Australia Beauty Products Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Australia Beauty Products Market Size and Share:

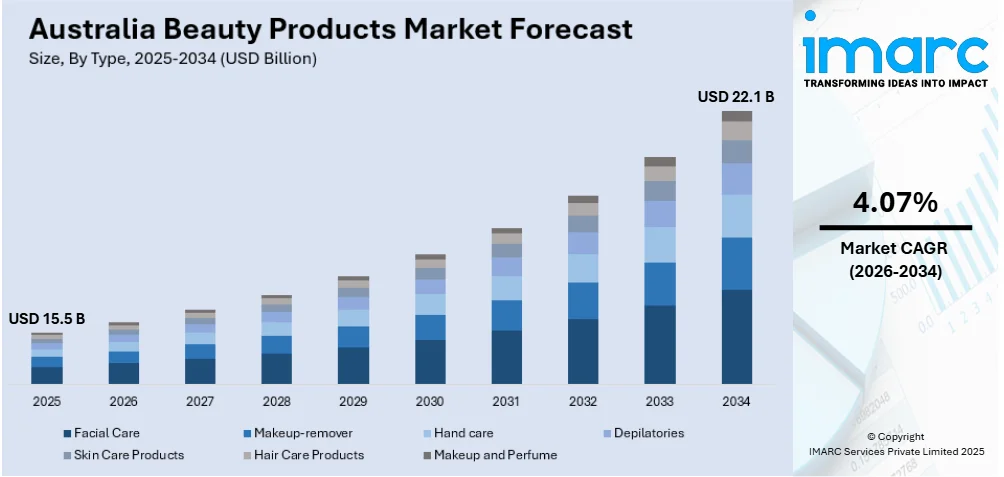

The Australia beauty products market size reached USD 15.5 Billion in 2025. Looking forward, the market is expected to reach USD 22.1 Billion by 2034, exhibiting a growth rate (CAGR) of 4.07% during 2026-2034. The Australia beauty products market share is increasing as individuals demand more sustainable and eco-friendly packaging, prompting brands to adopt biodegradable, recyclable, and refillable options. This trend, along with a rising interest in anti-aging solutions and expanded distribution channels, is supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 15.5 Billion |

| Market Forecast in 2034 | USD 22.1 Billion |

| Market Growth Rate 2026-2034 | 4.07% |

Key Trends of Australia Beauty Products Market:

Focus on Sustainable and Eco-Friendly Packaging

Individuals are becoming aware about the environmental effects of their purchases, urging brands to implement more sustainable practices. Packaging innovations like biodegradable, recyclable, and refillable containers are gaining traction as a response to concerns over single-use plastics. Leading beauty brands are committing to reduce their carbon footprint and use recyclable materials, aligning with both individual demand and regulatory pressures. In addition, some companies are pioneering initiatives such as take-back programs and eco-conscious shipping practices. This shift towards sustainable packaging is not only attracting environmentally-aware people but is also becoming a competitive differentiator in the market. Brands are emphasizing their commitment to sustainability to increase client loyalty and preference. For instance, Original & Mineral (O&M), an Australian hair brand, partnered with Green Salon Collective (GSC) in 2024 to reward salons for sustainability efforts. Salons purchasing O&M COR.color will receive credits for recycling metal salon waste, like foil and color tubes, helping reduce landfill waste. The partnership also included a £1 "Green Tax" charge to help fund the recycling initiative.

To get more information on this market Request Sample

Increased Demand for Anti-Aging and Skin Care Solutions

With the aging population and increased focus on long-term skin health, the demand for skin care products that solve aging issues like wrinkles, fine lines, and skin elasticity is on a rise. Top players are meeting this demand by formulating products with ingredients such as retinol, peptides, hyaluronic acid, and collagen for youthful, radiant skin. People are not just looking for products that work instantly but also for those that give long-term, preventive benefits. Further, the growing demand for dermatologically-tested skincare and evidence-based formulations is driving brands to innovate even more. With maturing markets, anti-aging products are becoming niche, addressing various types of skin and demands, ranging from moisturizing to firming. In 2024, Australian high-end skincare brand, LA MAXIME introduced the SkinGlow5 anti-aging skincare set, a carry-on set containing Australian botanicals such as Kakadu Plum. The five-step system, which is suitable for carry-on, provides instant, visible results in five days and is TSA-approved.

Expansion of Distribution Channels and Accessibility

With a rise in both online and offline retail opportunities, buyers have greater access to a diverse range of beauty products. Major beauty retailers are expanding their presence both in physical stores and through e-commerce platforms, enabling wider product availability. Additionally, the growing number of direct-to-consumer (DTC) brands is enhancing the convenience and accessibility of purchasing beauty products. Social media platforms and influencer partnerships also play a role in driving awareness and guiding users to new brands, while offering seamless purchase options via integrated e-commerce solutions. Increased access to international beauty brands through online marketplaces further broadens the selection for buyers in Australia. In 2024, Kérastase, the luxury haircare brand, launched its products, making it easier for people in Australia to access its range. Known for its science-backed formulas, Kérastase is now available in-store and online in the country.

Growth Drivers of Australia Beauty Products Market:

Rising Influence of Social Media and Beauty Influencers

Social media sites are a significant driver in influencing consumer decisions within Australia's beauty industry. Sites such as Instagram, TikTok, and YouTube are significant media for beauty influencers and brands to promote the efficacy of a product, trends, and tutorials. This online visibility creates robust brand consciousness, product curiosity, and purchasing decision influence. Younger audiences are heavily dependent on influencer reviews and online opinions when choosing skincare or makeup items. Viral beauty challenges and trends equally drive higher sales across product categories. As digital engagement grows, social media continues to be a driving force behind the popularity of both established and emerging beauty brands in Australia, fueling the Australia beauty products market demand.

Growing Emphasis on Personalized Beauty Solutions

The shift toward individualized skincare and cosmetic products is significantly boosting the beauty products market demand in Australia. Consumers increasingly seek items tailored to their unique skin types, tones, and lifestyle needs. This has led to rising demand for customizable beauty solutions, from foundation shades and skincare regimens to hair care treatments. Advanced technologies such as AI-based skin analysis and digital beauty consultations are making personalization more accessible and appealing. Brands that offer inclusive ranges and personalized experiences are gaining stronger consumer loyalty. According to the Australia beauty products market analysis, this trend reflects a move away from one-size-fits-all products, highlighting the growing importance of customization as a critical growth driver in Australia’s evolving beauty industry.

Rising Health and Wellness Integration in Beauty

The blending of beauty with health and wellness is accelerating market growth in Australia. Consumers are increasingly choosing products that not only enhance appearance but also support overall skin and hair health. This has boosted demand for clean-label formulations enriched with vitamins, minerals, botanicals, and probiotics. Wellness-inspired beauty solutions, such as stress-reducing skincare or multifunctional products combining cosmetic and therapeutic benefits, are gaining traction. The growing popularity of holistic beauty routines reflects a consumer shift toward long-term well-being rather than short-term aesthetics. As this integration of wellness and beauty expands, brands focusing on science-backed, health-oriented formulations are well-positioned to capture a larger market share in Australia.

Australia Beauty Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Facial Care

- Makeup-remover

- Hand care

- Depilatories

- Skin Care Products

- Hair Care Products

- Makeup and Perfume

The report has provided a detailed breakup and analysis of the market based on the type. This includes facial care, makeup-remover, hand care, depilatories, skin care products, hair care products, and makeup and perfume.

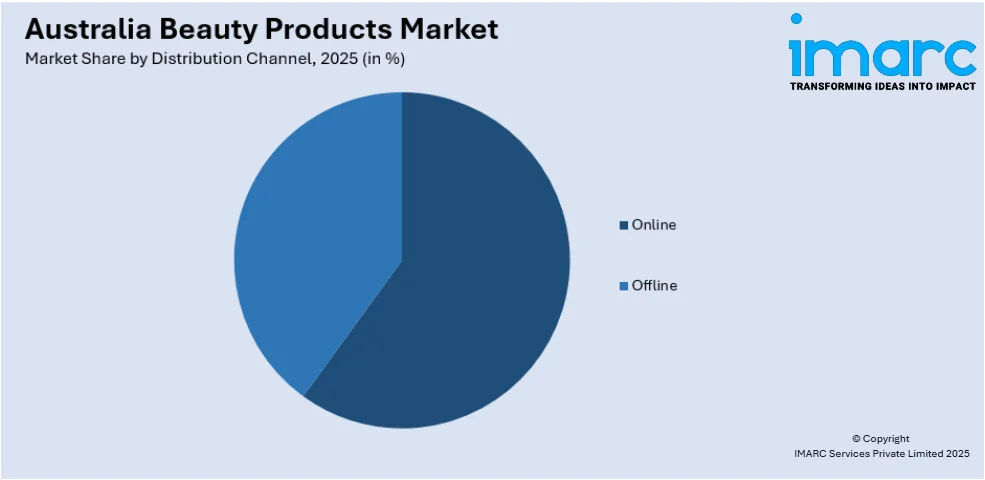

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Online

- Offline

- Supermarket and Hypermarket

- Specialty Stores

- Drug Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline (supermarket and hypermarket, specialty stores, and drug stores).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Beiersdorf AG

- Colgate-Palmolive Company

- Estée Lauder Inc

- Henkel Australia Pty. Ltd.

- L'Oréal Paris

- McPherson's

- Procter & Gamble

Australia Beauty Products Market News:

- In September 2024, Bubble skincare announced its expansion into Australia with a launch at Priceline stores on October 11. This move made the brand's products more accessible to Australian users who previously faced challenges with international shipping.

- In August 2024, Dries Van Noten's highly anticipated beauty collection launched exclusively at MECCA in Australia. The collection featured fragrances, lipsticks, creams, soaps, and accessories, all designed with striking aesthetics and a focus on ethical luxury. With refillable packaging and natural ingredients, the products aim to combine beauty, sustainability, and craftsmanship.

Australia Beauty Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Facial Care, Makeup-Remover, Hand Care, Depilatories, Skin Care Products, Hair Care Products, Makeup and Perfume |

| Distribution Channels Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Beiersdorf AG, Colgate-Palmolive Company, Estée Lauder Inc, Henkel Australia Pty. Ltd., L'Oréal Paris, McPherson's, Procter & Gamble, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia beauty products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia beauty products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia beauty products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The beauty products market in Australia was valued at USD 15.5 Billion in 2025.

The Australia beauty products market is projected to exhibit a CAGR of 4.07% during 2026-2034.

The Australia beauty products market is projected to reach a value of USD 22.1 Billion by 2034.

The Australia beauty products market trends are shaped by rising demand for natural and sustainable formulations, increased adoption of personalized skincare, and growing influence of e-commerce. Consumers favor cruelty-free, eco-friendly brands, while digital platforms and social media trends further continue to redefine purchasing behaviors and product discovery across the sector.

The Australia beauty products market is driven by growing consumer preference for natural and organic ingredients, rising disposable incomes, and expanding e-commerce accessibility. Increased focus on self-care, skincare routines, and social media influence further fuels demand, encouraging brands to innovate and cater to evolving beauty expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)