Australia Automotive Lighting Market Size, Share, Trends and Forecast by Technology, Vehicle Type, Sales Channel, Application, and Region, 2025-2033

Australia Automotive Lighting Market Overview:

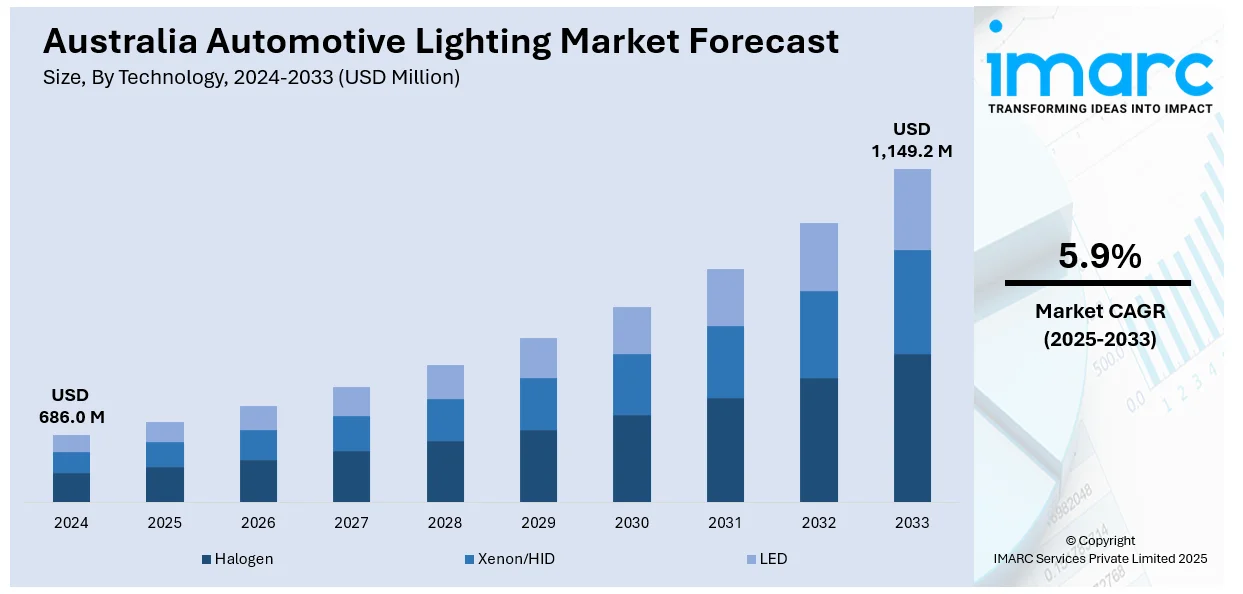

The Australia automotive lighting market size reached USD 686.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,149.2 Million by 2033, exhibiting a growth rate (CAGR) of 5.9% during 2025-2033. The market is driven by the growing adoption of advanced driver assistance systems (ADAS), increasing demand for cars that express personal style, heightened purchase of electric vehicles (EVs) and implementation of regulatory mandates aimed at reducing energy consumption and emissions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 686.0 Million |

| Market Forecast in 2033 | USD 1,149.2 Million |

| Market Growth Rate 2025-2033 | 5.9% |

Australia Automotive Lighting Market Trends:

Growing Integration of Advanced Driver Assistance Systems (ADAS)

The Australian automotive sector is increasingly accepting advanced driver assistance systems (ADAS), which is creating the need for advanced automotive lighting solutions. Companies are concentrating on fitting cars with smart lighting systems, including adaptive headlights, automatic high beams, and ambient lighting, to improve driver safety and vehicle performance. These systems are depending very much on accuracy lighting technologies to enable features such as lane departure warning, pedestrian detection, and night vision. Automotive lighting is no longer playing a functional purpose; it is becoming an integral part of vehicular intelligence and safety architecture. As ADAS becomes increasingly important in passenger cars and commercial vehicles, original equipment manufacturers (OEMs) and suppliers are getting their research and development (R&D) processes aligned with illumination innovations enhancing visibility, limiting driver fatigue, and meeting demanding road safety rules. The Australian automotive market size is expected to reach 2.50 Million Units by 2033. This will further drive the integration of ADAS systems.

To get more information on this market, Request Sample

Rising Preference for Aesthetic and Customizable Lighting

People are increasingly looking for cars that express personal style, which is driving the demand for styling and customizable automotive lighting. Lighting features like light emitting diode (LED) headlights, tail lights, and ambient interior illumination are becoming a part of a car's visual personality and brand identity. Car manufacturers are constantly launching models with upgraded lighting features not only for better visibility but also for overall automobile styling. From programmable turn signals to color ambient lights that can be customized within the cabin, lighting is becoming a major differentiator in vehicle design. The trend is particularly prevalent among younger buyers and in the luxury vehicle market, where customers are valuing design and customization. Suppliers and OEMs are therefore investing in modular and programmable lighting solutions that enable consumers to customize their vehicles while ensuring compliance with safety regulations. In 2024, TJM launched the TJM Narva Ultima 215 driving lights, which are developed and engineered in Australia.

Enforcement of Energy-Efficiency and Emissions Regulations

Regulatory mandates aimed at reducing energy consumption and emissions are playing a significant role in shaping the market. Government policies and standards are encouraging the adoption of energy-efficient lighting technologies, such as LEDs and OLEDs, which consume significantly less power compared to traditional halogen or xenon lights. Automotive manufacturers are responding by phasing out older lighting systems and integrating energy-efficient alternatives that align with environmental norms. This shift is also being driven by growing awareness among individuals regarding vehicle fuel efficiency, as lighting components indirectly affect a vehicle’s overall energy usage. Furthermore, as Australia aligns itself with international environmental commitments, there is an increase in pressure on the automotive industry to innovate and adopt sustainable technologies. People are also preferring electric vehicles (EVs) with sustainable lighting. As a result, key market players are launching various new models of EVs in the country. The IMARC Group predicts that the Australia EV market size is expected to reach USD 171.6 Billion by 2033.

Australia Automotive Lighting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, vehicle type, sales channel, and application.

Technology Insights:

- Halogen

- Xenon/HID

- LED

The report has provided a detailed breakup and analysis of the market based on the technology. This includes halogen, xenon/HID, and LED.

Vehicle Type Insights:

- Passenger Vehicle

- Commercial Vehicle

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger vehicle and commercial vehicle.

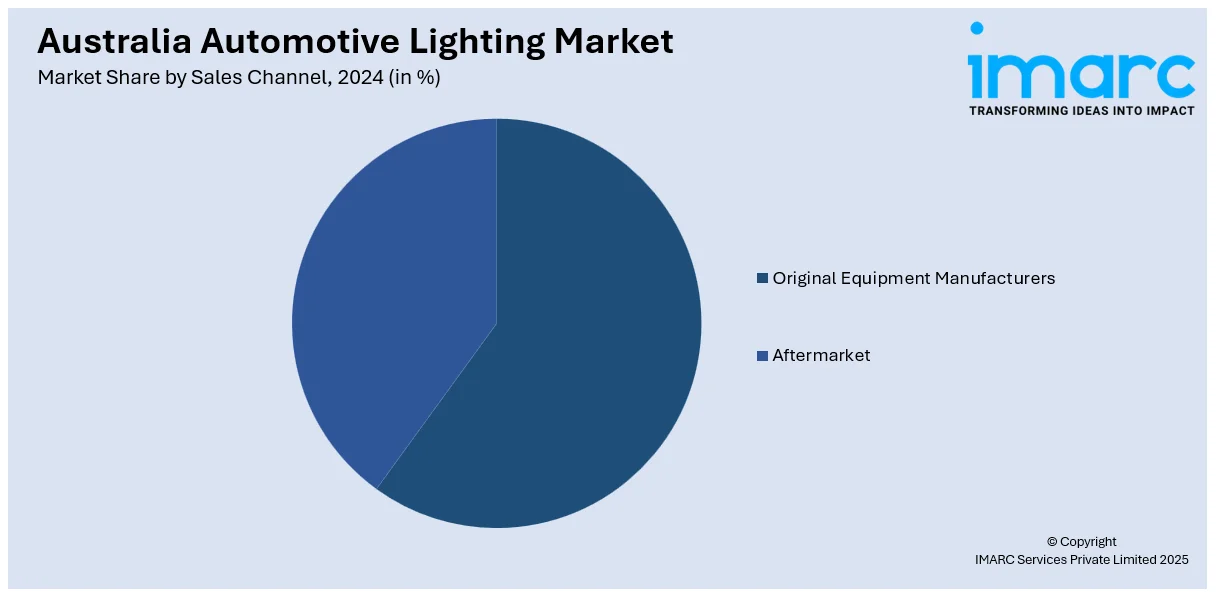

Sales Channel Insights:

- Original Equipment Manufacturers

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes original equipment manufacturers and aftermarket.

Application Insights:

- Front Lighting/Headlamps

- Rear Lighting

- Side Lighting

- Interior Lighting

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes front lighting/headlamps, rear lighting, side lighting, and interior lighting.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive Lighting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Halogen, Xenon/HID, LED |

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle |

| Sales Channels Covered | Original Equipment Manufacturers, Aftermarket |

| Applications Covered | Front Lighting/Headlamps, Rear Lighting, Side Lighting, Interior Lighting |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automotive lighting market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automotive lighting market on the basis of technology?

- What is the breakup of the Australia automotive lighting market on the basis of vehicle type?

- What is the breakup of the Australia automotive lighting market on the basis of sales channel?

- What is the breakup of the Australia automotive lighting market on the basis of application?

- What is the breakup of the Australia automotive lighting market on the basis of region?

- What are the various stages in the value chain of the Australia automotive lighting market?

- What are the key driving factors and challenges in the Australia automotive lighting market?

- What is the structure of the Australia automotive lighting market and who are the key players?

- What is the degree of competition in the Australia automotive lighting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive lighting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive lighting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)