Australia Automotive Software Market Size, Share, Trends and Forecast by Product, Vehicle Type, Application, and Region, 2025-2033

Australia Automotive Software Market Overview:

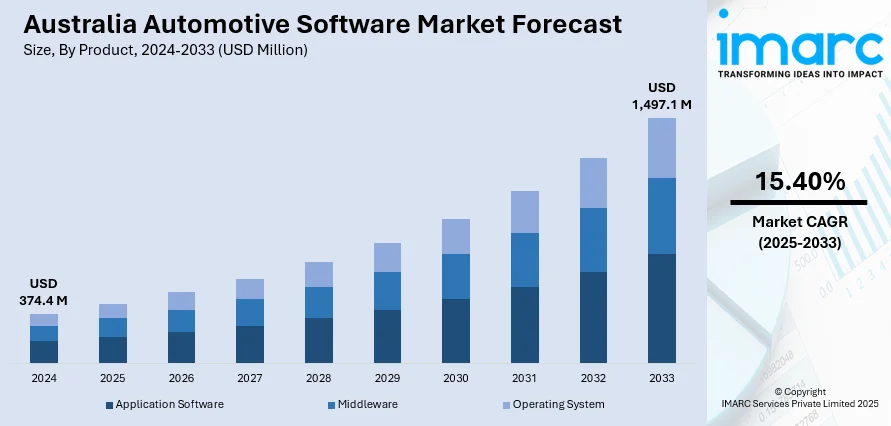

The Australia automotive software market size reached USD 374.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,497.1 Million by 2033, exhibiting a growth rate (CAGR) of 15.40% during 2025-2033. Vehicle software integration, embedded diagnostics, over-the-air updates, ADAS functionality, connected mobility, autonomous systems, AI-based vehicular applications, cloud-based analytics, regulatory compliance, government innovation policies, digital mobility services, interdisciplinary development strategies, collaboration between OEMs and software vendors, middleware integration, real-time data processing, V2X communications, predictive maintenance, system-level cybersecurity, and scalable architectures are some of the factors positively impacting the Australia automotive software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 374.4 Million |

| Market Forecast in 2033 | USD 1,497.1 Million |

| Market Growth Rate 2025-2033 | 15.40% |

Australia Automotive Software Market Trends:

Shift Toward Software-Defined Vehicle Architectures

The transition from traditional vehicle platforms to software-centric models is redefining the way value is generated in the Australian automotive industry. Original equipment manufacturers (OEMs) are increasingly investing in embedded automotive software to enable real-time analytics, predictive maintenance, and enhanced vehicle control. This evolution places software developers and system integrators at the core of the design and production process, particularly for functions related to infotainment, navigation, and user interface personalization. Such innovations support operational optimization and customer satisfaction. Geely Auto sold over 1.68 million units globally in 2023, with new energy vehicle sales up by 48.3% and exports increasing 38%. In Australia, its all-electric EX5 SUVs became available at dealerships starting March 11, 2025, with customer deliveries beginning later that month. Geely’s launch of the EX5 in Australia, powered by CEVA’s digital logistics backbone and customer-facing configurator tools, further illustrates how software-driven services are becoming central to modern automotive market strategies. As per the Australia automotive software market forecast, which highlights continued interest from OEMs in building software-first platforms across both passenger and commercial vehicle segments. These platforms require modular, scalable architectures, capable of integrating third-party APIs and managing real-time data flow between sensors and control units. This demand drives a fundamental restructuring of supply chains and internal workflows to accommodate continuous software delivery models. Another related factor is the increasing reliance on middleware and virtualization technologies. These components ensure interoperability between various systems, streamlining updates and simplifying compliance with Australian safety and environmental regulations. The Australia automotive software market growth is closely associated with this trend, as vendors offering agile, secure, and adaptable software stacks see greater market engagement and long-term partnerships forming with OEMs and suppliers.

To get more information on this market, Request Sample

Integration of Connected and Autonomous Vehicle Technologies

The emergence of connected and autonomous vehicles is transforming the automotive landscape in Australia. This evolution is being driven by both consumer expectations and institutional frameworks that emphasize safety, sustainability, and technological innovation. Software systems now manage everything from vehicle-to-everything (V2X) communications to onboard diagnostics and remote system configuration. These advancements align with the broader Australia automotive software market outlook, particularly as Australia increases funding toward electric and intelligent transport systems and digital infrastructure. The Australian Renewable Energy Agency has allocated USD 2.4 Million to EVX Australia to install 250 kerbside chargers providing 500 charge points across New South Wales, Victoria, and South Australia. This comes as the number of EV drivers reaches 300,000 and public fast chargers have doubled to over 1,800 across more than 1,000 locations nationwide. This surge in EV infrastructure investments underscores the growing demand for advanced automotive software solutions that can support seamless integration of charging networks with connected and autonomous vehicle platforms. Public and private sector collaboration is accelerating the deployment of these technologies, emphasizing the need for real-time data processing and system-level cybersecurity. Software plays a key role in enabling consistent, reliable performance in increasingly complex driving environments, and in reducing human error in high-risk scenarios. Further reinforcing this driver is the expansion of high-performance computing frameworks within vehicles. As sensor and camera arrays grow in number and complexity, the ability to process data in milliseconds becomes critical. Software’s role as a strategic asset across the automotive value chain is now widely recognized, with manufacturers adjusting development models to remain competitive in a digitally enabled environment.

Australia Automotive Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, vehicle type, and application.

Product Insights:

- Application Software

- Middleware

- Operating System

The report has provided a detailed breakup and analysis of the market based on the product. This includes application software, middleware, and operating system.

Vehicle Type Insights:

- ICE Passenger Vehicle

- ICE Light Commercial Vehicle

- ICE Heavy Commercial Vehicle

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Autonomous Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes ICE passenger vehicle, ICE light commercial vehicle, ICE heavy commercial vehicle, battery electric vehicle, hybrid electric vehicle, plug-in hybrid electric vehicle, and autonomous vehicles.

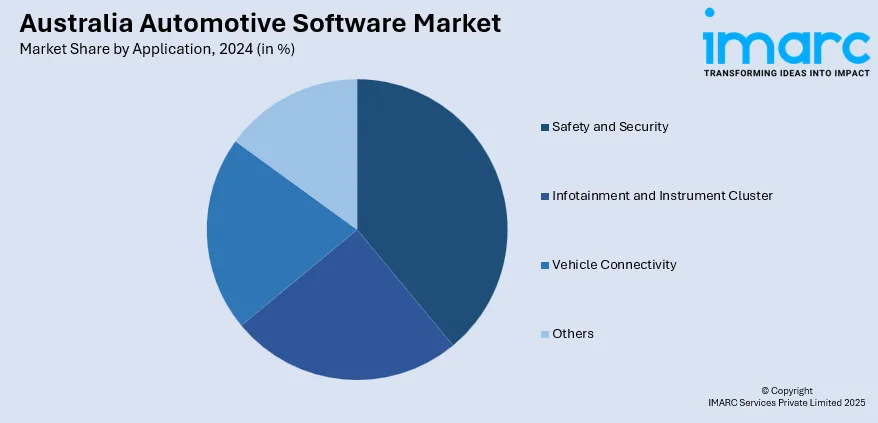

Application Insights:

- Safety and Security

- Infotainment and Instrument Cluster

- Vehicle Connectivity

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes safety and security, infotainment and instrument cluster, vehicle connectivity, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive Software Market News:

- On March 4, 2024, Perseus Operating Group of Constellation Software Inc. officially completed the acquisition of Auto-IT Pty Ltd, a Melbourne-based developer of Dealer Management System (DMS) software. With over four decades of experience, Auto-IT is a key player in the Australian automotive software market, and this acquisition marks Perseus’ tenth in the dealership software space under the Constellation Dealer Group, and deepens its footprint in the Australian DMS landscape.

Australia Automotive Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Application Software, Middleware, Operating System |

| Vehicle Types Covered | ICE Passenger Vehicle, ICE Light Commercial Vehicle, ICE Heavy Commercial Vehicle, Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle, Autonomous Vehicles |

| Applications Covered | Safety and Security, Infotainment and Instrument Cluster, Vehicle Connectivity, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automotive software market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automotive software market on the basis of product?

- What is the breakup of the Australia automotive software market on the basis of vehicle type?

- What is the breakup of the Australia automotive software market on the basis of application?

- What is the breakup of the Australia automotive software market on the basis of region?

- What are the various stages in the value chain of the Australia automotive software market?

- What are the key driving factors and challenges in the Australia automotive software?

- What is the structure of the Australia automotive software market and who are the key players?

- What is the degree of competition in the Australia automotive software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)