Australia Automotive Suspension Systems Market Size, Share, Trends and Forecast by Component Type, Type, Vehicle Type, and Region, 2025-2033

Australia Automotive Suspension Systems Market Overview:

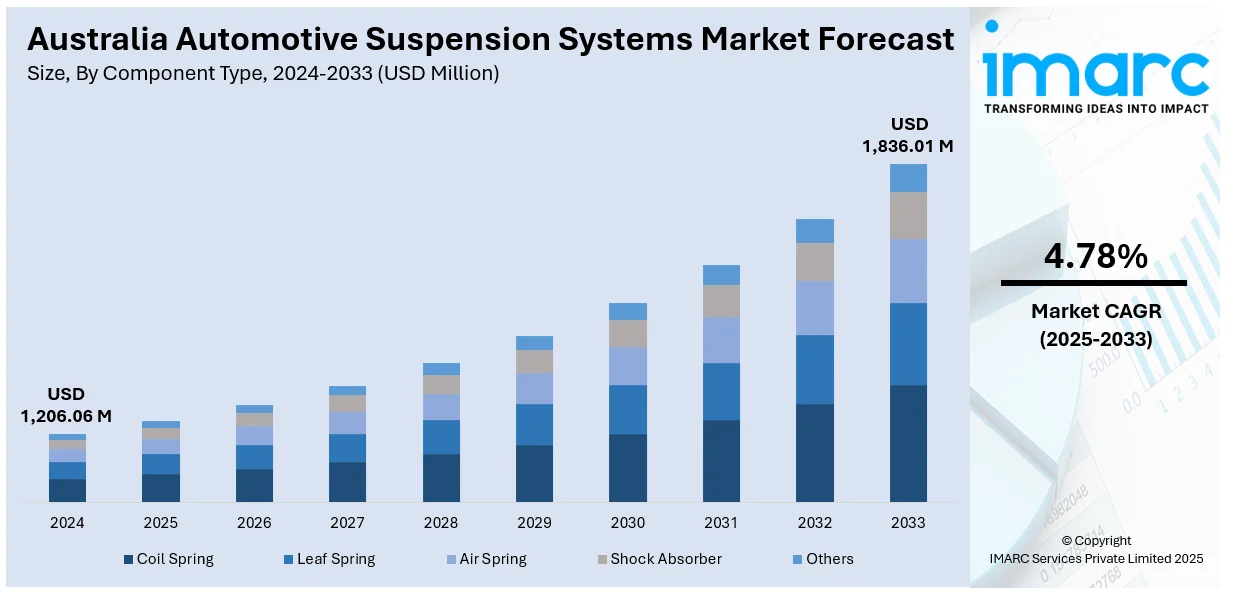

The Australia automotive suspension systems market size reached USD 1,206.06 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,836.01 Million by 2033, exhibiting a growth rate (CAGR) of 4.78% during 2025-2033. The market in Australia is driven by the growing demand for enhanced vehicle comfort, safety, and technological innovation. Individuals seek better ride quality, stability, and handling, encouraging manufacturers to adopt advanced suspension technologies like air suspension, adaptive dampers, and artificial intelligence (AI)-driven systems for improved performance and efficiency. The Australia automotive suspension systems market share is projected to expand as users prioritize advanced features, leading to greater adoption of cutting-edge suspension technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,206.06 Million |

| Market Forecast in 2033 | USD 1,836.01 Million |

| Market Growth Rate 2025-2033 | 4.78% |

Australia Automotive Suspension Systems Market Trends:

Growing Demand for Vehicle Comfort and Safety

Rising individual awareness about comfort and safety aspects in vehicles is a key factor strengthening the automotive suspension systems market in Australia. As the demand for enhanced driving experiences increases, buyers are looking for cars that provide exceptional ride comfort, stability, and handling. Auto manufacturers are reacting by incorporating sophisticated suspension systems that minimize vibrations, improve vehicle stability, and offer a more seamless, enjoyable ride. This trend is especially noticeable in the passenger car category, where safety and comfort are the main concerns. As a result, there is an increased employment of technologies like air suspension, adaptive dampers, and electronically managed suspensions. A significant instance of this is GWM's strategy in 2025, as the company is adapting its vehicles particularly for Australian conditions. Concentrating on calibration of suspension and advanced driver assistance systems (ADAS) software. GWM engineers are evaluating these updates on vehicles such as the H6 GT PHEV and Cannon Alpha PHEV, scheduled for launch in 2025. GWM seeks to enhance the driving experience by customizing suspension systems to local requirements, meeting the growing demands of users for improved comfort, handling, and safety. This transition towards more sophisticated suspension technologies demonstrates the wider industry emphasis on addressing the requirements for performance and safety in contemporary vehicles, further propelling the expansion of the automotive suspension systems market in the area.

To get more information on this market, Request Sample

Technological Advancements in Suspension Systems

Technological progress is also propelling the Australia automotive suspension systems market growth, as ongoing improvements boost performance, efficiency, and the overall driving experience. A major trend is the emergence of adaptive and semi-active suspension systems that automatically modify to varying road conditions. These systems enhance ride comfort and also promote vehicle durability by minimizing wear on other parts, while additionally improving fuel efficiency. Manufacturers are progressively concentrating on incorporating electronics, sensors, and AI technologies into suspension systems to satisfy consumer preferences and regulatory standards. A notable instance of this innovation is MG's anticipated introduction of its luxury electric vehicle (EV) brand, IM Motors, scheduled for the end of June 2025. The brand will showcase cutting-edge ‘Digital Chassis’ technology, incorporating an intelligent air suspension system that can adapt to three different ride heights with a vertical adjustment of 45mm. This system adjusts automatically to road conditions, guaranteeing maximum comfort and clearance. Additionally, it operates alongside AI-powered vehicle motion control and four-wheel steering, ensuring enhanced handling and a more comfortable ride. By integrating these advanced suspension technologies, MG is meeting the growing demand for more intelligent and efficient vehicle systems that improve both comfort and safety, thereby supporting the growth of the market in Australia.

Australia Automotive Suspension Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component type, type, and vehicle type.

Component Type Insights:

- Coil Spring

- Leaf Spring

- Air Spring

- Shock Absorber

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes coil spring, leaf spring, air spring, shock absorber, and others.

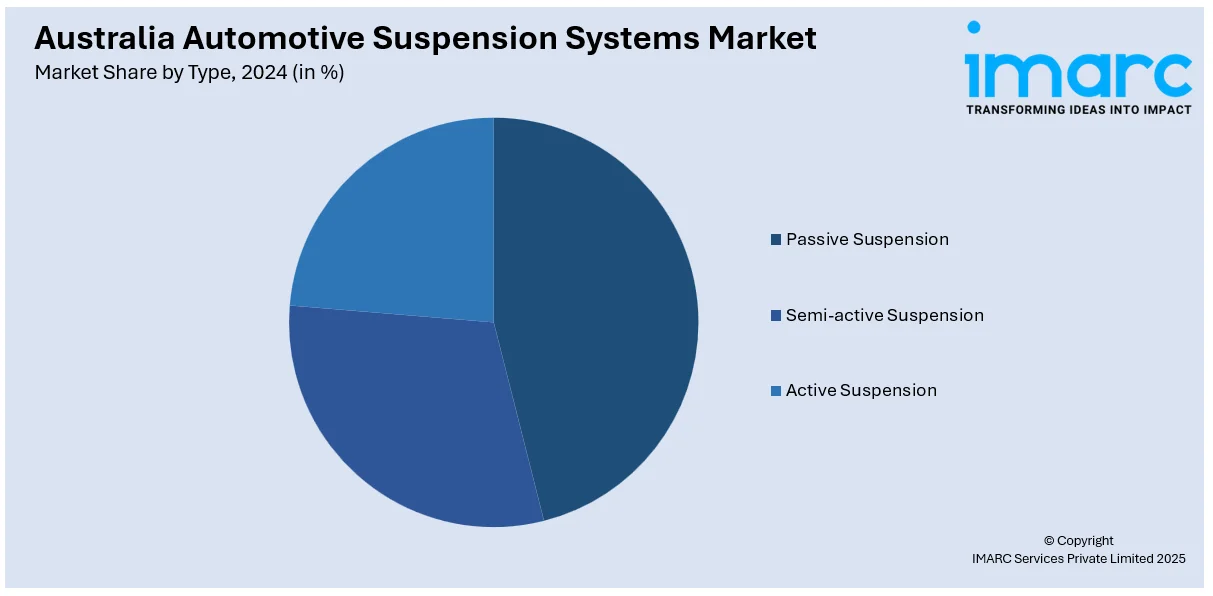

Type Insights:

- Passive Suspension

- Semi-active Suspension

- Active Suspension

The report has provided a detailed breakup and analysis of the market based on the type. This includes passive suspension, semi-active suspension, and active suspension.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars and commercial vehicles.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Automotive Suspension Systems Market News:

- In December 2024, Geely announced that its first model for Australia, the EX5 electric SUV, will launch in the first half of 2025 with locally tuned suspension and ADAS. This move aimed to avoid issues faced by other brands that launched without adapting to Australian road conditions.

- In October 2024, Lovells, Australia's largest automotive suspension manufacturer, announced a $1 million investment in a new R&D facility in South Australia to develop next-generation suspension and towing products, including gross combination mass (GCM) upgrade systems. Lovells also plans to expand operations in Newcastle and Adelaide.

Australia Automotive Suspension Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Coil Spring, Leaf Spring, Air Spring, Shock Absorber, Others |

| Types Covered | Passive Suspension, Semi-active Suspension, Active Suspension |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia automotive suspension systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia automotive suspension systems market on the basis of component type?

- What is the breakup of the Australia automotive suspension systems market on the basis of type?

- What is the breakup of the Australia automotive suspension systems market on the basis of vehicle type?

- What is the breakup of the Australia automotive suspension systems market on the basis of region?

- What are the various stages in the value chain of the Australia automotive suspension systems market?

- What are the key driving factors and challenges in the Australia automotive suspension systems?

- What is the structure of the Australia automotive suspension systems market and who are the key players?

- What is the degree of competition in the Australia automotive suspension systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia automotive suspension systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia automotive suspension systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia automotive suspension systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)