Australia Automotive Paint Market Size, Share, Trends and Forecast by Application, Type, Vehicle Type, Finish Type, and Region, 2026-2034

Australia Automotive Paint Market Summary:

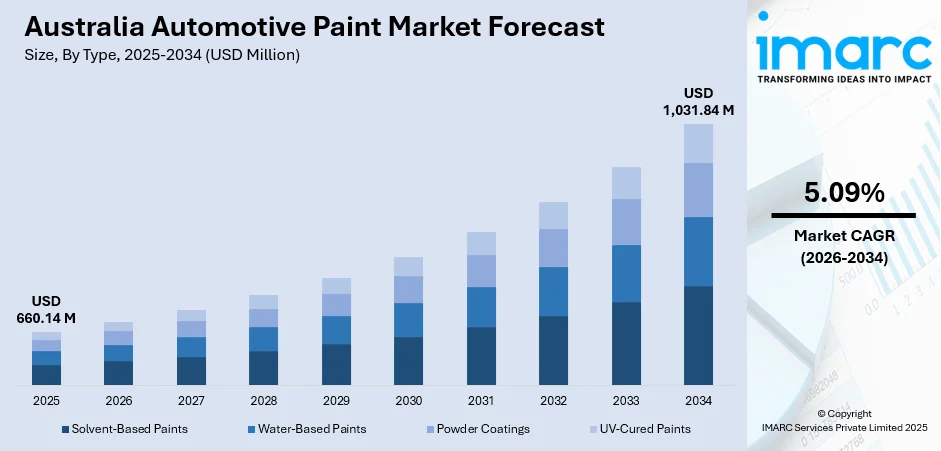

The Australia automotive paint market size was valued at USD 660.14 Million in 2025 and is projected to reach USD 1,031.84 Million by 2034, growing at a compound annual growth rate of 5.09% from 2026-2034.

The Australia automotive paint market is experiencing steady growth, supported by rising vehicle production, expanding aftermarket repair activities, and increasing consumer preference for high-quality, durable coatings. Demand is further reinforced by advancements in eco-friendly paint technologies and the growing adoption of water-based and low-VOC formulations. However, fluctuations in raw material costs and strict environmental regulations continue to influence market dynamics as manufacturers focus on innovation, performance enhancement, and sustainability to maintain competitiveness.

Key Takeaways and Insights:

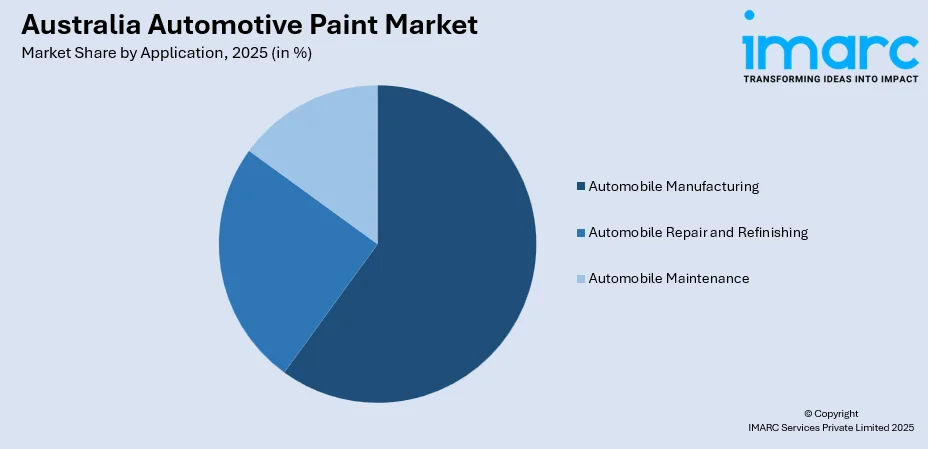

- By Application: Automobile manufacturing dominates the market with a share of 60% in 2025, driven by consistent demand for high quality coatings that enhance durability, aesthetics, and surface protection in vehicle production.

- By Type: Water-based paints lead the market with a share of 35% in 2025, supported by rising preference for low VOC, ecofriendly formulations that comply with tightening environmental regulations.

- By Vehicle Type: Passenger cars represent the largest segment with a market share of 50% in 2025, reflecting higher production volumes and strong consumer demand for personalized, visually appealing finishes.

- By Finish Type: Gloss finish signifies the largest segment with a market share of 45% in 2025, attributed to its premium shine, smooth appearance, and ability to enhance vehicle resale value.

- Key Players: The competitive landscape is shaped by companies focusing on advanced formulations, sustainability, and improved color performance. Firms compete through R&D investments, automotive partnerships, and technological upgrades, offering diverse coating solutions tailored for varying vehicle categories and finish requirements.

To get more information on this market, Request Sample

The Australia automotive paint market is evolving as manufacturers and repair service providers prioritize high-performance, sustainable, and visually appealing coating solutions. Growing vehicle ownership and consistent automotive production support stable demand for OEM and aftermarket paints, while rising accident repair volumes strengthen the need for refinishing products. In February 2025, the Register of Approved Vehicles recorded 152,264 entries, a 15.6% increase from 2024. Passenger vehicles hit 106,101 (up 36.9%). The industry is witnessing a shift toward environmentally conscious formulations, with water-based, low-VOC, and UV-curable coatings gaining traction as companies align with national environmental guidelines. Increasing consumer interest in customization, such as metallic and textured finishes, is further shaping product development strategies. Overall, the market remains poised for sustained growth as innovation and sustainability continue to define competitive differentiation.

Australia Automotive Paint Market Trends:

Growing Adoption of Advanced Coatings for Durability

The growing adoption of advanced coatings reflects a shift toward longer lasting protection and higher performance in vehicle finishes. Scratch resistant, UV stable, and corrosion protective formulations are gaining traction as they help vehicles withstand Australia’s intense climate and coastal exposure. This trend is further supported by local innovation, with Australian partners ACM CRC, LaserBond, and The University of Sydney developing an automated laser cladding system for MMC coatings. Their work strengthens domestic manufacturing by enabling corrosion resistant surface solutions, reducing reliance on imported components, and supporting more sustainable automotive coating practices.

Automation Reshaping Paint Operations

Body shops and OEM facilities are steadily adopting robotics, smart spray guns, and automated paint booths to achieve more consistent coating quality and reduce material wastage. For instance, in October 2025, PPG launched the PPG MIX‘N’SHAKE™ automated stirring technology, enhancing paint mix consistency and reducing waste for body shops. The system, debuting at EQUIP AUTO in Paris, will be marketed as SEM Mix’n’Shake in Australia and New Zealand. Automated systems enable precise paint application, faster cycle times, and better control over volatile organic compound emissions. This shift is helping manufacturers improve productivity, lower operating costs, and maintain uniform finish standards across high volume automotive production.

Rising Demand for Premium Aesthetic Finishes

Consumers are increasingly seeking metallic, matte, pearlescent, and textured finishes to personalise vehicle appearance, driving stronger demand for specialised colour palettes and premium coatings. This shift is also reflected in service innovations such as Ozzy Tyres’ custom brake caliper painting service launched in September 2025, which offers bold colour upgrades in under two hours. Such developments highlight growing interest in visual customisation and enhanced vehicle styling across Australia.

Market Outlook 2026-2034:

Australia’s automotive paint market is expected to experience stable growth, supported by expanding vehicle refinishing activity, rising customisation trends, and steady new vehicle registrations. Increasing demand for durable, weather resistant coatings suited to Australia’s climatic conditions continues to bolster product innovation. Advancements in automated paint technologies and growing adoption of premium aesthetic finishes are further strengthening market momentum. As manufacturers invest in sustainable and high-performance formulations, the market is projected to maintain a positive outlook over the forecast period. The market generated a revenue of USD 660.14 Million in 2025 and is projected to reach a revenue of USD 1,031.84 Million by 2034, growing at a compound annual growth rate of 5.09% from 2026-2034.

Australia Automotive Paint Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Application | Automobile Manufacturing | 60% |

| Type | Water-Based Paints | 35% |

| Vehicle Type | Passenger Cars | 50% |

| Finish Type | Gloss Finish | 45% |

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Automobile Manufacturing

- Automobile Repair and Refinishing

- Automobile Maintenance

The automobile manufacturing dominates with a market share of 60% of the total Australia automotive paint market in 2025.

Automobile manufacturing dominates the Australia automotive paint market as OEMs prioritise high-performance coatings that ensure durability, weather resistance, and long-lasting aesthetics. Manufacturers increasingly rely on advanced paint technologies to meet quality standards for new vehicle launches.

This segment also benefits from rising production of passenger vehicles, which requires consistent and precise coating applications for body panels and components. In November 2025, Walkinshaw Group unveiled a USD 114 Million manufacturing facility in Dandenong South, Victoria, creating 155 jobs. The 100,000-square-metre site will produce over 10,000 vehicles annually, enhancing Australia’s automotive capability and reinforcing confidence in the region's manufacturing sector. Automotive manufacturers are adopting eco-efficient systems that reduce emissions and support compliance with tightening standards.

Type Insights:

- Solvent-Based Paints

- Water-Based Paints

- Powder Coatings

- UV-Cured Paints

The water-based paints lead with a share of 35% of the total Australia automotive paint market in 2025.

Water based paints lead due to their lower VOC emissions, regulatory compliance, and improved environmental performance. These coatings offer strong adhesion, colour stability, and reduced odour, making them a preferred choice for both OEMs and repair centres. Their popularity continues to rise as manufacturers strengthen sustainability commitments across product lines. The availability of advanced water-based technologies with faster curing and enhanced durability further reinforces their dominance in the market.

Their popularity also grows as automotive brands integrate greener materials into sustainability roadmaps. Water based formulations meet modern performance needs without compromising finish quality. Growing consumer preference for ecofriendly refinishing solutions is also boosting adoption in the aftermarket. Continuous R&D investments are improving their resistance, gloss retention, and spray efficiency, making them increasingly competitive against traditional solvent-based paints.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Motorcycles

- Heavy-Duty Vehicles

The passenger cars prevail with a market share of 50% of the total Australia automotive paint market in 2025.

Passenger cars prevail as the largest segment, driven by high ownership levels and frequent refinishing requirements. This category demands a wide spectrum of coatings, from protective primers to premium topcoats, supporting a strong paint consumption base. Rising sales of compact SUVs across Australia have supported increased production-based paint usage, reinforcing the segment’s influence. In November 2025, BYD announced its plans to introduce a luxurious seven-seat SUV, codenamed Dynasty-D, to enhance its SUV lineup. Expected to surpass 5.2 meters in length, it aims to rival models like the Hyundai Palisade, with a launch delayed to 2026 for refinement.

The segment also benefits from rising consumer interest in aesthetic customisation, which drives stronger demand for specialised finishes and premium coating solutions. Growing preference for personalised vehicle appearances has encouraged more frequent colour restoration and refinishing work, especially as owners look to extend the visual appeal of ageing vehicles. This behaviour supports steady uptake of high-quality automotive coatings, as workshops prioritise durable, easy to apply, and visually appealing paint systems. Overall, the trend is strengthening the segment’s long term market relevance.

Finish Type Insights:

- Matte Finish

- Gloss Finish

- Satin Finish

- Metallic Finish

The gloss finish exhibited a clear dominance with a share of 45% of the total Australia automotive paint market in 2025.

Gloss finish dominates the market because it delivers a high shine and visually striking appearance that enhances overall vehicle aesthetics. Its ability to minimise minor imperfections makes it a preferred option for OEMs focused on premium presentation. The finish remains a staple across new vehicle launches due to its consistent performance and consumer appeal.

Its popularity is further supported by compatibility with advanced clearcoat technologies that boost resistance to scratches, chemicals, and UV exposure. Refinishing professionals also favour gloss due to its ability to achieve deeper colour expression and long lasting surface protection. As demand for visually refined and durable coatings grows, gloss finishes maintain a strong foothold in the Australian automotive paint market.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory and New South Wales show strong demand for automotive paints due to high vehicle density, active repair networks, and growing adoption of water-based coatings. Increasing refinishing activity and modern workshop upgrades continue to support consistent market expansion across both regions.

Victoria and Tasmania experience steady growth driven by rising vehicle servicing needs and strong uptake of premium finishes in urban centres. Expanding workshop capabilities, combined with consumer interest in customisation and improved durability standards, contribute to higher demand for advanced coating technologies in these states.

Queensland’s market benefits from high vehicle usage, increased maintenance requirements, and strong acceptance of UV-resistant and corrosion-protective coatings. Coastal exposure conditions also encourage demand for durable paint systems, while customisation trends in major cities further strengthen the consumption of specialty automotive finishes.

Northern Territory and South Australia show gradual progress supported by expanding repair networks and rising demand for coatings suited to extreme heat and harsh terrains. The prevalence of commercial and off-road vehicles increases the need for protective paint solutions, sustaining consistent aftermarket activity.

Western Australia demonstrates robust demand due to high vehicle ownership and strong influence from mining and industrial fleets requiring protective coatings. Urban centres show rising preference for aesthetic upgrades, while regional areas rely on durable, long-lasting paint systems tailored for challenging operating environments.

Market Dynamics:

Growth Drivers:

Why is the Australia Automotive Paint Market Growing?

Focus on Cost Efficient Production Processes

Cost optimisation is becoming a key priority for automotive manufacturers, driving the uptake of paint technologies that minimise material wastage and improve application control. Energy efficient curing methods are also gaining traction as companies streamline operations and reduce overall production expenses. Modern coating systems that deliver faster drying, better coverage, and consistent finish quality help improve workflow efficiency. This shift toward leaner, more economical processes continues to reinforce the demand for advanced, high performance automotive paint solutions.

Growth in Repair and Maintenance Activities

Increasing focus on vehicle upkeep is boosting demand for automotive paints used in touch ups, repainting, and exterior restoration. Consumers are prioritising appearance and longevity, prompting more frequent use of refinishing services. Workshops rely on high quality coatings to achieve durable, seamless results that match factory standards. As vehicles age and cosmetic upgrades rise, consistent paint consumption across the aftermarket strengthens market growth. This ongoing maintenance driven activity ensures steady demand for versatile and reliable coating products.

Growing Shift Toward Environmentally Responsible Coatings

Rising environmental expectations are accelerating the adoption of low VOC, water based, and eco-friendly paint formulations. Automotive manufacturers and repair centres prefer sustainable coatings that support cleaner operations without compromising finish quality. In October 2025, BASF Coatings appointed Wholesale Paint Group as an authorized distributor for automotive refinishing products in South Australia. This partnership enhances WPG's distribution of Glasurit and baslac products, aiming to strengthen market presence and provide added value to customers. These products help align with evolving regulatory frameworks and strengthen environmental commitments. Improved performance characteristics, including better adhesion and colour stability, make green coatings increasingly viable for both OEM and aftermarket use. This shift toward responsible material choices is shaping long term market evolution in Australia.

Market Restraints:

What Challenges the Australia Automotive Paint Market is Facing?

Rising Competition from Alternative Protective Technologies

Automotive paints face growing pressure from wraps, PPF films, and ceramic coatings, which offer durable, low maintenance protection. These solutions reduce the need for frequent repainting, prompting many vehicle owners to choose alternatives that deliver long lasting results and improved surface preservation.

Skill Gaps and Inconsistencies in Application Quality

High quality automotive painting requires trained technicians, yet shortages in skilled labour often lead to uneven finishes and surface defects. Inadequate preparation or incorrect coating techniques increase rework, reduce efficiency, and negatively influence customer perception of repainting and refinishing services.

Higher costs of advanced formulations

Environmentally responsible and high-performance coatings are costlier to manufacture and apply, creating challenges for budget sensitive workshops. Smaller repair centres may delay adoption, limiting widespread use of premium paints and slowing the overall shift toward more durable, compliant coating technologies in the market.

Competitive Landscape:

The Australia automotive paint market features a competitive landscape shaped by continuous innovation, expanding product portfolios, and rising demand for high performance coating solutions. Companies are focusing on advanced formulations, including water based and low VOC paints, to strengthen their environmental positioning and meet evolving regulatory expectations. Product differentiation through enhanced durability, colour accuracy, and faster curing capabilities remains a key competitive strategy. Many players are also investing in improved application technologies and partnerships with repair centres to widen market reach. As custom finishes and refinishing services grow, competition intensifies around quality consistency, technical support, and after sales service.

Recent Developments:

- In March 2025, Axalta Coating Systems acquired U-POL Australia and New Zealand, enhancing its automotive refinishing portfolio. This acquisition aims to expand Axalta's market presence while ensuring continuity in operations, with Daniel Harper now serving as general manager for the region.

Australia Automotive Paint Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Automobile Manufacturing, Automobile Repair and Refinishing, Automobile Maintenance |

| Types Covered | Solvent-Based Paints, Water-Based Paints, Powder Coatings, UV-Cured Paints |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Motorcycles, Heavy-Duty Vehicles |

| Finish Types Covered | Matte Finish, Gloss Finish, Satin Finish, Metallic Finish |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia automotive paint market size was valued at USD 660.14 Million in 2025.

The Australia automotive paint market is expected to grow at a compound annual growth rate of 5.09% from 2026-2034 to reach USD 1,031.84 Million by 2034.

Water-based paints held the largest share due to their lower emissions, regulatory compliance, and strong performance in adhesion and colour stability. Their growing acceptance among OEMs and repair centres further strengthens their leading position in the market.

Key factors driving the Australia automotive paint market include rising demand for durable coatings, increasing repair and refurbishment activities, and growing preference for environmentally responsible formulations. Advancements in application technologies and a focus on aesthetic enhancement also contribute to sustained market expansion.

Major challenges include competition from alternative protective solutions such as wraps and films, skill shortages affecting application quality, and higher costs associated with advanced coating formulations. These issues hinder adoption, especially among cost conscious workshops and smaller refinishing centres.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)