come equipped with features like touchscreens, navigation, entertainment, and voice control, which rely on reliable and high-speed data transfer. Automotive connectors play a crucial role in ensuring smooth communication between these systems, enhancing user experience. Automakers are focusing on improving in-car entertainment and connectivity to attract tech-savvy users. As the demand for seamless incorporation of smartphones, internet access, and multimedia rises, vehicles require more complex wiring and specialized connectors. The ongoing shift towards connected vehicles with advanced automotive infotainment features is positively influencing the market in Australia. According to the IMARC Group, the Australia automotive infotainment market is set to attain USD 775.2 Million by 2033, exhibiting a growth rate (CAGR) of 6.99% during 2025-2033.

Australia Automotive Connectors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on connection type, connector type, system type, vehicle type, and application.

Connection Type Insights:

- Wire to Wire Connection

- Wire to Board Connection

- Board to Board Connection

The report has provided a detailed breakup and analysis of the market based on the connection type. This includes wire to wire connection, wire to board connection, and board to board connection.

Connector Type Insights:

- PCB Connectors

- IC Connectors

- RF Connectors

- Fiber Optic Connectors

- Others

A detailed breakup and analysis of the market based on the connector type have also been provided in the report. This includes PCB connectors, IC connectors, RF connectors, fiber optic connectors, and others.

System Type Insights:

- Sealed Connector System

- Unsealed Connector System

The report has provided a detailed breakup and analysis of the market based on the system type. This includes sealed connector system and unsealed connector system.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, commercial vehicles (light commercial vehicles and heavy commercial vehicles), and electric vehicles.

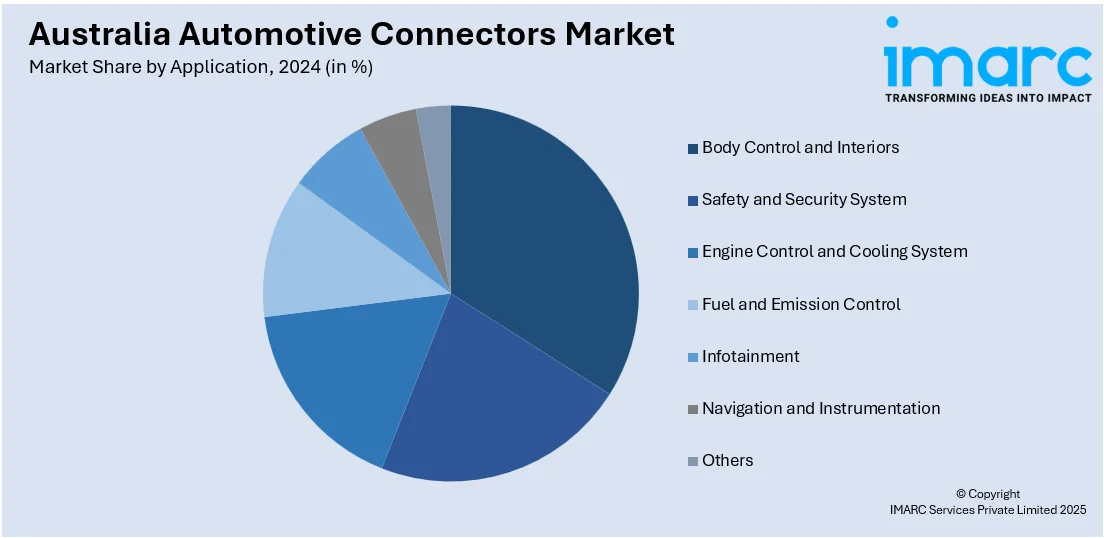

Application Insights:

- Body Control and Interiors

- Safety and Security System

- Engine Control and Cooling System

- Fuel and Emission Control

- Infotainment

- Navigation and Instrumentation

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes body control and interiors, safety and security system, engine control and cooling system, fuel and emission control, infotainment, navigation and instrumentation, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive Connectors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Connection Types Covered | Wire to Wire Connection, Wire to Board Connection, Board to Board Connection |

| Connector Types Covered | PCB Connectors, IC Connectors, RF Connectors, Fiber Optic Connectors, Others |

| System Types Covered | Sealed Connector System, Unsealed Connector System |

| Vehicle Types Covered |

|

| Applications Covered | Body Control and Interiors, Safety and Security System, Engine Control and Cooling System, Fuel and Emission Control, Infotainment, Navigation and Instrumentation, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automotive connectors market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automotive connectors market on the basis of connection type?

- What is the breakup of the Australia automotive connectors market on the basis of connector type?

- What is the breakup of the Australia automotive connectors market on the basis of system type?

- What is the breakup of the Australia automotive connectors market on the basis of vehicle type?

- What is the breakup of the Australia automotive connectors market on the basis of application?

- What is the breakup of the Australia automotive connectors market on the basis of region?

- What are the various stages in the value chain of the Australia automotive connectors market?

- What are the key driving factors and challenges in the Australia automotive connectors?

- What is the structure of the Australia automotive connectors market and who are the key players?

- What is the degree of competition in the Australia automotive connectors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, the Australia automotive connectors market forecast, and dynamics from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive connectors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive connectors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)