Australia Biologics Market Size, Share, Trends and Forecast by Source, Product, Disease, Manufacturing, and Region, 2025-2033

Australia Biologics Market Overview:

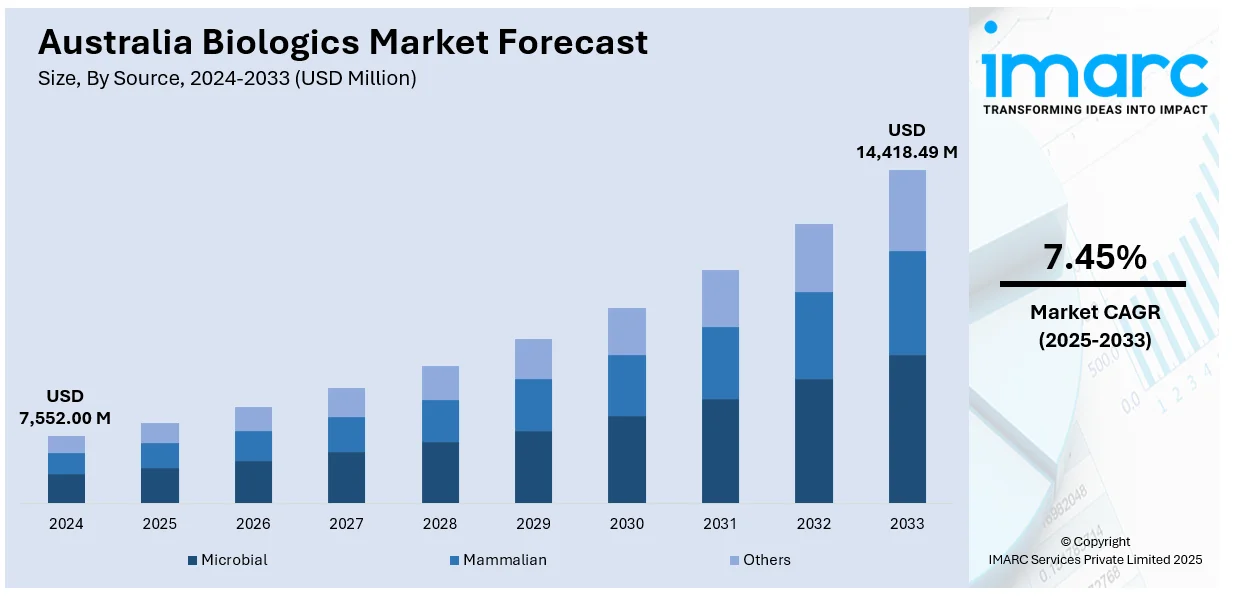

The Australia biologics market size reached USD 7,552.00 Million in 2024. Looking forward, the market is expected to reach USD 14,418.49 Million by 2033, exhibiting a growth rate (CAGR) of 7.45% during 2025-2033. Growing incidence of chronic diseases, aging population, and biotechnology advancements, such as genetic engineering and cell culture technologies, are driving the market growth. Regulatory support from the Australian Therapeutic Goods Administration (TGA), the trend towards personalized medicine, increasing healthcare spending, and government efforts to enhance access to biologics also drive market growth. Other drivers boosting the Australia biologics market share include the growing adoption of biosimilars, the demand for more effective treatments, and innovations in drug delivery systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7,552.00 Million |

| Market Forecast in 2033 | USD 14,418.49 Million |

| Market Growth Rate 2025-2033 | 7.45% |

Key Trends of Australia Biologics Market:

Increasing Prevalence of Chronic Diseases

Increased incidence of chronic disease in Australia is a primary driver of the biologics market. As conditions such as cancer, diabetes, heart disease, and autoimmune disease become increasingly prevalent, there is increased demand for effective treatment. According to the Australian Institute of Health and Welfare (AIHW), about 50% of the population in Australia is living with at least one chronic disease, with common conditions like diabetes, heart disease, cancer, and arthritis. Biologics, which are specifically designed for certain areas of the body like cells or proteins, are being more commonly used for these diseases since they provide more targeted treatment than conventional drugs. This serves to enhance patient results as well as minimize side effects. With the increase in the number of individuals suffering from chronic illnesses, particularly within an aging population, the need for biologic medications is projected to increase. This trend highlights the need for advanced therapies to manage these long-term health issues, leading to continued growth in the biologics market in Australia.

To get more information on this market, Request Sample

Burgeoning Aging Population

Australia’s aging population is another important factor driving the Australia biologics market demand. As people live longer, there is a higher occurrence of age-related conditions like arthritis, cancer, and osteoporosis. Biologic treatments are particularly effective for older patients as they target the underlying causes of these diseases. These therapies often provide better results and fewer side effects than traditional medications, improving the quality of life for older individuals. As the elderly population continues to grow, the demand for biologic treatments to manage age-related diseases is expected to increase. This demographic shift is likely to drive further growth in the biologics market, with biologics becoming a key part of the healthcare system for older Australians.

Advancements in Biotechnology

Advances in biotechnology is driving the Australia biologics market growth. Over recent years, new technologies in genetic engineering, protein production, and cell culture techniques have made it easier to develop more effective biologic therapies. These innovations allow for the creation of treatments that target specific diseases more precisely, improving patient outcomes. Australia’s strong biotech sector plays a key role in developing these therapies, with many new biologics being introduced to the market. As biotechnology continues to improve, more biologic treatments will be available for a range of diseases, supporting the ongoing growth of the biologics market in the country.

Growth Drivers of Australia Biologics Market:

Expanding Healthcare Infrastructure

Australia's healthcare infrastructure is rapidly growing since it allows greater access to biologics as well as advanced treatments. Health services still receive investment from the nation's government. It expands both private and public healthcare facilities. The growing demand that is seen for biologic therapies is supported by this increase in the medical infrastructure. Clinics and hospitals are now better prepared to manage treatments using complex biologics so patients can access therapies confidently. For more patients, biologic drugs can reach them because of the improved distribution channels. This wider patient base spans both urban regions along with rural regions. Growth of healthcare facilities directly contributes to the biologics market's expansion as a result.

Government Support and Policy Initiatives

Government policies in Australia are increasingly supporting the growth of biologics through funding, incentives, and streamlined regulatory frameworks. The Therapeutic Goods Administration (TGA) plays a critical role in facilitating faster approval of biologics, encouraging both domestic and international investments in the sector. According to the Australia biologics market analysis, Australia has favorable reimbursement policies, which allow for easier access to biologic treatments under the Medicare system. Additionally, the government's focus on personalized medicine and innovation has spurred research and development in the biologics sector. These efforts create a conducive environment for the expansion of biologic therapies in the country.

Rise in Public Awareness and Acceptance

The growing awareness of biologic treatments among the Australian population is driving market growth. As patients become more informed about the effectiveness of biologics for treating various chronic and autoimmune diseases, their demand increases. Educational campaigns from healthcare organizations and pharmaceutical companies are helping to reduce misconceptions and build trust in biologic drugs. This, in turn, has led to a higher adoption rate among patients who are seeking alternatives to traditional pharmaceuticals. As public perception improves and more patients seek advanced treatments, the biologics market in Australia continues to thrive.

Australia Biologics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, product, disease, and manufacturing.

Source Insights:

- Microbial

- Mammalian

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes microbial, mammalian, and other.

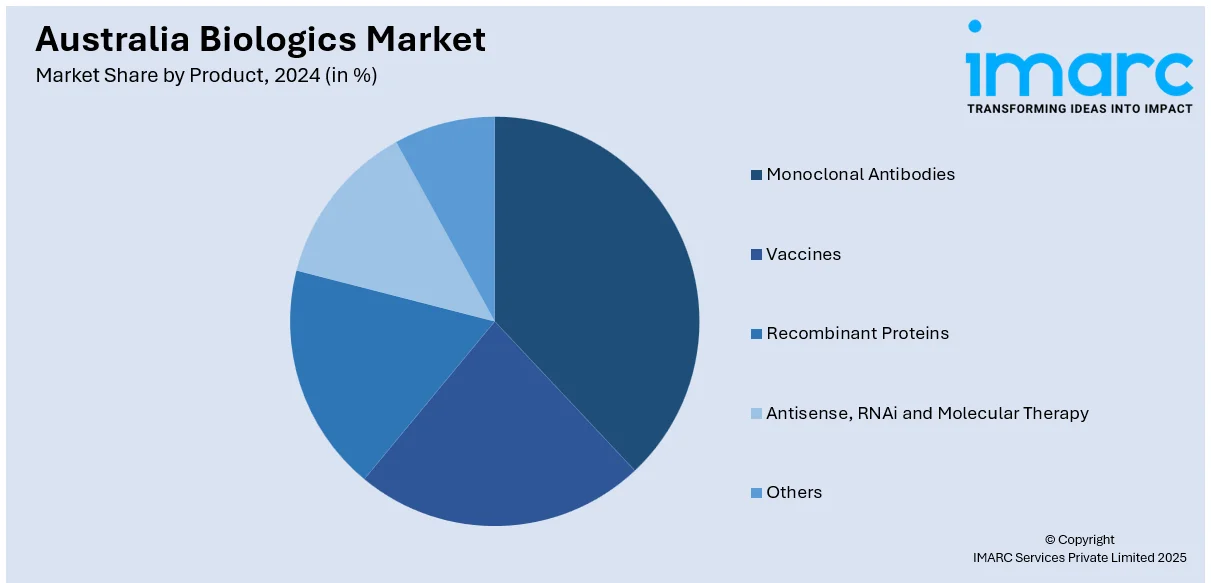

Product Insights:

- Monoclonal Antibodies

- Vaccines

- Recombinant Proteins

- Antisense, RNAi and Molecular Therapy

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes monoclonal antibodies, vaccines, recombinant proteins, antisense, RNAi and molecular therapy, and others.

Disease Insights:

- Oncology

- Immunological Disorders

- Cardiovascular Disorders

- Hematological Disorders

- Others

The report has provided a detailed breakup and analysis of the market based on the disease. This includes oncology, immunological disorders, cardiovascular disorders, hematological disorders, and others.

Manufacturing Insights:

- Outsourced

- In-House

A detailed breakup and analysis of the market based on the manufacturing have also been provided in the report. This includes outsourced and in-house.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Amgen Inc.

- Biocon Biologics Limited

- Celltrion Healthcare Co., Ltd

- CSL Limited

- Sandoz AG

Australia Biologics Market News:

- In 2024, Biocon Biologics entered a five-year exclusive partnership with Sandoz Australia to promote and distribute its trastuzumab and bevacizumab biosimilars. This collaboration aims to enhance access to affordable oncology therapies in Australia.

- In 2024, Kinoxis Therapeutics secured USD 14.5 million in Series B funding to advance its drug, KNX100, for preventing premature placement of dementia patients into care homes. The drug, originally developed for substance abuse treatment, is set to enter Phase 2 trials

- In 2023, Spinogenix initiated a world-first clinical trial in Australia for its therapy aimed at slowing the progression of motor neurone disease. The trial, involving 112 participants, is being conducted at Nucleus Network's Melbourne facility.

Australia Biologics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Microbial, Mammalian, Others |

| Products Covered | Monoclonal Antibodies, Vaccines, Recombinant Proteins, Antisense, RNAi and Molecular Therapy, Others |

| Diseases Covered | Oncology, Immunological Disorders, Cardiovascular Disorders, Hematological Disorders, Others |

| Manufacturings Covered | Outsourced, In-House |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Amgen Inc., Biocon Biologics Limited, Celltrion Healthcare Co., Ltd, CSL Limited, Sandoz AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia biologics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia biologics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia biologics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia biologics market was valued at USD 7,552.00 Million in 2024.

The Australia biologics market is projected to exhibit a CAGR of 7.45% during 2025-2033.

The Australia biologics market is projected to reach a value of USD 14,418.49 Million by 2033.

The Australia biologics market is witnessing strong growth, driven by rising demand for targeted therapies, and advancements in monoclonal antibodies. Increasing prevalence of chronic diseases, government support for biopharmaceutical research, and expanding biotechnology investments are further shaping market dynamics, fostering innovation and enhancing patient access to advanced treatments.

The Australia biologics market is propelled by the rising incidence of chronic and autoimmune diseases, and growing acceptance of biosimilars. Supportive regulatory frameworks, increased healthcare spending, and expanding biotechnology capabilities further accelerate adoption, driving demand for innovative biologic therapies across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)