Australia Automotive Safety Glass Market Size, Share, Trends and Forecast by Glass Type, Material Type, Vehicle Type, Application, Technology, End-User, and Region, 2025-2033

Australia Automotive Safety Glass Market Overview:

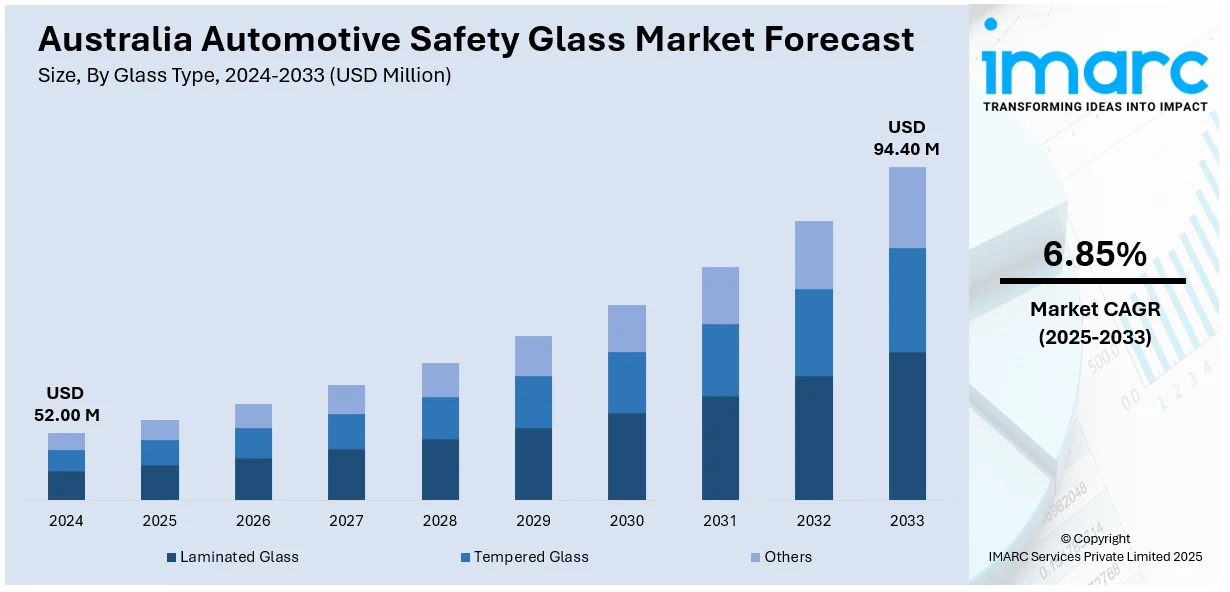

The Australia automotive safety glass market size reached USD 52.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 94.40 Million by 2033, exhibiting a growth rate (CAGR) of 6.85% during 2025-2033. Rising vehicle sales, growing electric vehicle (EV) adoption, stricter government safety rules, increasing road accidents, higher consumer awareness, and expansion of premium segments are supporting the market growth. Moreover, surging demand for laminated windshields, smart glass integration, climate-adapted glazing needs, growth in aftermarket repairs, and noise-reducing glass trends are stimulating the market growth. Furthermore, the push for energy-efficient vehicle components and investments in high-performance safety glass systems are boosting the Australia automotive safety glass market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 52.00 Million |

| Market Forecast in 2033 | USD 94.40 Million |

| Market Growth Rate 2025-2033 | 6.85% |

Australia Automotive Safety Glass Market Trends:

Adoption of Advanced Driver-Assistance Systems (ADAS)

Advanced Driver-Assistance Systems (ADAS) are a major driver of growth in the Australia automotive safety glass market. These systems include features like lane departure warning, automatic emergency braking, and adaptive cruise control. ADAS functions often depend on sensors and cameras mounted behind the windshield or integrated into the glass. This creates a rising demand for safety glass that supports these technologies. These vehicles require specially calibrated glass to ensure proper sensor performance. Additionally, ADAS-equipped vehicles often require precise alignment when replacing windshields, increasing demand for high-quality, manufacturer-compliant safety glass. This shift has pushed both original equipment manufacturer (OEM) and aftermarket suppliers to produce laminated glass compatible with ADAS functionality, which is further driving the Australia automotive safety glass market growth.

To get more information on this market, Request Sample

Rising Consumer Awareness of Road Safety and Vehicle Integrity

Consumer awareness around road safety and vehicle construction has significantly increased in Australia, contributing to higher demand for automotive safety glass. For instance, in 2024, about 1300 road deaths occurred, representing an increase of 3.3% on the year prior. This type of glass, typically laminated or tempered, is designed to prevent shattering and reduce injury during. With growing awareness of crash safety and injury prevention, buyers are more likely to invest in vehicles equipped with premium safety features, including certified glass components. Media coverage of vehicle safety ratings, including the widespread use of Australasian New Car Assessment Program (ANCAP) star ratings, has also informed consumer choices, leading to higher expectations for safety glass performance. Furthermore, the rise of family-oriented vehicles and sport utility vehicle (SUVs) has made safety a primary concern, especially for parents. This demand has prompted manufacturers to integrate multi-layered laminated glass in windshields and side windows, which not only enhance crash protection but also offer sound insulation.

Government Regulations Mandating Safety Glass

Government regulations in Australia have had a direct and measurable impact on the automotive safety glass market. Under the Australian Design Rules (ADRs), specifically ADR 8/01 and ADR 15/01, all passenger vehicles are required to be fitted with laminated windshields and toughened (tempered) side and rear windows. These standards are enforced by the Department of Infrastructure, Transport, Regional Development, Communications and the Arts. Laminated glass is composed of two layers of glass bonded with a plastic layer, which prevents shattering on impact—crucial for occupant protection. In addition to structural requirements, regulations also enforce optical clarity, strength, and ultraviolet (UV) filtration capabilities. Moreover, any vehicle imported or manufactured in Australia must comply with these design rules, making safety glass a non-negotiable component in vehicle production, which is further fueling the market growth.

Australia Automotive Safety Glass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on glass type, material type, vehicle type, application, technology, and end-user.

Glass Type Insights:

- Laminated Glass

- Tempered Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the glass type. This includes laminated glass, tempered glass, and others.

Material Type Insights:

- IR PVB

- Metal Coated Glass

- Tinted Glass

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes IR PVB, metal coated glass, tinted glass, and others.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, trucks, buses, and others.

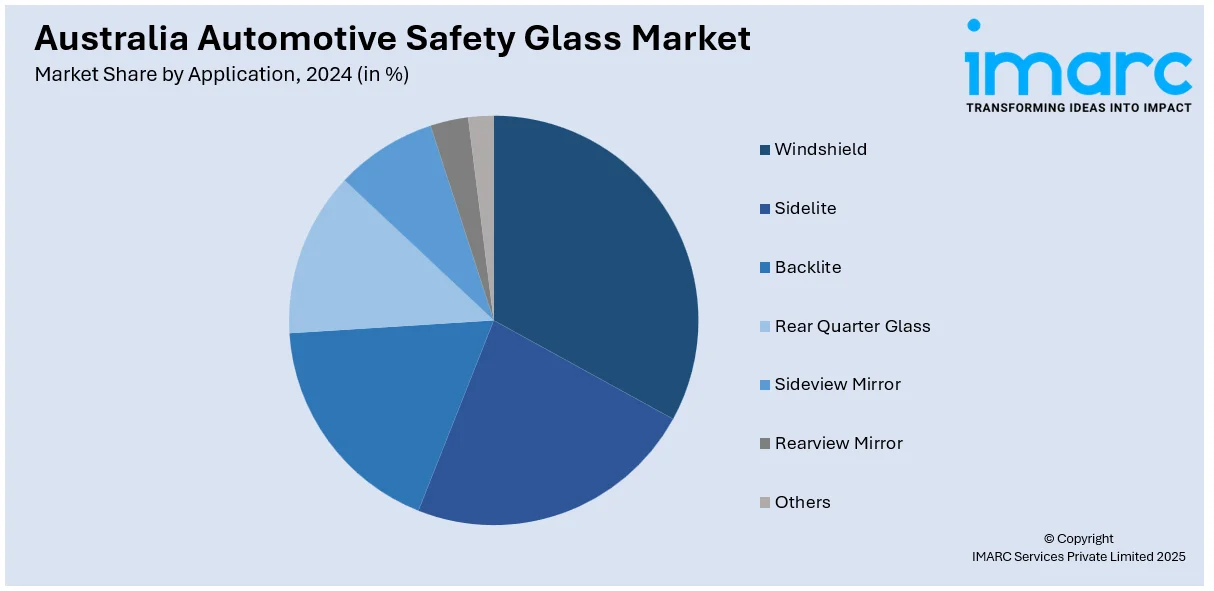

Application Insights:

- Windshield

- Sidelite

- Backlite

- Rear Quarter Glass

- Sideview Mirror

- Rearview Mirror

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes windshield, sidelite, backlite, rear quarter glass, sideview mirror, rearview mirror, and others.

Technology Insights:

- Active Smart Glass

- Suspended Particle Glass

- Electrochromic Glass

- Liquid Crystal Glass

- Passive Glass

- Thermochromic

- Photochromic

The report has provided a detailed breakup and analysis of the market based on the technology. This includes active smart glass (suspended particle glass, electrochromic glass, and liquid crystal glass) and passive glass (thermochromic and photochromic).

End-User Insights:

- OEMs

- Aftermarket Suppliers

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes OEMs and aftermarket suppliers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive Safety Glass Market News:

- In 2024, Pilkington (a subsidairy of NSG) showcased advanced automotive glazing solutions, including smart glass with integrated sensors and heads-up display (HUD) compatibility. These innovations aim to support the growing needs of electric and autonomous vehicles, focusing on safety, connectivity, and energy efficiency.

Australia Automotive Safety Glass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Glass Types Covered | Laminated Glass, Tempered Glass, Others |

| Material Types Covered | IR PVB, Metal Coated Glass, Tinted Glass, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Trucks, Buses, Others |

| Applications Covered | Windshield, Sidelite, Backlite, Rear Quarter Glass, Sideview Mirror, Rearview Mirror, Others |

| Technologies Covered | Active Smart Glass: Suspended Particle Glass, Electrochromic Glass, Liquid Crystal Glass Passive Glass: Thermochromic, Photochromic |

| End-User Covered | OEMs, Aftermarket Suppliers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automotive safety glass market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automotive safety glass market on the basis of glass type?

- What is the breakup of the Australia automotive safety glass market on the basis of material type?

- What is the breakup of the Australia automotive safety glass market on the basis of vehicle type?

- What is the breakup of the Australia automotive safety glass market on the basis of application?

- What is the breakup of the Australia automotive safety glass market on the basis of technology?

- What is the breakup of the Australia automotive safety glass market on the basis of end-user?

- What is the breakup of the Australia automotive safety glass market on the basis of region?

- What are the various stages in the value chain of the Australia automotive safety glass market?

- What are the key driving factors and challenges in the Australia automotive safety glass market?

- What is the structure of the Australia automotive safety glass market and who are the key players?

- What is the degree of competition in the Australia automotive safety glass market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive safety glass market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive safety glass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive safety glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)