Australia Battery Management System Market Size, Share, Trends and Forecast by Battery Type, Type, Topology, Application, and Region, 2025-2033

Australia Battery Management System Market Overview:

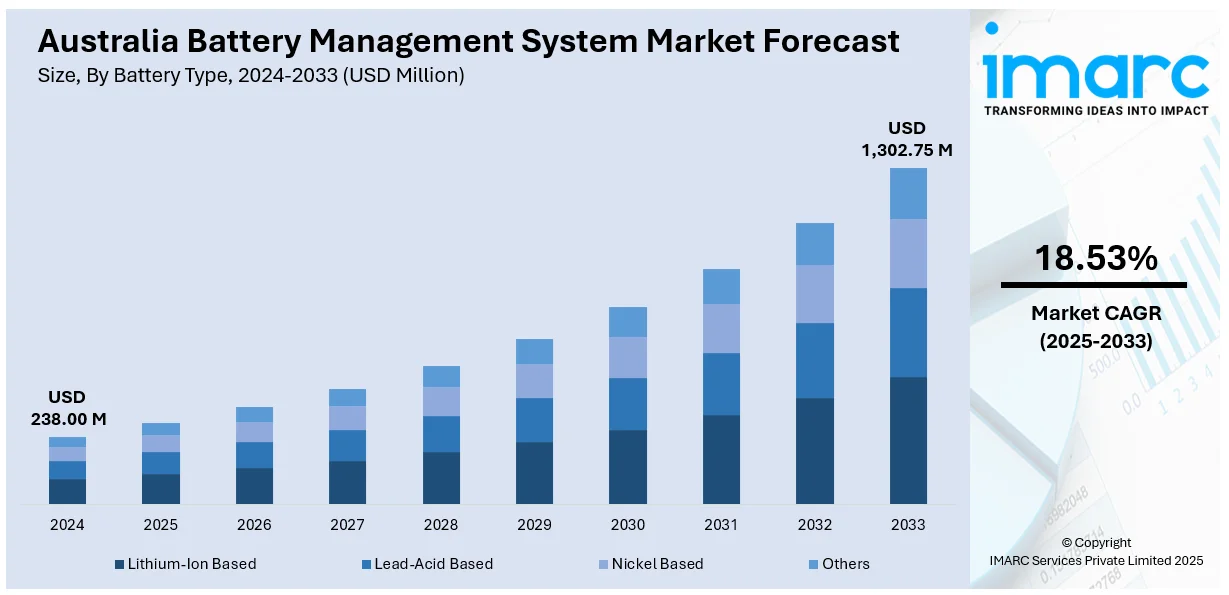

The Australia battery management system market size reached USD 238.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,302.75 Million by 2033, exhibiting a growth rate (CAGR) of 18.53% during 2025-2033. The market is growing due to rising demand for long-duration grid storage and the electrification of public transport. Furthermore, these trends are expanding the need for smart, efficient energy control systems, directly influencing Australia's battery management system market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 238.00 Million |

| Market Forecast in 2033 | USD 1,302.75 Million |

| Market Growth Rate 2025-2033 | 18.53% |

Australia Battery Management System Market Trends:

Rise of Long-Duration Grid Storage

Australia’s battery management system market is witnessing a notable transformation driven by the increasing demand for long-duration energy storage systems that can maintain grid stability, especially during periods of high renewable energy generation. With Australia aggressively transitioning towards clean energy, the need for reliable grid-scale storage solutions has intensified. Advanced BMS technologies are now a fundamental component of large battery energy storage systems (BESS), playing a critical role in energy optimization, thermal management, battery safety, and system longevity. These smart systems ensure that energy generated from solar and wind is effectively stored when production is high and dispatched when demand surges, minimizing energy waste and improving grid reliability. A prime example of this trend emerged in March 2025, when Energy Vault and Enervest entered into a 14-year Long-Term Energy Service Agreement (LTESA) for the Stoney Creek BESS project in New South Wales. The 125 MW/1.0 GWh, 8-hour duration storage system integrates advanced BMS technology to monitor performance, regulate dispatch, and cut down on maintenance costs. It also reinforces Australia’s decarbonization efforts by supporting a stable renewable-powered grid. This development reflects a broader industry shift toward smarter, more durable, and efficient energy storage solutions suited to long-duration grid applications, further propelling Australia battery management system market growth.

To get more information on this market, Request Sample

Electrification of Public Transport Fleets

The battery management system market in Australia is being driven by the growing electrification of public transport, especially within urban bus networks. The shift from diesel to electric buses is part of broader national and regional sustainability goals aimed at reducing carbon emissions and improving air quality in cities. For electric buses to operate efficiently and safely over extended periods, robust BMS technology is essential. These systems manage battery temperature, monitor charge-discharge cycles, prevent overcharging, and optimize overall battery performance, ensuring longer battery life and reduced risk of system failure. In March 2025, Custom Denning further advanced this initiative by deploying additional Element 2 electric buses, each fitted with Forsee Power’s ZEN PLUS battery systems. These high-capacity 462 kWh batteries, managed by integrated BMS, allowed the buses to travel up to 500 km per charge and support rapid 1C pantograph charging for quick turnaround times. This deployment underscores how BMS is crucial for real-time energy monitoring and efficient transit operations. As more cities adopt electric public transport, BMS will continue to be vital in achieving reliable, cost-effective, and sustainable mobility solutions across Australia, paving the way for cleaner, smarter urban transportation systems.

Australia Battery Management System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on battery type, type, topology, and application.

Battery Type Insights:

- Lithium-Ion Based

- Lead-Acid Based

- Nickel Based

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion based, lead-acid based, nickel based, and others.

Type Insights:

- Motive Battery

- Stationary Battery

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes motive battery and stationary battery.

Topology Insights:

- Centralized

- Distributed

- Modular

A detailed breakup and analysis of the market based on the topology have also been provided in the report. This includes centralized, distributed, and modular.

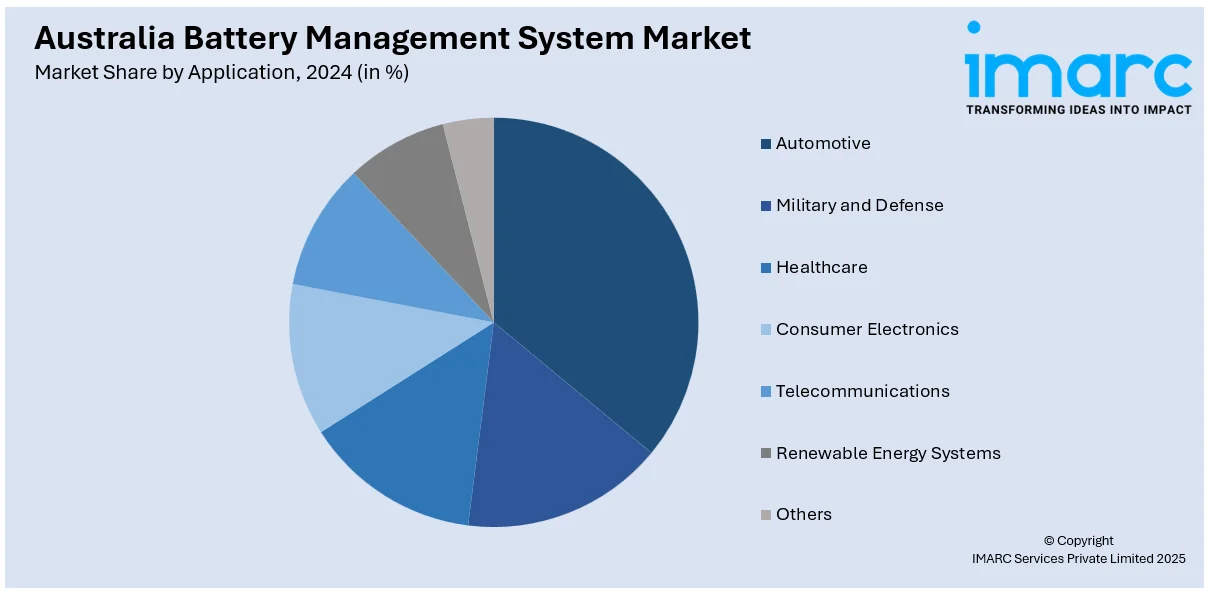

Application Insights:

- Automotive

- Electric Vehicles

- E-Bikes

- Golf Carts

- Military and Defense

- Healthcare

- Consumer Electronics

- Telecommunications

- Renewable Energy Systems

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive (electric vehicles, e-bikes, and golf carts), military and defense, healthcare, consumer electronics, telecommunications, renewable energy systems, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Battery Management System Market News:

- April 2025: Wartsila began delivering a 64 MW/128 MWh DC-coupled battery system for Octopus Australia’s Fulham Hybrid project. Integrated with GEMS Power Plant Controller, it advanced BMS capabilities in energy coordination, boosting efficiency and reliability in Australia’s grid-connected solar-plus-storage infrastructure.

- February 2025: Energy Vault began constructing a 200 MW/2-hour battery energy storage system at ACEN Australia’s New England Solar project in New South Wales. This marked the first large-scale BMS-integrated deployment in the region, boosting demand for advanced grid-support and energy optimization technologies.

Australia Battery Management System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-Ion Based, Lead-Acid Based, Nickel Based, Others |

| Types Covered | Motive Battery, Stationary Battery |

| Topologies Covered | Centralized, Distributed, Modular |

| Applications Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia battery management system market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia battery management system market on the basis of battery type?

- What is the breakup of the Australia battery management system market on the basis of type?

- What is the breakup of the Australia battery management system market on the basis of topology?

- What is the breakup of the Australia battery management system market on the basis of application?

- What is the breakup of the Australia battery management system market on the basis of region?

- What are the various stages in the value chain of the Australia battery management system market?

- What are the key driving factors and challenges in the Australia battery management system market?

- What is the structure of the Australia battery management system market and who are the key players?

- What is the degree of competition in the Australia battery management system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia battery management system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia battery management system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia battery management system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)