Australia Automotive HVAC Market Size, Share, Trends and Forecast by Component, Technology, Vehicle Type, and Region, 2025-2033

Australia Automotive HVAC Market Overview:

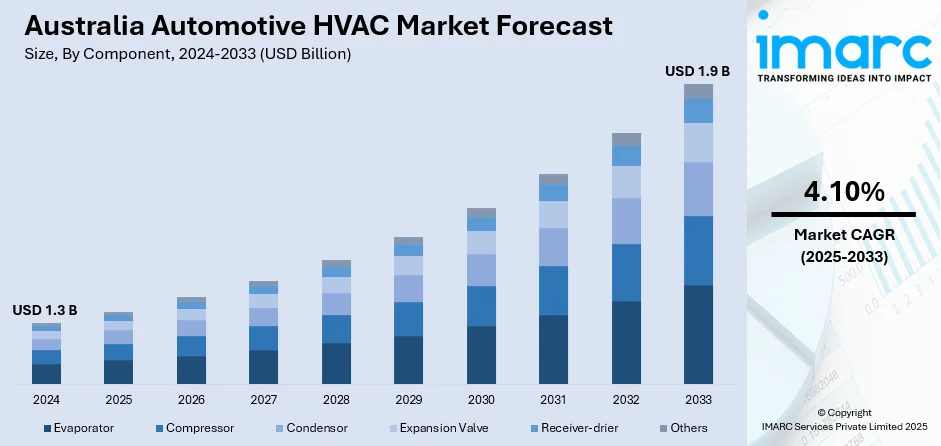

The Australia automotive HVAC market size reached USD 1.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The demand for in-vehicle comfort is on the rise with the growing need from consumers for greater comfort within vehicles, more take-up of hybrid and electric cars, tighter emissions standards mandating energy-saving systems, increased application of advanced smart climate control technology, greater concern about cabin air quality resulting from increased concern over health and safety, enhancing the Australia automotive HVAC market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.3 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Market Growth Rate 2025-2033 | 4.10% |

Australia Automotive HVAC Market Trends:

Integration of Smart Climate Control Systems

The Australian automotive HVAC industry is undergoing a dramatic transformation toward the use of smart climate control systems. Such systems make use of advanced technologies like Artificial Intelligence (AI) and the Internet of Things (IoT) to deliver individualized and optimal climate control within cars. With the use of data from various sensors, the systems are capable of adapting temperature, airflow, and humidity settings to match personal tastes and outside conditions. This not only improves passenger comfort but also helps in energy efficiency by maximizing HVAC performance. The use of smart climate control systems is becoming a major differentiator for car manufacturers who want to address the changing needs of Australian consumers. For instance, in August 2024, Hyundai and Kia introduced three new temperature control technologies to improve passenger comfort and energy efficiency in vehicles. These include a nano cooling film that reduces interior temperatures by up to 12.5°C, a radiant heating system that conserves energy and extends electric vehicle range by 17%, and metal-coated heated glass that quickly defrosts and dehumidifies windows.

To get more information on this market, Request Sample

Shift Towards Energy-Efficient HVAC Solutions

In response to environmental concerns and regulatory pressures, the Australian automotive HVAC market growth is seeing a significant shift towards energy-efficient solutions. Manufacturers are increasingly incorporating technologies like heat pump systems and variable refrigerant flow (VRF) systems that provide better thermal management with reduced energy consumption. These innovations are especially beneficial for electric and hybrid vehicles, as they help conserve battery life by optimizing energy usage. Moreover, the adoption of eco-friendly refrigerants with lower global warming potential supports both sustainability and regulatory compliance, further fueling the growth of energy-efficient HVAC systems in Australia’s automotive industry. For instance, in March 2025, the Department of Climate Change, Energy, the Environment, and Water (DCCEEW) updated regulations to recognize certain automotive qualifications for issuing refrigerant handling licenses (RHL). New qualifications include the AUR32721 Certificate III in Automotive Electric Vehicle Technology and the AUR32120 Certificate III in Automotive Body Repair Technology, provided specific units related to air conditioning and HVAC systems are completed. This update addresses the growing needs of the automotive and air conditioning industries, particularly with the rise of electric vehicles.

Australia Automotive HVAC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, technology, and vehicle type.

Component Insights:

- Evaporator

- Compressor

- Condensor

- Expansion Valve

- Receiver-drier

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes evaporator, compressor, condenser, expansion valve, receiver-drier, and others.

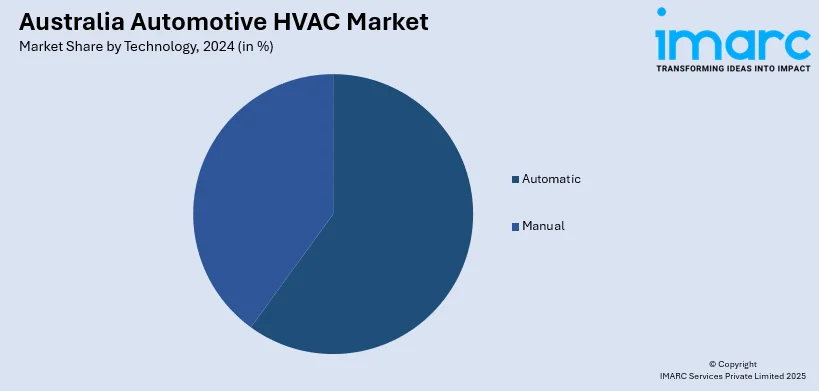

Technology Insights:

- Automatic

- Manual

The report has provided a detailed breakup and analysis of the market based on the technology. This includes automatic and manual.

Vehicle Type Insights:

- Passenger Car

- Commercial Vehicle

- Electric Vehicle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger car, commercial vehicle, and electric vehicle.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive HVAC Market News:

- In April 2025, Mahle introduced a bionic radial blower for automotive air-conditioning systems, inspired by penguin fins to enhance efficiency and reduce noise. The fan design, which mimics the penguin's aerodynamic fins, is 60% quieter and 15% more energy-efficient than similar systems. Using artificial intelligence, Mahle optimized the fan’s shape, producing over 30 million virtual designs.

- In January 2025, DENSO expanded its presence in Australia’s bus HVAC sector with the launch of its second-generation electric LD9E air-conditioning unit. Recognized for its low battery consumption, the LD9E received strong industry interest. DENSO also plans new models for double-deck and articulated buses and is strengthening its national service network. Their innovations, including electric and Volvo-specific systems, position DENSO as a leader in sustainable HVAC solutions. The company remains committed to zero-emission goals and ongoing support for the local industry.

Australia Automotive HVAC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Evaporator, Compressor, Condenser, Expansion Valve, Receiver-Drier, Others |

| Technologies Covered | Automatic, Manual |

| Vehicle Types Covered | Passenger Car, Commercial Vehicle, Electric Vehicle |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automotive HVAC market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automotive HVAC market on the basis of component?

- What is the breakup of the Australia automotive HVAC market on the basis of technology?

- What is the breakup of the Australia automotive HVAC market on the basis of vehicle type?

- What is the breakup of the Australia automotive HVAC market on the basis of region?

- What are the various stages in the value chain of the Australia automotive HVAC market?

- What are the key driving factors and challenges in the Australia automotive HVAC?

- What is the structure of the Australia automotive HVAC market and who are the key players?

- What is the degree of competition in the Australia automotive HVAC market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive HVAC market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive HVAC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive HVAC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)