Australia Baby Healthcare Products Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, End User, and Region, 2025-2033

Australia Baby Healthcare Products Market Overview:

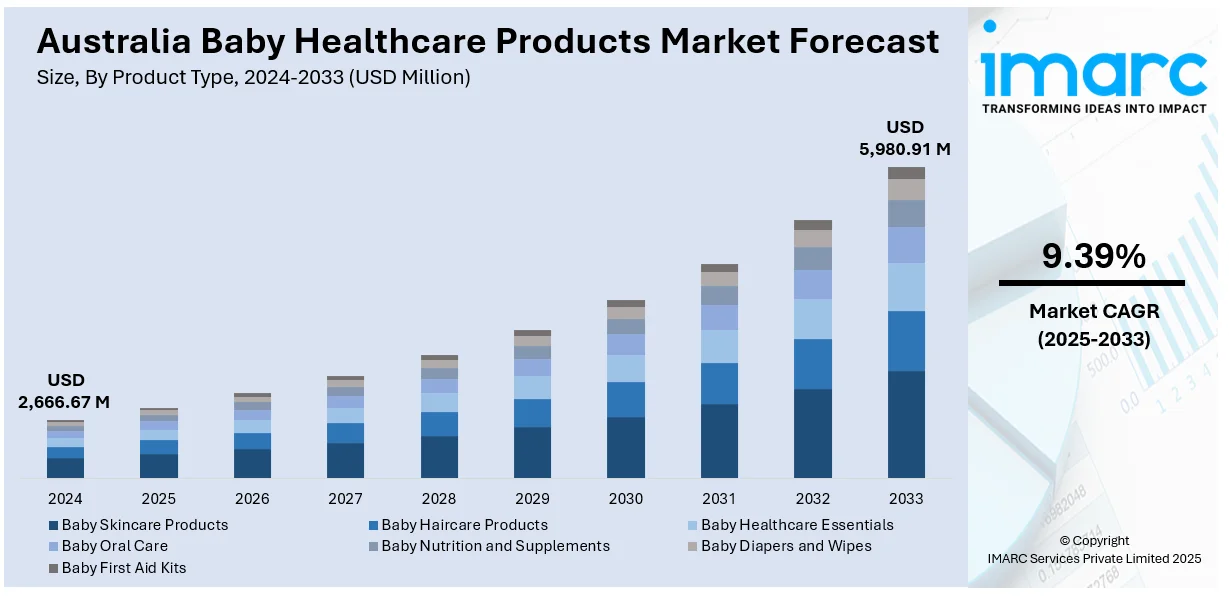

The Australia baby healthcare products market size reached USD 2,666.67 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,980.91 Million by 2033, exhibiting a growth rate (CAGR) of 9.39% during 2025-2033. The market is driven by parents who prioritize their kids' health and well-being, rapid growth of e-commerce facilitating the availability of baby healthcare products, and growing demand for organic and green products. Development of customized baby products designed to meet their unique needs of various skin types, sensitivities, and allergies are also contributing positively to the Australia baby healthcare products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,666.67 Million |

| Market Forecast in 2033 | USD 5,980.91 Million |

| Market Growth Rate 2025-2033 | 9.39% |

Australia Baby Healthcare Products Market Trends:

Increased Demand for Organic and Natural Products

The most notable trend in the Australian baby healthcare products market is the growing demand for organic and natural products. Today, parents are increasingly aware of the ingredients in the products that they apply to their infants. As a result, they are consciously looking for products that are devoid of synthetic chemicals, artificial perfumes, and toxic additives. This shift is driving the demand for product lines that utilize plant-based, biodegradable, and hypoallergenic materials. Many brands are reformulating their products to meet these consumer needs by highlighting clean labels and transparency. Additionally, consumers are concerned about environmentally friendly sourcing of materials and have a preference for sustainable packaging. These factors are contributing positively to the Australia baby healthcare products market growth.

To get more information on this market, Request Sample

Growth of E-Commerce and Digital Retailing Channels

The rise of e-commerce websites and digital retailing has transformed the mode of shopping by Australian consumers for baby healthcare items. Parents today prefer the convenience of buying products online, especially for regular purchases such as baby wipes, diapers, and skincare. Online shopping has the added benefit of product reviews, expert opinions, and subscription services that provide regular delivery. This convenience is influencing consumers to try more types of niche and premium products that might not be found in brick-and-mortar stores. Furthermore, brands are utilizing social media and influencer marketing to engage with tech-savvy parents, establish credibility, and provide customized product recommendations. Parenting-specific mobile apps and websites further facilitate the shopping experience. As digitalization intensifies in Australia's retail landscape, the baby healthcare market is conforming at a quicker pace with fast delivery models, better online customer support, and data-driven marketing strategies.

Innovation and Personalization in Product Offerings

Innovation and customization are emerging as key trends in the Australian market for baby healthcare products. As the focus shifts toward tailored solutions, businesses are developing products designed to meet the unique needs of various skin types, sensitivities, and allergies. Customized options in baby skincare products, nutritional supplements, and hygiene solutions are becoming more common, allowing parents to select items based on their child's individual health profile. Packaging is also evolving with innovation, featuring designs that enhance usability, such as single-hand dispensers, resealable packages, and travel-sized options. Additionally, baby care appliances are now incorporating smart technology that enables real-time tracking and information sharing with medical practitioners. As competition in the market intensifies, brands are investing more in research and development to remain at the forefront with products that offer better performance, enhanced safety, and user-friendly features. This emphasis on personalization and improved functionality is setting new standards for quality and convenience within the baby healthcare sector in Australia.

Australia Baby Healthcare Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, distribution channel, and end user.

Product Type Insights:

- Baby Skincare Products

- Baby Haircare Products

- Baby Healthcare Essentials

- Thermometers

- Nasal Aspirators

- Teething Products

- Baby Oral Care

- Baby Nutrition and Supplements

- Baby Diapers and Wipes

- Baby First Aid Kits

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby skincare products, baby haircare products, baby healthcare essentials (thermometers, nasal aspirators, and teething products), baby oral care, baby nutrition and supplements, baby diapers and wipes, and baby first aid kits.

Age Group Insights:

- 0 – 6 Months

- 6 – 12 Months

- 1 – 3 Years

A detailed breakup and analysis of the market based on the age group has also been provided in the report. This includes 0-6 months, 6-12 months, and 1-3 years.

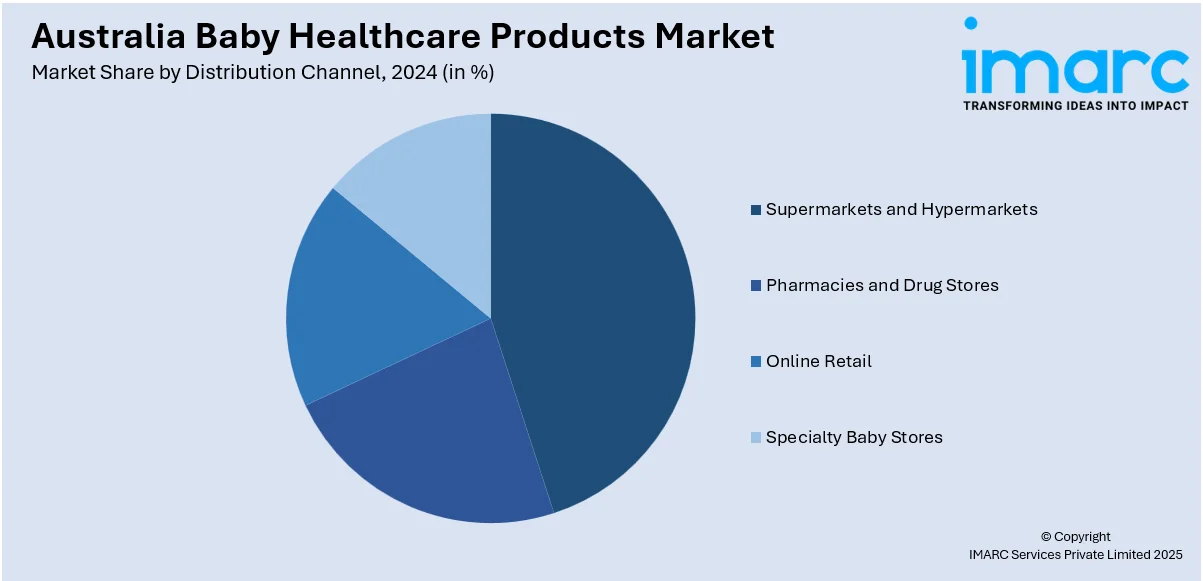

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Pharmacies and Drug Stores

- Online Retail

- Specialty Baby Stores

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, pharmacies and drug stores, online retail, and specialty baby stores.

End User Insights:

- Household

- Hospitals and Clinics

- Daycare Centers

The report has provided a detailed breakup and analysis of the market based on the end user. This includes household, hospitals and clinics, and daycare centers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Baby Healthcare Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Age Groups Covered | 0-6 Months, 6-12 Months, 1-3 Years |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies and Drug Stores, Online Retail, Specialty Baby Stores |

| End Users Covered | Household, Hospitals and Clinics, Daycare Centers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia baby healthcare products market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia baby healthcare products market on the basis of product type?

- What is the breakup of the Australia baby healthcare products market on the basis of age group?

- What is the breakup of the Australia baby healthcare products market on the basis of distribution channel?

- What is the breakup of the Australia baby healthcare products market on the basis of end user?

- What is the breakup of the Australia baby healthcare products market on the basis of region?

- What are the various stages in the value chain of the Australia baby healthcare products market?

- What are the key driving factors and challenges in the Australia baby healthcare products?

- What is the structure of the Australia baby healthcare products market and who are the key players?

- What is the degree of competition in the Australia baby healthcare products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia baby healthcare products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia baby healthcare products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia baby healthcare products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)