Australia Avocado Oil Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2026-2034

Australia Avocado Oil Market Summary:

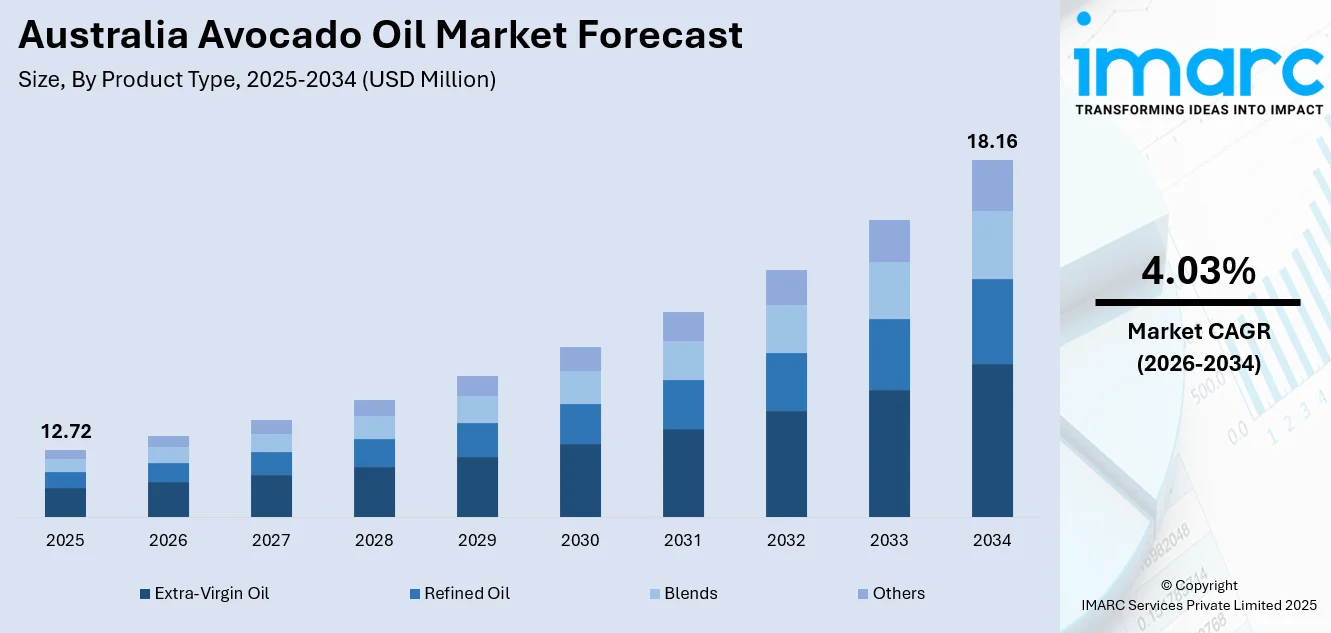

The Australia avocado oil market size was valued at USD 12.72 Million in 2025 and is projected to reach USD 18.16 Million by 2034, growing at a compound annual growth rate of 4.03% from 2026-2034.

The market is experiencing steady expansion driven by rising health awareness among Australian consumers, who increasingly favor premium oils rich in monounsaturated fats and antioxidants for their cardiovascular benefits. The growing adoption of Mediterranean diets and plant-based eating patterns has positioned avocado oil as a clean-label alternative in both culinary and personal care applications. Domestic producers have strengthened their competitive positioning through cold-press processing techniques that maintain nutritional integrity, supporting premium product differentiation in international export markets, thereby expanding the Australia avocado oil market share.

Key Takeaways and Insights:

- By Product Type: Extra-virgin oil dominates the market with approximately 46% revenue share in 2025, driven by its superior nutritional profile from cold-pressed extraction without heat or chemicals.

- By Application: Food and beverages lead with a share of 50% in 2025, owing to avocado oil's versatility across salad dressings, cooking, and high-heat applications.

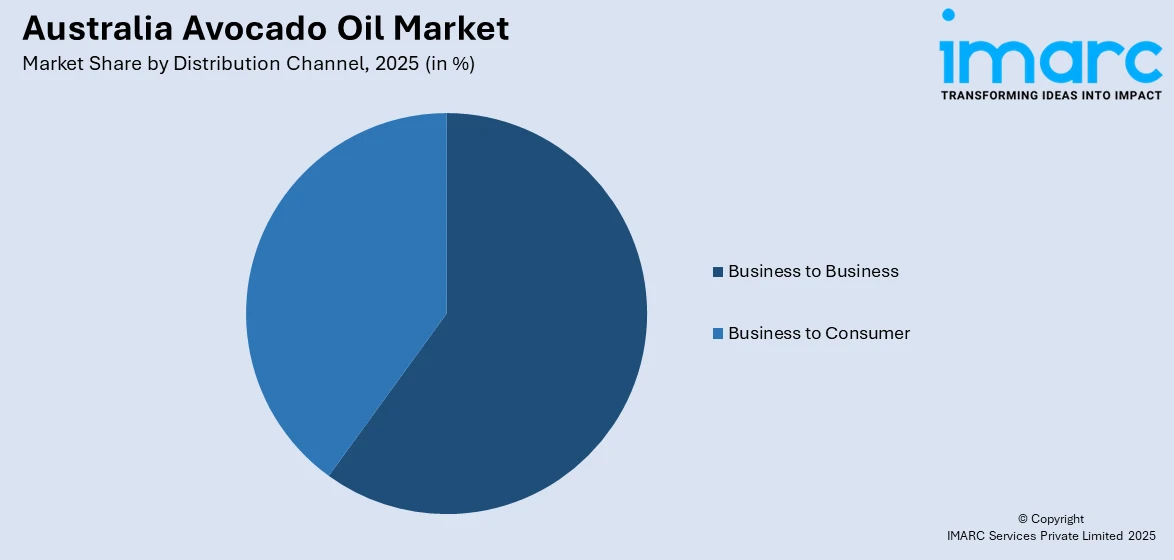

- By Distribution Channel: Business to business accounts for 56% share of the market in 2025, reflecting strong wholesale demand from food service operators and manufacturing sectors.

- By Region: Australia Capital Territory and New South Wales lead the market with a share of 25% in 2025, supported by concentrated processing infrastructure and metropolitan distribution networks.

- Key Players: The Australia avocado oil market exhibits moderate competitive intensity, with both international premium brands and emerging domestic producers competing across price segments while emphasizing quality certifications and sustainable sourcing practices.

To get more information on this market Request Sample

Australia's market benefits from the nation's reputation for premium agricultural products and stringent food safety standards, which enhance export competitiveness in Asian and Middle Eastern markets. The domestic market has witnessed accelerated growth as health-conscious consumers replace traditional cooking oils with avocado oil for its high smoke point and heart-healthy fatty acid composition. Cold-press technology adoption by Australian processors has enabled superior flavor retention and nutrient preservation, creating differentiation in premium retail and food service channels. Australian avocado producers generated 131,385 tonnes of avocados for FY2024/25, worth AUD$794 million, this further provided stable raw material availability for oil processing operations. This supply chain reliability, combined with technological innovations in precision agriculture and artificial intelligence (AI)-powered orchard management systems deployed across Australian farms, has strengthened the foundation for sustained market growth over the forecast period.

Australia Avocado Oil Market Trends:

Health-Conscious Consumption Elevating Premium Positioning

Australian consumers are increasingly prioritizing nutritional attributes when selecting cooking oils, with avocado oil gaining prominence for its high monounsaturated fat content and vitamin E concentration. This trend has been amplified by growing awareness of cardiovascular disease prevention and the Mediterranean diet's health benefits. The shift toward clean-label products has positioned avocado oil as a preferred alternative to highly processed seed oils, particularly among urban populations seeking minimally processed food options. As reported by ABC News, avocado producers in Western Australia are expecting an unprecedented harvest and are aiming for the Chinese market, wishing to obtain export approval shortly. During the 2024/25 season, Western Australia produced 36,889 metric tons of avocados, accounting for 28% of the national total of 131,385 metric tons. In the 2023/24 season, Australia's overall avocado production reached a record peak of 150,913 metric tons National production is expected to rise further, extending 171,163 metric tons over the next two seasons.

Export Growth Driving Domestic Production Infrastructure

Australia's avocado export success has created downstream opportunities for value-added oil production, as international demand for premium Australian agricultural products strengthens market positioning. Asian and Middle Eastern markets have emerged as key destinations for both fresh avocados and derived products including oil, driven by rising disposable incomes and health consciousness in these regions. Australian avocado exports climbed 106% in 2023/24, with Australian Avocados winning Marketing Campaign of the Year at the Asia Fruit Awards in September 2024 for a campaign spanning seven countries and partnering with over 30 retail chains. This international visibility has indirectly supported avocado oil demand by reinforcing Australia's reputation as a reliable supplier of premium produce, enabling domestic processors to capture higher margins in export markets where quality differentiation commands pricing power.

Technology Adoption Enhancing Production Efficiency

Australian avocado growers are increasingly deploying precision agriculture technologies and AI-powered orchard management systems to optimize yield quality and harvest timing, directly benefiting oil production through improved fruit quality and processing efficiency. Advanced cold-press extraction techniques preserve nutritional compounds and flavor profiles, creating product differentiation in premium market segments. In January 2025, Bonsai Robotics secured USD 15 Million in Series A funding to expand its AI-powered orchard management system across tree nut and avocado orchards in the U.S. and Australia, deploying over 40 units with access to insights from over 500,000 acres of operations. These technological advancements enable Australian producers to maintain consistent oil quality while minimizing waste, supporting scalable growth in both domestic and export markets where product consistency is essential for long-term buyer relationships.

Market Outlook 2026-2034:

The Australia avocado oil market is positioned for sustained growth over the forecast period, driven by structural shifts in consumer dietary preferences and expanding application opportunities across food, cosmetic, and nutraceutical sectors. Rising health consciousness among Australian consumers will continue supporting premium positioning for extra virgin cold-pressed avocado oil, particularly as clinical evidence around cardiovascular benefits gains broader awareness through mainstream health communications. The market generated a revenue of USD 12.72 Million in 2025 and is projected to reach a revenue of USD 18.16 Million by 2034, growing at a compound annual growth rate of 4.03% from 2026-2034. Technological innovations in processing efficiency and sustainable agriculture practices will further strengthen Australia's competitive positioning in international markets, where quality assurance and traceability command premium pricing from discerning consumers across Asia-Pacific and Middle Eastern regions.

Australia Avocado Oil Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Extra-Virgin Oil |

46% |

|

Application |

Food and Beverages |

50% |

|

Distribution Channel |

Business to Business |

56% |

|

Region |

Australia Capital Territory & New South Wales |

25% |

Product Type Insights:

- Extra-Virgin Oil

- Refined Oil

- Blends

- Others

Extra-virgin oil dominates with a market share of 46% of the total Australia avocado oil market in 2025.

Extra-virgin avocado oil maintains market leadership through its superior nutritional profile and sensory characteristics preserved during cold-press extraction without heat or chemical solvents. This processing method retains high concentrations of monounsaturated fats, particularly oleic acid, along with vitamin E, lutein, and phytosterols that deliver cardiovascular and antioxidant benefits valued by health-conscious consumers. The oil's vibrant emerald green color and distinctive flavor profile, characterized by nutty, buttery, and fruity notes, create premium positioning in specialty retail and food service channels. Its exceptional smoke point around 500°F makes extra-virgin avocado oil versatile for both high-heat cooking applications and raw uses in dressings and finishing oils, addressing diverse consumer needs across culinary categories.

Australian producers have invested heavily in cold-press technology and quality assurance protocols to maintain the extra-virgin designation, which requires strict adherence to free fatty acid and peroxide value standards. The premium pricing commanded by extra-virgin variants reflects both higher production costs from lower extraction yields and consumer willingness to pay for perceived quality differentiation. As awareness of refined oil processing methods and potential nutrient degradation grows among Australian consumers, demand for minimally processed extra-virgin oils has strengthened, reinforcing this segment's market dominance and supporting continued investment in cold-press infrastructure by domestic processors seeking to capture higher-margin opportunities.

Application Insights:

- Food and Beverages

- Cosmetics

- Pharmaceuticals

- Others

Food and beverages lead with a share of 50% of the total Australia avocado oil market in 2025.

The food and beverages application dominates avocado oil consumption through widespread adoption in home cooking, food service operations, and packaged food manufacturing. Avocado oil's high smoke point and neutral-to-mild flavor profile make it exceptionally versatile across cooking methods including frying, sautéing, grilling, and baking, while its clean-label credentials align with consumer preferences for recognizable ingredients in processed foods. The oil's compatibility with both cold applications like salad dressings and marinades, and high-heat cooking positions it as a multi-purpose kitchen staple replacing traditional vegetable oils in health-conscious households.

Premium restaurants and cafes have increasingly featured avocado oil in menu offerings, leveraging its perceived health halo to differentiate culinary experiences and justify premium pricing. Food manufacturers incorporate avocado oil into products ranging from dairy-free spreads to ready-to-eat meals, capitalizing on its clean-label appeal and functional performance in extending shelf life through oxidative stability. The growing Australian plant-based food sector has further accelerated demand, as vegan and vegetarian product formulations often feature avocado oil for its favorable fatty acid composition and neutral taste that complements diverse flavor profiles without overwhelming delicate ingredients.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Business to Business

- Business to Consumer

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Stores

- Others

Business to business exhibits a clear dominance with a 56% share of the total Australia avocado oil market in 2025.

The business-to-business distribution channel dominates market share through bulk supply arrangements serving food service operators, food manufacturers, cosmetic formulators, and wholesale distributors. This channel enables efficient volume movement and competitive pricing through direct relationships between producers and commercial end-users, bypassing retail markup structures. Food service establishments including restaurants, cafes, catering operations, and institutional kitchens purchase avocado oil in bulk formats, driven by growing menu adoption of health-oriented cooking oils and consumer demand for premium ingredients in dining experiences.

Food manufacturers source avocado oil through B2B channels for incorporation into packaged goods including snack foods, sauces, dressings, and plant-based products, where bulk purchasing enables cost optimization while meeting clean-label formulation objectives. Cosmetic and personal care manufacturers access avocado oil through specialized B2B suppliers offering technical specifications and quality certifications required for skincare, hair care, and therapeutic applications. The channel's efficiency in serving large-volume customers with customized packaging, delivery schedules, and pricing arrangements creates structural advantages over retail distribution, particularly for commercial buyers prioritizing supply chain reliability and procurement cost management over consumer-facing branding.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory and New South Wales lead with a share of 25% of the total Australia avocado oil market in 2025.

The Australia Capital Territory and New South Wales region leads market concentration through its combination of production infrastructure, processing capacity, and proximity to major metropolitan consumption centers. The region hosts significant food processing facilities and distribution networks serving Sydney's population, creating efficient supply chains for both domestic retail and export logistics. Processing operations in areas including Bomen have access to renewable energy infrastructure, with facilities like Riverina Oils operating on solar power since November 2024, reducing operational costs and supporting sustainability positioning valued by premium market segments.

The region's established agricultural supply chains and food manufacturing ecosystems enable efficient sourcing of avocado fruit from multiple growing regions while maintaining processing consistency and quality control. Proximity to Port Botany facilitates export logistics for Australian avocado oil destined for Asian markets, where freight time sensitivity affects product freshness and shelf life considerations. The concentration of health-conscious consumers in Sydney and Canberra metropolitan areas drives strong retail demand for premium avocado oil through specialty food retailers, organic grocers, and farmers' markets, creating sustainable local market foundations that complement export-oriented production strategies employed by regional processors.

Market Dynamics:

Growth Drivers:

Why is the Australia Avocado Oil Market Growing?

Rising Health Awareness Driving Premium Oil Adoption

Australian consumers increasingly recognize the cardiovascular benefits of monounsaturated fatty acids found abundantly in avocado oil, leading to dietary substitution away from saturated fats and highly processed seed oils. The government is also promoting healthy lifestyle habits among the masses. In 2025, the State Public Health Plan 2025-2030 (SPHP) has been initiated to enhance the health, wellbeing, and quality of life for residents of Western Australia. The strategy has been created to assist local authorities, non-profit organisations, communities, and advocates in making choices regarding public health planning. The Mediterranean diet's growing adoption in Australia has positioned avocado oil as a compatible premium ingredient, aligning with evidence-based nutritional guidance from health authorities recommending increased unsaturated fat consumption for heart disease prevention. Consumer education around inflammatory responses triggered by oxidized cooking oils has elevated demand for oils with superior oxidative stability, a characteristic where avocado oil demonstrates scientific advantages through its antioxidant content and resistance to degradation under heat exposure.

Expansion of Plant-Based Diets and Clean-Label Products

The accelerating shift toward vegetarian, vegan, and flexitarian dietary patterns in Australia has created sustained demand for plant-derived ingredients that support diverse nutritional needs without animal-source products. Avocado oil serves as a versatile ingredient in plant-based food formulations, providing essential fatty acids and functional properties in dairy alternatives, meat substitutes, and ready-to-eat meals targeting health-conscious consumers. The oil's neutral flavor profile enables seamless integration into diverse culinary applications without overwhelming delicate plant-based flavors, a critical consideration for product developers seeking broad consumer acceptance. IMARC Group predicts that the Australia plant-based food market is projected to attain USD 981.3 Million by 2033.

Growing Application Diversity Across Non-Food Sectors

Avocado oil's functional properties increasingly attract attention from cosmetic formulators and pharmaceutical developers seeking natural ingredient alternatives that align with clean beauty movements and botanical medicine trends. The oil's exceptional skin penetration characteristics, antioxidant content, and emollient properties make it valuable across anti-aging skincare formulations, therapeutic massage oils, and dermatological preparations. Pharmaceutical applications leverage specific bioactive compounds for wound healing, anti-inflammatory preparations, and nutrient delivery systems. This application diversification expands addressable markets beyond traditional culinary segments, creating multiple demand streams that collectively enhance market stability and growth trajectories while reducing vulnerability to single-sector consumption fluctuations. In 2025, Bubble Skincare launched in Australia to provide its hero products like the Slam Dunk Hydrating Moisturiser for fulfilling the skincare needs of customers. The Slam Dunk Hydrating Moisturiser is formulated for normal to dry skin and sells for only $28 (50ml). Essential components such as aloe leaf juice calm and safeguard, while Vitamin E and avocado oil condition the skin, providing 24-hour moisture and minimizing redness.

Market Restraints:

What Challenges the Australia Avocado Oil Market is Facing?

Price Volatility and Raw Material Supply Constraints

Avocado crop yields exhibit significant seasonal and weather-driven variability, creating raw material pricing fluctuations that challenge oil processors' margin management and long-term supply agreements with commercial buyers. Australia's geographic concentration of avocado production in regions susceptible to extreme weather events including storms, cyclones, and drought conditions introduces supply risk that can disrupt processing operations and force temporary price adjustments affecting market competitiveness. The timing of avocado harvest peaks and processing capacity constraints during high-volume periods may result in fruit quality degradation if immediate processing is unavailable, reducing oil yield and quality while increasing waste disposal costs for producers unable to efficiently manage seasonal supply surges through expanded storage or processing infrastructure.

Competition from Established Premium Oil Categories

Olive oil's entrenched market position in Australian kitchens and strong Mediterranean diet associations create consumer preference inertia that challenges avocado oil's market penetration despite comparable nutritional profiles. Canola oil's established domestic production infrastructure, lower retail pricing, and widespread availability in mainstream retail channels provide cost-competitive alternatives for price-sensitive consumers prioritizing functional cooking performance over premium nutritional positioning. The proliferation of specialty oils including walnut, macadamia, and flaxseed targeting health-conscious consumers fragments the premium oil market, intensifying competition for limited shelf space in specialty retailers and constraining avocado oil's visibility among consumers exploring alternative cooking oil options.

Limited Processing Capacity and Specialized Infrastructure Requirements

Cold-press extraction technology demands significant capital investment and technical expertise that constrains entry of new processors into premium avocado oil production, limiting market supply expansion and maintaining concentrated industry structure. Specialized storage requirements for maintaining oil quality including dark, temperature-controlled environments increase logistics costs and complexity throughout the supply chain from processing through retail distribution. The extended product development timelines required for establishing cold-press operations, validating quality standards, and securing organic or other premium certifications create barriers to rapid market expansion, potentially constraining supply growth relative to emerging consumer demand in domestic and export markets where Australian producers seek to capitalize on quality positioning opportunities.

Competitive Landscape:

The Australia avocado oil market demonstrates a moderately concentrated competitive structure characterized by established international premium brands competing alongside emerging domestic producers across differentiated price and quality segments. Market participants emphasize distinct positioning strategies including organic certification, sustainable sourcing practices, cold-press processing methodologies, and regional origin claims to capture consumer attention in increasingly crowded specialty oil categories. Premium brands leverage sophisticated marketing communications highlighting health benefits, culinary versatility, and quality assurance protocols to justify higher retail pricing and build brand loyalty among health-conscious consumers willing to invest in perceived superior products. Domestic producers capitalize on local agricultural heritage, traceability, and reduced food miles messaging to differentiate against imported alternatives while establishing distribution partnerships with specialty retailers, organic grocers, and food service operators seeking Australian-origin products for menu differentiation and sustainability credentials appealing to environmentally conscious consumers.

Australia Avocado Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Extra-Virgin Oil, Refined Oil, Blends, Others |

| Applications Covered | Food and Beverages, Cosmetics, Pharmaceuticals, Others |

| Distribution Channels Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia avocado oil market size was valued at USD 12.72 Million in 2025.

The Australia avocado oil market is expected to grow at a compound annual growth rate of 4.03% from 2026-2034 to reach USD 18.16 Million by 2034.

Extra-virgin oil dominates with 46% market share in in 2025, driven by its superior nutritional profile achieved through cold-pressed extraction without heat or chemical solvents, preserving monounsaturated fats, vitamin E, lutein, and phytosterols while maintaining distinctive flavor characteristics and high smoke point functionality valued by health-conscious consumers.

Key factors driving the Australia avocado oil market include rising health awareness among consumers prioritizing cardiovascular benefits and clean-label products, expansion of plant-based diets and Mediterranean eating patterns increasing demand for premium vegetable oils, and adoption of cold-press processing technology by Australian producers enabling superior quality differentiation in domestic and export markets.

Major challenges include price volatility from seasonal avocado crop variations affecting raw material costs and processing margins, intense competition from established premium oils including olive and canola oil with stronger market penetration and consumer familiarity, and limited cold-press processing capacity requiring specialized infrastructure investment that constrains rapid supply expansion to meet emerging consumer demand across domestic and international markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)