Australia Automotive Glass for Windshield Market Size, Share, Trends and Forecast by Glass Type, Vehicle Type, Distribution Channel, Product Type, Technology, and Region, 2025-2033

Australia Automotive Glass for Windshield Market Overview:

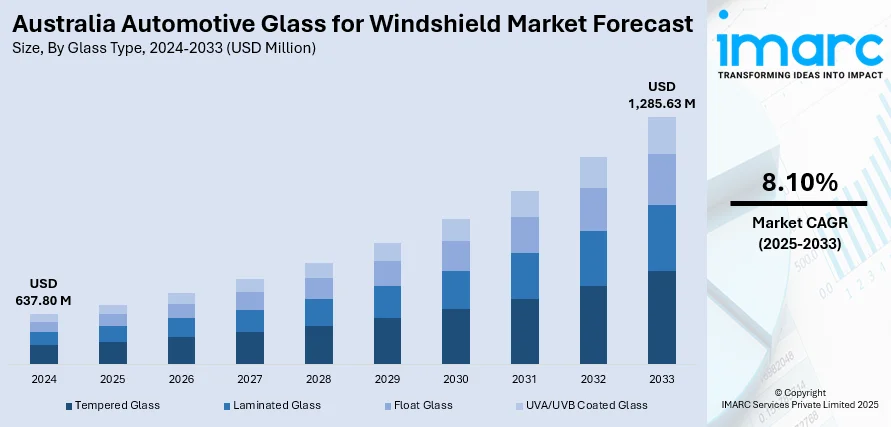

The Australia automotive glass for windshield market size reached USD 637.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,285.63 Million by 2033, exhibiting a growth rate (CAGR) of 8.10% during 2025-2033. At present, rising user expectations for safety and comfort are encouraging automakers and service centers to wager on better-quality glass solutions. Besides this, insurance companies are partnering with certified workshops to ensure quick and efficient service, which improves customer satisfaction and trust and thus contributes to the expansion of the Australia automotive glass for windshield market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 637.80 Million |

| Market Forecast in 2033 | USD 1,285.63 Million |

| Market Growth Rate 2025-2033 | 8.10% |

Australia Automotive Glass for Windshield Market Trends:

Rising vehicle sales

Increasing vehicle sales are fueling the market growth. As per industry reports, 1,237,287 new cars were sold in Australia in 2024, marking a 1.7% rise from 2023’s record figure. As new vehicles are entering the market, original equipment manufacturers (OEMs) need to install durable and technologically advanced windshield glass. This steady increase in vehicle sales is driving the demand for both factory-installed and aftermarket windshield solutions. Newer vehicle models often come equipped with features, such as rain sensors, ultraviolet (UV) protection, noise reduction, and advanced driver-assistance systems (ADAS), which require specialized windshield glass. This is encouraging manufacturers and suppliers to produce more complex and feature-rich glass to meet industry standards. Over time, these vehicles also enter the replacement cycle due to accidents, damage, or wear and tear, further contributing to the aftermarket demand. The growing fleet size is increasing the likelihood of repairs and replacements, supporting the market growth. Additionally, rising user expectations for safety and comfort are motivating automakers and service centers to invest in better-quality glass solutions. Dealerships and automotive service providers benefit, as they offer installation and maintenance services for windshields, making them key players in the expanding market in the country.

To get more information on this market, Request Sample

Rising insurance coverage

Increasing insurance coverage is impelling the Australia automotive glass for windshield market growth. With more comprehensive insurance plans including windshield coverage, drivers are more likely to address minor damages, such as chips and cracks, without hesitation. This is leading to higher service volumes at repair centers and a consistent demand for both original and aftermarket windshield glass. Insurance companies are collaborating with certified workshops, ensuring quick and high-quality service, which improves customer satisfaction and trust. These arrangements streamline the repair process, encouraging timely maintenance and enhancing road safety. As awareness about insurance benefits is increasing, more vehicle owners are choosing plans that cover glass damage. Additionally, insurers may offer incentives or reduced premiums for using preferred service providers, adding value to the customer experience. Rising disposable incomes also allow people to opt for better insurance coverage and premium auto glass features like UV protection and noise reduction. As per the CEIC, the gross disposable income data for Australia was recorded at 695,764.000 Million AUD in December 2024. This marked an increase from the earlier figure of 663,997.000 AUD Million for September 2024.

Australia Automotive Glass for Windshield Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on glass type, vehicle type, distribution channel, product type, and technology.

Glass Type Insights:

- Tempered Glass

- Laminated Glass

- Float Glass

- UVA/UVB Coated Glass

The report has provided a detailed breakup and analysis of the market based on the glass type. This includes tempered glass, laminated glass, float glass, and UVA/UVB coated glass.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Heavy-Duty Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, commercial vehicles, two-wheelers, and heavy-duty vehicles.

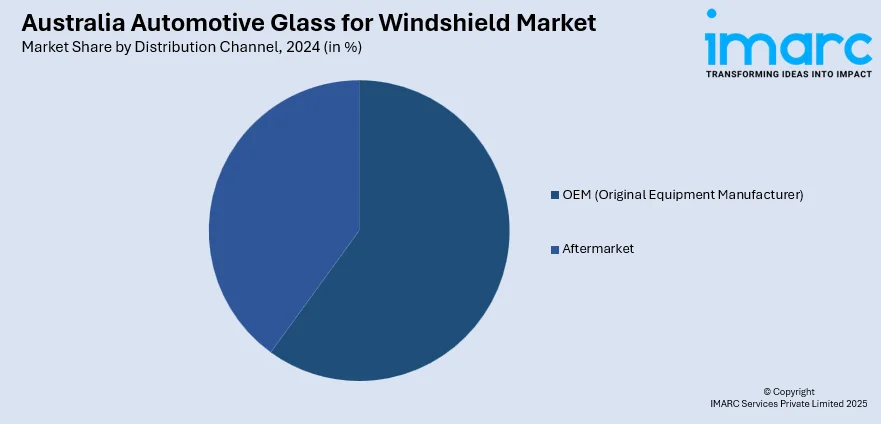

Distribution Channel Insights:

- OEM (Original Equipment Manufacturer)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes OEM (original equipment manufacturer) and aftermarket.

Product Type Insights:

- Windshield Glass

- Sidelite Glass

- Backlite Glass

- Sunroof Glass

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes windshield glass, sidelite glass, backlite glass, and sunroof glass.

Technology Insights:

- Traditional Glass Processing

- Advanced Glass Processing

- Smart Glass Technology

The report has provided a detailed breakup and analysis of the market based on the technology. This includes traditional glass processing, advanced glass processing, and smart glass technology.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive Glass for Windshield Market News:

- In July 2024, Zurich established a partnership with Tesla, becoming the preferred insurance provider for the electric vehicle (EV) brand in Australia. The arrangement enabled current and prospective Tesla owners to utilize the InsureMyTesla service, designed specifically for Model 3 and Model Y owners and exclusively offered by Zurich. InsureMyTesla encompassed all vehicle repairs, such as glass, charging devices, and batteries, through Tesla's certified repair network. There was a windscreen and glass coverage, which included the large glass roofs of Tesla items.

- In July 2024, National Windscreens declared the complete acquisition of Alpha Bus Glass, Melbourne’s top independent glass replacement and repair service for the bus, coach, and truck sector. The firm was operating in Melbourne, Sydney, Brisbane, and Darwin. It planned to introduce a variety of new vehicle technology features in ADAS and diagnostic services.

Australia Automotive Glass for Windshield Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Glass Types Covered | Tempered Glass, Laminated Glass, Float Glass, UVA/UVB Coated Glass |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two-Wheelers, Heavy-Duty Vehicles |

| Distribution Channels Covered | OEM (Original Equipment Manufacturer), Aftermarket |

| Product Types Covered | Windshield Glass, Sidelite Glass, Backlite Glass, Sunroof Glass |

| Technologies Covered | Traditional Glass Processing, Advanced Glass Processing, Smart Glass Technology |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automotive glass for windshield market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automotive glass for windshield market on the basis of glass type?

- What is the breakup of the Australia automotive glass for windshield market on the basis of vehicle type?

- What is the breakup of the Australia automotive glass for windshield market on the basis of distribution channel?

- What is the breakup of the Australia automotive glass for windshield market on the basis of product type?

- What is the breakup of the Australia automotive glass for windshield market on the basis of technology?

- What is the breakup of the Australia automotive glass for windshield market on the basis of region?

- What are the various stages in the value chain of the Australia automotive glass for windshield market?

- What are the key driving factors and challenges in the Australia automotive glass for windshield market?

- What is the structure of the Australia automotive glass for windshield market and who are the key players?

- What is the degree of competition in the Australia automotive glass for windshield market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive glass for windshield market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive glass for windshield market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive glass for windshield industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)