Australia Automotive Radar Market Size, Share, Trends and Forecast by Range, Vehicle Type, Application, and Region, 2025-2033

Australia Automotive Radar Market Overview:

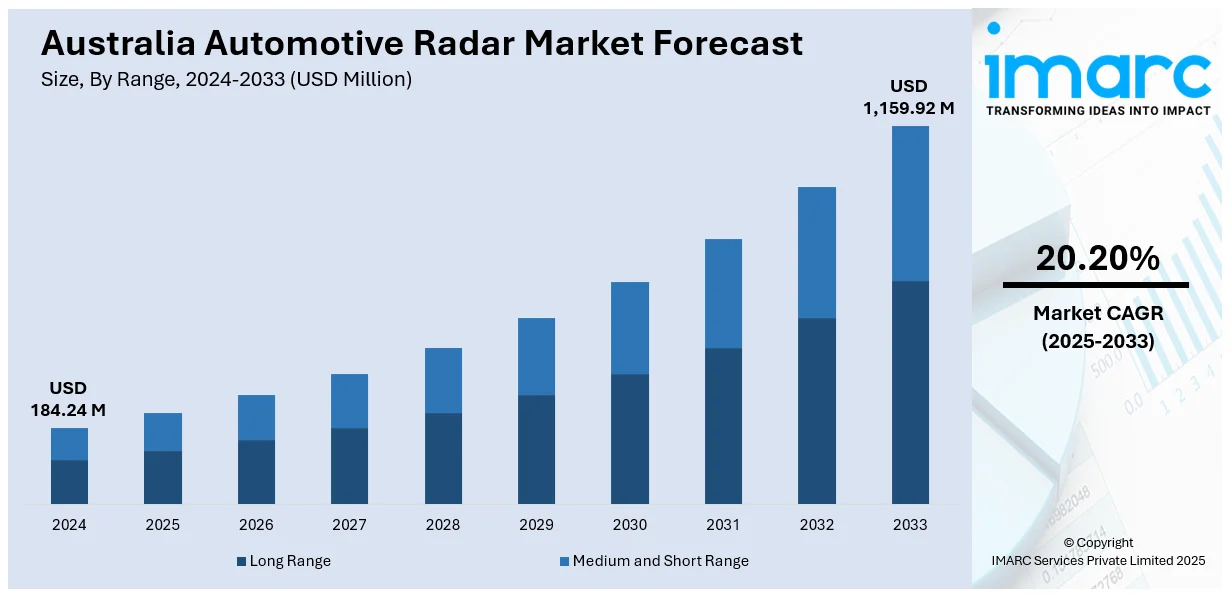

The Australia automotive radar market size reached USD 184.24 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,159.92 Million by 2033, exhibiting a growth rate (CAGR) of 20.20% during 2025-2033. The market is driven by rising demand for vehicle safety features, increasing adoption of advanced driver assistance systems (ADAS), government safety regulations, and the growth of electric and autonomous vehicles. Technological advancements in radar systems also contribute to Australia automotive radar market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 184.24 Million |

| Market Forecast in 2033 | USD 1,159.92 Million |

| Market Growth Rate 2025-2033 | 20.20% |

Australia Automotive Radar Market Trends:

Advancements in Radar Technology

Technological improvements are playing an important role in the Australian automotive radar market. Advances like radar-on-chip solutions and incorporation of artificial intelligence (AI) are improving radar system capabilities. These developments help detect objects with greater accuracy, deliver better performance across weather conditions, and cause less interference from other sensors. For example, the deployment of AI-enabled radar sensors makes possible intelligent decision-making and real-time object recognition, even in difficult conditions. Such technological advancement is enhancing the efficiency and cost-effectiveness of radar systems, thus driving their use in the automotive sector at a faster rate. For instance, in September 2024, Rohde & Schwarz, in collaboration with NOFFZ, introduced the R&S AREG-P, a next-generation radar target simulator designed to streamline the transition of automotive radar sensors from R&D to production. This modular solution improves testing efficiency, reduces costs, and supports parallel radar testing. With AI-driven optimization, compact design, and support for far-field testing using CATR technology, it ensures quality, compliance, and environmental benefits. The innovation is aimed at Tier 1 radar suppliers to boost productivity and first-pass yield in automotive radar manufacturing.

To get more information on this market, Request Sample

Expansion of Electric and Autonomous Vehicles

The growth of electric and autonomous vehicles in Australia is driving the demand for advanced radar systems. For instance, according to data from the EVC and public sources, approximately 114,000 new battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold in Australia in 2024, surpassing the previous record of over 98,000 units sold in 2023. Of the 2024 total, around 91,000 were BEVs and 23,000 were PHEVs. Radar technology plays a crucial role in enabling features such as collision avoidance, adaptive cruise control, and parking assistance, which are essential for the safe operation of autonomous vehicles. As the adoption of electric vehicles increases, the need for radar systems that can operate effectively in various driving conditions becomes more pronounced. This trend is prompting automotive manufacturers to invest in advanced radar technologies to enhance the safety and functionality of their electric and autonomous vehicle offerings, thus propelling the Australia automotive radar market growth.

Australia Automotive Radar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on range, vehicle type, and application.

Range Insights:

- Long Range

- Medium and Short Range

The report has provided a detailed breakup and analysis of the market based on the range. This includes long range and medium and short range.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type This includes passenger cars and commercial vehicles.

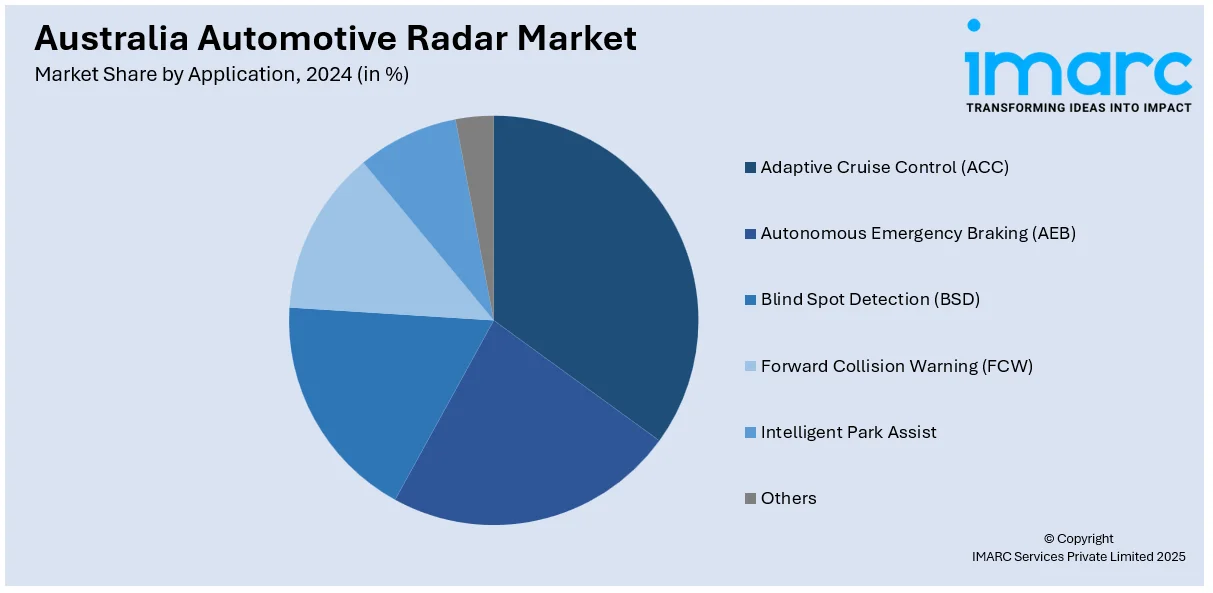

Application Insights:

- Adaptive Cruise Control (ACC)

- Autonomous Emergency Braking (AEB)

- Blind Spot Detection (BSD)

- Forward Collision Warning (FCW)

- Intelligent Park Assist

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes adaptive cruise control (ACC), autonomous emergency braking (AEB), blind spot detection (BSD), forward collision warning (FCW), intelligent park assist, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive Radar Market News:

- In January 2025, Texas Instruments (TI) unveiled new automotive chips at CES 2025 to enhance in-cabin safety and audio experiences. The AWRL6844 is the industry’s first 60GHz mmWave radar sensor with edge AI, enabling seat belt reminders, child detection, and intrusion monitoring. TI also introduced the AM275x-Q1 and AM62D-Q1 processors featuring high-performance DSP cores for premium audio systems, and the TAS6754-Q1 Class-D amplifier using innovative 1L modulation technology. These integrated solutions reduce cost, system complexity, and enable scalable design across vehicle models.

- In December 2024, Infineon Technologies released the RASIC™ CTRX8191F, a next-generation 28nm radar MMIC designed to meet the performance and cost needs of L2+ to L4 autonomous driving. It enhances detection in dense urban environments with high signal-to-noise ratio and supports scalable 4D radar systems. Infineon also introduced the CARKIT development kit to speed up prototyping.

- In April 2024, Rohde & Schwarz and IPG Automotive partnered to deliver a complete Hardware-in-the-Loop (HIL) radar test solution for autonomous vehicle development. By combining R&S radar simulators with IPG’s CarMaker simulation software, the solution allows safe, efficient, and cost-effective ADAS/AD testing in labs rather than on proving grounds. It enables real-time sensor validation and Euro NCAP scenario testing with high realism, automation, and scalability. This collaboration significantly reduces development time, cost, and risk in the automotive radar testing process.

Australia Automotive Radar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ranges Covered | Long Range, Medium and Short Range |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Applications Covered | Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Blind Spot Detection (BSD), Forward Collision Warning (FCW), Intelligent Park Assist, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automotive radar market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automotive radar market on the basis of range?

- What is the breakup of the Australia automotive radar market on the basis of vehicle type?

- What is the breakup of the Australia automotive radar market on the basis of application?

- What is the breakup of the Australia automotive radar market on the basis of region?

- What are the various stages in the value chain of the Australia automotive radar market?

- What are the key driving factors and challenges in the Australia automotive radar market?

- What is the structure of the Australia automotive radar market and who are the key players?

- What is the degree of competition in the Australia automotive radar market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive radar market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive radar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive radar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)