Australia Automotive Safety Systems Market Size, Share, Trends and Forecast by System Type, Vehicle Type, End User, and Region, 2026-2034

Australia Automotive Safety Systems Market Summary:

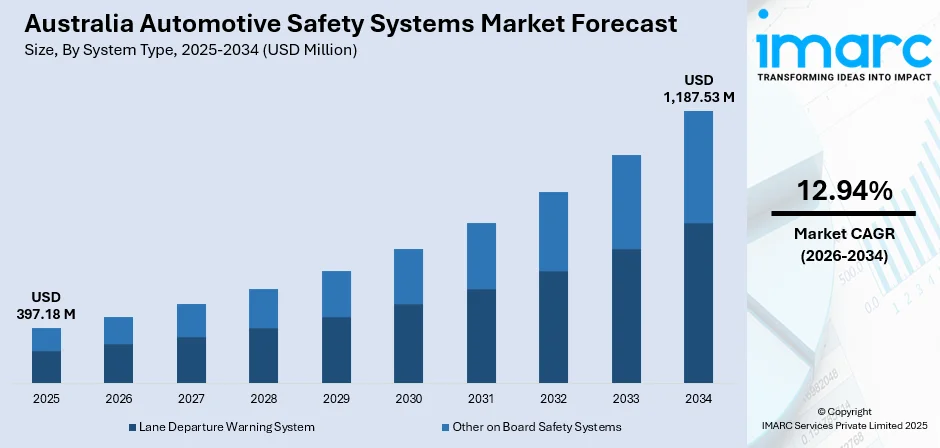

The Australia automotive safety systems market size was valued at USD 397.18 Million in 2025 and is projected to reach USD 1,187.53 Million by 2034, growing at a compound annual growth rate of 12.94% from 2026-2034.

The Australia automotive safety systems market is experiencing robust growth driven by stringent government regulations mandating advanced safety features, rising consumer awareness regarding vehicle safety, and continuous technological advancements in driver assistance systems. The implementation of mandatory autonomous emergency braking requirements and enhanced ANCAP safety rating protocols are accelerating the adoption of sophisticated safety technologies across all vehicle segments throughout the country.

Key Takeaways and Insights:

- By System Type: Other on board safety systems dominate the market with a share of 58% in 2025, driven by the comprehensive integration of multiple safety technologies including automatic emergency braking, blind spot monitoring, adaptive cruise control, and collision avoidance systems.

- By Vehicle Type: Passenger car leads the market with a share of 71% in 2025, attributed to the high volume of passenger vehicle sales, stringent safety regulations for personal vehicles, and strong consumer preference for advanced safety features.

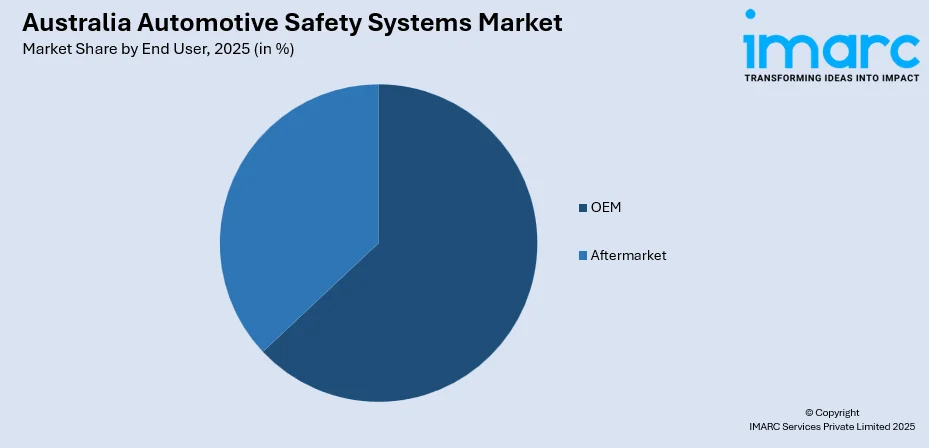

- By End User: OEM dominates with a market share of 63% in 2025, reflecting the mandatory integration of safety systems during vehicle manufacturing and increasing standardization of advanced driver assistance systems across new vehicle models.

- By Region: Australia Capital Territory & New South Wales leads the market with a share of 30% in 2025, driven by high population density, substantial vehicle registrations, strong economic activity, and heightened safety awareness among consumers.

- Key Players: The Australia automotive safety systems market features major global automotive safety suppliers and technology providers. Leading companies focus on technological innovation, strategic partnerships with OEMs, and compliance with evolving regulatory standards to maintain competitive positioning across the market.

To get more information on this market Request Sample

Australia has established itself as a significant market for automotive safety systems, supported by robust regulatory frameworks and strong consumer demand for vehicle safety features. For example, in November 2025, the Australasian New Car Assessment Program (ANCAP) awarded five-star safety ratings to six diverse models including the Tesla Model Y, Nissan Navara, BYD ATTO 1 and Volvo EX90, underscoring how manufacturers are meeting stringent crash-protection and safety-assist criteria in the region. The Australasian New Car Assessment Program continues to elevate safety standards through increasingly rigorous testing protocols, encouraging manufacturers to incorporate advanced safety technologies as standard equipment. The government's commitment to road safety through mandatory Australian Design Rules for autonomous emergency braking and other safety systems has fundamentally transformed the market landscape, creating sustained demand for sophisticated safety solutions across all vehicle categories.

Australia Automotive Safety Systems Market Trends:

Mandatory Autonomous Emergency Braking Implementation

The introduction of mandatory autonomous emergency braking requirements under Australian Design Rules represents a transformative regulatory development shaping market dynamics. According to the ANCAP’s, the implementation of the AEB mandate is estimated to save around 580 lives and avoid more than 20,400 serious injuries and 73,340 minor injuries over time, demonstrating measurable public safety impact from the regulation. The implementation is projected to prevent hundreds of fatalities and thousands of serious injuries over the coming decade, demonstrating the substantial public safety benefits driving continued regulatory advancement in vehicle safety technology standards.

Advanced Driver Assistance Systems Integration

The integration of comprehensive advanced driver assistance systems continues accelerating across the Australian vehicle fleet. In August 2025, Austroads launched national ADAS guidance supporting safer adoption of adaptive cruise and lane-keeping technologies. Modern vehicles increasingly feature interconnected safety technologies including adaptive cruise control, lane keeping assistance, blind spot monitoring, and rear cross-traffic alert systems. Sensor fusion technologies combining radar, camera, and ultrasonic sensors enable sophisticated environmental perception capabilities that enhance overall vehicle safety performance. This technological convergence supports the development pathway toward higher levels of vehicle automation.

Enhanced ANCAP Safety Rating Protocols

The Australasian New Car Assessment Program continues evolving its testing protocols to maintain relevance as safety technology advances. In November 2025, ANCAP refreshed its vehicle safety rating criteria, adopting a four-stage framework evaluating safe driving, crash avoidance, protection, and post-crash response. Updated assessment frameworks incorporate evaluation of assisted driving systems and connected vehicle technologies alongside traditional crashworthiness testing. The emphasis on pre-crash safety technologies and post-crash response capabilities reflects a comprehensive approach to vehicle safety that influences manufacturer product development strategies and consumer purchasing decisions throughout the Australian market.

Market Outlook 2026-2034:

The Australia automotive safety systems market outlook remains highly positive, supported by strengthening regulatory requirements, advancing technology capabilities, and growing consumer safety consciousness. The continued evolution of ANCAP rating protocols and Australian Design Rules will maintain pressure on manufacturers to incorporate increasingly sophisticated safety systems as standard equipment. The progression toward connected vehicle technologies and vehicle-to-everything communication systems presents significant growth opportunities for safety system suppliers. Electric vehicle adoption is creating additional demand for safety systems designed specifically for electrified powertrains. The market generated a revenue of USD 397.18 Million in 2025 and is projected to reach a revenue of USD 1,187.53 Million by 2034, growing at a compound annual growth rate of 12.94% from 2026-2034.

Australia Automotive Safety Systems Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

System Type |

Other on Board Safety Systems |

58% |

|

Vehicle Type |

Passenger Car |

71% |

|

End User |

OEM |

63% |

|

Region |

Australia Capital Territory & New South Wales |

30% |

System Type Insights:

- Lane Departure Warning System

- Other on Board Safety Systems

The other on board safety systems dominate with a market share of 58% of the total Australia automotive safety systems market in 2025.

Other on board safety systems segment encompasses a comprehensive range of integrated safety technologies including autonomous emergency braking, adaptive cruise control, blind spot detection, rear cross-traffic alert, forward collision warning, and parking assistance systems. The dominance of this segment reflects the automotive industry's shift toward holistic safety solutions that combine multiple technologies into unified safety packages rather than standalone features.

The increasing sophistication of sensor fusion technologies enables these integrated systems to provide comprehensive environmental awareness and automated intervention capabilities. Manufacturers increasingly offer bundled safety packages that incorporate multiple complementary technologies, enhancing overall vehicle safety performance while simplifying consumer purchasing decisions. The regulatory emphasis on autonomous emergency braking and other active safety features continues driving investment in this segment.

Vehicle Type Insights:

- Passenger Car

- Commercial Vehicle

The passenger car leads with a share of 71% of the total Australia automotive safety systems market in 2025.

Passenger vehicles represent the primary market segment for automotive safety systems, driven by the substantial volume of personal vehicle sales and stringent regulatory requirements applicable to light vehicles. According to reports, Mahindra Automotive confirmed all upcoming passenger models in Australia will include ADAS features as standard safety technology. Consumer demand for advanced safety features has become a significant factor influencing vehicle purchasing decisions, with ANCAP safety ratings serving as key reference points for Australian car buyers seeking maximum occupant protection.

The competitive dynamics of the passenger car market encourage manufacturers to differentiate through safety technology offerings, with premium and mid-range vehicles increasingly featuring comprehensive ADAS packages as standard equipment. The growing popularity of SUVs and crossover vehicles within the passenger car segment creates additional demand for safety systems designed to address the specific characteristics of these vehicle types, including enhanced pedestrian protection and advanced braking systems.

End User Insights:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

The OEM dominates with a market share of 63% of the total Australia automotive safety systems market in 2025.

Original equipment manufacturers represent the dominant channel for automotive safety systems distribution, reflecting the fundamental requirement for factory-integrated safety technologies to meet regulatory compliance and achieve optimal ANCAP ratings. In December 2025, the all‑new 2026 Toyota Hilux earned a five‑star ANCAP rating, with Toyota Safety Sense and integrated active safety systems standard across most variants, highlighting OEM leadership in delivering non‑retrofit safety technology. The complexity of modern safety systems necessitates tight integration with vehicle control architectures, favoring OEM installation during vehicle manufacturing processes.

Mandatory safety requirements under Australian Design Rules ensure consistent demand through OEM channels as manufacturers must equip new vehicles with specified safety technologies. The increasing standardization of advanced driver assistance systems as standard equipment across vehicle model ranges reinforces OEM channel dominance. Strategic partnerships between vehicle manufacturers and safety system suppliers facilitate technology development and ensure seamless integration of sophisticated safety solutions.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The Australia Capital Territory & New South Wales exhibits a clear dominance with a 30% share of the total Australia automotive safety systems market in 2025.

Australia Capital Territory & New South Wales combined regional market benefits from the highest population concentration in Australia, substantial vehicle registration volumes, and strong economic activity supporting new vehicle purchases. Sydney represents the largest metropolitan vehicle market in Australia, with high consumer awareness of vehicle safety and willingness to invest in advanced safety technologies. The concentration of corporate fleets and commercial vehicle operations in this region generates consistent demand for safety-equipped vehicles.

Government road safety initiatives and infrastructure investments in New South Wales support the adoption of advanced vehicle safety technologies. The region's diverse driving conditions, ranging from urban congestion to regional highways, create demand for comprehensive safety systems addressing multiple driving scenarios. Strong dealer networks and service infrastructure ensure effective distribution and support for vehicles equipped with sophisticated safety technologies.

Market Dynamics:

Growth Drivers:

Why is the Australia Automotive Safety Systems Market Growing?

Stringent Government Regulations and Safety Mandates

The Australian government's commitment to road safety through mandatory vehicle safety standards serves as the primary market driver. In 2025, the government introduced a new Australian Design Rule requiring Acoustic Vehicle Alerting Systems (AVAS) on all new electric, hybrid, and hydrogen vehicles to improve pedestrian safety at low speeds, marking a first‑of‑its‑kind safety mandate aimed at reducing silent EV crash risks. These regulations mandate specific safety technologies as standard equipment, ensuring consistent demand regardless of economic conditions. The estimated benefits include preventing hundreds of fatalities and thousands of serious injuries, providing clear public policy justification for continued regulatory advancement in vehicle safety requirements.

ANCAP Safety Rating Influence on Consumer Purchasing Decisions

The Australasian New Car Assessment Program exerts substantial influence on vehicle purchasing decisions throughout Australia. In November 2025, ANCAP announced eCall systems will feature in 2026–2028 assessments, promoting connected safety tech for top-tier ratings. With the vast majority of new vehicles sold carrying ANCAP ratings, and most consumers preferring five-star rated vehicles, manufacturers face strong incentives to maximize safety technology content. The program's evolving testing protocols continually raise the bar for safety performance, requiring manufacturers to incorporate increasingly sophisticated technologies to achieve top ratings. This consumer-driven demand mechanism complements regulatory requirements in driving market growth for advanced safety systems.

Technological Advancements in Sensor and Processing Capabilities

Continuous advancement in sensor technologies, processing capabilities, and artificial intelligence enables increasingly sophisticated safety systems that deliver enhanced protection and functionality. At Auto Shanghai 2025, Bosch unveiled a new generation of ADAS radar sensors with its own system‑on‑chip (SoC) and advanced multi‑purpose cameras, demonstrating real‑world next‑gen sensor and processing innovations for assisted and automated driving. Improvements in radar, camera, and LiDAR sensors provide more accurate environmental perception, while advanced computing platforms enable real-time processing of complex sensor data. Machine learning algorithms enhance system performance through improved object detection and prediction capabilities. These technological developments enable safety systems to address increasingly complex driving scenarios while reducing false activation rates that could undermine consumer acceptance.

Market Restraints:

What Challenges the Australia Automotive Safety Systems Market is Facing?

High Technology Costs and Vehicle Price Impacts

The sophisticated sensor arrays, processing hardware, and software development required for advanced safety systems contribute significantly to vehicle costs. These cost pressures can impact vehicle affordability, particularly in price-sensitive market segments. Balancing comprehensive safety technology content with competitive vehicle pricing presents ongoing challenges for manufacturers operating in the Australian market.

Consumer Understanding and System Limitations Awareness

Ensuring appropriate consumer understanding of advanced driver assistance system capabilities and limitations remains challenging. Misunderstanding regarding system functionality can lead to inappropriate reliance on driver assistance features. The automotive industry and regulators continue working to establish clear communication standards regarding the intended role of these systems in supporting, rather than replacing, attentive driving.

Complexity of Repair and Calibration Requirements

The increasing complexity of automotive safety systems creates challenges for vehicle servicing and repair. Advanced sensors and cameras require precise calibration following windscreen replacement, collision repairs, or wheel alignment services. The specialized equipment and training required for proper calibration adds complexity and cost to vehicle maintenance, potentially impacting aftermarket service accessibility.

Competitive Landscape:

The Australia automotive safety systems market features a competitive landscape dominated by established global automotive safety technology suppliers serving both OEM and aftermarket channels. Major international suppliers maintain strong relationships with vehicle manufacturers operating in Australia, providing comprehensive safety system solutions integrated during vehicle production. Competition centers on technological innovation, system performance, integration capabilities, and cost efficiency. Strategic partnerships between safety system suppliers and vehicle manufacturers facilitate collaborative development of next-generation safety technologies. Companies increasingly invest in artificial intelligence and machine learning capabilities to enhance system functionality. The market also features specialized providers focusing on specific technology areas such as camera systems, radar sensors, or software platforms, creating opportunities for technology partnerships and supply chain collaboration.

Recent Developments:

- In August 2025, Tesla has officially launched its Full Self-Driving (Supervised) system in Australia and New Zealand, offering a 30-day free trial to new buyers. The rollout marks one of the region’s most significant autonomous safety system deployments in 2025, expanding advanced driver-assistance capabilities and real-world supervised autonomy adoption.

Australia Automotive Safety Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | Lane Departure Warning System, Other on-Board Safety Systems |

| Vehicle Types Covered | Passenger Car, Commercial Vehicle |

| End Users Covered | OEM, Aftermarket |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia automotive safety systems market size was valued at USD 397.18 Million in 2025.

The Australia automotive safety systems market is expected to grow at a compound annual growth rate of 12.94% from 2026-2034 to reach USD 1,187.53 Million by 2034.

Other on board safety systems dominates the market with a 58% share, encompassing integrated safety technologies including autonomous emergency braking, adaptive cruise control, blind spot detection, and comprehensive driver assistance packages.

Key factors driving the Australia automotive safety systems market include stringent government regulations mandating safety features such as autonomous emergency braking, the influential role of ANCAP safety ratings in consumer purchasing decisions, continuous technological advancements in sensor and processing capabilities, and growing consumer awareness regarding vehicle safety.

Major challenges include high technology costs impacting vehicle pricing, ensuring appropriate consumer understanding of system capabilities and limitations, complexity of repair and calibration requirements for advanced safety systems, and the need for continuous technology development to meet evolving regulatory and testing standards.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)