Australia Automotive HMI Market Size, Share, Trends and Forecast by Product, Access Type, Technology, Vehicle Type, and Region, 2025-2033

Australia Automotive HMI Market Overview:

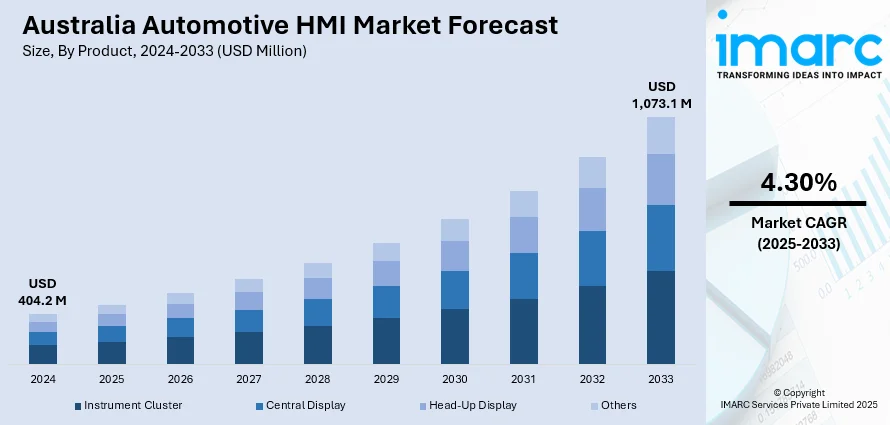

The Australia automotive HMI market size reached USD 404.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,073.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033. The rising consumer demand for safer, more intuitive driving experiences, advancements in artificial intelligence (AI) and connectivity technologies, and growing interest in electric and autonomous vehicles (AVs) along with Increasing focus on road safety regulations and a tech-savvy population is bolstering the Australia automotive HMI market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 404.2 Million |

| Market Forecast in 2033 | USD 1,073.1 Million |

| Market Growth Rate 2025-2033 | 4.30% |

Australia Automotive HMI Market Trends:

Shift Toward Multimodal and Touchless Interfaces

The Australia automotive HMI industry is rapidly progressing toward multimodal and touchless interaction. Drivers increasingly desire cars that can be operated by voice commands, gestures, and even slight facial expressions, with reduced need to touch screens or buttons. Voice assistants are becoming more intelligent, with capabilities to handle navigation, communication, and entertainment through natural speech. Gesture control enables simple actions such as taking calls or skipping music tracks without having to remove hands from the steering wheel. The trend promotes convenience and safety, particularly on long trips. In response to the rising Australian automotive HMI market growth, driven by consumer demand for natural and distraction-free driving experiences, automakers are concentrating on developing systems that facilitate seamless and intuitive communication with the vehicle.

To get more information on this market, Request Sample

Adoption of Augmented Reality in Displays

Augmented Reality (AR) is increasingly being incorporated into automotive displays in Australia, creating a more immersive and safer driving experience. AR-based head-up displays (HUDs) project essential information such as navigation, speed, and hazard warnings directly onto the windshield. This helps drivers stay informed without having to look away from the road. As vehicles become more connected and journeys often cover long distances in Australia, AR displays offer a new layer of convenience by highlighting lanes, exits, and even obstacles ahead. Manufacturers are investing heavily in AR integration to meet driver expectations for smarter, more visually enhanced interfaces that blend digital assistance naturally with the real world.

Personalization Through AI and Machine Learning

Machine Learning (ML) and AI are transforming the automotive HMI experience in Australia by bringing profound levels of personalization. Contemporary cars can learn a driver's routine, preference, and habit, making changes to seat position, temperature, entertainment, and even route proposals automatically. Over time, the systems develop an environment that is customized to their liking, with increased comfort and less need for manual intervention. Moreover, AI-based HMIs provide predictive support, recommending rest stops, reminding drivers of maintenance requirements, or providing alternative routes in case of traffic congestion. This emphasis on personalization is a testament to Australian drivers' increasing need for smarter, more responsive cars that learn and respond to their individual needs without additional effort.

Australia Automotive HMI Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional for 2025-2033. Our report has categorized the market based on product, access type, technology, and vehicle type.

Product Insights:

- Instrument Cluster

- Central Display

- Head-Up Display

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes instrument cluster, central display, head-up display, and others.

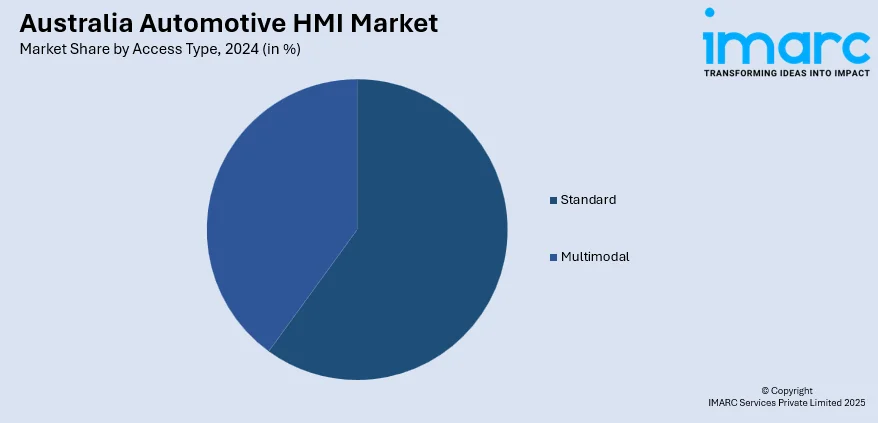

Access Type Insights:

- Standard

- Multimodal

A detailed breakup and analysis of the market based on the access type have also been provided in the report. This includes standard and multimodal.

Technology Insights:

- Visual Interface

- Acoustic

- Mechanical

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes visual interface, acoustic, mechanical, and others.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars and commercial vehicles.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive HMI Market News:

- In January 2025, AU Optronics (AUO) and Sony Honda Mobility jointly introduced a cutting-edge Micro LED Display Human-Machine Interface (HMI) at CES 2025. Integrated into the Afeela electric vehicle, the advanced display serves dual functions, acting as both a head-up display and an in-car control interface. This innovation highlights the growing role of Micro LED technology in enhancing user experience and driving interaction in next-generation electric vehicles.

Australia Automotive HMI Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Instrument Cluster, Central Display, Head-Up Display, Others |

| Access Types Covered | Standard, Multimodal |

| Technologies Covered | Visual Interface, Acoustic, Mechanical, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automotive HMI market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automotive HMI market on the basis of product?

- What is the breakup of the Australia automotive HMI market on the basis of access type?

- What is the breakup of the Australia automotive HMI market on the basis of technology?

- What is the breakup of the Australia automotive HMI market on the basis of vehicle type?

- What is the breakup of the Australia automotive HMI market on the basis of region?

- What are the various stages in the value chain of the Australia automotive HMI market?

- What are the key driving factors and challenges in the Australia automotive HMI?

- What is the structure of the Australia automotive HMI market and who are the key players?

- What is the degree of competition in the Australia automotive HMI market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive HMI market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive HMI market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive HMI industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)