Australia Battery Energy Management Systems Market Size, Share, Trends and Forecast by Component, Topology, Battery Type, Application, and Region, 2025-2033

Australia Battery Energy Management Systems Market Overview:

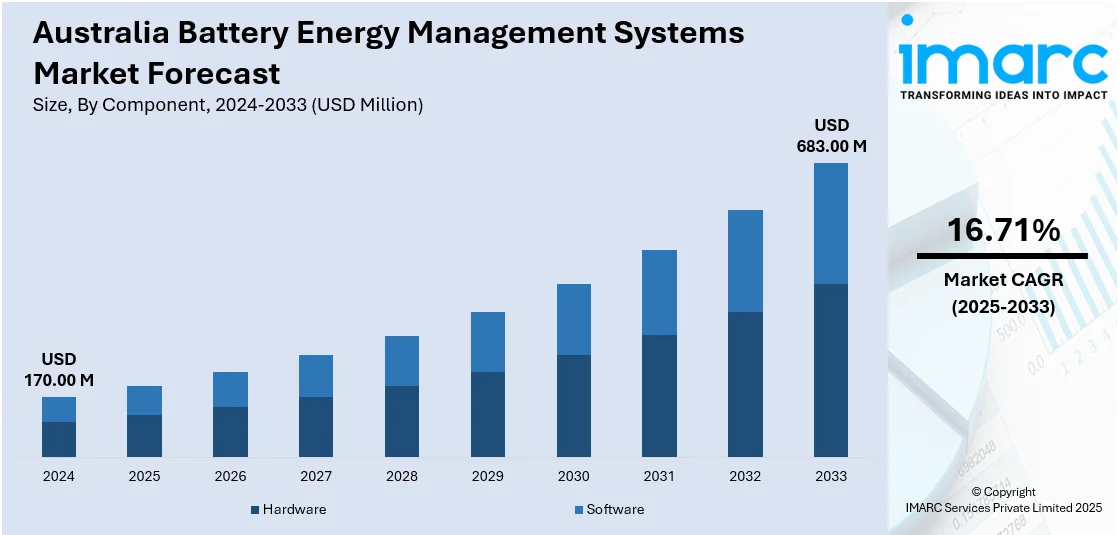

The Australia battery energy management systems market size reached USD 170.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 683.00 Million by 2033, exhibiting a growth rate (CAGR) of 16.71% during 2025-2033. At present, the growing adoption of renewable energy is driving the demand for efficient energy storage solutions. Besides this, rising electric vehicle (EV) production, which is creating the need for reliable battery usage, monitoring, and control, is contributing to the expansion of the Australia battery energy management systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 170.00 Million |

| Market Forecast in 2033 | USD 683.00 Million |

| Market Growth Rate 2025-2033 | 16.71% |

Australia Battery Energy Management Systems Market Trends:

Rising utilization of renewable energy

The growing adoption of renewable energy is positively influencing the market in Australia. As per the information provided on the official website of the Australian government, in 2024, Australia experienced a significant expansion in renewable energy generation capacity, achieving a record addition of 7.5 Gigawatts (GW) throughout the year. As more households, businesses, and utilities are installing solar panels and wind turbines, the energy supply is becoming variable. Battery energy management systems help balance this irregularity by storing excess energy when production is high and releasing it when demand increases or generation drops. This ensures a stable and reliable power supply. These systems also support the integration of renewable energy into the grid, aiding in reducing dependence on fossil fuels. In Australia, where solar energy adoption is especially high, battery energy management systems play an important role in managing rooftop solar output and optimizing self-usage. They help minimize electricity bills and improve energy independence. For utilities, these systems enable better control of grid operations and reduce peak load stress. With government support for clean energy and increasing environmental awareness, people are wagering on battery storage combined with management systems. This trend is driving the demand for reliable solutions across residential, commercial, and industrial segments. As renewable energy continues to expand, battery energy management systems are becoming essential tools for making clean power more efficient and practical.

To get more information on this market, Request Sample

Increasing EV production

Rising EV production is impelling the Australia battery energy management systems market growth. According to the IEA, sales in Australia of battery electric vehicles (BEVs), plug-in hybrids, and fuel cell electric vehicles increased by 14%, rising from 98,000 in 2023 to 112,000 in 2024. Sales of plug-in hybrid vehicles (PHVs), equipped with both a battery and an internal combustion engine, experienced the largest growth, climbing from 11,000 in 2023 to 21,000 in 2024. As more EVs are entering the Australian market, the demand for advanced battery management systems is increasing to ensure optimal performance, safety, and longevity of batteries. Battery energy management systems help regulate battery charging and discharging, prevent overheating, and balance energy usage, which is critical for the smooth operation of EVs. These systems also support vehicle-to-grid (V2G) technologies, allowing EVs to interact with the power grid and contribute stored energy during peak demand. With the growing shift towards sustainable transportation, automakers and fleet operators are investing in smart battery technologies to enhance vehicle range and reliability. Moreover, the expansion of EV charging infrastructure is increasing the integration of energy management systems that handle energy distribution and load balancing. Rising environmental awareness and supportive government policies are further accelerating EV production and adoption, thereby creating the need for robust battery energy management solutions.

Australia Battery Energy Management Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, topology, battery type, and application.

Component Insights:

- Hardware

- Battery Monitoring Unit

- Battery Control Unit

- Communication Network

- Others

- Software

- Supervisory Control and Data Acquisition

- Advance Distribution Management Solution

- Outage Management System

- Generation Management System

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (battery monitoring unit, battery control unit, communication network, and others) and software (supervisory control and data acquisition, advance distribution management solution, outage management system, generation management system, and others).

Topology Insights:

- Distributed

- Centralized

- Modular

A detailed breakup and analysis of the market based on the topology have also been provided in the report. This includes distributed, centralized, and modular.

Battery Type Insights:

- Lithium-ion Batteries

- Lead Acid Batteries

- Nickel Cadmium Batteries

- Sodium Sulfur Batteries

- Sodium-ion Batteries

- Flow Batteries

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion batteries, lead acid batteries, nickel cadmium batteries, sodium sulfur batteries, sodium-ion batteries, flow batteries, and others.

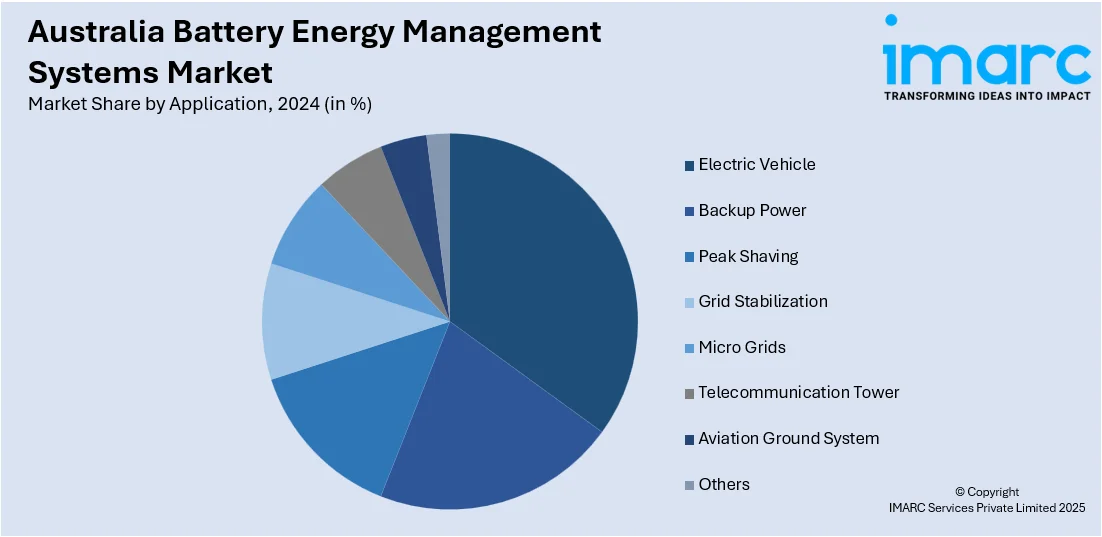

Application Insights:

- Electric Vehicle

- Backup Power

- Peak Shaving

- Grid Stabilization

- Micro Grids

- Telecommunication Tower

- Aviation Ground System

- Renewable Energy

- Standalone Solar

- Solar Diesel Hybrid

- Wind Energy

- Solar Wind Hybrid

- Others

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes electric vehicle, backup power, peak shaving, grid stabilization, micro grids, telecommunication tower, aviation ground system (renewable energy, standalone solar, solar diesel hybrid, wind energy, solar wind hybrid, and others), and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Battery Energy Management Systems Market News:

- In April 2025, Wartsila was set to provide a 64 MW/128 MWh energy storage system for Octopus Australia’s Fulham Solar Battery Hybrid initiative. The project attained generator performance standards (GPS) sanction in June 2024 and ranked among the initial extensive DC-coupled hybrid battery systems within the National Electricity Market (NEM). DC-coupled solar and storage systems provided an efficient method for managing energy.

- In February 2025, Energy Vault, a worldwide frontrunner in eco-friendly energy storage solutions, revealed a deal with the State Electricity Commission (SEC) for the implementation and incorporation of a 100 MW/200 MWh battery energy storage system (BESS) at the SEC Renewable Energy Park, Horsham, located in Victoria. This project marked a major advance in aiding Victoria's shift to renewable, dependable, and cost-effective energy. The BESS system utilized the VaultOS™ Energy Management System to oversee, regulate, and enhance the operations of the Hybrid BESS.

Australia Battery Energy Management Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Topologies Covered | Distributed, Centralized, Modular |

| Battery Types Covered | Lithium-ion Batteries, Lead Acid Batteries, Nickel Cadmium Batteries, Sodium Sulfur Batteries, Sodium-ion Batteries, Flow Batteries, Others |

| Applications Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia battery energy management systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia battery energy management systems market on the basis of component?

- What is the breakup of the Australia battery energy management systems market on the basis of topology?

- What is the breakup of the Australia battery energy management systems market on the basis of battery type?

- What is the breakup of the Australia battery energy management systems market on the basis of application?

- What is the breakup of the Australia battery energy management systems market on the basis of region?

- What are the various stages in the value chain of the Australia battery energy management systems market?

- What are the key driving factors and challenges in the Australia battery energy management systems market?

- What is the structure of the Australia battery energy management systems market and who are the key players?

- What is the degree of competition in the Australia battery energy management systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia battery energy management systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia battery energy management systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia battery energy management systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)