Australia Automotive Refinish Coatings Market Size, Share, Trends and Forecast by Resin Type, Product Type, Technology, Vehicle Type, and Region, 2025-2033

Australia Automotive Refinish Coatings Market Overview:

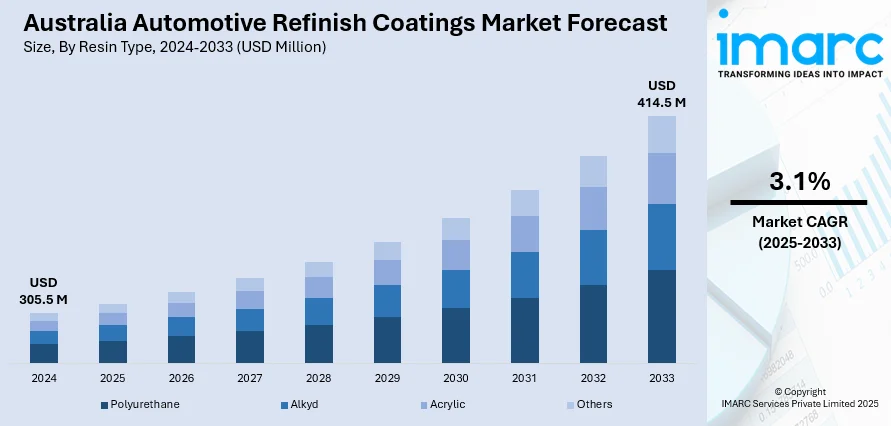

The Australia automotive refinish coatings market size reached USD 305.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 414.5 Million by 2033, exhibiting a growth rate (CAGR) of 3.1% during 2025-2033. The market is driven by the growing fleet of cars on Australian roads, rising focus on creating high-performing coatings possessing quicker curing speed, improved wear resistance, and better finish appearance, and rise in insurance-based repairs and automotive service networks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 305.5 Million |

| Market Forecast in 2033 | USD 414.5 Million |

| Market Growth Rate 2025-2033 | 3.1% |

Australia Automotive Refinish Coatings Market Trends:

Rising Vehicle Ownership and Expanding Car Registrations

The growing fleet of cars on Australian roads is positively influencing the market. According to a report by RACV, a total of 1,237,287 new vehicles were sold in Australia in 2024. As car ownership increases, particularly in urban areas such as Sydney, Melbourne, and Brisbane, the likelihood of accidents, collisions, and general wear-and-tear increases proportionately. This growing car registration generates greater demand for refinishing activity, as owners wish to preserve the appearance and resale value of their cars. Further, as more people sell their old cars in Australia, cosmetic renewal is required before resale. The second-hand car industry also creates the ongoing need for touch-ups to be painted, scratched, and the surface renewed. In addition, heightened desire for high-quality, used cars are leading to professional service in garages and body shops, where top-quality refinish coatings are employed. Therefore, these market forces drive the demand for basecoats, clearcoats, primers, and other refinish products.

To get more information on this market, Request Sample

Advancements in Coating Technologies and Eco-friendly Formulations

Technological innovation plays a pivotal part in shaping the market dynamics in Australia. Producers are constantly investing in research and development (R&D) with the aim to create high-performing coatings possessing quicker curing speed, improved wear resistance, and better finish appearance. Amongst the key trends is the demand for waterborne and low-volatile organic compounds (VOCs) coatings, encouraged by environmental regulatory requirements and need for ecofriendly products. These products minimize the release of toxic solvents, in keeping with Australia's national agendas of minimizing carbon footprints and enhancing air quality. The improved efficiency and minimized downtime of contemporary coatings also attract commercial body shops, which enjoy faster turnaround times and enhanced productivity. In addition, the rising use of smart coatings like self-healing and anti-scratch coatings illustrates how innovation is directly affecting end-user decisions. As environmental compliance becomes non-negotiable in procurement and service delivery, demand for technologically sophisticated, sustainable refinish coatings is increasing.

Growth of Insurance-based Repairs and Automotive Service Networks

A significant majority of repairs and refinishing are done under insurance claims, especially after accidents or acts of nature. Insurance firms tend to tie up with approved body shops and repair facilities that apply premium coatings for refinish applications. The association ensures quality and drives the demand for premium-grade refinish coatings. In addition, growth in multi-brand service networks and collision repair franchises throughout Australia is optimizing the supply chain for coatings producers, making product standardization and bulk purchase easier. As customer satisfaction and repair time are becoming more of a priority, these service providers want coatings that provide quick drying times, extended durability, and color consistency, further motivating the use of advanced refinishing products. Also, electronic claims processing and the emergence of automated evaluation tools are speeding up repair cycles.

Australia Automotive Refinish Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on resin type, product type, technology, and vehicle type.

Resin Type Insights:

- Polyurethane

- Alkyd

- Acrylic

- Others

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes polyurethane, alkyd, acrylic, and others.

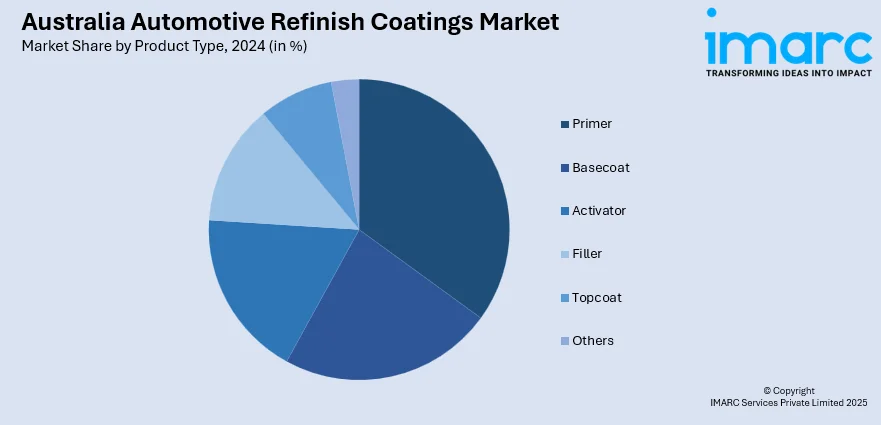

Product Type Insights:

- Primer

- Basecoat

- Activator

- Filler

- Topcoat

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes primer, basecoat, activator, filler, topcoat, and others.

Technology Insights:

- Solvent-borne

- Water-borne

- UV-cured

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes solvent-borne, water-borne, and UV-cured.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Others

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, commercial vehicles, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive Refinish Coatings Market News:

- In March 2024, AkzoNobel introduced Refinish+, a digital platform created specifically for body shops to streamline operations, enhance efficiency, and boost profitability. Refinish+ offers body shops easy access, and a single sign on, to AkzoNobel's entire collection of digital capabilities comprising AkzoNobel's cloud-based color retrieval program MIXIT. AkzoNobel also announced its plans of introducing Refinish+ in North America, Australia and selected markets in Europe in the first half of 2024.

- In February 2024, IGL Coatings, a market leader in ceramic coatings in Australia, is delighted to announce the accelerated growth for the availability of the top-notch ceramic coating throughout Australia. With 2024 representing a new beginning for local support and same-day availability. IGL Coatings Australia's strategic decision emphasizes the development of deeper relationships with the IGL customers and partners, improving our service offerings, and establishing our presence as a market leader and industry innovator.

Australia Automotive Refinish Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyurethane, Alkyd, Acrylic, Others |

| Product Types Covered | Primer, Basecoat, Activator, Filler, Topcoat, Others |

| Technologies Covered | Solvent-borne, Water-borne, UV-cured |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automotive refinish coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automotive refinish coatings market on the basis of resin type?

- What is the breakup of the Australia automotive refinish coatings market on the basis of product type?

- What is the breakup of the Australia automotive refinish coatings market on the basis of technology?

- What is the breakup of the Australia automotive refinish coatings market on the basis of vehicle type?

- What is the breakup of the Australia automotive refinish coatings market on the basis of region?

- What are the various stages in the value chain of the Australia automotive refinish coatings market?

- What are the key driving factors and challenges in the Australia automotive refinish coatings market?

- What is the structure of the Australia automotive refinish coatings market and who are the key players?

- What is the degree of competition in the Australia automotive refinish coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive refinish coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive refinish coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive refinish coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)