Australia Automotive Plastics Market Size, Share, Trends and Forecast by Vehicle Type, Material, Application, and Region, 2025-2033

Australia Automotive Plastics Market Overview:

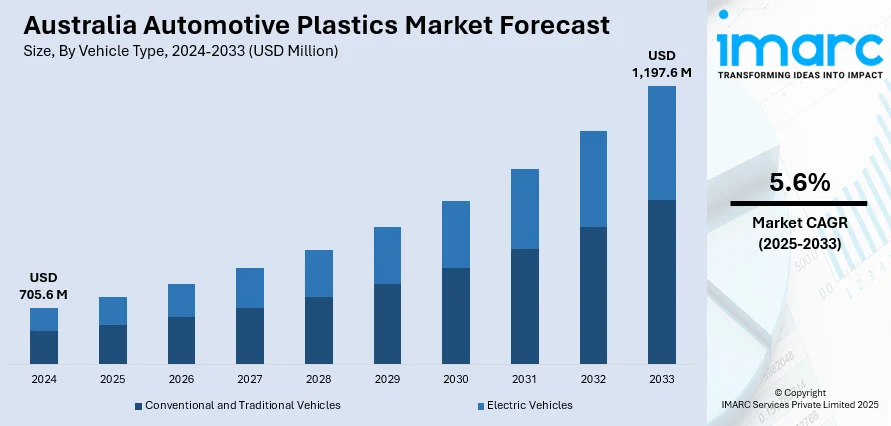

The Australia automotive plastics market size reached USD 705.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,197.6 Million by 2033, exhibiting a growth rate (CAGR) of 5.6% during 2025-2033. Propelled by demand for weight-efficient, strong, and design-preferred material in automobiles, the market is changing at a rapid pace with increasing adoption of EVs and smart interior technology, growing Australia automotive plastics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 705.6 Million |

| Market Forecast in 2033 | USD 1,197.6 Million |

| Market Growth Rate 2025-2033 | 5.6% |

Australia Automotive Plastics Market Trends:

Growing Use of Lightweight Materials for Fuel Efficiency

Australia's automotive sector is intensely focusing on the use of lightweight materials like plastics to improve vehicle fuel efficiency and respond to changing environmental regulations. Plastics, with their lower weight compared to conventional metals, play a major role in lightening vehicles, hence improving fuel economy and reducing emissions. For example, in April 2024, BASF Coatings unveiled its Sustainability Future Target Picture, with a focus on circular behaviors, such as sustainable automotive plastics, to drive innovation and responsible action in the automotive industry. Additionally, this is according to the latest global trend as countries move toward sustainable mobility technologies and the transition locally to hybrids and electrically powered vehicles. Plastics from the automotive sector are being introduced in structural items like powertrain systems and in under-the-hood applications that have high strength-to-weight levels but still guarantee safety. It also enables automakers to take vehicle design creatively without sacrificing efficiency. This underscores the rising importance of the Australia automotive plastics market outlook, given the boosting quest by manufacturers for material replacements to gain more sustainability and cost-effectiveness. With the increase in lightweighting, the contribution of advanced polymer solutions to transforming Australia's automotive market continues to grow consistently.

To get more information on this market, Request Sample

Growth in Demand for High-Performance Thermoplastics in Electrical Systems

Amplified growth in electric and hybrid vehicles is fueling demand for high-performance thermoplastics within Australia's automotive industry. As vehicles become more electrified, the requirement for materials that can withstand high thermal and electrical stress is critical. Thermoplastics like polyamides, polycarbonates, and polyphenylene sulfide are increasingly utilized in applications such as battery compartments, wiring harnesses, and electric motor parts. The plastics possess excellent electrical insulation, heat resistance, and dimensional stability, which makes them suitable for the demanding operating conditions of contemporary electric drivetrains. This trend is also driven by customers' demands for more intelligent, secure vehicles with embedded electronic systems. Automotive companies are subsequently relying on engineered plastics to provide durable and dependable performance of electrical devices. The share of Australia automotive plastics is set to expand along with technology advancements, and high-performance thermoplastics will be an integral part of the new paradigm in automotive electronics and energy management systems.

Aesthetic and Functional Interior Applications Growth

In Australia, consumers are turning towards cars with improved interior comfort, sophisticated infotainment, and upscale looks—fueling the need for quality automotive plastics for cabin applications. ABS, polyurethane, and polypropylene plastics find extensive applications in dashboard panels, door trims, seat parts, and center consoles because of their design flexibility, affordability, and sense appeal. These materials also help minimize vehicle weight overall while allowing effortless integration of technology features such as touchscreens, ambient lighting, and climate control. Moreover, increasing popularity of shared mobility and fleet services in cities is motivating producers to utilize long-lasting, easy-to-clean plastic interiors that can endure repeated usage. With accelerated innovation in texture, finish, and modular design, automotive plastics are taking up an active role in crafting aesthetically pleasing and user-friendly interiors. This emphasizes the Australia automotive plastics growth potential as demand in the market keeps growing for multifunctional products, where performance and luxury are merged. For instance, in September 2025, the Volkswagen T-Cross facelift will land in Australia with additional standard equipment, such as more refined interior plastics, a dedicated R-Line model, and upgraded tech such as Travel Assist and LED headlights.

Australia Automotive Plastics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on vehicle type, material, and application.

Vehicle Type Insights:

- Conventional and Traditional Vehicles

- Electric Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes conventional and traditional vehicles and electric vehicles.

Material Insights:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Polycarbonate (PC)

- Polyamide

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), acrylonitrile butadiene styrene (ABS), polyurethane (PU), polymethyl methacrylate (PMMA), polycarbonate (PC), polyamide, and others.

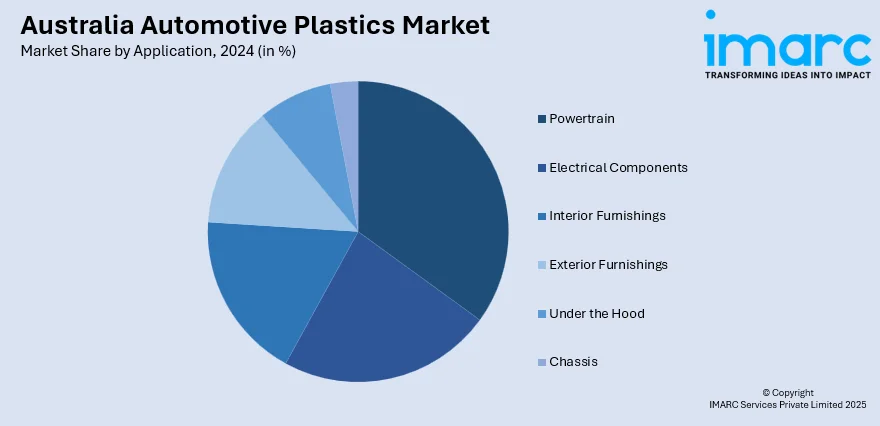

Application Insights:

- Powertrain

- Electrical Components

- Interior Furnishings

- Exterior Furnishings

- Under the Hood

- Chassis

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes powertrain, electrical components, interior furnishings, exterior furnishings, under the hood, and chassis.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive Plastics Market News:

- In November 2024, Covestro and Ausell extended their partnership to develop the recycling of plastics from end-of-life vehicles. The project aims to convert scrapped automotive parts, such as headlamps, into high-performance recycled products, furthering the automotive industry's circular economy and minimizing waste and carbon footprint.

Australia Automotive Plastics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Conventional and Traditional Vehicles, Electric Vehicles |

| Materials Covered | Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Acrylonitrile Butadiene Styrene (ABS), Polyurethane (PU), Polymethyl Methacrylate (PMMA), Polycarbonate (PC), Polyamide, Others |

| Applications Covered | Powertrain, Electrical Components, Interior Furnishings, Exterior Furnishings, Under the Hood, Chassis |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automotive plastics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automotive plastics market on the basis of vehicle type?

- What is the breakup of the Australia automotive plastics market on the basis of material?

- What is the breakup of the Australia automotive plastics market on the basis of application?

- What is the breakup of the Australia automotive plastics market on the basis of region?

- What are the various stages in the value chain of the Australia automotive plastics market?

- What are the key driving factors and challenges in the Australia automotive plastics?

- What is the structure of the Australia automotive plastics market and who are the key players?

- What is the degree of competition in the Australia automotive plastics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive plastics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive plastics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)