Australia Baby Apparel Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Age Group, End User, and Region, 2025-2033

Australia Baby Apparel Market Overview:

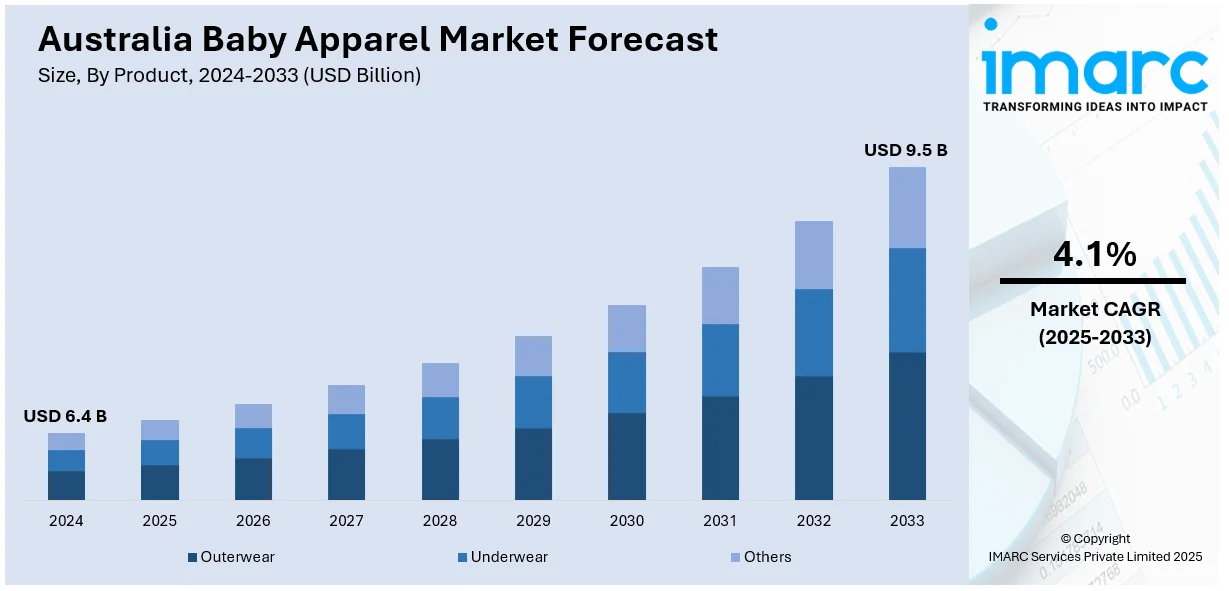

The Australia baby apparel market size reached USD 6.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.1% during 2025-2033. The market is fueled by increasing demand for organic and sustainable materials, rising adoption of e-commerce, and greater parental concern for health and safety. Additionally, inflating disposable levels, rising social media influence and emerging fashion trends is positively impacting the market dynamics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.4 Billion |

| Market Forecast in 2033 | USD 9.5 Billion |

| Market Growth Rate 2025-2033 | 4.1% |

Australia Baby Apparel Market Trends:

Eco-Friendly and Sustainable Baby Clothes

Sustainability has emerged as a prominent factor providing favorable impact on the Australia baby apparel market outlook, with parents increasingly concerned about the health of their children as well as the planet. Therefore, numerous brands are moving toward sustainable production, incorporating organic cotton, bamboo clothes, and eco-friendly dyes. These textiles are not just safer for babies' delicate skin but also less environmentally taxing. Customers are increasingly conscious of the carbon footprint of fast fashion, even in infantwear, and are choosing high-quality, long-lasting clothing that will last longer. Circular fashion initiatives like resale websites and clothing rental services are also on the rise, reducing waste and increasing garment lifecycles. Brands that espouse eco-friendly values and supply chain transparency are winning the confidence and loyalty of contemporary Australian parents. As sustainability becomes a trend across industries, it is also becoming an essential differentiator in the competitive baby clothing market in Australia.

To get more information on this market, Request Sample

Rise of E-Commerce and Digital Influence

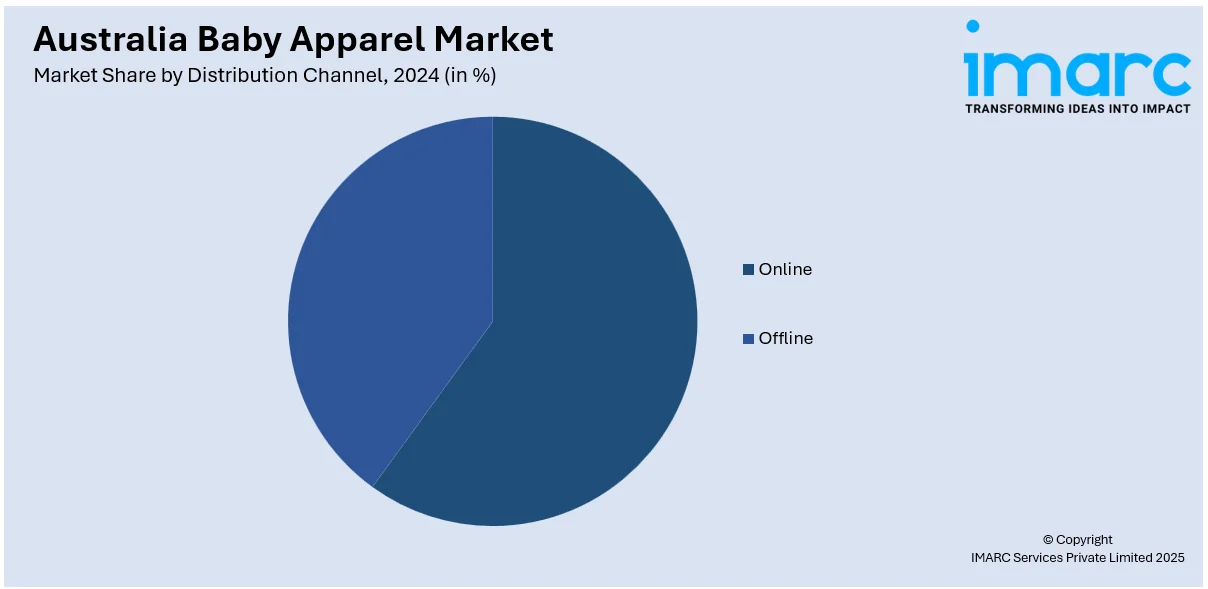

E-commerce has quickly changed the manner in which Australian consumers purchase baby clothing. With hectic lifestyles and growing digital literacy, today's parents are increasingly opting for online channels over physical retail outlets. According to the Australian and New Zealand Ecommerce Report 2024 published by IAB Australia and Pureprofile, online shopping has emerged as a major component of the retail environment in Australia and New Zealand. The report shows that 83% of online consumers in Australia and 77% of those in New Zealand shop online every month. Online stores and mobile applications offer convenience, more product assortment, and exposure to international brands, which is why most favor them. Besides, social media advertising on websites such as Instagram, Facebook, and Pinterest also greatly determine what to buy. Influencer marketing and bloggers promote baby apparel trends, fashion tips, and product testing, which resonate heavily with new parents. Flash sales, targeted advertising, and user-generated content increase brand interaction and stimulate sales. Retailers increasingly spend on smooth digital shopping experiences, including size charts, reviews, and simple returns. The online boom in the Australia baby apparel market share is set to continue, fueled by tech-savvy consumers and continued innovation in user-friendly, mobile-optimized shopping platforms.

Personalization and Custom Baby Apparel

Personalization is emerging as a significant trend in the Australian baby clothing market, with parents looking for meaningful, unique pieces for their babies. Customized outfits, name embroidery, birthdate prints, and themed collections are popular, particularly for milestone occasions such as birthdays, christenings, and baby showers. The trend is driven by the emotional attachment parents have with their child's clothing and a need to be different in a social media age. Customized baby apparel also come in as gift items, possessing a sentimental value that mass-produced clothing may not. Retailers are catching up on this by making customization simple through online tools where customers can choose colors, style, font, and graphics. The growing popularity of small enterprises and niche brands that offer custom baby clothing has also been key to making the trend catch on. As more new parents enter the market—containing generations who value and profess individuality—the demand for personalized baby clothing will continue to increase steadily, further fueling the Australia baby apparel market growth.

Australia Baby Apparel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type of product, material, distribution channel, age group, and end user.

Product Insights:

- Outerwear

- Underwear

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes outerwear, underwear, and others.

Material Insights:

- Cotton

- Wool

- Silk

The report has provided a detailed breakup and analysis of the market based on the material. This includes cotton, wool, and silk.

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Age Group Insights:

- 0-12 Months

- 12-24 Months

- 2-3 Years

A detailed breakup and analysis of the market based on the age group has also been provided in the report. This includes 0-12 months, 12-24 months, and 2-3 years.

End User Insights:

- Girls

- Boys

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes girls and boys.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Baby Apparel Market News:

- In July 2024, the baby care retailer, Huggies, in conjunction with Caprice Australia, has launched its first baby clothing collection in Australia, extending its brand into the clothing market. Bodysuit and pant pairs, rompers, coveralls, and long and short-sleeved bodysuits are among the items in the Huggies Babywear range.

- In August 2024, a clothing brand for infants, Isla and Mimi, has launched its own line of environment-friendly baby clothes that honor their Indigenous roots. Featuring a range of cozy and distinctively styled clothing for girls ages 0–3 that is 100% organic cotton and Global Organic Textile Standard-certified, the online collection 'Gingham Blooms' highlights the family's heritage while incorporating designs influenced by Aboriginal campsite paintings.

Australia Baby Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Outerwear, Underwear, Others |

| Materials Covered | Cotton, Wool, Silk |

| Distribution Channels Covered | Online, Offline |

| Age Groups Covered | 0-12 Months, 12-24 Months, 2-3 Years |

| End Users Covered | Girls, Boys |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia baby apparel market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia baby apparel market on the basis of product?

- What is the breakup of the Australia baby apparel market on the basis of material?

- What is the breakup of the Australia baby apparel market on the basis of distribution channel?

- What is the breakup of the Australia baby apparel market on the basis of age group?

- What is the breakup of the Australia baby apparel market on the basis of end user?

- What is the breakup of the Australia baby apparel market on the basis of region?

- What are the various stages in the value chain of the Australia baby apparel market?

- What are the key driving factors and challenges in the Australia baby apparel market?

- What is the structure of the Australia baby apparel market and who are the key players?

- What is the degree of competition in the Australia baby apparel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia baby apparel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia baby apparel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia baby apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)