Australia Battery Market Report by Type (Primary Battery, Secondary Battery), Product (Lithium-Ion, Lead Acid, Nickel Metal Hydride, Nickel Cadmium, and Others), Application (Automotive Batteries, Industrial Batteries, Portable Batteries), and Region 2025-2033

Australia Battery Market Overview:

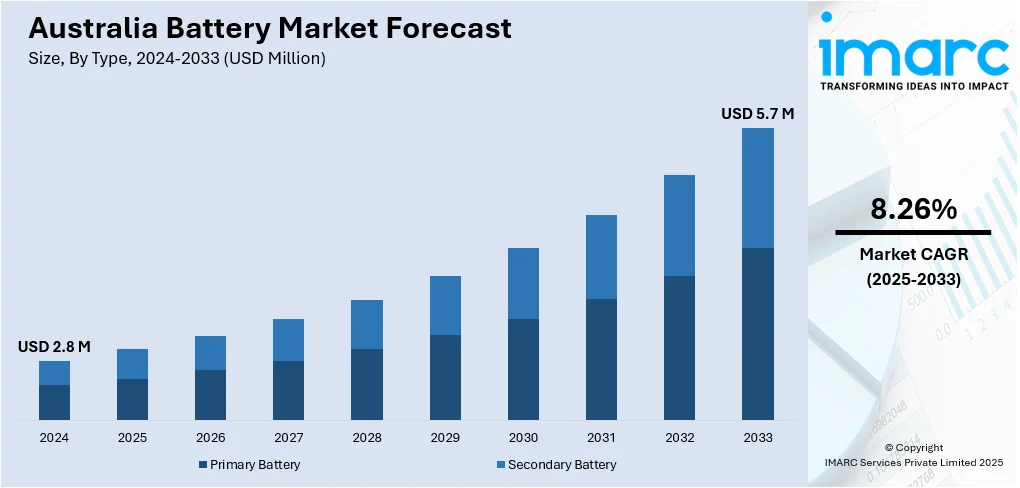

Australia battery market size reached USD 2.8 Million in 2024. Looking forward, the market is projected to reach USD 5.7 Million by 2033, exhibiting a growth rate (CAGR) of 8.26% during 2025-2033. The increasing adoption of hybrid electric vehicles (HEVs) and electric vehicles (EVs) is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.8 Million |

|

Market Forecast in 2033

|

USD 5.7 Million |

| Market Growth Rate 2025-2033 | 8.26% |

A battery is an electrochemical device that is specifically designed for the storage and release of electrical energy, comprising elements like a cathode, an anode, an electrolyte, etc. Functioning as an energy storage technology, it proves invaluable during blackouts, power shortages, or heightened electricity demand. This technology provides portable, self-contained power sources, liberating electronic devices from the constraints of wall outlets. Its contribution to mobility and convenience is paramount, making it indispensable for portable electronics like smartphones, laptops, tablets, etc. In line with this, its integration extends to critical medical devices, such as cardiovascular care equipment, pacemakers, drug delivery devices, surgical power tools, etc. Additionally, a battery plays a pivotal role in storing energy generated from renewable sources, ensuring a balanced supply and demand. By storing excess energy during low-demand periods, this device optimizes the utilization of renewable energy from sources like solar and wind power.

To get more information on this market, Request Sample

Key Trends of Australia Battery Market:

Rising Adoption of Renewable Energy Storage Solutions

Australia's strong focus on renewable energy, especially solar and wind, is propelling the use of advanced battery storage technologies. As intermittent energy generation poses challenges, storage solutions offer reliable methods to maintain grid stability and provide continuous power. Both residential and commercial sectors, along with utilities, are increasingly investing in batteries to capture excess renewable energy and optimize its use during peak hours. This transformation advances the move toward a more sustainable energy mix and diminishes reliance on fossil fuels. As the integration of renewables accelerates, the demand for efficient storage technologies is poised for growth, reinforcing the overall clean energy framework and significantly contributing to Australia battery market share.

Growing Demand for Electric Vehicles

The increasing interest in electric vehicles (EVs) in Australia stands out as a key driver of the battery market. With consumers looking for sustainable transportation options, car manufacturers are broadening their EV lineups, resulting in a greater need for advanced lithium-ion batteries that offer improved range and durability. Government incentives, subsidies, and enhancements in charging infrastructure bolster this trend. Battery producers are focusing on innovations to elevate energy density and cut costs, making EVs more affordable for a broader audience. The intersection of environmental aspirations and consumer demands for efficient transport solutions is likely to accelerate investments in battery manufacturing capability, directly impacting Australia battery market growth in the years ahead.

Expansion of Grid-Scale Energy Storage Projects

Australia is experiencing a swift growth in grid-scale energy storage systems, designed to balance the intricacies of supply and demand while boosting energy reliability. Large battery initiatives are being implemented to facilitate the integration of renewable energy and mitigate blackouts during peak demand times. Utilities and energy providers are channeling investments into these systems as they present cost-effective alternatives to conventional grid infrastructure enhancements. These projects are also instrumental in stabilizing wholesale electricity markets by delivering rapid response capabilities. With energy consumption and renewable energy adoption on the rise, grid-scale batteries are expected to be crucial in maintaining long-term energy security. This ongoing increase in installations is likely to elevate Australia battery market demand, underscoring the sector's essential role in the country’s energy future.

Growth Drivers of Australia Battery Market:

Government Incentives and Policies

Government support is crucial for promoting battery adoption across Australia. In line with the nation’s commitment to meet carbon reduction targets, both federal and state levels are providing subsidies, tax incentives, and grant initiatives to foster battery integration in renewable energy endeavors and home storage solutions. Policies aimed at promoting electric vehicle usage also have a positive impact on battery demand. By encouraging both large-scale and smaller storage installations, the government is facilitating efficient clean energy storage and reliable supply. These regulatory measures lessen initial costs for consumers and businesses and cultivate a stable environment for manufacturers, thus fostering long-term growth in the Australian battery sector.

Technological Advancements

The swift advancement in battery technology is transforming the Australian energy landscape. Developments in lithium-ion batteries and emerging solid-state technologies are offering enhanced energy density, greater safety, and extended lifespan performance, making them ideal for various applications such as electric vehicles and grid storage. Cost reductions, driven by research and mass production, are making these technologies more affordable. According to Australia battery market analysis, these innovations are likely to speed up adoption across both consumer and industrial markets. Advances in recycling methods also promote sustainability, focusing on effective material recovery and minimizing environmental effects. As improvements in performance, reliability, and efficiency continue, ongoing technological innovation will be among the most significant factors propelling the growth of the Australian battery market.

Rising Energy Security Needs

The increasing demand for dependable electricity in Australia has heightened the importance of batteries in enhancing energy security. Issues such as grid instability, surges in peak demand, and the dangers of blackouts have spurred investments in large-scale storage solutions. Batteries offer quick-response backup power, stabilize frequency variations, and improve overall grid resilience. For both residences and businesses, energy storage allows for greater independence from fluctuating electricity prices and continuous power during outages. At a national level, implementing grid-scale batteries complements renewable energy initiatives by storing excess solar and wind energy for future use. This capability to manage supply and demand establishes batteries as a vital component for energy reliability and efficiency in Australia’s future energy systems.

Government Initiative for Australia Battery Market:

Subsidy and Rebate Programs

Australia has implemented a range of subsidy and rebate initiatives aimed at promoting the adoption of battery storage systems, especially within residential and small business sectors. These programs are designed to lower initial costs, making energy storage systems more accessible for households that are installing solar panels. By integrating solar energy with battery storage, consumers achieve increased energy independence and better protection against variable electricity prices. Additionally, state-specific programs boost adoption by providing targeted rebates, ensuring the benefits are locally felt. This strategy diminishes reliance on the grid and boosts the incorporation of renewable energy nationwide. These policies have emerged as key drivers in facilitating clean energy transitions and encouraging sustainable demand within the battery market.

Grid Modernization Projects

Government-supported grid modernization efforts in Australia are crucial for the development of the battery market. As the incorporation of renewable energy sources increases, maintaining grid stability and reliability has become essential. Investments in large-scale energy storage solutions, such as utility-scale batteries, help mitigate supply variations from solar and wind energy. These initiatives also improve resilience to power outages and alleviate pressure during peak demand hours. By endorsing grid-scale storage, authorities are generating opportunities for new business models while ensuring long-term energy security. These modernization efforts benefit consumers and enhance the overall energy infrastructure, positioning Australia as a frontrunner in the deployment of large-scale battery storage.

Research and Development Funding

The Australian government is actively promoting research and development related to batteries through various funding and grant programs, aimed at stimulating innovation and domestic manufacturing. R&D efforts focus on enhancing battery efficiency, safety, and cost-effectiveness, as well as improving recycling processes to establish sustainable supply chains. Funding also fosters pilot projects centered on solid-state and next-generation battery technologies, placing Australia at the cutting edge of clean energy advancements. By investing in local talent and technology hubs, the country aims to decrease dependence on imports while developing competitive advantages in global markets. These initiatives ensure that the sector evolves beyond simple installation and usage, supporting a comprehensive ecosystem that encompasses design, development, and lasting sustainability in the battery industry.

Opportunities of Australia Battery Market:

Energy Export Potential

Australia possesses a distinctive chance to establish itself as a regional center for battery storage and energy trading within the Asia-Pacific region. With an abundance of mineral resources such as lithium, nickel, and cobalt, the nation can take advantage of producing high-quality batteries that meet regional energy needs. By utilizing advanced storage technologies, Australia can enable cross-border renewable energy transactions and reinforce its position within clean energy supply chains. This strategy fosters trade relationships and enhances long-term energy security. Additionally, expansive storage initiatives can aid in stabilizing power grids in neighboring countries, creating new export-driven prospects. Improving infrastructure and building strategic partnerships will be essential for unlocking this potential, ultimately driving demand in Australia’s battery market.

Recycling and Circular Economy

The increasing emphasis on sustainability offers Australia a significant opportunity to advance battery recycling and cultivate a strong circular economy. As the use of lithium-ion batteries rises in electric vehicles, consumer electronics, and grid storage, efficient recycling systems become essential for recovering precious materials like lithium, cobalt, and nickel. Establishing large-scale recycling facilities helps minimize reliance on imports, mitigates environmental impacts, and secures supply chain sustainability in the long run. This shift paves the way for new business models targeting environmentally conscious industries and consumers. Furthermore, support through regulations and technological advancements in recycling methods will enhance market confidence. With escalating demand, sustainable recycling practices are anticipated to be a key growth driver for Australia battery market share.

Local Manufacturing Development

Australia is in an optimal position to bolster its domestic battery manufacturing capabilities, decreasing reliance on imports and enhancing its energy framework. With increased investments and government incentives, the creation of local production facilities can generate jobs, spur innovation, and significantly elevate the economy. By establishing integrated supply chains that encompass everything from mining to battery assembly, Australia can maximize its rich deposits of raw materials like lithium. In addition, local manufacturing could offer a competitive edge through reduced costs, quicker delivery, and the ability to meet region-specific demands. Strategic partnerships with global technology firms and investments in advanced manufacturing capabilities will further broaden possibilities. This domestic strength is anticipated to play a critical role in fostering long-term resilience and growth in Australia’s battery market.

Challenges of Australia Battery Market:

High Cost of Advanced Batteries

A significant obstacle in the Australian battery market is the elevated expense linked to advanced technologies such as lithium-ion and solid-state batteries. Although these batteries offer exceptional performance, energy density, and efficiency, their production and procurement costs tend to be high. This price point limits accessibility for households, small businesses, and some large-scale projects. The high costs also hinder the uptake of electric vehicles and renewable energy storage systems, where affordability is vital. Until there are reductions in prices through large-scale production or the emergence of alternative low-cost solutions, broad accessibility will continue to be a challenge. Thus, cost competitiveness remains a crucial issue for stakeholders in the Australian battery market.

Raw Material Constraints

The Australian battery market faces notable difficulties due to its dependence on essential minerals like lithium, cobalt, and nickel. While Australia is a prominent global supplier of several of these resources, the market is often subject to supply chain bottlenecks, reliance on exports, and fluctuating global demand, resulting in price volatility. Moreover, geopolitical issues and limited domestic refining capabilities exacerbate these challenges. The high demand from the global electric vehicle and renewable energy sectors further strains available resources. These raw material issues increase costs and impede the growth of local manufacturing. Establishing resilient supply chains and investing in refining infrastructure is crucial to mitigate this weakness in the Australian battery market.

Recycling Limitations

Recycling and waste management present another significant challenge for the Australian battery market. With the increasing uptake of electric vehicles and storage systems, the volume of end-of-life batteries is expected to rise sharply. However, the country currently lacks adequate infrastructure for the efficient recycling or repurposing of used batteries. This shortfall leads to environmental risks, resource wastage, and an increased reliance on imported recycled materials. The lack of comprehensive recycling systems also hinders the recovery of valuable materials, such as lithium and cobalt, which could otherwise lessen dependency on raw imports. To ensure sustainable long-term growth for the Australian battery market, it is essential to develop advanced recycling technologies and adopt circular economy models.

Australia Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, product, and application.

Type Insights:

- Primary Battery

- Secondary Battery

The report has provided a detailed breakup and analysis of the market based on the type. This includes primary battery and secondary battery.

Product Insights:

- Lithium-Ion

- Lead Acid

- Nickel Metal Hydride

- Nickel Cadmium

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes lithium-ion, lead acid, nickel metal hydride, nickel cadmium, and others.

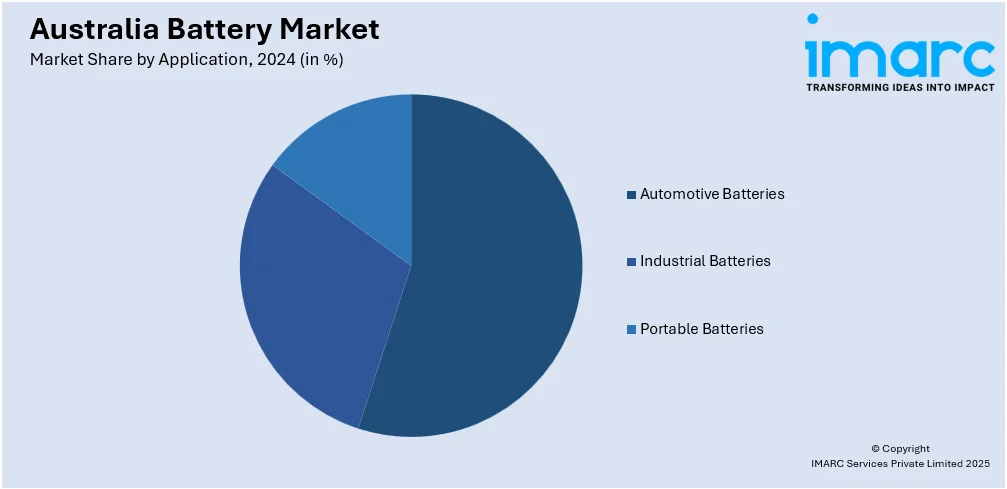

Application Insights:

- Automotive Batteries

- Industrial Batteries

- Portable Batteries

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive batteries, industrial batteries, and portable batteries.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In August 2025, the Australian government launched the AUD 500 Million Battery Breakthrough Initiative to boost domestic battery manufacturing. Managed by ARENA, the program offers funding for battery materials, cell production, and pack assembly, aiming to capitalize on Australia’s critical minerals and enhance clean energy transition efforts.

- In August 2025, Enphase Energy launched the IQ Battery 5P with FlexPhase in Australia, an all-in-one AC-coupled energy storage solution. It offers flexible configurations for single and three-phase homes, scalable from 5 kWh to 70 kWh, ensuring reliable backup power and energy independence, along with a 15-year warranty.

- In July 2025, Australia launched a USD 2.3 Billion rebate program to promote home battery adoption, offering a 30% discount on installation. Aimed at enhancing solar energy storage and reducing electricity bills, the initiative allows households to store solar power for later use, potentially leading to significant savings and reduced grid dependence.

Australia Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Primary Battery, Secondary Battery |

| Products Covered | Lithium-Ion, Lead Acid, Nickel Metal Hydride, Nickel Cadmium, Others |

| Applications Covered | Automotive Batteries, Industrial Batteries, Portable Batteries |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The battery market in Australia was valued at USD 2.8 Million in 2024.

The Australia battery market is projected to exhibit a compound annual growth rate (CAGR) of 8.26% during 2025-2033.

The Australia battery market is expected to reach a value of USD 5.7 Million by 2033.

The Australia battery market is witnessing rising adoption of renewable energy storage, expanding grid-scale projects, and advancements in battery recycling. Rising demand for high-capacity storage solutions, coupled with the growth of electric vehicles and smart energy systems, is further shaping long-term market development and innovation.

Key growth drivers include government incentives promoting clean energy, technological advancements enhancing efficiency, and increasing energy security needs. Rising investments in domestic battery manufacturing and growing demand for household and commercial storage solutions further fuel expansion, creating strong momentum for the future of the Australia battery market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)