Australia Biocatalyst Market Size, Share, Trends and Forecast by Type, Application, Source, and Region, 2025-2033

Australia Biocatalyst Market Overview:

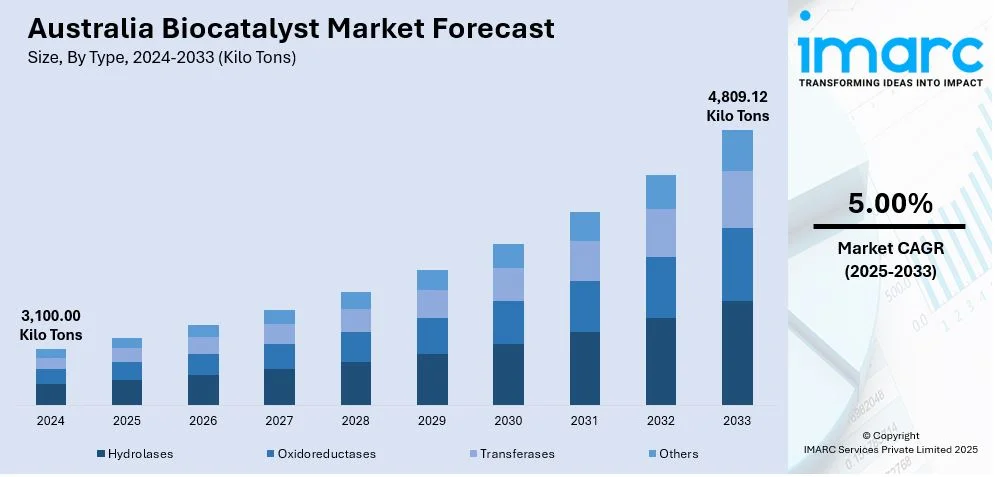

The Australia biocatalyst market size reached 3,100.00 Kilo Tons in 2024. Looking forward, IMARC Group expects the market to reach 4,809.12 Kilo Tons by 2033, exhibiting a growth rate (CAGR) of 5.00% during 2025-2033. The market involves growing demand for sustainable industrial processes, supportive government policies promoting green chemistry, advancements in enzyme engineering, and increased investment in bio-based technologies. Rising environmental awareness and the push for circular economy practices further increase the Australia biocatalyst market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 3,100.00 Kilo Tons |

| Market Forecast in 2033 | 4,809.12 Kilo Tons |

| Market Growth Rate 2025-2033 | 5.00% |

Australia Biocatalyst Market Trends:

Rising Demand for Green Chemistry Solutions

Australia’s biocatalyst market is growing rapidly, driven by the rising demand for sustainable and eco-friendly chemical processes across industries like pharmaceuticals, biofuels, and food processing. Biocatalysts, with their ability to function under mild conditions and reduce toxic waste, are becoming essential tools in green chemistry. This shift is further propelled by regulatory pressures to lower industrial emissions and improve environmental performance. Aligning with Australia biocatalyst market trends, the Western Australian Government has committed AU$2.31 million in partnership with Brandon BioCatalyst through 2029. This funding underscores governmental support for innovation and commercialization in biocatalysis, particularly in the biomedical and life sciences sectors. Such public-private collaborations are vital for accelerating biocatalyst research and development (R&D), supporting university spinouts, and advancing Australia’s position as a hub for sustainable and high-impact chemical manufacturing solutions.

To get more information on this market, Request Sample

Integration of Enzyme Engineering and Synthetic Biology

A key trend transforming Australia biocatalyst market outlook is the integration of enzyme engineering with synthetic biology, enabling the creation of customized biocatalysts for targeted industrial applications. Using tools like CRISPR and directed evolution, biotech startups and research institutions are enhancing enzyme performance, stability, and specificity, unlocking new possibilities in pharmaceuticals, food processing, and bio-industrial sectors. This innovation surge is supported by strong university-industry collaborations and robust government funding. According to CSIRO’s Synthetic Biology: National Progress Report, synthetic biology could generate $29.6 billion in annual revenue and create nearly 52,000 jobs by 2040 in Australia—highlighting the immense economic and societal potential of this field. This alignment of cutting-edge science, business interest, and national backing is expediting the implementation of next-generation biocatalysts, generating a more sustainable and competitive bioeconomy.

Expansion of the Bioeconomy and Circular Economy Initiatives

Australia's pledge to develop a bioeconomy that's sustainable is fueling the applications, especially in industries encouraging circular economy approaches thus aiding the Australia biocatalyst market growth. Biocatalysts are being utilized to transform agricultural residues, food waste, and other biomass into desirable chemicals, fuels, and materials. This is in line with national plans to minimize landfill consumption and foster renewable resources. Agricultural, waste management, and biomanufacturing companies are spending on biocatalytic processes to convert waste into saleable products with the help of public investment and state-level sustainability requirements. Biocatalysts are critical in making biorefineries more efficient and scalable, which are the hub of Australia's circular economy activities. The trend is likely to accelerate as policy, technology, and market incentives meet.

Australia Biocatalyst Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and source.

Type Insights:

- Hydrolases

- Oxidoreductases

- Transferases

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes hydrolases, oxidoreductases, transferases, and others.

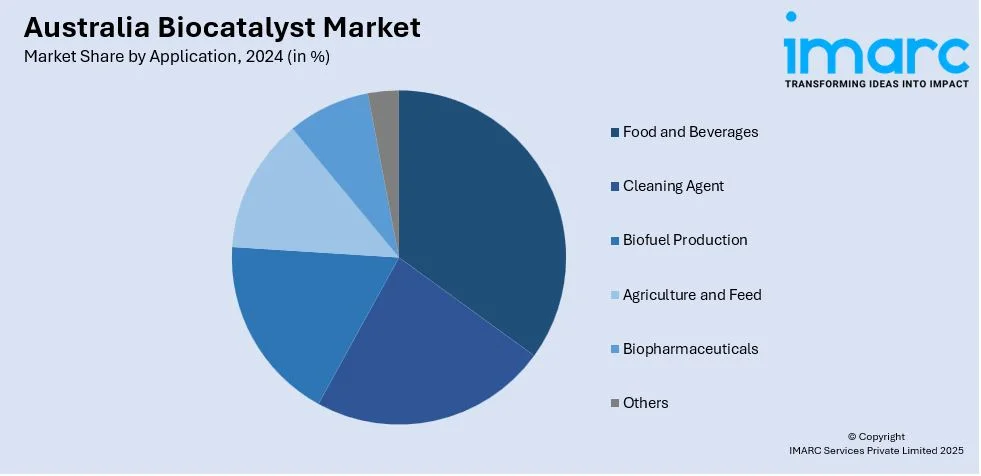

Application Insights:

- Food and Beverages

- Cleaning Agent

- Biofuel Production

- Agriculture and Feed

- Biopharmaceuticals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverages, cleaning agent, biofuel production, agriculture and feed, biopharmaceuticals, and others.

Source Insights:

- Microorganisms

- Plants

- Animal

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes microorganisms, plants, and animal.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Biocatalyst Market News:

- In September 2024, Monash spinouts Myostellar and GILZrx each secured an additional AU$500,000 from CUREator, highlighting the impact of university-led biotech innovation. Myostellar is developing treatments for muscle regeneration in Duchenne Muscular Dystrophy, while GILZrx is advancing safer alternatives to corticosteroids for autoimmune diseases. This funding supports critical preclinical research, underscoring the importance of translating academic breakthroughs into real-world therapeutics with strong commercial and clinical potential.

Australia Biocatalyst Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Kilo Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydrolases, Oxidoreductases, Transferases, Others |

| Applications Covered | Food and Beverages, Cleaning Agent, Biofuel Production, Agriculture and Feed, Biopharmaceuticals, Others |

| Sources Covered | Microorganisms, Plants, Animal |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia biocatalyst market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia biocatalyst market on the basis of type?

- What is the breakup of the Australia biocatalyst market on the basis of application?

- What is the breakup of the Australia biocatalyst market on the basis of source?

- What is the breakup of the Australia biocatalyst market on the basis of region?

- What are the various stages in the value chain of the Australia biocatalyst market?

- What are the key driving factors and challenges in the Australia biocatalyst market?

- What is the structure of the Australia biocatalyst market and who are the key players?

- What is the degree of competition in the Australia biocatalyst market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia biocatalyst market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia biocatalyst market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia biocatalyst industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)