Australia Automotive Steering System Market Size, Share, Trends and Forecast by Type, Component, Vehicle Type, and Region, 2025-2033

Australia Automotive Steering System Market Overview:

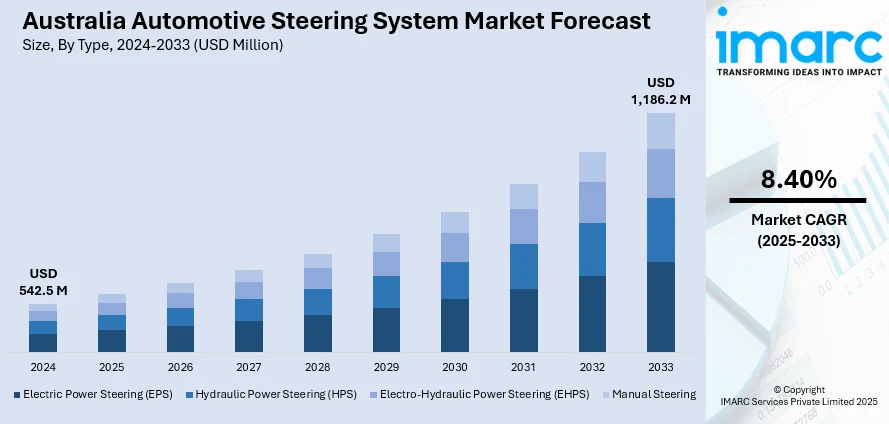

The Australia automotive steering system market size reached USD 542.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,186.2 Million by 2033, exhibiting a growth rate (CAGR) of 8.40% during 2025-2033. The market is witnessing significant growth due to rising vehicle production, stringent government safety and emission regulations, and growing consumer demand for fuel-efficient vehicles. Moreover, technological advancements like electric power steering, integration of AI in steering systems and increasing demand for electrically assisted hydraulic power steering (E-HPS) in commercial vehicles are some of the key drivers accelerating the Australia automotive steering system market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 542.5 Million |

| Market Forecast in 2033 | USD 1,186.2 Million |

| Market Growth Rate 2025-2033 | 8.40% |

Australia Automotive Steering System Market Trends:

Technological Advancements in Steering Systems

The Australian automotive steering system market is significantly influenced by technological innovations, notably the shift from traditional hydraulic systems to electric power steering (EPS). EPS enhances fuel efficiency and provides better steering responsiveness, aligning with the growing consumer demand for advanced driving experiences. Additionally, the integration of steer-by-wire technology and advanced driver-assistance systems (ADAS) in vehicles propels market growth. These technologies eliminate mechanical linkages, offering improved vehicle control and safety. As Australian consumers increasingly prefer vehicles equipped with modern features, manufacturers are investing in research and development (R&D) to introduce cutting-edge steering solutions, thereby driving the Australia automotive steering system market growth. For instance, in March 2025, Lexus is poised to introduce a piece of Formula 1 to Australian streets, as its innovative yoke steering wheel is scheduled to debut in vehicles later this year. The high-end automobile brand has confirmed plans to implement its contentious F1-style steering wheel system into the upcoming RZ electric models.

To get more information on this market, Request Sample

Rising Vehicle Production and Sales

Australia's automotive industry is experiencing a steady increase in vehicle production and sales, which directly boosts the demand for steering systems. The surge in popularity of SUVs and light commercial vehicles (utes) among Australian consumers necessitates robust and efficient steering mechanisms to ensure safety and performance. This trend compels manufacturers to focus on developing steering systems that can handle the dynamics of larger vehicles. Furthermore, the growing adoption of electric vehicles (EVs) in Australia, which predominantly utilize EPS due to its compatibility with electric drivetrains, is further creating a positive impact on the market outlook.

Consumer Demand for Enhanced Driving Comfort and Fuel Efficiency

Australian consumers are increasingly prioritizing driving comfort and fuel efficiency in their vehicle choices. Modern steering systems, particularly EPS, offer smoother handling and require less physical effort, enhancing the overall driving experience. Additionally, EPS systems contribute to better fuel economy by reducing engine load compared to traditional hydraulic systems. This dual benefit of comfort and efficiency resonates with consumer preferences, leading to higher adoption rates of vehicles equipped with advanced steering technologies. Manufacturers responding to these consumer demands are investing in the development of innovative steering solutions, thereby propelling the market share.

Australia Automotive Steering System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, and vehicle type.

Type Insights:

- Electric Power Steering (EPS)

- Hydraulic Power Steering (HPS)

- Electro-Hydraulic Power Steering (EHPS)

- Manual Steering

The report has provided a detailed breakup and analysis of the market based on the type. This includes electric power steering (EPS), hydraulic power steering (HPS), electro-hydraulic power steering (EHPS), and manual steering.

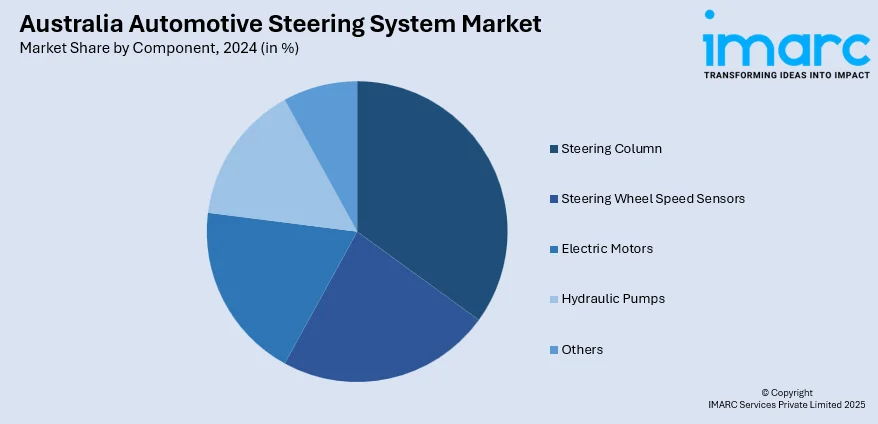

Component Insights:

- Steering Column

- Steering Wheel Speed Sensors

- Electric Motors

- Hydraulic Pumps

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes steering column, steering wheel speed sensors, electric motors, hydraulic pumps, and others.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, light commercial vehicles, and heavy commercial vehicles.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive Steering System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electric Power Steering (EPS), Hydraulic Power Steering (HPS), Electro-Hydraulic Power Steering (EHPS), Manual Steering |

| Components Covered | Steering Column, Steering Wheel Speed Sensors, Electric Motors, Hydraulic Pumps, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automotive steering system market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automotive steering system market on the basis of type?

- What is the breakup of the Australia automotive steering system market on the basis of component?

- What is the breakup of the Australia automotive steering system market on the basis of vehicle type?

- What is the breakup of the Australia automotive steering system market on the basis of region?

- What are the various stages in the value chain of the Australia automotive steering system market?

- What are the key driving factors and challenges in the Australia automotive steering system market?

- What is the structure of the Australia automotive steering system market and who are the key players?

- What is the degree of competition in the Australia automotive steering system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive steering system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive steering system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive steering system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)