Australia Biobanking Market Size, Share, Trends and Forecast by Specimen Type, Biobank Type, Application, End User, and Region, 2025-2033

Australia Biobanking Market Overview:

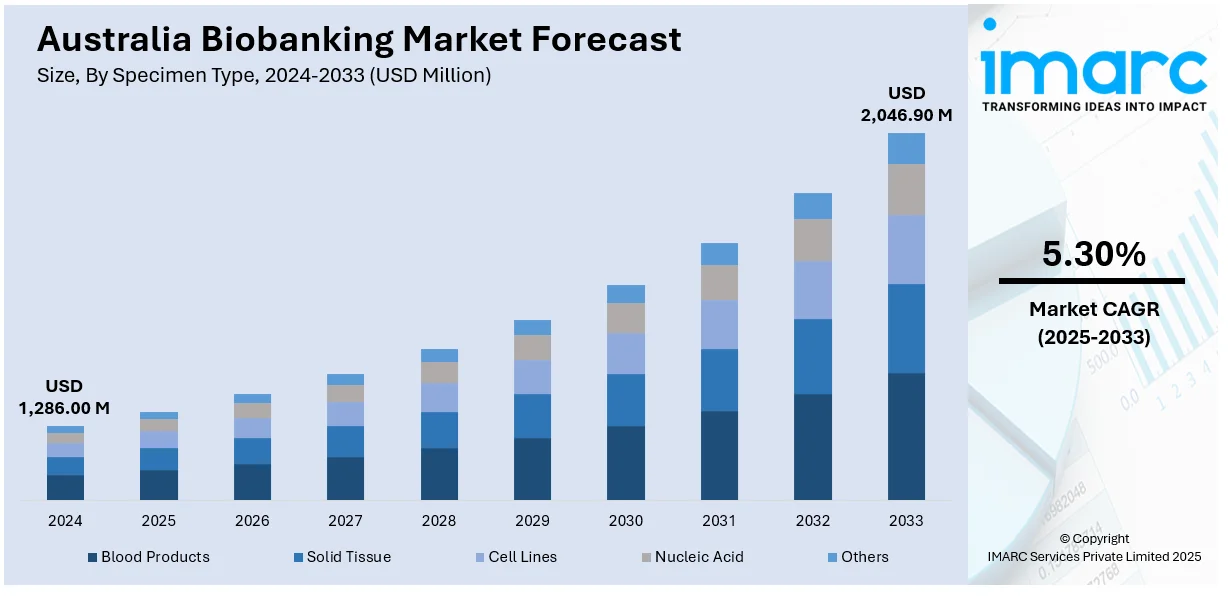

The Australia biobanking market size reached USD 1,286.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,046.90 Million by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. Rising genomic research, precision medicine adoption, surging government funding, increasing chronic disease prevalence, public-private collaborations, ethical regulatory frameworks, cold-chain logistics improvements, burgeoning clinical trial activity, population-scale health studies, and the growth of rare disease-focused biobanks are some of the factors fueling the Australia biobanking market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,286.00 Million |

| Market Forecast in 2033 | USD 2,046.90 Million |

| Market Growth Rate 2025-2033 | 5.30% |

Australia Biobanking Market Trends:

Rising Investments in Genomics and Precision Medicine

The Australia biobanking market is witnessing significant momentum due to sustained investments in genomics and precision medicine. National initiatives, such as Genomics Australia and the Genomic Health Futures Mission under the Medical Research Future Fund (MRFF), are actively funding projects that rely on high-quality biological samples for research and diagnostics. These programs aim to integrate genomics into routine clinical care, which directly increases the demand for organized biobanks capable of supplying ethically collected, well-annotated specimens. Moreover, public-private partnerships have also emerged, wherein research institutions and biotech companies are working jointly to develop biobank-linked genomic datasets. As personalized therapies continue to gain prominence, the need for diverse, longitudinal biospecimens is expected to rise further. Biobanks serve as the backbone of such initiatives by offering scalable access to deoxyribo nucleic acid (DNA), ribo nucleic acid (RNA), and tissue samples that enable targeted drug discovery, biomarker validation, and patient stratification, all of which are core to the advancement of precision medicine in Australia.

To get more information on this market, Request Sample

Government-Backed Programs Expanding Infrastructure

Federal and state government programs in Australia are actively supporting the expansion and modernization of biobanking infrastructure. The Medical Research Future Fund (MRFF), backed by several billion dollars in funding, has been instrumental in advancing biobanking infrastructure aligned with national research goals. In 2025, the Australian Government committed over USD 140 million to two UNSW-led precision medicine initiatives, nearly USD 113 million to broaden the ZERO Childhood Cancer Program nationwide, and over USD 30 million to extend PrOSPeCT’s genomic profiling for advanced and rare adult cancers. Dedicated funding streams have enabled the establishment of disease-specific and population-wide biobanks across major cities, enhancing geographic coverage and research inclusivity. These efforts are supplemented by investments in data management systems, biosample tracking technologies, and standardized collection protocols. Government guidelines, such as those from the National Health and Medical Research Council (NHMRC), ensure that biobanking operations maintain ethical rigor and scientific reliability. With a policy environment that encourages translational research and commercialization, government-backed infrastructure is playing a pivotal role in attracting global clinical trials and research collaborations.

Growth in Chronic Disease Burden Driving Sample Demand

The rising chronic disease burden is a key driver for the Australia biobanking market growth, as researchers increasingly rely on biospecimens to study long-term health outcomes. Conditions like cancer, diabetes, and cardiovascular diseases (CVDs) account for a significant proportion of national healthcare costs and research funding. Biobanks enable the collection and storage of patient-derived samples over extended periods, supporting longitudinal cohort studies that can uncover genetic, molecular, and lifestyle-based disease determinants. Moreover, hospitals and academic institutions are integrating biobanking into clinical workflows to collect samples at diagnosis, treatment, and follow-up stages, which enriches datasets for multi-phase analysis. This approach enhances the understanding of disease progression, treatment resistance, and relapse patterns, which are critical for developing effective interventions.

Australia Biobanking Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on specimen type, biobank type, application, and end user.

Specimen Type Insights:

- Blood Products

- Solid Tissue

- Cell Lines

- Nucleic Acid

- Others

The report has provided a detailed breakup and analysis of the market based on the specimen type. This includes blood products, solid tissue, cell lines, nucleic acid, and others.

Biobank Type Insights:

- Population-based Biobanks

- Disease-oriented Biobanks

A detailed breakup and analysis of the market based on the biobank type have also been provided in the report. This includes population-based biobanks and disease-oriented biobanks.

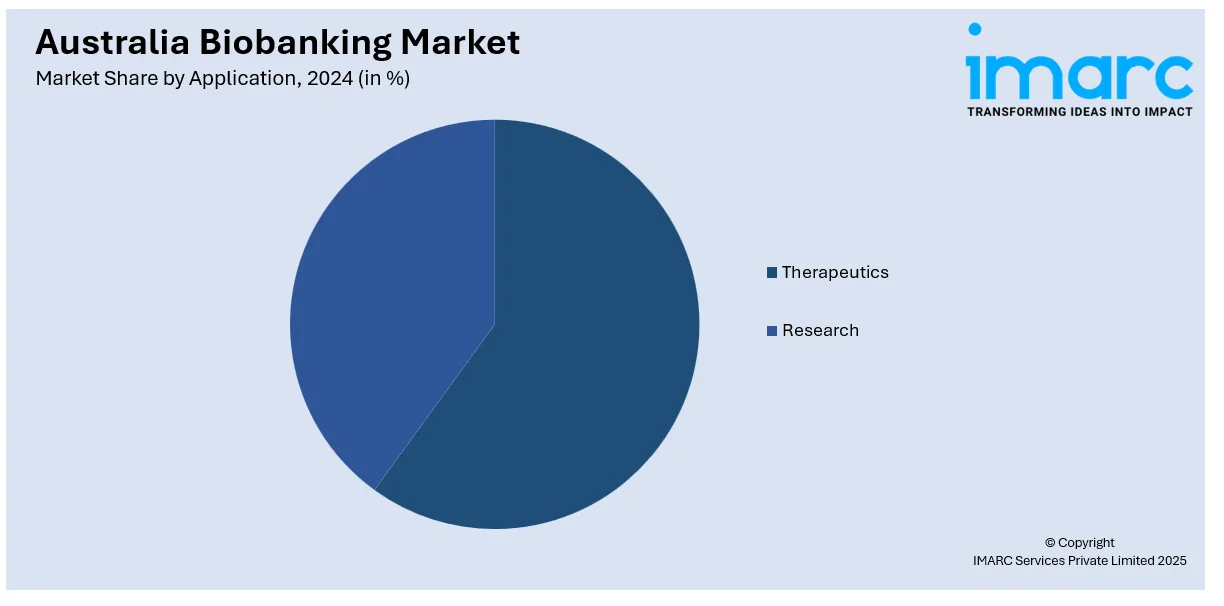

Application Insights:

- Therapeutics

- Research

The report has provided a detailed breakup and analysis of the market based on the application. This includes therapeutics and research.

End User Insights:

- Academic Institutions

- Pharma and Biotech Companies

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes academic institutions and pharma and biotech companies.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Biobanking Market News:

- In January 2025: The Ear Science Institute Australia launched the Aussie Ear Bank, the nation’s first biobank dedicated to genetic-associated hearing loss. Backed by $650,000 in grants, the Western Australia-based facility will store tissue samples and genetic data, driving global collaboration to develop personalized therapies for congenital and age-related deafness.

- In June 2024: The Australian Human Microbiome Biobank (AHMB) officially opened at Brisbane’s Translational Research Institute. Led by Professor Gene Tyson, the facility collects and analyzes human gut microbiota samples, using advanced anaerobic chambers and cultivation platforms to study uncultivable species and drive the development of novel microbiome-based therapeutics.

Australia Biobanking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Specimen Types Covered | Blood Products, Solid Tissue, Cell Lines, Nucleic Acid, Others |

| Biobank Types Covered | Population-based Biobanks, Disease-oriented Biobanks |

| Applications Covered | Therapeutics, Research |

| End Users Covered | Academic Institutions, Pharma and Biotech Companies |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia biobanking market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia biobanking market on the basis of specimen type?

- What is the breakup of the Australia biobanking market on the basis of biobank type?

- What is the breakup of the Australia biobanking market on the basis of application?

- What is the breakup of the Australia biobanking market on the basis of end user?

- What is the breakup of the Australia biobanking market on the basis of region?

- What are the various stages in the value chain of the Australia biobanking market?

- What are the key driving factors and challenges in the Australia biobanking?

- What is the structure of the Australia biobanking market and who are the key players?

- What is the degree of competition in the Australia biobanking market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia biobanking market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia biobanking market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia biobanking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)