Australia Baby Food and Infant Formula Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Australia Baby Food and Infant Formula Market Overview:

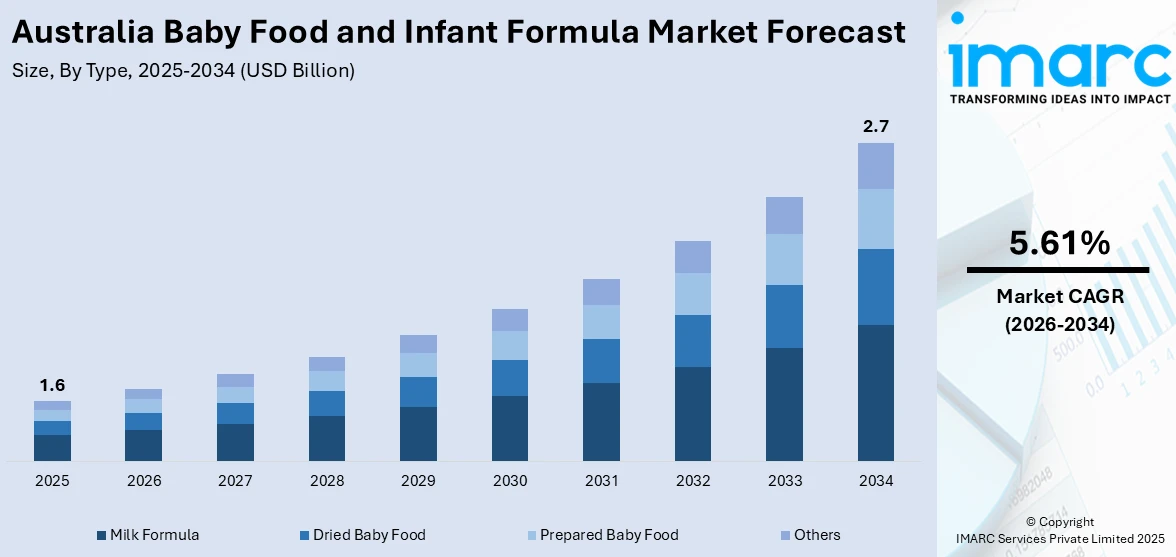

The Australia baby food and infant formula market size reached USD 1.6 Billion in 2025. Looking forward, the market is projected to reach USD 2.7 Billion by 2034, exhibiting a growth rate (CAGR) of 5.61% during 2026-2034. The market is driven by rising health-conscious parenting, increased female workforce participation, growing demand for organic and premium products, and the need for convenient, nutritious feeding solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.6 Billion |

| Market Forecast in 2034 | USD 2.7 Billion |

| Market Growth Rate 2026-2034 | 5.61% |

Key Trends of Australia Baby Food and Infant Formula Market:

Rising Health-Conscious Parenting Trends

Australian parents are increasingly prioritizing health, nutrition, and ingredient transparency when selecting baby food and infant formula. This shift is driven by greater awareness about the long-term impact of early nutrition on child development and immunity, which is fueling the Australia baby food and infant formula market share. Parents actively seek products free from preservatives, artificial additives, and genetically modified ingredients. Consumers across urban and regional territories are strongly attracted to brands supplying clean-label organic fortified products. The availability of health information online and parenting communities, and pediatric nutrition websites drives consumers to choose health-focused products. The novelty of manufacturers develops nutritious components and beneficial properties to satisfy consumers who want to make knowledgeable selections about their purchases.

To get more information on this market Request Sample

Increased Female Workforce Participation

The growing number of Australian women joining or rejoining the workforce after childbirth has significantly influenced the demand for convenient and reliable infant nutrition solutions. Parents who work need quick feeding solutions that maintain both nutritional value and eating quality. This has led to a steady rise in demand for ready-to-eat baby foods and infant formulas that are easy to prepare, store, and carry, driving the Australia baby food and infant formula market growth. Convenience is key, especially in dual-income households and among urban consumers. As a result, manufacturers are focusing on packaging innovations, longer shelf lives, and single-serve formats. This trend is also driving the growth of premium and specialized formulas tailored for different developmental stages and dietary needs.

Demand for Organic and Premium Products

Australia’s baby food market is experiencing a surge in demand for organic, natural, and premium offerings. Parents are willing to pay more for products that promise safety, traceability, and nutritional excellence. This is especially true among millennial parents, who often view organic products as an investment in their child's health. The “premiumization” trend has expanded to include plant-based formulas, allergen-free foods, and functional products with added probiotics, DHA, and essential vitamins. Local and international brands are responding by launching high-quality, sustainably sourced, and ethically produced lines, which creates a positive impact on the Australia baby food and infant formula market outlook. This demand supports innovation and competition, fueling ongoing growth in both physical retail and online sales channels.

Growth Drivers of Australia Baby Food and Infant Formula Market:

Urbanization and Lifestyle Changes

Urbanization in Australia has led to significant changes in lifestyle, especially for young families. With both parents often balancing work and hectic schedules, convenience has become a crucial consideration in selecting food for infants. Ready-to-feed, pre-packaged, and simple-to-prepare baby food products are increasingly favored, as they save time while ensuring balanced nutrition. Parents are looking for options that merge convenience with safety, hygiene, and nutritional quality, prompting companies to broaden their offerings in ready-to-use formats. This trend is reinforced by the availability of these products in supermarkets, pharmacies, and online platforms, making them easily reachable. As a result, urbanization and evolving lifestyles continue to heavily influence purchasing behaviors, providing ongoing growth opportunities in the Australia baby food and infant formula market.

Innovation and Product Diversification

Product innovation and diversification are essential factors driving the growth of the baby food industry in Australia. Manufacturers are launching advanced formulations enriched with probiotics, prebiotics, and vital micronutrients to enhance immunity and gut health. The increasing demand for plant-based alternatives is also transforming the market, catering to lactose-intolerant infants and vegan families. Furthermore, the significance of sustainable packaging solutions is on the rise as parents grow more eco-conscious, favoring products that align with responsible consumption. This heightened focus on innovation is directly stimulating the Australia baby food and infant formula market demand, as parents are attracted to distinct products that emphasize safety, health, and sustainability. By addressing various dietary needs, environmental issues, and changing consumer preferences, innovation ensures that brands stay competitive and fosters long-term market growth in the region.

Rising Disposable Income

The increase in disposable income among Australian households positively impacts consumer spending on premium baby food and infant formula products. With greater purchasing power, parents are willing to spend more on organic, fortified, and specialized nutrition options tailored to meet their infants' specific health needs. The adoption of imported and premium brands is also rising, as families equate these with higher safety, quality, and nutritional standards. This readiness to invest in trusted and value-added products illustrates a growing focus on quality rather than cost regarding infant nutrition. Additionally, online retail and specialty stores are enhancing access to premium international brands for Australian consumers, further boosting sales. As disposable incomes continue to grow, this factor will remain a vital element of the ongoing expansion of the Australia baby food and infant formula market.

Opportunities of Australia Baby Food and Infant Formula Market:

E-Commerce Growth

The rise of e-commerce platforms is creating significant opportunities within the Australia baby food and infant formula market. Parents are turning to online shopping for its convenience, wider selection of products, and home delivery options. Subscription services that provide regular deliveries of infant formula and baby food are becoming increasingly popular, ensuring a steady supply and fostering brand loyalty. Online channels enable brands to connect directly with consumers, showcase product advantages, and present competitive pricing. Digital marketing combined with personalized suggestions boosts consumer confidence and influences purchasing behavior. Additionally, cross-border e-commerce facilitates access for Australian consumers to international brands that may not be easily found in stores. This expanding digital landscape is poised to be a crucial factor driving market growth in the years ahead.

Sustainable Packaging Solutions

Sustainability is emerging as a significant opportunity, with eco-friendly packaging affecting consumer choices in Australia. Parents are now more focused on minimizing plastic waste and supporting brands that practice environmental responsibility. Companies are responding with packaging options that are recyclable, biodegradable, and reusable, which align with consumer expectations and enhance brand reputation. These initiatives offer distinct differentiation in a competitive market where both product safety and sustainability are highly valued. According to Australia baby food and infant formula market analysis, eco-friendly packaging is becoming a key factor in many purchase decisions, especially among younger, environmentally conscious parents. Aligning product development with sustainability objectives appeals to consumers and positions companies advantageously in light of evolving regulations that emphasize green practices.

Rural Market Penetration

Rural and regional areas of Australia represent an untapped growth opportunity for baby food and infant formula manufacturers. While urban centers continue to be the largest markets, establishing strong distribution networks in less populated regions can help in reaching new consumer bases. Enhanced logistics and digital retail avenues are facilitating product access for families in remote locations, ensuring availability and reliability. Furthermore, an increasing awareness regarding infant nutrition in regional communities is driving demand for safe and convenient baby food options. Companies that tailor pricing strategies, packaging sizes, and marketing efforts to meet the needs of rural consumers can capitalize on these advantages. By closing the accessibility gap and diversifying beyond urban markets, brands can strengthen their national presence and secure long-term growth prospects in the Australia baby food and infant formula market.

Challenges of Australia Baby Food and Infant Formula Market:

Strict Regulatory Standards

The baby food and infant formula sector in Australia operates under some of the strictest regulations worldwide to ensure the safety and nutrition of infants. Although these standards safeguard consumers, they also present significant challenges for manufacturers. Companies are required to adhere to stringent guidelines concerning product composition, labeling, testing, and quality assurance, which complicates operations and increases costs. Frequent changes to regulatory frameworks add to the challenges, necessitating ongoing monitoring and adjustments. Smaller companies, in particular, struggle with limited resources to manage compliance effectively. For multinational corporations, aligning global product offerings with local Australian regulations can delay product introductions and stifle innovation. These obstacles make regulatory compliance a crucial aspect influencing growth in the Australian baby food and infant formula market.

High Competition

The Australian baby food and infant formula market is marked by strong competition between local producers and international brands. While this competitive landscape offers consumers a wide range of choices and encourages innovation, it presents significant obstacles for manufacturers. Fierce competition limits pricing flexibility, compelling companies to find a balance between affordability and profitability. Established global brands frequently control prominent shelf space, making it challenging for smaller or emerging businesses to achieve visibility. Furthermore, increasing consumer interest in organic and premium products intensifies the quest for differentiation. Companies must invest significantly in marketing, product innovation, and brand trust to maintain market share. However, such investments often lead to tighter profit margins. Consequently, thriving in this crowded market necessitates effective positioning, ongoing product development, and robust customer engagement strategies.

Increasing Raw Material Costs

Variations in raw material costs are a constant hurdle for the Australian baby food and infant formula industry. Ingredients like dairy, grains, fruits, and packaging materials are vital to infant nutrition, and changes in their supply and pricing can disrupt supply chains significantly. Global economic trends, climate change, and trade limitations frequently contribute to these price variations, exerting pressure on manufacturers' profit margins. Companies often find themselves absorbing extra costs or passing them on to consumers, potentially impacting affordability and sales volumes. Additionally, sustainability demands and the pursuit of organic components further increase sourcing expenses. Navigating these challenges requires effective procurement strategies, supply chain diversification, and the establishment of long-term relationships with dependable suppliers. Rising input costs continue to present a significant barrier to achieving consistent profitability throughout the industry.

Australia Baby Food and Infant Formula Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Milk Formula

- Dried Baby Food

- Prepared Baby Food

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes milk formula, dried baby food, prepared baby food, and others.

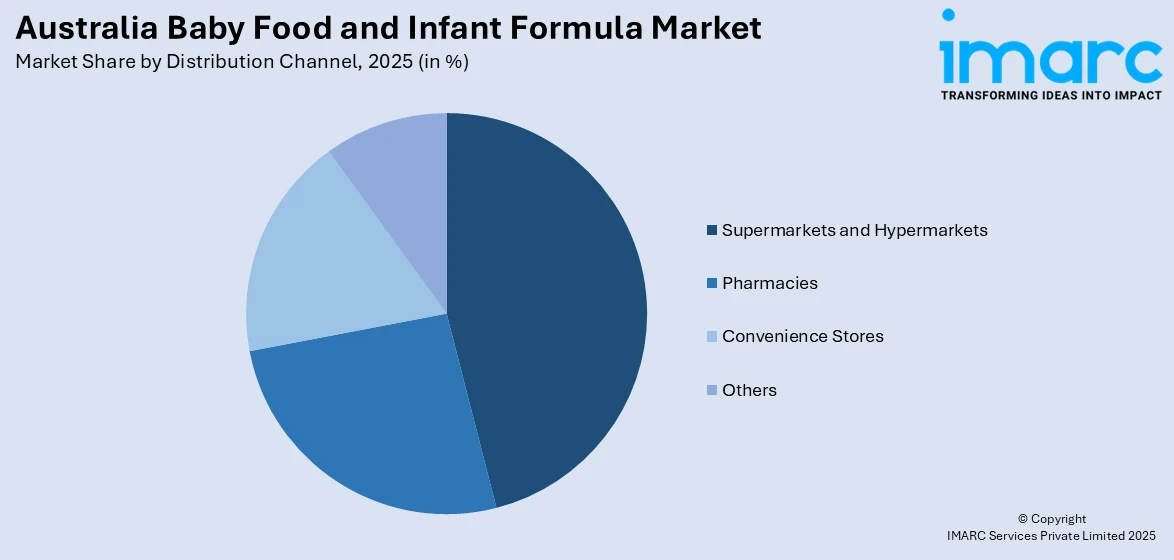

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, pharmacies, convenience stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Baby Food and Infant Formula Market News:

- In October 2024, the Australian firm Coco2 revealed the introduction of what is said to be the world’s first infant formula made from coconuts. The formula is said to have taken a decade to create in partnership with the University of Queensland, parents, and medical experts. It is claimed to closely replicate the nutritional and health advantages of breast milk, containing vital vitamins, minerals, and fatty acids.

- In April 2024, OTHER NUTRITION HOLDINGS INC. declared the official commercial introduction of its groundbreaking ‘Follow-On’ formula for babies aged 6-12 months in Australia. The commercial release of the Follow-On formula for babies in Australia is an important milestone since it is the first country, alongside New Zealand, where the Company’s new infant formula can be sold. Moreover, the Company reveals the introduction of its Toddler Drink for children aged 12-36 months in Australia.

Australia Baby Food and Infant Formula Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Milk Formula, Dried Baby Food, Prepared Baby Food, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia baby food and infant formula market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia baby food and infant formula market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia baby food and infant formula industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The baby food and infant formula market in Australia was valued at USD 1.6 Billion in 2025.

The Australia baby food and infant formula market is projected to exhibit a compound annual growth rate (CAGR) of 5.61% during 2026-2034.

The Australia baby food and infant formula market is expected to reach a value of USD 2.7 Billion by 2034.

The market is witnessing rising demand for organic, clean-label, and allergen-free products, reflecting parents’ growing focus on natural nutrition. Digital retail adoption is accelerating, supported by subscription-based services. Additionally, sustainable packaging innovations and personalized nutrition solutions are emerging as notable trends shaping consumer preferences.

Increasing female workforce participation and urban lifestyle changes are boosting reliance on convenient, ready-to-use baby food options. Rising disposable incomes encourage spending on premium and imported brands. Expanding healthcare awareness about early childhood nutrition and supportive distribution networks across supermarkets, pharmacies, and online channels further drive market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)