Australia Automotive Paints and Coatings Market Size, Share, Trends and Forecast by Resin Type, Technology, Layer, Application, and Region, 2025-2033

Australia Automotive Paints and Coatings Market Overview:

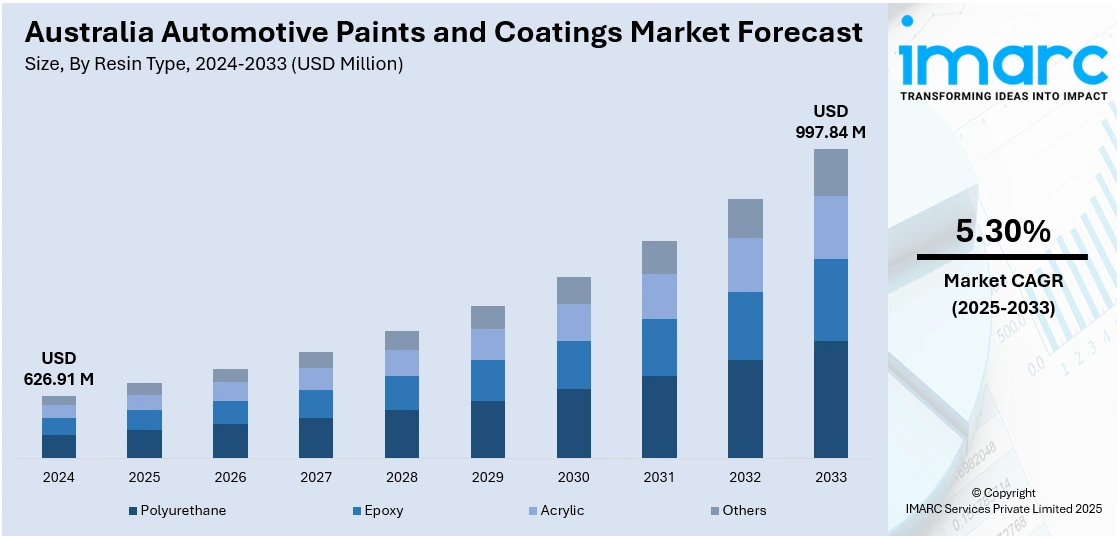

The Australia automotive paints and coatings market size reached USD 626.91 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 997.84 Million by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. Increasing vehicle production, rising aftermarket demand, integration of low-VOC coatings, growing regulatory pressure on emissions, adoption of multifunctional coating technologies, shift toward lightweight electric vehicle solutions, technological advancements in smart coatings, emphasis on sustainability initiatives, collaboration between industry players and academic institutions, and growing preference for premium durable finishes are some of the factors positively impacting the Australia automotive paints and coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 626.91 Million |

| Market Forecast in 2033 | USD 997.84 Million |

| Market Growth Rate 2025-2033 | 5.30% |

Australia Automotive Paints and Coatings Market Trends:

Increasing Vehicle Production and Aftermarket Demand

Rising vehicle production combined with growing aftermarket services form a significant driver for the market. Automotive manufacturers are expanding production capacities to meet domestic and export demands, driven by shifting consumer preferences toward electric vehicles and more fuel-efficient models. One of the key market trends is the integration of environmentally friendly, waterborne, and low-VOC (volatile organic compound) coatings across manufacturing and aftermarket operations. The Australia automotive paints and coatings market forecast identifies strong momentum for products designed to reduce emissions without compromising on color vibrancy, gloss retention, and surface protection. Manufacturers are investing heavily in research and development to offer coatings that improve application efficiency, corrosion resistance, and scratch protection. On December 13, 2024, Dulux Automotive Coatings announced the relaunch of its FleetShield Automotive range, targeting the Australian bus and coach sector with updated packaging, a streamlined product lineup, and a new universal range of ancillary products. On the same date, Dulux emphasized that the refreshed FleetShield range, supported by parent company Nippon Paint’s global expertise, will improve product clarity and compatibility for applicators across Australia and New Zealand. Increasing regulatory pressure to adhere to stricter environmental standards is also influencing product development strategies among key players operating in the Australian market. Automotive paints and coatings are now expected to deliver multifunctional benefits, including UV resistance, enhanced adhesion, and self-healing properties. These evolving product expectations are driving innovation in raw materials, formulation techniques, and application processes.

To get more information on this market, Request Sample

Technological Advancements and Sustainability Initiatives

Technological advancements and sustainability initiatives form a second critical pillar supporting the expansion of the sector. As part of the major market trends, emphasis is being placed on sustainable product development and carbon footprint reduction. The Australia automotive paints and coatings market growth is strongly influenced by industry-wide shifts toward bio-based coatings, powder coatings, and UV-cured technologies, which help reduce emissions and resource consumption. These eco-friendly alternatives are increasingly sought after by manufacturers seeking to comply with international environmental standards while meeting consumer expectations for greener products. In line with this, strategic collaborations and partnerships between material science companies, automotive manufacturers, and academic institutions is accelerating innovation pipelines, resulting in new product launches specifically designed to meet Australia’s climate conditions and driving patterns. The Australia automotive paints and coatings market outlook remains optimistic, fueled by a combination of technological disruption, regulatory alignment, and evolving consumer preferences. The popularity of electric vehicles and hybrid models is also contributing to the demand for lighter and more energy-efficient coatings. Companies are tailoring solutions specifically designed for electric vehicle bodies, using materials that complement lightweight frames while maintaining high performance. On February 14, 2024, IGL Coatings announced a major expansion of its operations in Australia, strengthening its local distribution network through partnerships with leading automotive businesses across New South Wales, Queensland, Victoria, and Western Australia. On the same date, IGL Coatings confirmed that this expansion will improve local availability of its ceramic coatings and surface protection products, backed by comprehensive training programs aimed at raising standards in the automotive detailing and coatings sector. The industry is undergoing a transformation marked by the adoption of nanotechnology, smart coatings, and digital color matching systems that improve precision, efficiency, and quality. These developments are expected to reshape competitive strategies, emphasizing high-performance, sustainable solutions as the cornerstone of future market positioning in Australia.

Australia Automotive Paints and Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on resin type, technology, layer, and application.

Resin Type Insights:

- Polyurethane

- Epoxy

- Acrylic

- Others

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes polyurethane, epoxy, acrylic, and others.

Technology Insights:

- Solvent-borne

- Water-borne

- Powder

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes solvent-borne, water-borne, powder, and others.

Layer Insights:

- E-coat

- Primer

- Base Coat

- Clear Coat

The report has provided a detailed breakup and analysis of the market based on the layer. This includes e-coat, primer, base coat, and clear coat.

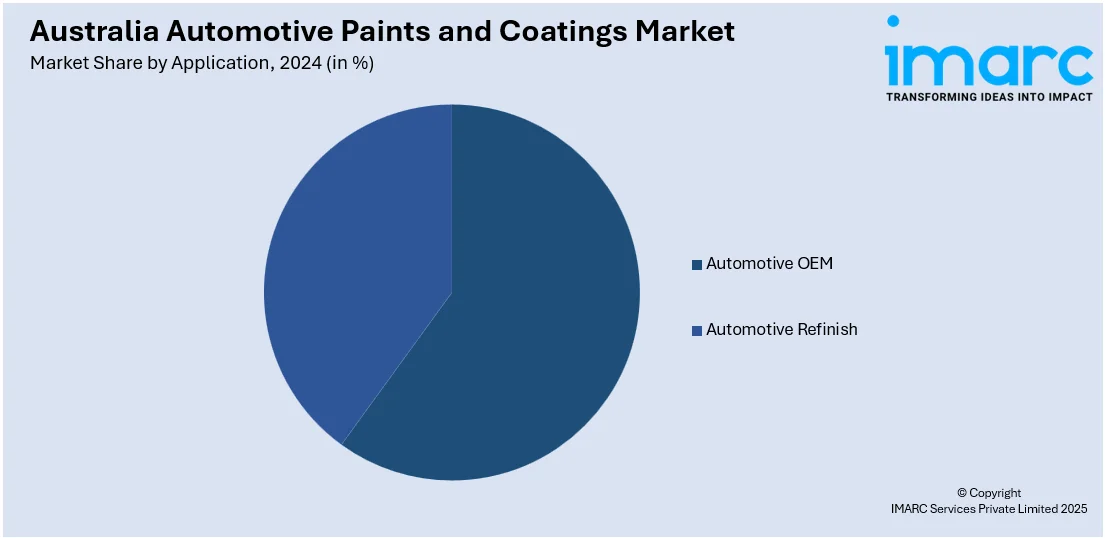

Application Insights:

- Automotive OEM

- Automotive Refinish

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive OEM and automotive refinish.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive Paints and Coatings Market News:

- On July 21, 2023, Nordson Industrial Coating Systems announced the expansion of its eMobility manufacturing and industrial coatings services in Australia, reinforcing its role in the automotive sector through precision dispensing solutions used in battery production, electric vehicle assembly, and protective coatings.

Australia Automotive Paints and Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyurethane, Epoxy, Acrylic, Others |

| Technologies Covered | Solvent-borne, Water-borne, Powder, Others |

| Layers Covered | E-coat, Primer, Base Coat, Clear Coat |

| Applications Covered | Automotive OEM, Automotive Refinish |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automotive paints and coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automotive paints and coatings market on the basis of resin type?

- What is the breakup of the Australia automotive paints and coatings market on the basis of technology?

- What is the breakup of the Australia automotive paints and coatings market on the basis of layer?

- • What is the breakup of the Australia automotive paints and coatings market on the basis of application?

- What is the breakup of the Australia automotive paints and coatings market on the basis of region?

- What are the various stages in the value chain of the Australia automotive paints and coatings market?

- What are the key driving factors and challenges in the Australia automotive paints and coatings market?

- What is the structure of the Australia automotive paints and coatings market and who are the key players?

- What is the degree of competition in the Australia automotive paints and coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive paints and coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive paints and coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive paints and coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)