Australia Bearings Market Size, Share, Trends and Forecast by Product, Type, End User, and Region, 2026-2034

Australia Bearings Market Summary:

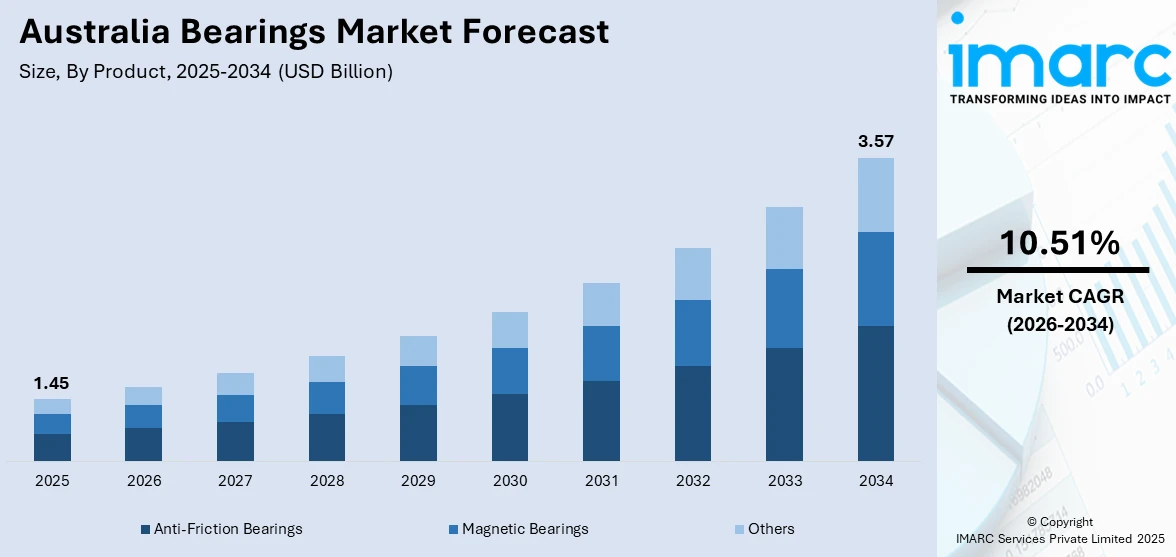

The Australia bearings market size was valued at USD 1.45 Billion in 2025 and is projected to reach USD 3.57 Billion by 2034, growing at a compound annual growth rate of 10.51% from 2026-2034.

The Australia bearings market is experiencing robust growth, driven by the expanding automotive sector, significant mining industry investments, and the nation's transition towards renewable energy infrastructure. Rising demand for precision-engineered components across manufacturing, heavy industrial machinery, and electric vehicle (EV) applications continues to propel market expansion. The emergence of advanced manufacturing technologies and Industry 4.0 adoption creates sustained demand for high-performance bearings.

Key Takeaways and Insights:

- By Product: Anti-friction bearings dominate the market with a share of 67% in 2025, owing to their superior friction reduction capabilities, widespread industrial applications, and cost-effectiveness in high-volume manufacturing processes. Growing demand from automotive and renewable energy sectors fuels market expansion.

- By Type: Ball bearings lead the market with a share of 40% in 2025. This dominance is driven by their versatility in handling both radial and axial loads, compact design suitability for EVs (EVs), and extensive use across consumer electronics and industrial machinery applications.

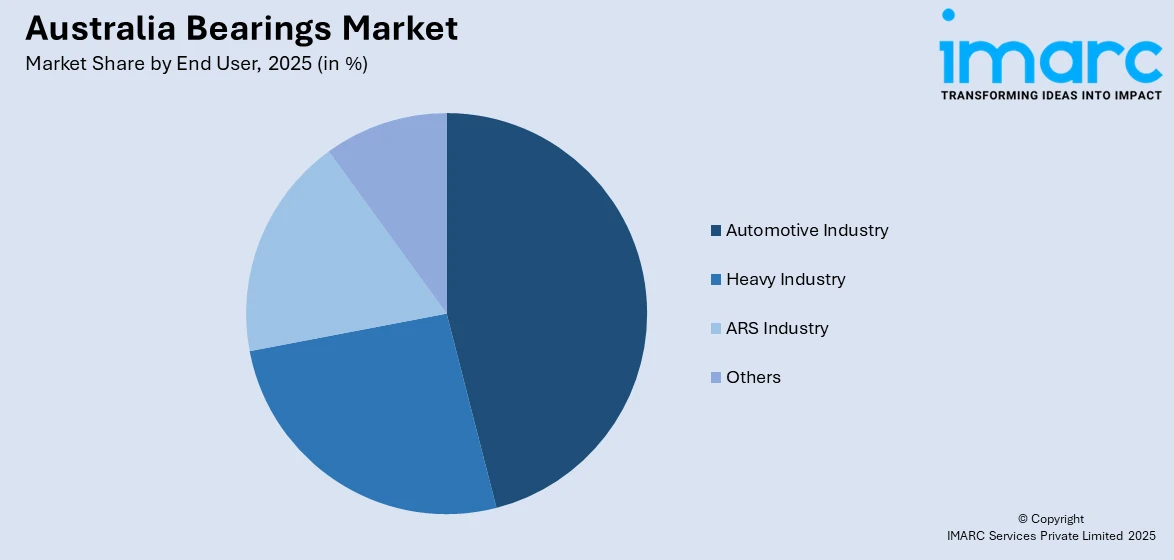

- By End User: Automotive industry comprises the largest segment with a market share of 36% in 2025, reflecting the critical role of bearings in vehicle powertrains, wheel assemblies, and electric motor systems that support Australia's evolving automotive landscape.

- By Region: Australia Capital Territory & New South Wales represents the largest region with 30% share in 2025, fueled by concentrated manufacturing activities, major infrastructure projects, and the presence of automotive aftermarket distribution networks throughout Sydney's industrial corridors.

- Key Players: Key players drive the Australia bearings market by investing in advanced manufacturing technologies, expanding distribution networks, and developing specialized bearing solutions for EVs and renewable energy applications, strengthening their market positioning through strategic partnerships.

To get more information on this market Request Sample

The Australia bearings market demonstrates significant growth potential, driven by multiple converging factors across the industrial, automotive, and energy sectors. The nation's commitment to infrastructure development, bolstered by substantial government allocations to residential, commercial, and industrial construction projects, creates sustained demand for precision components across equipment and machinery applications. As per the Australian Bureau of Statistics, in the September quarter of 2024, the overall number of housing starts in Australia increased by 4.6% to reach 43,247 dwellings. The increase in dwelling commencements was driven by new houses from the private sector, which rose by 5.2% to a total of 27,651 dwellings, following a 3.7% rise in the June quarter. The automotive sector's transformation towards electrification generates substantial requirements for specialized bearings capable of withstanding high rotational speeds in electric powertrains. Additionally, the mining sector's continued expansion drives demand for heavy-duty bearings used in crushing, conveying, and material-handling equipment.

Australia Bearings Market Trends:

Rising Adoption of Smart Bearing Technologies

The Australia bearings market is witnessing increased adoption of sensor-integrated bearing solutions that enable real-time performance monitoring and predictive maintenance capabilities. Manufacturing facilities and industrial operators are deploying condition monitoring systems to reduce unplanned downtime and optimize equipment reliability. These smart bearings provide early fault detection, helping extend equipment lifespan and lower maintenance costs. Growing Industry 4.0 adoption is further accelerating integration with digital platforms and automated systems.

Growth of EV Bearing Applications

EV adoption is transforming bearing requirements across the Australian automotive industry, creating demand for specialized components capable of handling higher rotational speeds and providing electrical insulation properties. The shift towards electrification demands bearings with reduced friction coefficients to maximize battery range and powertrain efficiency. Data from the Federal Chamber of Automotive Industries (FCAI) and the Electric Vehicle Council (EVC) showed that a record high of 156,753 EVs were bought in Australia in 2025. This accelerating transition drives sustained demand for advanced automotive-grade bearings.

Expansion of Renewable Energy Infrastructure

Wind energy development is creating substantial demand for specialized turbine-grade bearings across the thriving Australia renewable energy sector. As per IMARC Group, the Australia renewable energy market size reached USD 193.3 Billion in 2025. The nation's wind power capacity continues to expand, as governments pursue ambitious decarbonization targets and energy independence objectives. Large-scale onshore and offshore wind projects require high-performance bearings to ensure turbine reliability and long operational lifespans. Continuous investments in grid infrastructure and renewable technology manufacturing further support sustained demand for advanced bearing solutions.

Market Outlook 2026-2034:

The Australia bearings market demonstrates strong growth potential, driven by sustained investments across the automotive, manufacturing, mining, and renewable energy sectors. The convergence of industrial automation trends, EV proliferation, and infrastructure development creates favorable conditions for market expansion through the forecast period. The market generated a revenue of USD 1.45 Billion in 2025 and is projected to reach a revenue of USD 3.57 Billion by 2034, growing at a compound annual growth rate of 10.51% from 2026-2034. Government initiatives supporting clean energy transition, combined with private sector investments in advanced manufacturing capabilities, position the market for continued expansion, as demand for high-performance, precision-engineered bearing solutions intensifies across industrial applications.

Australia Bearings Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Anti-Friction Bearings | 67% |

| Type | Ball Bearings | 40% |

| End User | Automotive Industry | 36% |

| Region | Australia Capital Territory & New South Wales | 30% |

Product Insights:

- Anti-Friction Bearings

- Magnetic Bearings

- Others

Anti-friction bearings dominate with a market share of 67% of the total Australia bearings market in 2025.

Anti-friction bearings lead the market in Australia, driven by their essential role in reducing mechanical friction and enhancing energy efficiency across diverse industrial applications. These bearings utilize rolling elements, including balls or rollers, positioned between races to minimize friction between rotating and stationary components. The growing demand from automotive manufacturing, mining equipment, and renewable energy installations drives sustained market expansion. Their compatibility with high-speed and heavy-load applications further strengthens adoption across multiple end-use sectors.

The preference for anti-friction bearings stems from their superior performance characteristics, including lower friction coefficients, reduced heat generation, and extended service life compared to alternative bearing types. Manufacturing facilities across Australia increasingly adopt these components to achieve energy savings and optimize equipment reliability. The integration of advanced materials and precision manufacturing techniques enables anti-friction bearings to withstand demanding operational conditions encountered in heavy industrial machinery, EV powertrains, and wind turbine assemblies, reinforcing their market dominance throughout the forecast period.

Type Insights:

- Ball Bearings

- Roller Bearings

- Plain Bearings

- Others

Ball bearings lead with a share of 40% of the total Australia bearings market in 2025.

Ball bearings maintain market leadership, due to their versatile application capabilities and ability to handle both radial and axial loads efficiently. These bearings find extensive use across automotive systems, electric motors, consumer electronics, and industrial machinery, where compact design and smooth rotational movement are essential requirements. The growing EV sector particularly drives demand, as ball bearings are integral components in motors and drivetrains requiring high-speed operation with minimal energy loss. As per IMARC Group, the Australia EV market size was valued at USD 21.06 Billion in 2025.

The continued dominance of ball bearings reflects ongoing improvements in material science and lubrication technology that enhance precision, reduce friction, and improve durability. Australian manufacturers across the automotive, aerospace, and general manufacturing sectors rely on ball bearings for smooth machinery operation and consistent performance under varying operational loads. The development of ball bearings for EV applications, featuring enhanced speed capabilities and electrical insulation properties, positions this segment for sustained growth as the automotive industry accelerates its electrification transition.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Automotive Industry

- Heavy Industry

- ARS Industry

- Others

Automotive industry exhibits a clear dominance in the market with 36% share in 2025.

Automotive industry represents the largest end user for bearings in Australia, driven by extensive bearing requirements across engines, transmissions, wheel assemblies, and electric motor systems. Bearings play critical roles in reducing friction, supporting heavy loads, and ensuring smooth operation throughout vehicle powertrains and suspension components. The sector's transformation towards EVs and hybrid vehicles (HVs) creates additional demand for specialized bearings capable of withstanding higher rotational speeds. Sales of plug-in HVs reached 53,484 units in 2025, marking a 130.9% rise from 2024, reflecting the expanding addressable market for automotive bearings.

Consumer demand for EVs and growing requirements from the automotive aftermarket continue to drive market expansion within this end user segment. Bearings in automotive applications minimize friction, provide heavy load-bearing capacity, and enhance overall vehicle performance and fuel efficiency. The development of low-friction bearings, specifically designed for EV powertrains, featuring advanced seal technologies and optimized designs, addresses evolving requirements as manufacturers prioritize extended driving range and operational efficiency in electrified transportation solutions.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represents the leading segment with a 30% share of the total Australia bearings market in 2025.

Australia Capital Territory & New South Wales dominate the regional bearings market, driven by concentrated manufacturing activities, substantial infrastructure investments, and the presence of major industrial distribution networks throughout the Sydney metropolitan area. The region benefits from strong government support for advanced manufacturing and innovation, with substantial funding allocated to sustainable industrial development initiatives. The New South Wales government invested AUD 28 Million in a Western Sydney renewables manufacturing hub in September 2025, expected to strengthen the region's position as a manufacturing and innovation powerhouse.

The concentration of automotive aftermarket operations, heavy industrial equipment suppliers, and maintenance service providers reinforces the region's market leadership position. Ongoing investments in infrastructure modernization and the expansion of manufacturing capabilities position the region for continued market dominance throughout the forecast period. Rising demand from the renewable energy, rail, and construction sectors further boosts bearing consumption. Strong logistics connectivity also enhances supply chain efficiency and regional distribution strength.

Market Dynamics:

Growth Drivers:

Why is the Australia Bearings Market Growing?

Expanding EV Ecosystem Driving Specialized Bearing Demand

The accelerating transition towards EVs in Australia creates substantial demand for specialized bearings designed for high-speed electric motor applications and powertrain systems. EVs require bearings capable of withstanding higher rotational speeds while providing electrical insulation to prevent current-induced damage and premature component failure. The shift towards vehicle electrification, supported by favorable government policies, generates sustained requirements across original equipment and aftermarket channels. Bearing manufacturers are responding to this demand by developing advanced solutions, featuring ceramic hybrid elements, optimized seal configurations, and reduced friction coefficients that extend vehicle range and improve operational efficiency. The continued expansion of EV sales and charging infrastructure positions the automotive bearing segment for robust growth throughout the forecast period. Strong collaborations between original equipment manufacturers (OEMs) and bearing suppliers are accelerating innovation and market adoption.

Substantial Mining Sector Investments Fueling Heavy-Duty Bearing Consumption

Australia's globally significant mining industry drives substantial demand for large-diameter, shock-resistant bearings used in crushers, conveyors, drilling rigs, and material-handling equipment throughout extraction and processing operations. The mining sector's continued expansion creates sustained requirements for durable bearing solutions capable of withstanding demanding operational conditions, including extreme loads, vibration, and environmental exposure. Investment in the Australian mining sector reached USD 11.5 Billion in the March quarter of 2024, reflecting a 6% increase compared to 2023 and demonstrating the industry's robust capital expenditure trajectory. Manufacturers are increasingly offering custom-engineered bearings with enhanced wear resistance and extended service life to meet mining-specific needs. Predictive maintenance technologies are being integrated to reduce downtime and improve operational efficiency. Rising demand for automation and remote-controlled mining equipment further drives adoption of advanced bearing solutions.

Renewable Energy Transition Accelerating Wind Turbine Bearing Requirements

Australia's commitment to clean energy transition and decarbonization targets drives substantial investments in wind energy infrastructure, creating significant demand for highly durable turbine-grade bearings capable of operating under extreme loads and environmental conditions. Wind turbines require specialized bearings for shaft assemblies, gearboxes, generators, and pitch control systems that must withstand variable wind loads, vibration, and harsh weather exposure throughout extended operational lifespans. Additionally, the push for higher-capacity turbines and longer blades necessitates bearings with enhanced load-bearing capabilities and corrosion resistance. Manufacturers are increasingly adopting advanced materials, such as ceramic hybrids and reinforced steels to improve reliability. Growing government incentives and private investments in renewable projects are accelerating turbine installations, further supporting the bearings market in Australia. Condition monitoring technologies are also being integrated to optimize performance, reduce downtime, and extend operational life, ensuring consistent energy output and supporting Australia’s renewable energy goals.

Market Restraints:

What Challenges the Australia Bearings Market is Facing?

Proliferation of Counterfeit Products Undermining Market Quality

The Australia bearings market faces significant challenges from counterfeit products that erode customer trust, reduce demand for premium-quality bearings, and create safety risks across industrial applications. Counterfeit bearings typically utilize inferior materials and outdated manufacturing processes, resulting in poor quality and frequent equipment failures that damage brand reputations and increase operational costs for end users.

Raw Material Price Volatility Affecting Production Economics

Fluctuations in raw material costs, particularly specialized bearing steel, ceramics, and alloy components, directly impact production expenses and challenge manufacturers' ability to maintain stable pricing and profit margins. Supply chain disruptions, geopolitical tensions, and trade regulations create additional complexity for manufacturers seeking consistent access to high-quality materials at competitive prices.

Supply Chain Constraints and Logistics Challenges

In Australia, the bearings industry faces persistent supply chain vulnerabilities that constrain production capacity and extend lead times for specialized bearing components. A significant portion of high-grade bearing steel is sourced from a limited number of countries, creating geographic concentration risks that make manufacturers vulnerable to supply disruptions. Trade restrictions, transportation delays, and logistics bottlenecks have further extended lead times for certain bearing types, forcing equipment manufacturers to adapt designs around available components and affecting overall market growth and operational efficiency.

Competitive Landscape:

The Australia bearings market exhibits a competitive landscape, characterized by the presence of established global manufacturers and regional distributors serving diverse industrial applications. Leading companies maintain market positions through large-scale production capabilities, strong research and development focus, and established relationships with OEMs and end users across the automotive, mining, and renewable energy sectors. Industry participants invest continuously in innovations to develop advanced bearing solutions, including hybrid bearings, self-lubricating designs, and energy-efficient products that address evolving customer requirements. Strategic emphasis on cost control through lean manufacturing processes and supply chain optimization enables competitive pricing while maintaining product quality.

Australia Bearings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Anti-Friction Bearings, Magnetic Bearings, Others |

| Types Covered | Ball Bearings, Roller Bearings, Plain Bearings, Others |

| End Users Covered | Automotive Industry, Heavy Industry, ARS Industry, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia bearings market size was valued at USD 1.45 Billion in 2025.

The Australia bearings market is expected to grow at a compound annual growth rate of 10.51% from 2026-2034 to reach USD 3.57 Billion by 2034.

Anti-friction bearings dominated the market with a share of 67%, driven by their superior friction reduction capabilities, widespread industrial applications, and cost-effectiveness across the manufacturing and automotive sectors.

Key factors driving the Australia bearings market include expanding EV adoption, substantial mining sector investments, accelerating renewable energy infrastructure development, and the growing industrial automation trends, including the utilization of Industry 4.0 practices.

Major challenges include proliferation of counterfeit products undermining market quality, raw material price volatility affecting production economics, supply chain constraints and logistics disruptions, and intense competition from low-cost imports.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)